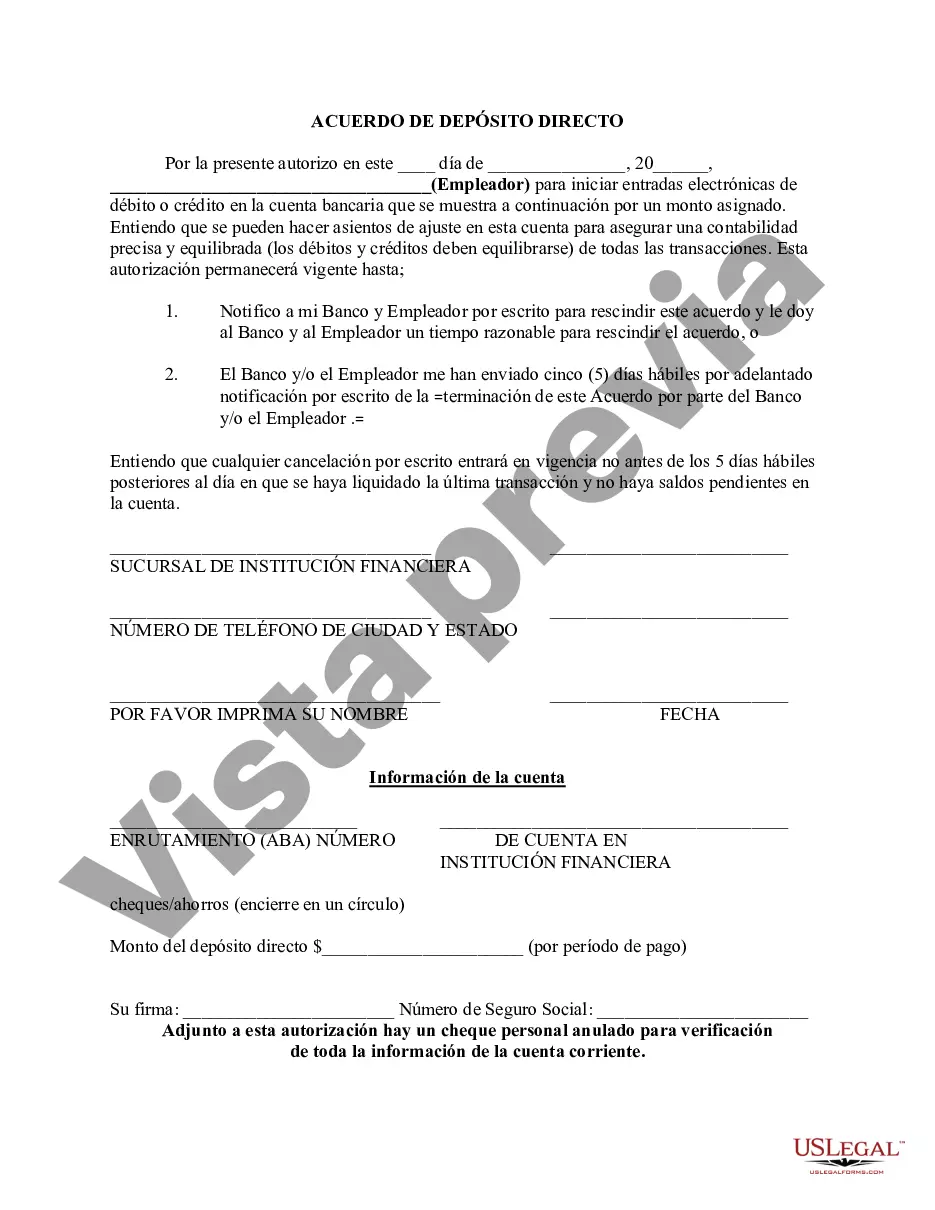

The Vermont Direct Deposit Form for Employees is a document that is used by employers in the state of Vermont to facilitate the direct deposit of employees' wages into their designated bank accounts. This form is an imperative tool for ensuring the timely and efficient payment of salaries or wages to employees. The Vermont Direct Deposit Form for Employees contains various sections and fields that must be completed accurately. These sections typically include the employee's personal information, such as their full name, address, social security number, and contact details. Additionally, the employee must provide their bank account details, including the name of the financial institution, the bank's routing number, and their account number. By submitting the completed Vermont Direct Deposit Form for Employees, employees authorize their employer to deposit their wages directly into the designated bank account. This method of payment offers numerous benefits to both employers and employees. For the employer, it streamlines the payroll process by eliminating the need to manually prepare and distribute paper checks. Moreover, direct deposit is more secure and reliable, reducing the risk of lost or stolen checks. Employees, on the other hand, benefit from the convenience of having their wages automatically deposited into their bank accounts on payday. They no longer need to make trips to the bank to deposit or cash their paychecks, saving time and effort. It is important to note that there may be different versions or variations of the Vermont Direct Deposit Form for Employees, tailored to the specific requirements of different employers or industries. However, the basic purpose and information requested on these forms remain consistent. Some types of Vermont Direct Deposit Forms for Employees may include specific sections or fields related to additional payroll information, such as deductions for health insurance premiums, retirement contributions, or other voluntary deductions. Overall, the Vermont Direct Deposit Form for Employees is a crucial document that facilitates the secure and efficient payment of wages through direct deposit. It simplifies the payroll process, enhances convenience for employees, and ensures accurate and timely compensation.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Vermont Formulario de depósito directo para empleados - Direct Deposit Form for Employees

Description

How to fill out Vermont Formulario De Depósito Directo Para Empleados?

Finding the right authorized record template can be a have difficulties. Of course, there are plenty of themes accessible on the Internet, but how can you find the authorized form you will need? Make use of the US Legal Forms site. The services provides a huge number of themes, including the Vermont Direct Deposit Form for Employees, that can be used for organization and private requires. All of the types are examined by experts and fulfill federal and state demands.

Should you be already authorized, log in to your profile and then click the Down load key to obtain the Vermont Direct Deposit Form for Employees. Make use of your profile to look from the authorized types you have purchased previously. Visit the My Forms tab of the profile and get an additional version of your record you will need.

Should you be a new end user of US Legal Forms, listed below are easy directions that you should comply with:

- Very first, make certain you have chosen the right form for your city/area. You may look through the form using the Review key and browse the form explanation to make sure this is the best for you.

- If the form does not fulfill your expectations, take advantage of the Seach area to find the proper form.

- When you are sure that the form would work, go through the Buy now key to obtain the form.

- Select the prices program you desire and type in the essential information. Make your profile and buy the transaction with your PayPal profile or Visa or Mastercard.

- Choose the submit format and acquire the authorized record template to your system.

- Total, change and print out and indication the attained Vermont Direct Deposit Form for Employees.

US Legal Forms may be the biggest collection of authorized types for which you will find numerous record themes. Make use of the service to acquire appropriately-manufactured files that comply with state demands.