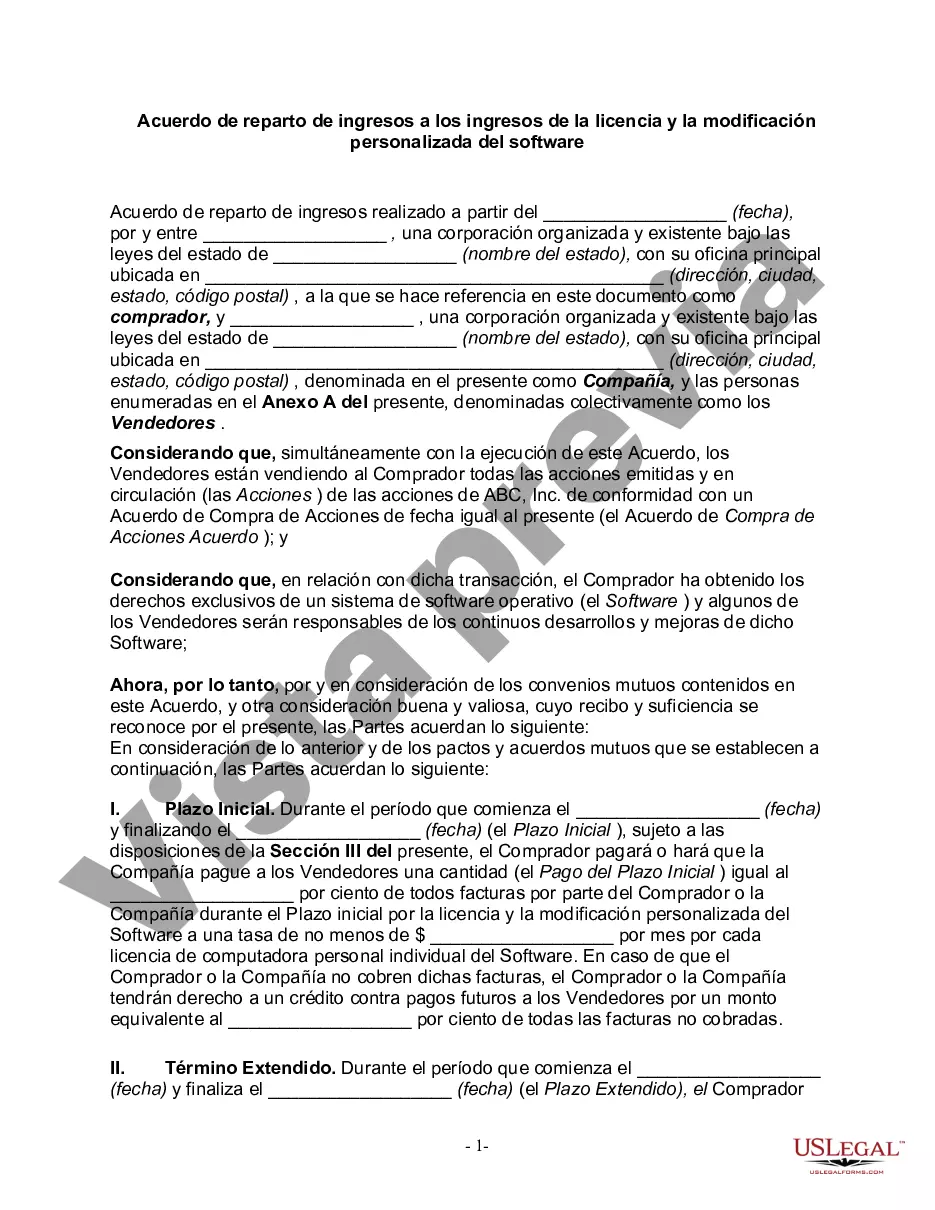

The Virgin Islands Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software refers to an agreement between parties involved in the licensing and customization of software, specifically in the context of the Virgin Islands. This agreement outlines the terms and conditions under which revenue generated from the licensing and custom modification of software is shared among the parties involved. This revenue sharing agreement aims to establish a fair and mutually beneficial arrangement by defining clear guidelines on how the income derived from software licensing and custom modification will be distributed among the relevant stakeholders. It often includes a detailed breakdown of revenue sharing percentages, payment schedules, and any additional considerations that may be applicable. Keyword: Virgin Islands, Revenue Sharing Agreement, Income, Licensing, Custom Modification, Software Types of Virgin Islands Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software: 1. Standard Revenue Sharing Agreement: This type of agreement provides a general framework for revenue distribution from software licensing and custom modification. It sets out the standard revenue sharing percentages or ratios that will be applied to determine each party's share of the income derived. 2. Customized Revenue Sharing Agreement: This type of agreement allows parties to negotiate and customize the revenue sharing percentages and terms based on their unique needs and circumstances. It provides flexibility to adapt the agreement to suit specific software licensing and customization projects. 3. Exclusive Revenue Sharing Agreement: In some cases, a software developer or licensor may enter into an exclusive revenue sharing agreement with a single licensee or customizer. This agreement grants exclusive rights to the licensee or customizer to distribute, modify, and derive income from the software within the Virgin Islands. The revenue sharing terms are typically tailored to meet the specific requirements of this exclusivity. 4. Joint Venture Revenue Sharing Agreement: A joint venture revenue sharing agreement occurs when two or more parties collaborate on the licensing and custom modification of software in the Virgin Islands. This agreement outlines the distribution of revenue among the joint venture partners based on their respective contributions, responsibilities, or ownership percentages. 5. Hybrid Revenue Sharing Agreement: A hybrid revenue sharing agreement combines various revenue sharing models to create a customized arrangement that suits the specific needs of the parties involved. It may involve elements of standard revenue sharing, exclusive agreements, or joint ventures, with each component delineated in the agreement. It is important to note that the specific terms and conditions of the Virgin Islands Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software may vary depending on the parties involved, the nature of the software, and the scope of the licensing and customization activities.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Virgin Islands Acuerdo de reparto de ingresos a los ingresos de la licencia y la modificación personalizada del software - Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software

Description

How to fill out Virgin Islands Acuerdo De Reparto De Ingresos A Los Ingresos De La Licencia Y La Modificación Personalizada Del Software?

If you wish to full, download, or print legitimate document layouts, use US Legal Forms, the largest collection of legitimate varieties, which can be found on the web. Take advantage of the site`s simple and easy hassle-free lookup to obtain the files you need. Various layouts for organization and individual reasons are categorized by types and says, or keywords. Use US Legal Forms to obtain the Virgin Islands Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software with a couple of clicks.

When you are already a US Legal Forms client, log in in your profile and click on the Download button to find the Virgin Islands Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software. Also you can access varieties you formerly downloaded from the My Forms tab of the profile.

If you are using US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Make sure you have selected the form for the correct city/nation.

- Step 2. Use the Review method to look through the form`s information. Don`t forget to read through the outline.

- Step 3. When you are unhappy together with the develop, make use of the Lookup discipline at the top of the monitor to get other types from the legitimate develop format.

- Step 4. Once you have discovered the form you need, select the Purchase now button. Opt for the pricing strategy you choose and add your credentials to register to have an profile.

- Step 5. Method the transaction. You should use your credit card or PayPal profile to accomplish the transaction.

- Step 6. Find the format from the legitimate develop and download it on the system.

- Step 7. Total, modify and print or signal the Virgin Islands Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software.

Every single legitimate document format you get is your own eternally. You possess acces to each and every develop you downloaded within your acccount. Click the My Forms segment and decide on a develop to print or download again.

Remain competitive and download, and print the Virgin Islands Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software with US Legal Forms. There are millions of skilled and condition-particular varieties you can use for your organization or individual requires.