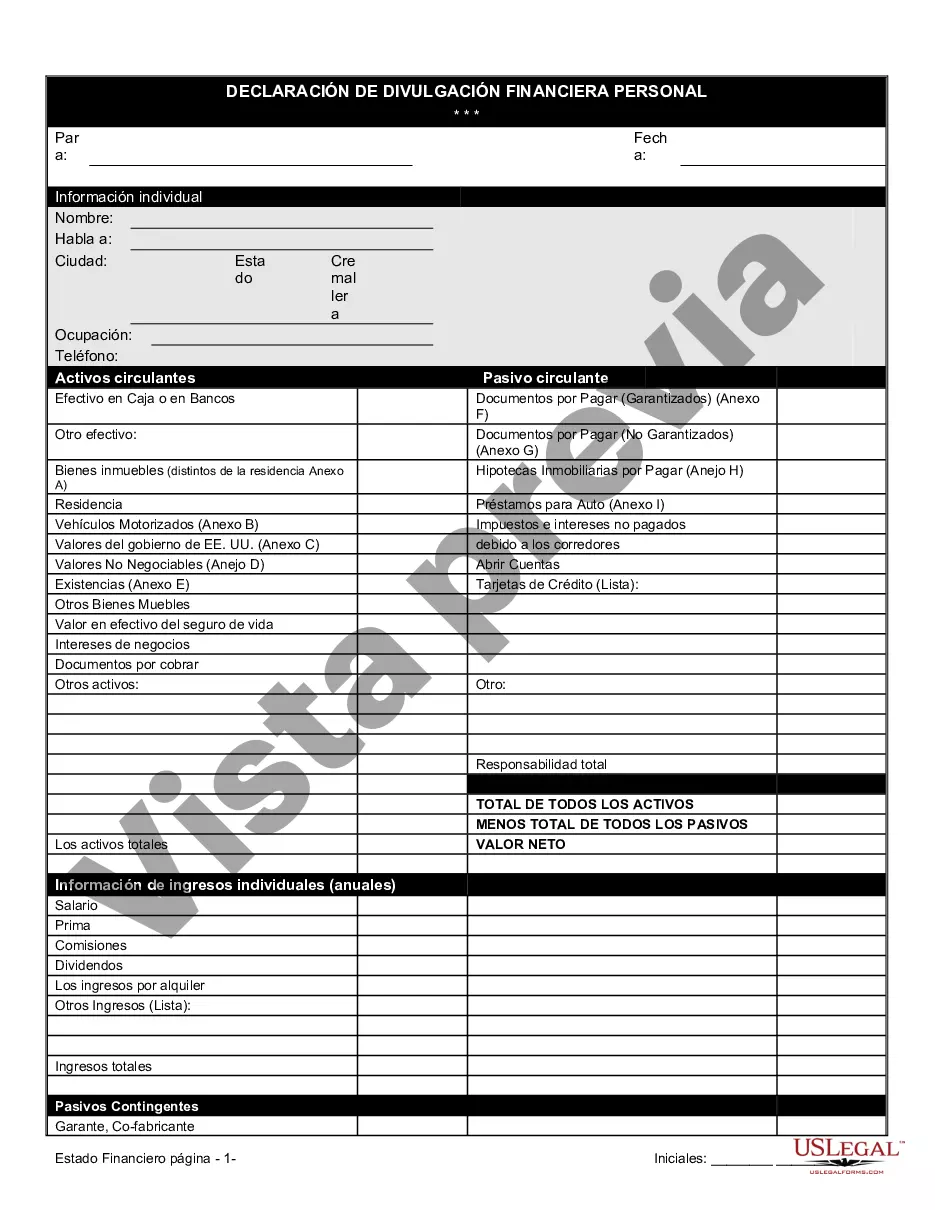

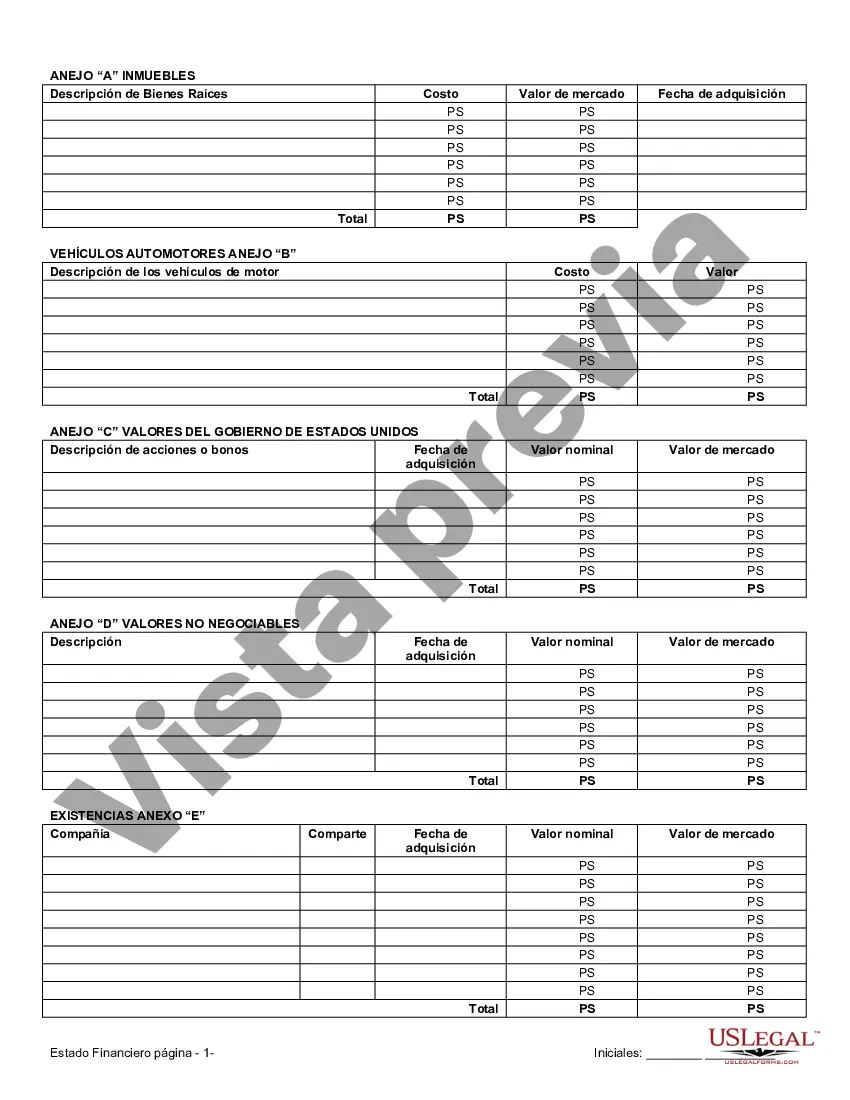

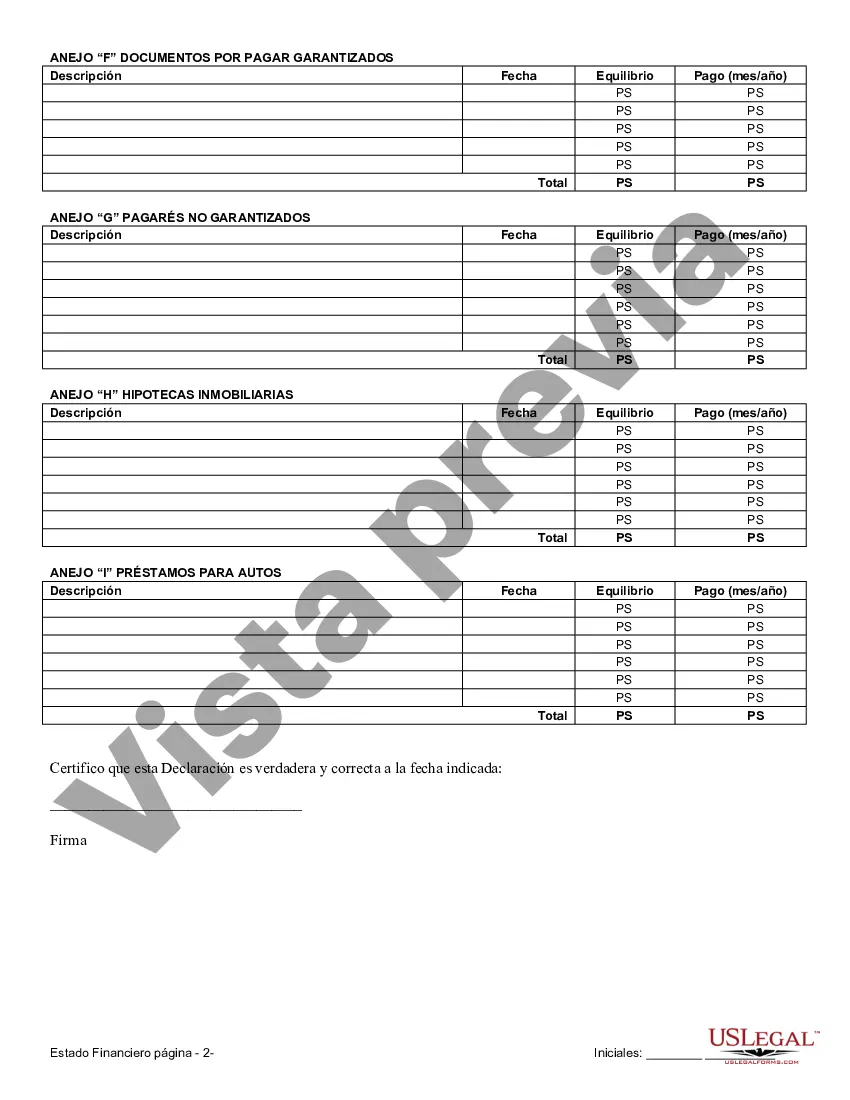

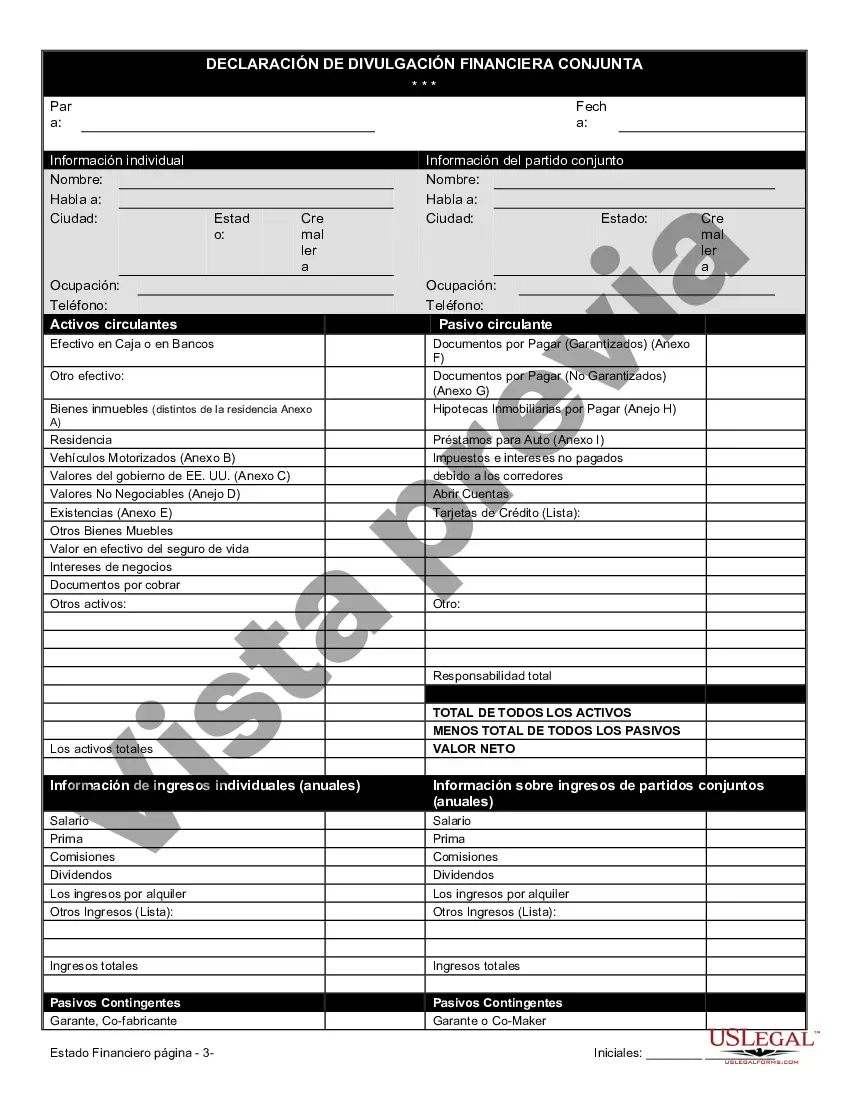

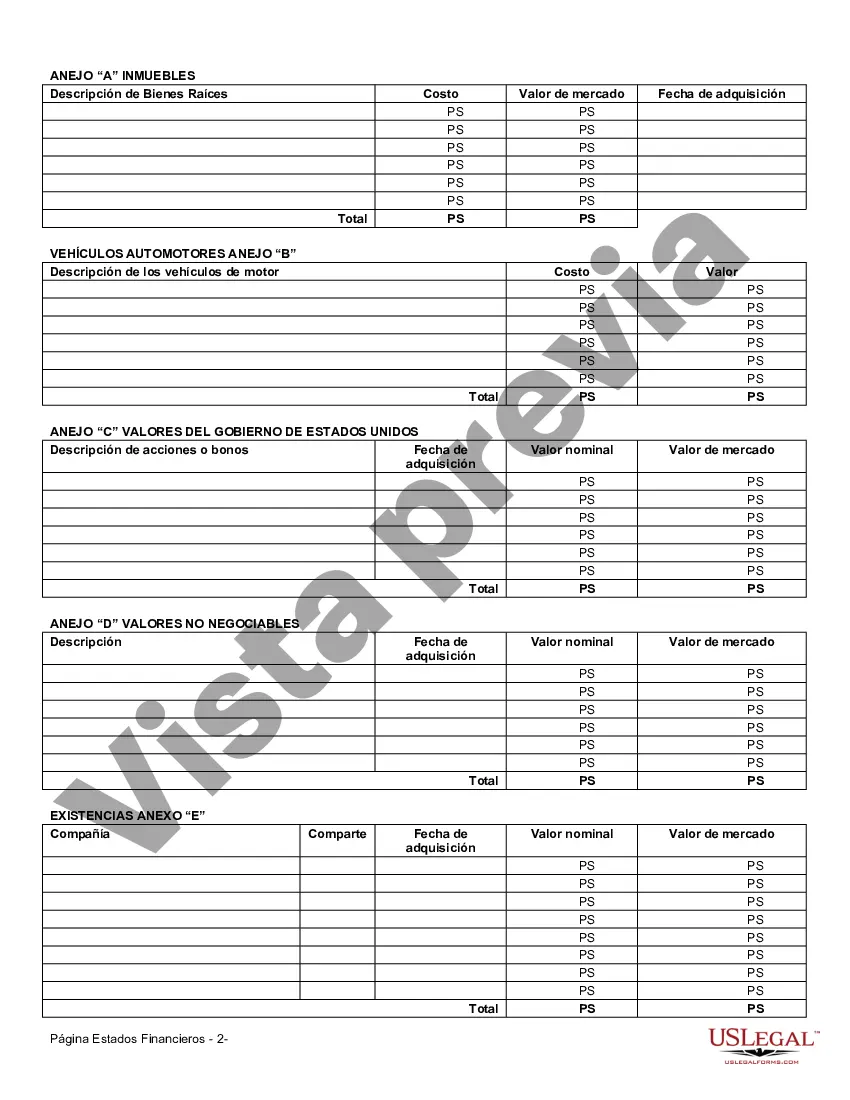

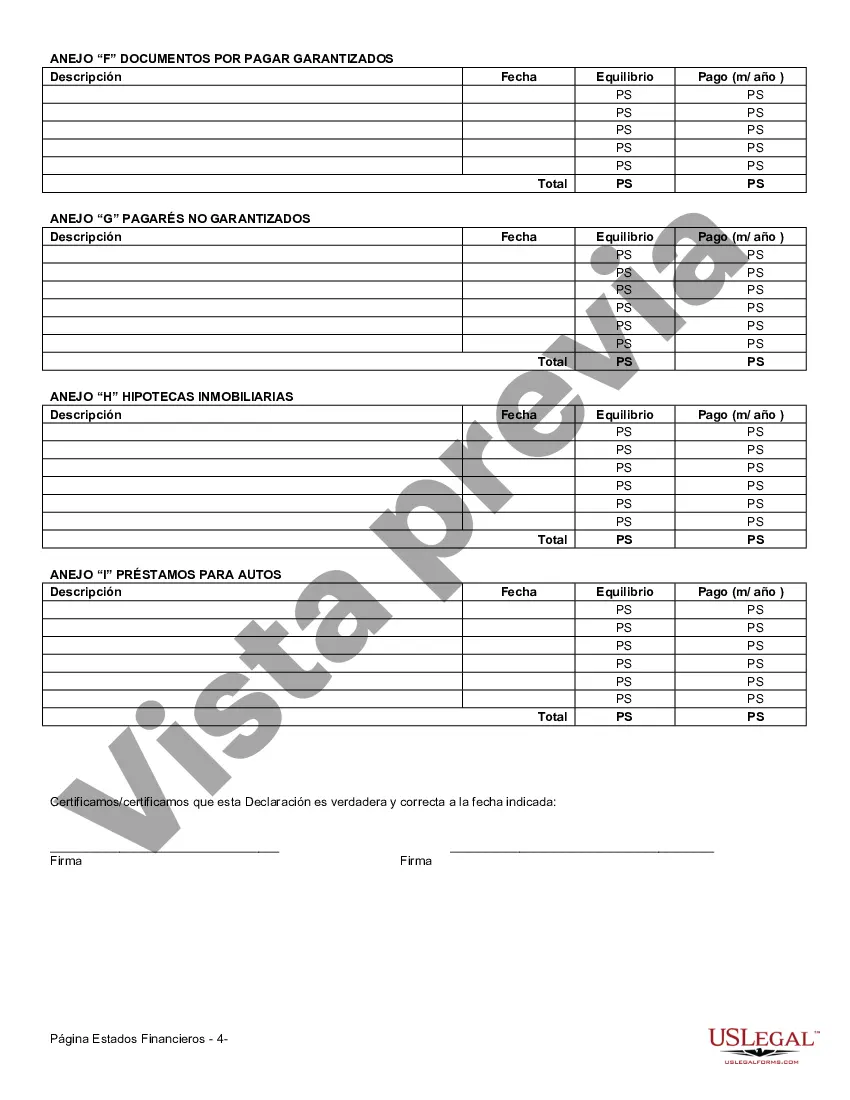

The Vermont Financial Statement Form — Universal Use is a vital document used by individuals and businesses to provide a comprehensive overview of their financial status. This form is particularly significant when it comes to filing taxes, applying for loans, maintaining accurate records, or analyzing one's financial health. It offers a standardized format that ensures consistent reporting across various entities. Keywords: Vermont Financial Statement Form, Universal Use, detailed description, types, keywords 1. Introduction to the Vermont Financial Statement Form — Universal Use: The Vermont Financial Statement Form — Universal Use is a standardized document utilized statewide to present financial information to relevant parties. It enables individuals and businesses to disclose their economic resources, liabilities, income, expenses, and other crucial financial aspects accurately. 2. Importance of the Vermont Financial Statement Form — Universal Use: This form is necessary for tax purposes as it provides an organized summary of financial data, making it easier for individuals and businesses to report their income, deductions, and credits. Furthermore, it allows lenders to evaluate loan applications and make informed decisions based on the applicant's financial standing. Additionally, the financial statement form aids in personal financial planning, highlighting areas of strength and potential improvements. 3. Components of the Vermont Financial Statement Form — Universal Use: This form typically includes sections for: a. Personal Information: This section entails personal details such as name, address, Social Security number, and contact information. b. Assets: It lists all the assets owned, including real estate, vehicles, investments, bank accounts, retirement accounts, and other valuable possessions. c. Liabilities: This section outlines all outstanding debts and obligations, including mortgages, loans, credit card debt, and other financial liabilities. d. Income: It includes various sources of income, such as wages, salaries, self-employment earnings, rental income, investments, and any other revenue streams. e. Expenses: This section details monthly expenses, including housing costs, utilities, transportation, insurance, healthcare expenses, education, entertainment, and other relevant expenditures. f. Miscellaneous: Additional information, such as dependents, alimony, child support payments, and any other relevant financial details, may be included here. 4. Different Types of Vermont Financial Statement Form — Universal Use: While there is typically only one version of the Vermont Financial Statement Form — Universal Use, it may be updated periodically to reflect changes in financial reporting requirements or to accommodate specific circumstances. It is crucial to ensure that you are using the most recent version of the form, which can be obtained from the Vermont Department of Taxes website or local tax offices. In conclusion, the Vermont Financial Statement Form — Universal Use is an integral tool for individuals and businesses in Vermont to provide a detailed and comprehensive snapshot of their financial condition. By accurately completing this form, individuals can fulfill their tax obligations and successfully navigate various financial processes.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Vermont Formulario de estado financiero - Uso universal - Financial Statement Form - Universal Use

Description

How to fill out Vermont Formulario De Estado Financiero - Uso Universal?

If you have to comprehensive, obtain, or print legitimate file templates, use US Legal Forms, the largest selection of legitimate varieties, which can be found on the web. Utilize the site`s basic and hassle-free search to obtain the documents you will need. Numerous templates for company and personal functions are categorized by categories and states, or keywords. Use US Legal Forms to obtain the Vermont Financial Statement Form - Universal Use with a number of click throughs.

If you are presently a US Legal Forms consumer, log in in your bank account and click on the Acquire switch to find the Vermont Financial Statement Form - Universal Use. Also you can access varieties you formerly saved from the My Forms tab of your own bank account.

If you use US Legal Forms for the first time, follow the instructions below:

- Step 1. Be sure you have selected the form for that right area/region.

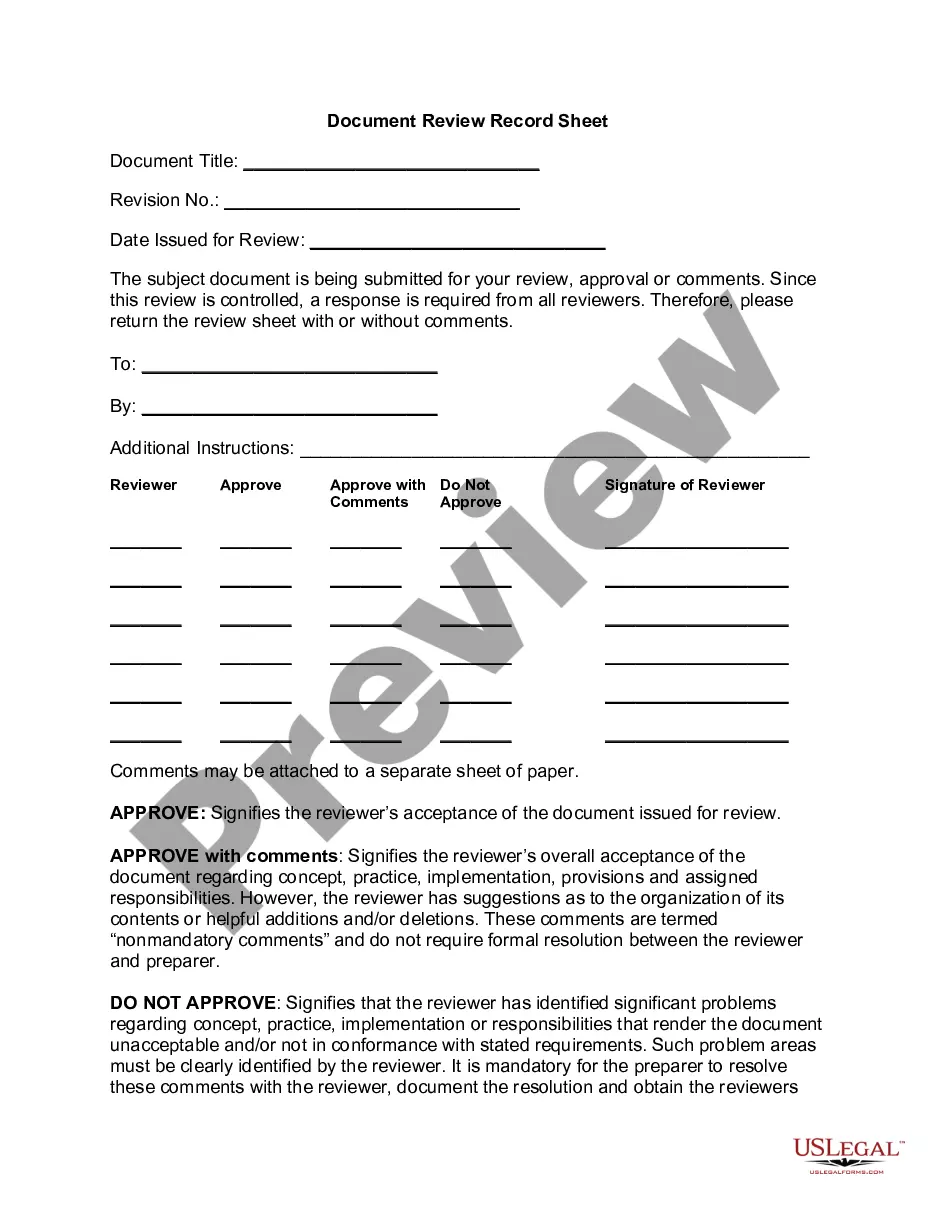

- Step 2. Use the Review choice to check out the form`s content. Never forget to see the explanation.

- Step 3. If you are unsatisfied with all the kind, take advantage of the Search area near the top of the display screen to locate other types in the legitimate kind format.

- Step 4. After you have identified the form you will need, click on the Get now switch. Pick the pricing prepare you prefer and add your references to register for the bank account.

- Step 5. Procedure the deal. You can utilize your Мisa or Ьastercard or PayPal bank account to perform the deal.

- Step 6. Find the format in the legitimate kind and obtain it in your device.

- Step 7. Total, revise and print or indicator the Vermont Financial Statement Form - Universal Use.

Every single legitimate file format you get is the one you have eternally. You might have acces to each and every kind you saved inside your acccount. Click the My Forms segment and choose a kind to print or obtain once more.

Compete and obtain, and print the Vermont Financial Statement Form - Universal Use with US Legal Forms. There are thousands of skilled and status-certain varieties you can utilize for your company or personal needs.