Virgin Islands Payroll Deduction — Special Services is a financial program that allows employees in the Virgin Islands to voluntarily allocate a portion of their salary towards specific services or benefits. This payroll deduction option offers a convenient and efficient way for employees to manage their finances and enjoy additional services at discounted rates or with added convenience. 1. Virgin Islands Payroll Deduction — Special Services for Health Insurance: This type of payroll deduction allows employees to allocate a portion of their salary towards health insurance premiums. It enables individuals to have the convenience of having their health insurance premiums automatically deducted from their paychecks, making the process seamless and hassle-free. 2. Virgin Islands Payroll Deduction — Special Services for Retirement Plans: Many employers in the Virgin Islands offer retirement plans such as 401(k) or pension programs. Through this payroll deduction option, employees can opt to have a certain percentage of their salary deducted and contributed towards their retirement savings. It allows for easy retirement planning and ensures individuals are actively saving for their future financial security. 3. Virgin Islands Payroll Deduction — Special Services for Education Loan Repayments: This type of payroll deduction aims to assist employees in repaying their education loans conveniently. By setting up a direct deduction from their paycheck, individuals can ensure timely loan repayments while managing their finances effectively. 4. Virgin Islands Payroll Deduction — Special Services for Charitable Giving: For individuals who wish to support charitable organizations or participate in workplace giving campaigns, this option allows them to donate a portion of their salary directly towards their chosen charities. Payroll deduction for charitable giving is an easy and efficient way to make a positive impact in the local community or support global causes. 5. Virgin Islands Payroll Deduction — Special Services for Employee Benefits: This type of payroll deduction includes a wide range of employee benefits that an organization offers, such as life insurance, dental and vision insurance, flexible spending accounts (FSA's), employee assistance programs (Maps), and more. Employees can choose which benefits they wish to enroll in and allocate funds towards these services through payroll deduction. Overall, Virgin Islands Payroll Deduction — Special Services provides employees with the flexibility to customize their payroll deductions according to their needs and preferences. It simplifies financial management, ensures timely payment of various services, and enhances the overall employee experience.

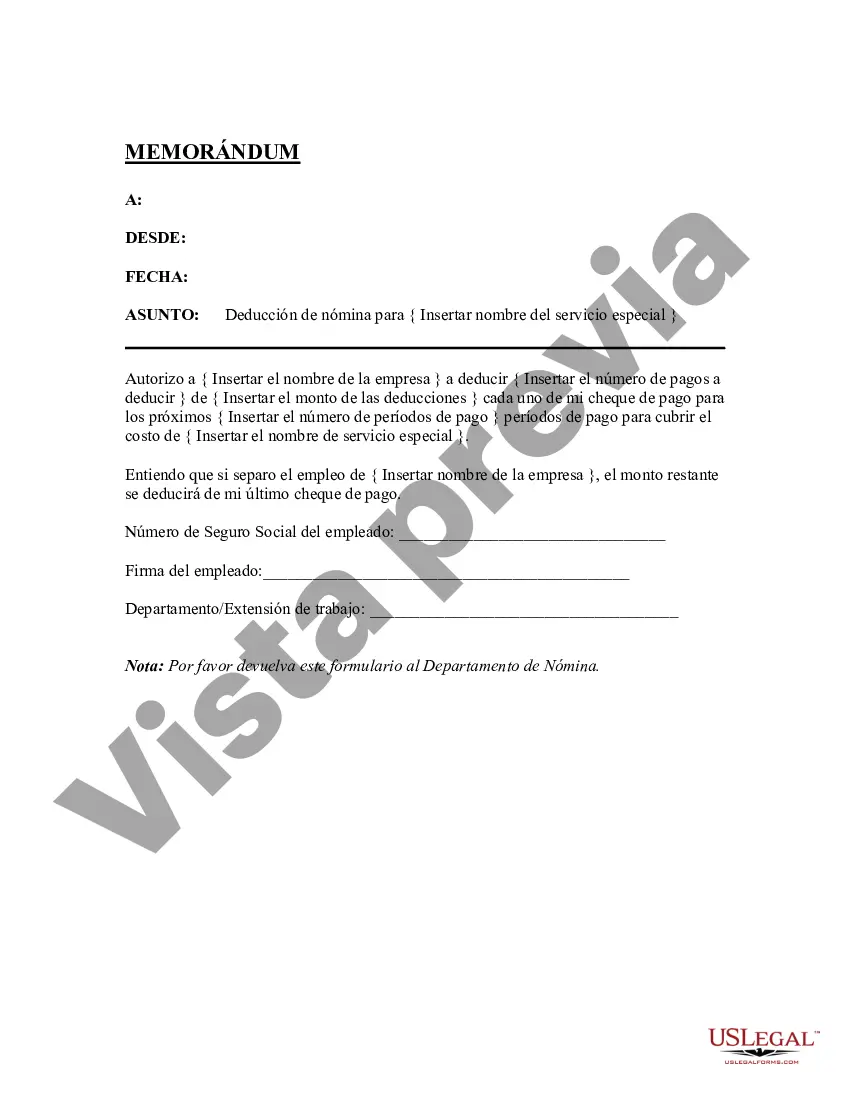

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Virgin Islands Deducción de Nómina - Servicios Especiales - Payroll Deduction - Special Services

Description

How to fill out Virgin Islands Deducción De Nómina - Servicios Especiales?

If you want to complete, download, or printing legitimate papers layouts, use US Legal Forms, the greatest variety of legitimate kinds, that can be found online. Take advantage of the site`s easy and handy search to discover the paperwork you require. Different layouts for organization and personal reasons are sorted by categories and suggests, or keywords. Use US Legal Forms to discover the Virgin Islands Payroll Deduction - Special Services in a number of click throughs.

In case you are currently a US Legal Forms customer, log in to the accounts and click the Acquire button to have the Virgin Islands Payroll Deduction - Special Services. You can even entry kinds you formerly downloaded inside the My Forms tab of your respective accounts.

If you use US Legal Forms initially, follow the instructions under:

- Step 1. Ensure you have chosen the shape to the correct city/nation.

- Step 2. Utilize the Preview method to examine the form`s content material. Don`t forget about to read through the explanation.

- Step 3. In case you are not satisfied together with the develop, take advantage of the Research area at the top of the display to find other types of the legitimate develop web template.

- Step 4. When you have discovered the shape you require, click the Buy now button. Opt for the pricing strategy you like and add your credentials to sign up on an accounts.

- Step 5. Procedure the financial transaction. You should use your bank card or PayPal accounts to complete the financial transaction.

- Step 6. Select the format of the legitimate develop and download it in your system.

- Step 7. Total, revise and printing or signal the Virgin Islands Payroll Deduction - Special Services.

Every single legitimate papers web template you purchase is yours eternally. You might have acces to every develop you downloaded in your acccount. Select the My Forms portion and select a develop to printing or download once again.

Compete and download, and printing the Virgin Islands Payroll Deduction - Special Services with US Legal Forms. There are thousands of expert and express-specific kinds you can utilize for your personal organization or personal requires.