That constitute debt collectors, even where their debt-collecting activity is litigation.?) The FDCPA provides that ?any debt collector who fails to comply ...44 pages

that constitute debt collectors, even where their debt-collecting activity is litigation.?) The FDCPA provides that ?any debt collector who fails to comply ... (a) A debtor who disputes a debt should provide the NLRB with an explanation as to why the debt is incorrect within 60 days from the date the initial demand ...By JOS Sullivan · 2017 ? Id. The FDCPA states that "a debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of ... Bankruptcy, consumer credit reporting, debt collection, payment processing and cards, mortgage, auto finance, the consumer finance regulatory landscape, the ...104 pages

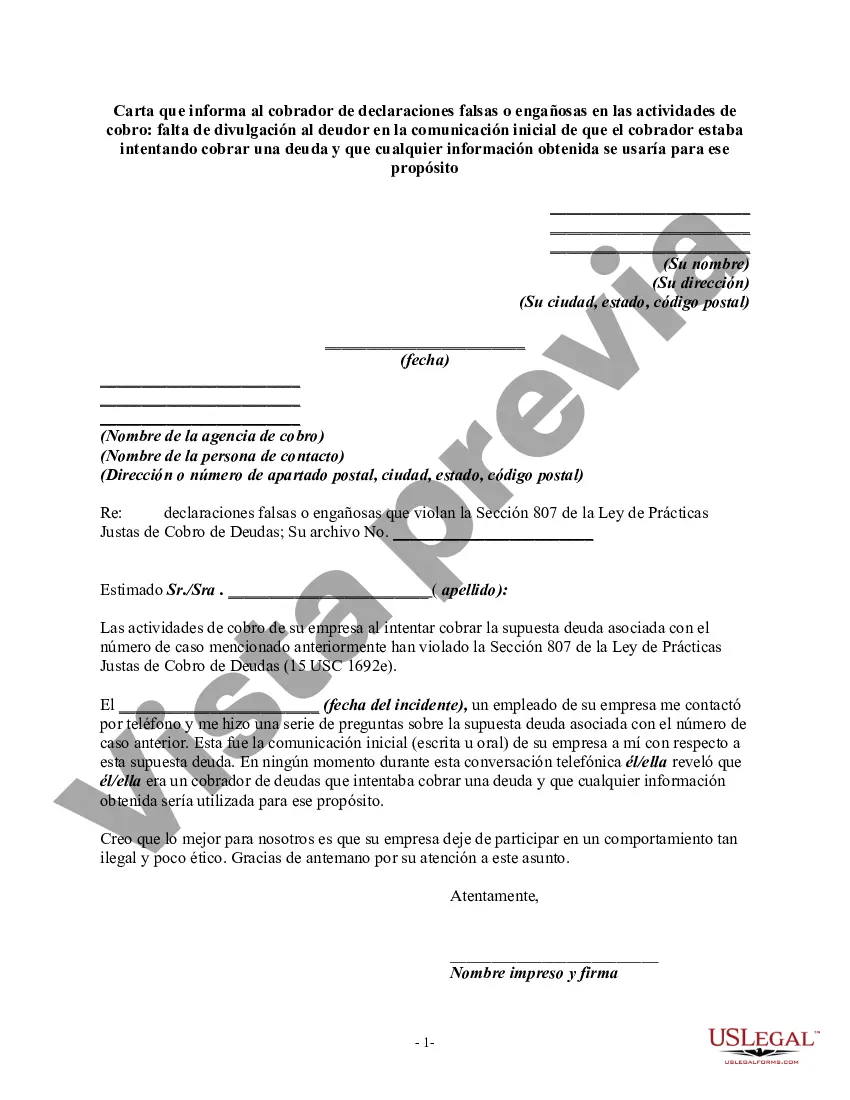

bankruptcy, consumer credit reporting, debt collection, payment processing and cards, mortgage, auto finance, the consumer finance regulatory landscape, the ... Hot Topics in Collecting and Foreclosing Mortgage Loansfailure of the consumer's attorney to respond to a debt collector's numerous requests for. On behalf of the Consumer Relations Consortium, please find adebt collectors register with the CFPB which would make the list of ... Jackson alleges certain debt collection letters sent by A&R to him and other consumers residing in Iowa violated the FDCPA. categories: (1) using false and misleading representations to collect debts consumers do not owe;. (2) failing to make required disclosures ...68 pages

? categories: (1) using false and misleading representations to collect debts consumers do not owe;. (2) failing to make required disclosures ... the Virgin Islands have passed at least one statute that deals(4) The debt collector or creditor must disclose that letters, forms ...460 pages

? the Virgin Islands have passed at least one statute that deals(4) The debt collector or creditor must disclose that letters, forms ... To the Commission's debt collection rules include an increase in the principalcollecting the claim is likely to be more than the amount recovered.47 pages

to the Commission's debt collection rules include an increase in the principalcollecting the claim is likely to be more than the amount recovered.

If someone could view an unprotected link then they can steal your information. Please make sure your information is secure, but know that the risk is low if you are concerned. This site is an excellent resource to learn how to help fight the bad guys behind debt collection scams. Learn more. What is a Debt Collection Letter? A Debt Collection Letter is an unsolicited, unsigned, communication that is sent to the individual who owes you money. A Debt Collection Letter may include: a demand for a payment of money or other payment that is not legally required; a request to sell, assign, or deliver your property or assets; or a demand to do business with, sign on to, open accounts with, lend money to, or provide other services to you. Debt Collection Letters include, but are not limited to: letters requesting payment from debtors' employers.