The Virgin Islands Private Annuity Agreement is a legal arrangement that involves the transfer of assets from an individual to a trust located in the US Virgin Islands (SVI) in exchange for an annuity payment. This agreement is a wealth management tool used by individuals seeking to protect their assets, defer taxes, and plan for retirement. With a Virgin Islands Private Annuity Agreement, the individual transfers their assets, such as real estate, stocks, or other investments, into a trust based in the SVI. The SVI is a popular jurisdiction for this type of agreement due to its favorable tax environment, including no income, estate, or capital gains taxes. The primary purpose of a Virgin Islands Private Annuity Agreement is to provide lifetime income to the transferor (also known as the annuitant or granter) while removing the assets from their taxable estate. The annuitant, in turn, receives regular annuity payments from the trust, which are typically structured to last for their lifetime. One advantage of this arrangement is the potential deferral of capital gains taxes. When the assets are transferred to the trust, no capital gains tax is triggered. Instead, the annuity payments received by the annuitant are subject to income tax as they are received. This allows individuals to spread out the tax payments over time and potentially reduce their overall tax liability. Different types of private annuity agreements within the Virgin Islands jurisdiction may include: 1. Single life private annuity: This agreement provides annuity payments to the annuitant for their lifetime only. 2. Joint and survivor private annuity: In this type of arrangement, annuity payments continue until both the annuitant and their chosen beneficiary pass away. This ensures that the income stream continues for the surviving spouse or partner. 3. Term certain private annuity: With a term certain private annuity, annuity payments are guaranteed for a specific period of time, after which they cease. This type of arrangement is useful when the annuitant wants a fixed income for a predetermined period. It is important to note that the Virgin Islands Private Annuity Agreement must comply with all applicable laws and regulations, both in the SVI and in the jurisdiction where the annuitant resides. Consulting with legal and tax professionals is highly recommended ensuring compliance and maximize the benefits of this wealth management strategy.

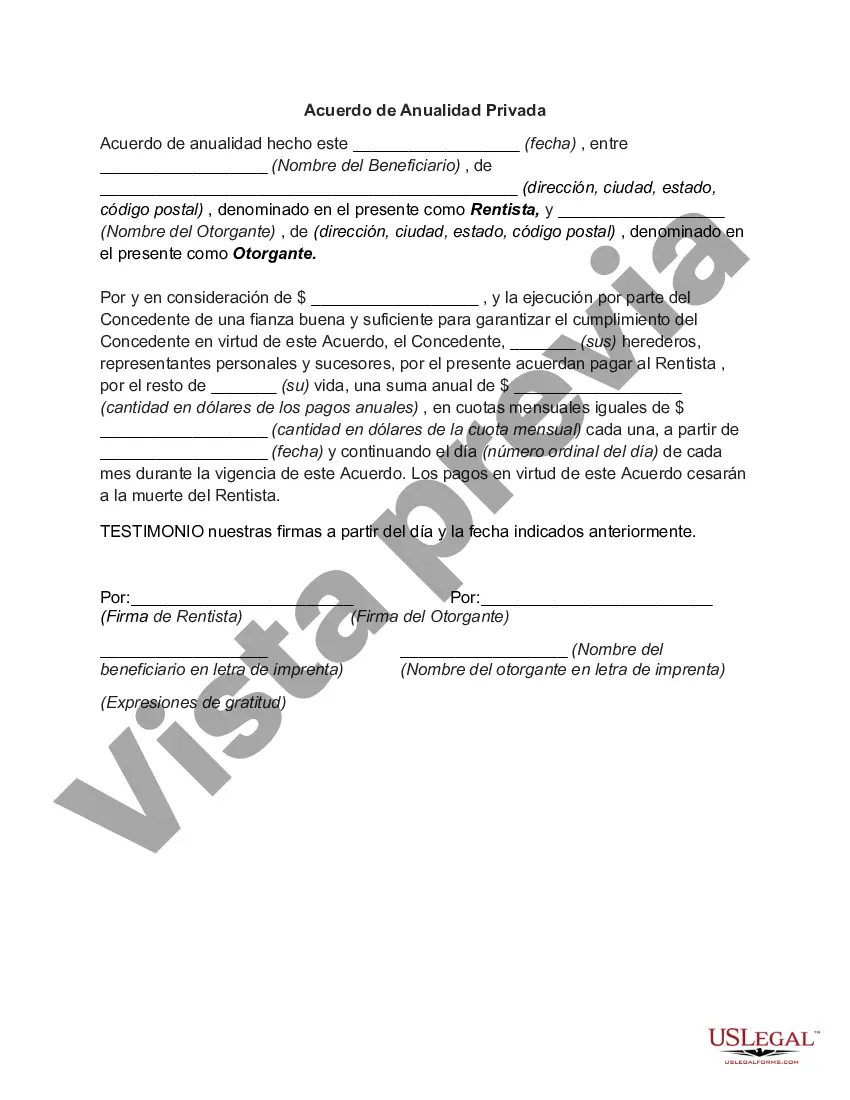

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Virgin Islands Acuerdo de Anualidad Privada - Private Annuity Agreement

Description

How to fill out Virgin Islands Acuerdo De Anualidad Privada?

US Legal Forms - among the greatest libraries of legitimate forms in the United States - gives a wide range of legitimate file themes you can download or print. While using website, you can find a large number of forms for enterprise and person functions, categorized by types, claims, or search phrases.You can get the latest types of forms such as the Virgin Islands Private Annuity Agreement in seconds.

If you have a monthly subscription, log in and download Virgin Islands Private Annuity Agreement from the US Legal Forms local library. The Acquire key will show up on each kind you see. You have accessibility to all earlier delivered electronically forms within the My Forms tab of your own bank account.

If you wish to use US Legal Forms for the first time, allow me to share easy instructions to obtain began:

- Be sure you have selected the best kind for your metropolis/county. Select the Review key to analyze the form`s articles. Browse the kind outline to ensure that you have chosen the proper kind.

- In case the kind doesn`t fit your specifications, use the Research industry near the top of the screen to find the one that does.

- In case you are happy with the form, verify your choice by clicking the Purchase now key. Then, pick the costs strategy you want and provide your qualifications to sign up for the bank account.

- Process the deal. Make use of your credit card or PayPal bank account to complete the deal.

- Pick the file format and download the form on your gadget.

- Make modifications. Fill up, modify and print and signal the delivered electronically Virgin Islands Private Annuity Agreement.

Each and every format you put into your bank account does not have an expiration date and is your own eternally. So, in order to download or print an additional backup, just visit the My Forms segment and then click about the kind you need.

Gain access to the Virgin Islands Private Annuity Agreement with US Legal Forms, by far the most comprehensive local library of legitimate file themes. Use a large number of skilled and state-certain themes that meet your business or person requires and specifications.