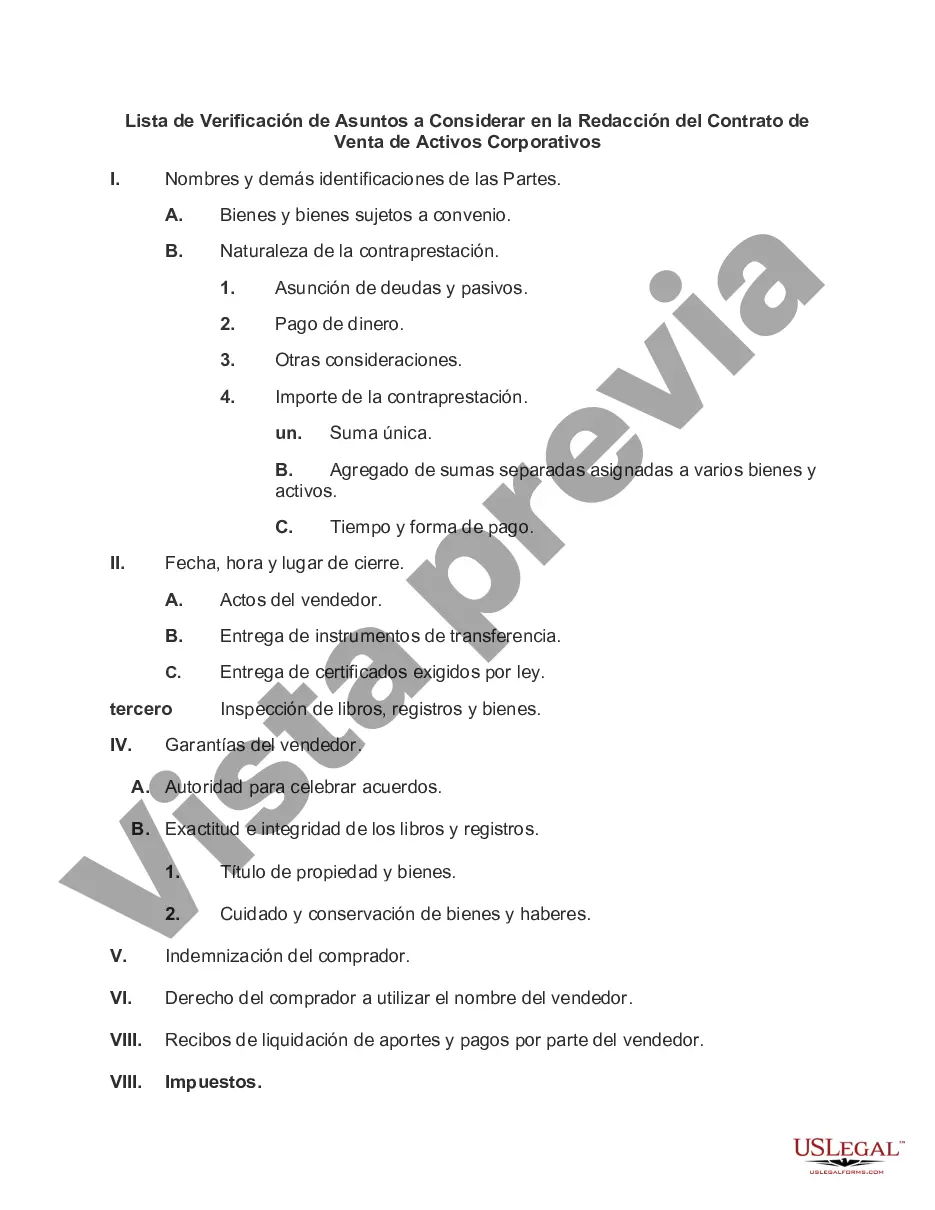

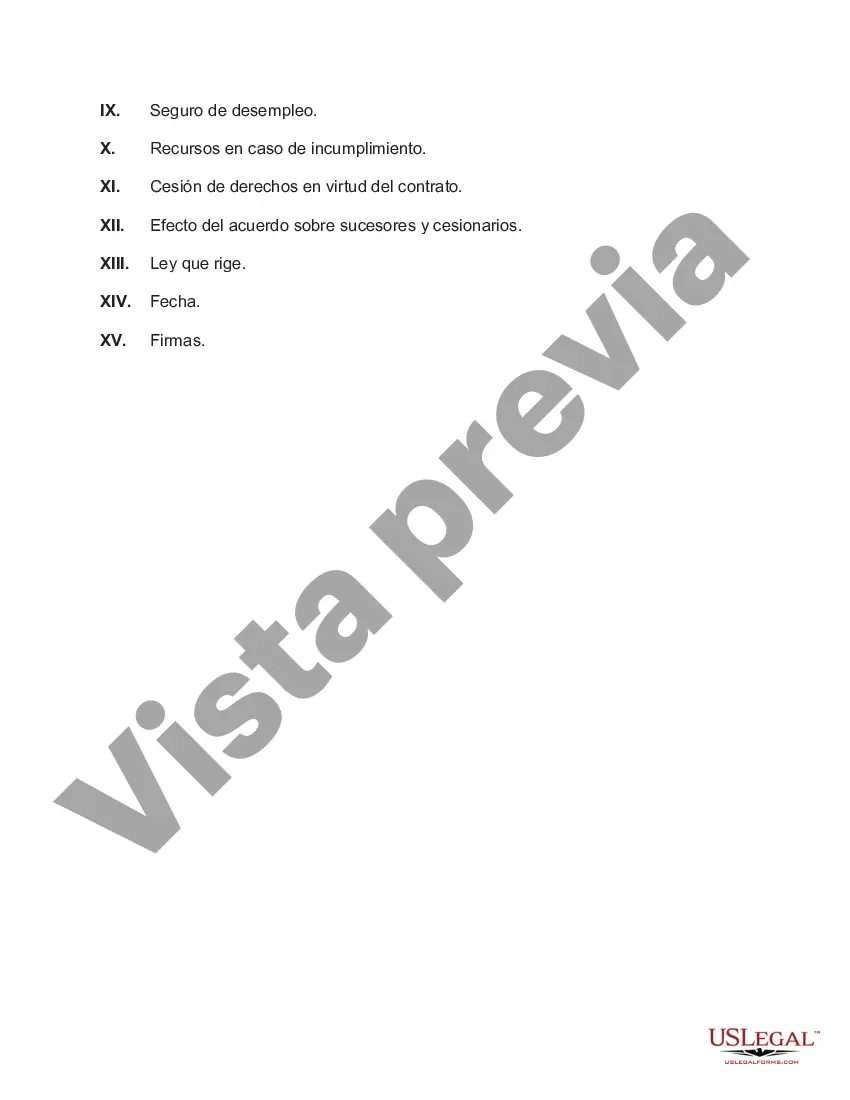

Title: A Comprehensive Guide: Virgin Islands Checklist of Matters to be Considered in Drafting an Agreement for the Sale of Corporate Assets Introduction: When engaging in the sale of corporate assets in the Virgin Islands, it is crucial to ensure a smooth and legally sound transaction. To aid in this process, a meticulously drafted agreement is essential. This article aims to provide a detailed checklist of matters that should be considered when drafting an agreement for the sale of corporate assets in the Virgin Islands, covering various types of agreements. 1. Parties Involved: — Identify the buyer and seller precisely, including their legal names, addresses, and contact information. — Specify if the buyer is an individual, corporation, partnership, or any other legal entity. — Clearly define the buyer's intention to acquire assets, rather than stock or equity. 2. Assets Included: — Clearly define the assets being sold, including real estate, equipment, inventory, intellectual property, etc. — Detail any excluded assets that will not be transferred as part of the agreement. — Include the specific location, condition, and description of each asset. 3. Purchase Price and Payment Terms: — State the purchase price, clearly defining how it should be paid (e.g., lump sum or installment basis). — Include the currency and any adjustments to the price, such as inventory valuation. — Specify when and how the payment will be made, including any escrow arrangements. 4. Representations and Warranties: — Include representations and warranties made by the seller regarding the assets being sold, their condition, and legal ownership. — Clarify any limitations on warranties, if applicable. — Indicate if due diligence was conducted and include any disclosures made by the seller. Types of the Virgin Islands Checklist of Matters for Different Agreements: a) Checklist for Share Purchase Agreement (SPA): — Specify whether the agreement is for the purchase of shares of stock/equity in a corporation. — Include additional considerations such as details on the transfer of ownership, shareholder approvals, and stock certificates. b) Checklist for Asset Purchase Agreement (APA): — Emphasize the transfer of specific assets rather than stock. — Address the assumption of liabilities, including debts, contracts, and warranties. — Outline the required consents and approvals from third parties, such as lenders or regulatory bodies. c) Checklist for Intellectual Property Agreement: — Highlight the transfer of intellectual property rights, patents, trademarks, copyrights, or trade secrets. — Include provisions for the protection of intellectual property during and after the sale. Conclusion: Drafting an agreement for the sale of corporate assets in the Virgin Islands requires meticulous attention to detail and adherence to legal considerations. This checklist provides an overview of the essential matters to be considered, covering various types of agreements, including share purchase agreements, asset purchase agreements, and intellectual property agreements. Following this thorough checklist will help ensure a successful and legally compliant transaction in the Virgin Islands.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Virgin Islands Lista de Verificación de Asuntos a Considerar en la Redacción del Contrato de Venta de Activos Corporativos - Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets

Description

How to fill out Virgin Islands Lista De Verificación De Asuntos A Considerar En La Redacción Del Contrato De Venta De Activos Corporativos?

Are you currently within a place where you need to have paperwork for possibly enterprise or personal functions almost every day? There are a lot of legal record themes available on the Internet, but locating versions you can trust is not easy. US Legal Forms offers 1000s of kind themes, like the Virgin Islands Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets, which are published to meet federal and state requirements.

Should you be already informed about US Legal Forms internet site and possess an account, merely log in. Following that, it is possible to obtain the Virgin Islands Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets format.

If you do not come with an bank account and need to begin using US Legal Forms, adopt these measures:

- Discover the kind you will need and ensure it is for your correct area/region.

- Take advantage of the Preview key to analyze the shape.

- Look at the description to ensure that you have selected the appropriate kind.

- In the event the kind is not what you`re looking for, take advantage of the Search field to find the kind that suits you and requirements.

- Once you find the correct kind, click on Acquire now.

- Opt for the pricing plan you desire, fill out the required details to create your bank account, and buy your order utilizing your PayPal or charge card.

- Select a hassle-free paper structure and obtain your backup.

Find every one of the record themes you might have purchased in the My Forms food list. You can aquire a further backup of Virgin Islands Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets at any time, if needed. Just click the required kind to obtain or produce the record format.

Use US Legal Forms, probably the most substantial selection of legal forms, in order to save time and steer clear of blunders. The support offers professionally produced legal record themes that can be used for a range of functions. Produce an account on US Legal Forms and commence making your lifestyle easier.