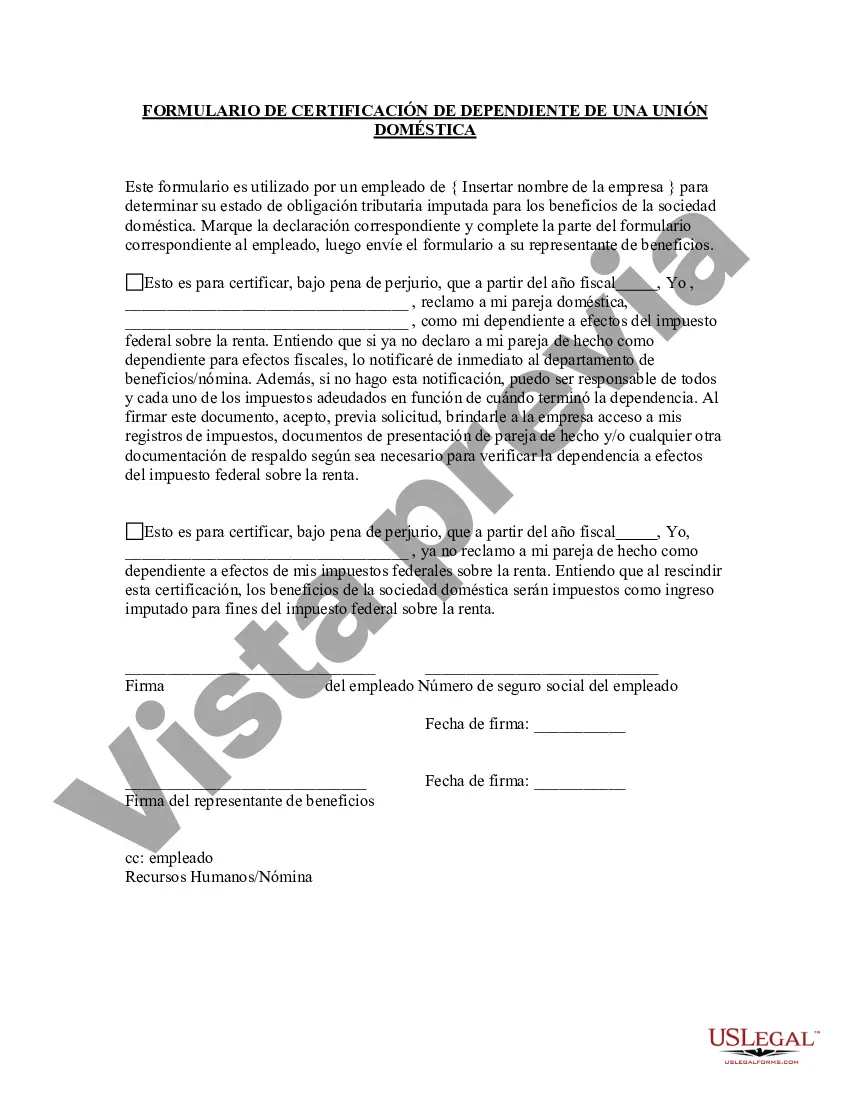

The Virgin Islands Domestic Partnership Dependent Certification Form is an official document that enables individuals in a domestic partnership to declare their dependents for various benefits. This form is primarily used in the United States Virgin Islands (SVI) to establish the eligibility of dependents in domestic partnerships for health insurance coverage, tax exemptions, and other related privileges. Keywords: Virgin Islands, Domestic Partnership, Dependent Certification Form, United States Virgin Islands, benefits, eligibility, health insurance coverage, tax exemptions, privileges. In the SVI, there are primarily two types of the Virgin Islands Domestic Partnership Dependent Certification Forms: 1. Health Insurance Dependent Certification Form: This form is used to determine the eligibility of dependents in a domestic partnership for health insurance coverage. By completing this form accurately and providing relevant details about the dependents, individuals in domestic partnerships can ensure that their loved ones can receive the necessary healthcare benefits. 2. Tax Exemption Dependent Certification Form: This particular form is designed to establish the eligibility of dependents within a domestic partnership for tax exemptions. By submitting this form, individuals in a domestic partnership can claim tax benefits for their dependents, thereby reducing their overall tax liability. Both types of the Virgin Islands Domestic Partnership Dependent Certification Forms play a crucial role in acknowledging the rights and privileges of domestic partners and their dependents in the SVI. By completing and submitting these forms, individuals in domestic partnerships can ensure that their dependents' needs are adequately met and that they can access essential benefits and protections.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Virgin Islands Formulario de certificación de dependiente de pareja de hecho - Domestic Partnership Dependent Certification Form

Description

How to fill out Virgin Islands Formulario De Certificación De Dependiente De Pareja De Hecho?

US Legal Forms - one of the greatest libraries of legitimate varieties in the United States - delivers a variety of legitimate record templates it is possible to download or printing. Utilizing the website, you can find 1000s of varieties for organization and specific functions, sorted by classes, suggests, or search phrases.You will find the most recent types of varieties such as the Virgin Islands Domestic Partnership Dependent Certification Form in seconds.

If you already have a monthly subscription, log in and download Virgin Islands Domestic Partnership Dependent Certification Form from your US Legal Forms local library. The Obtain switch will show up on each and every type you perspective. You have accessibility to all earlier delivered electronically varieties in the My Forms tab of your bank account.

If you would like use US Legal Forms for the first time, listed here are simple directions to get you started out:

- Be sure to have picked the proper type for the area/state. Click on the Preview switch to review the form`s information. See the type information to actually have selected the right type.

- If the type does not satisfy your demands, use the Lookup discipline on top of the screen to discover the one who does.

- If you are satisfied with the shape, confirm your choice by visiting the Acquire now switch. Then, choose the costs strategy you like and give your credentials to sign up for the bank account.

- Method the transaction. Make use of bank card or PayPal bank account to perform the transaction.

- Pick the format and download the shape on your device.

- Make adjustments. Complete, revise and printing and indication the delivered electronically Virgin Islands Domestic Partnership Dependent Certification Form.

Every design you included in your money lacks an expiration time and is your own for a long time. So, if you want to download or printing one more version, just go to the My Forms segment and click about the type you will need.

Get access to the Virgin Islands Domestic Partnership Dependent Certification Form with US Legal Forms, probably the most substantial local library of legitimate record templates. Use 1000s of professional and state-distinct templates that meet your business or specific requirements and demands.