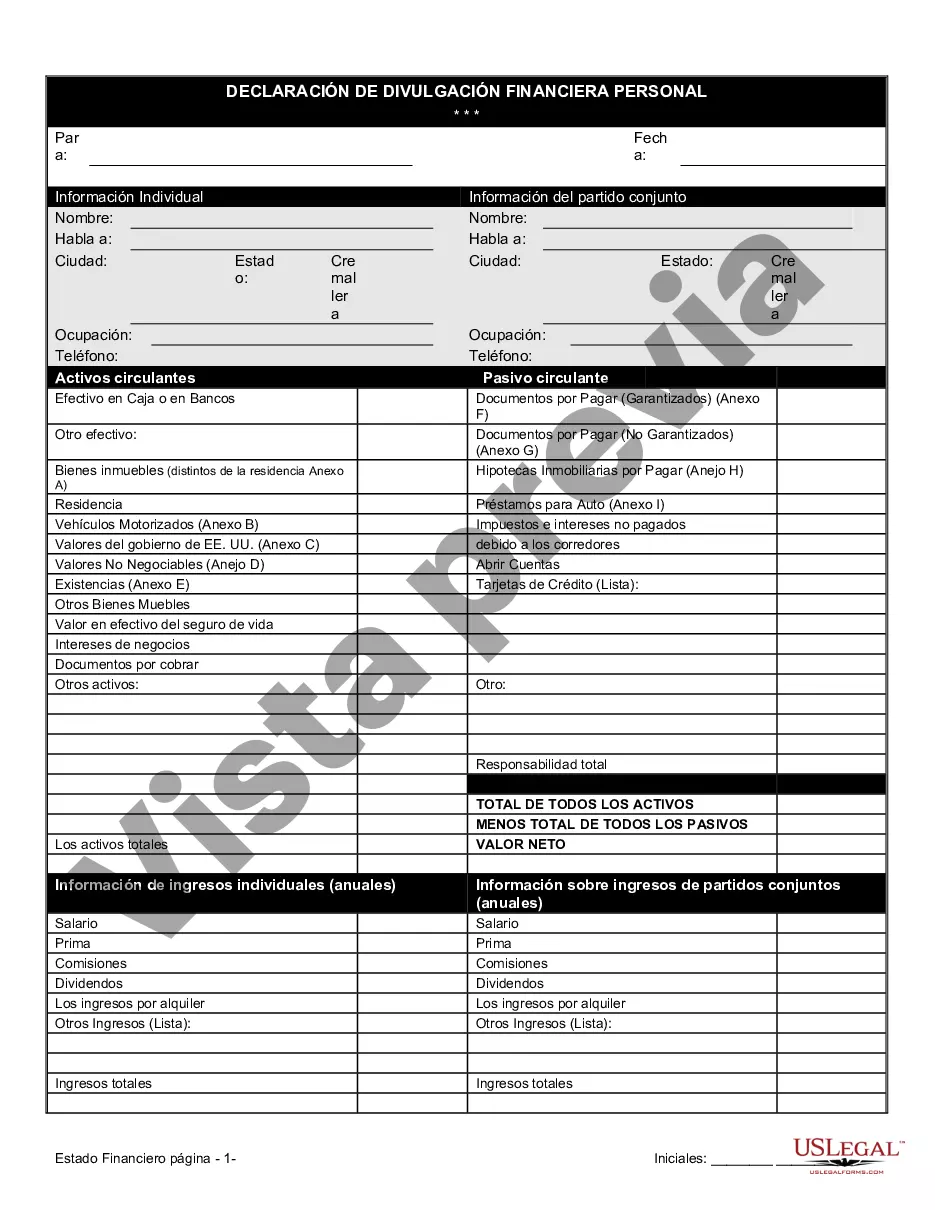

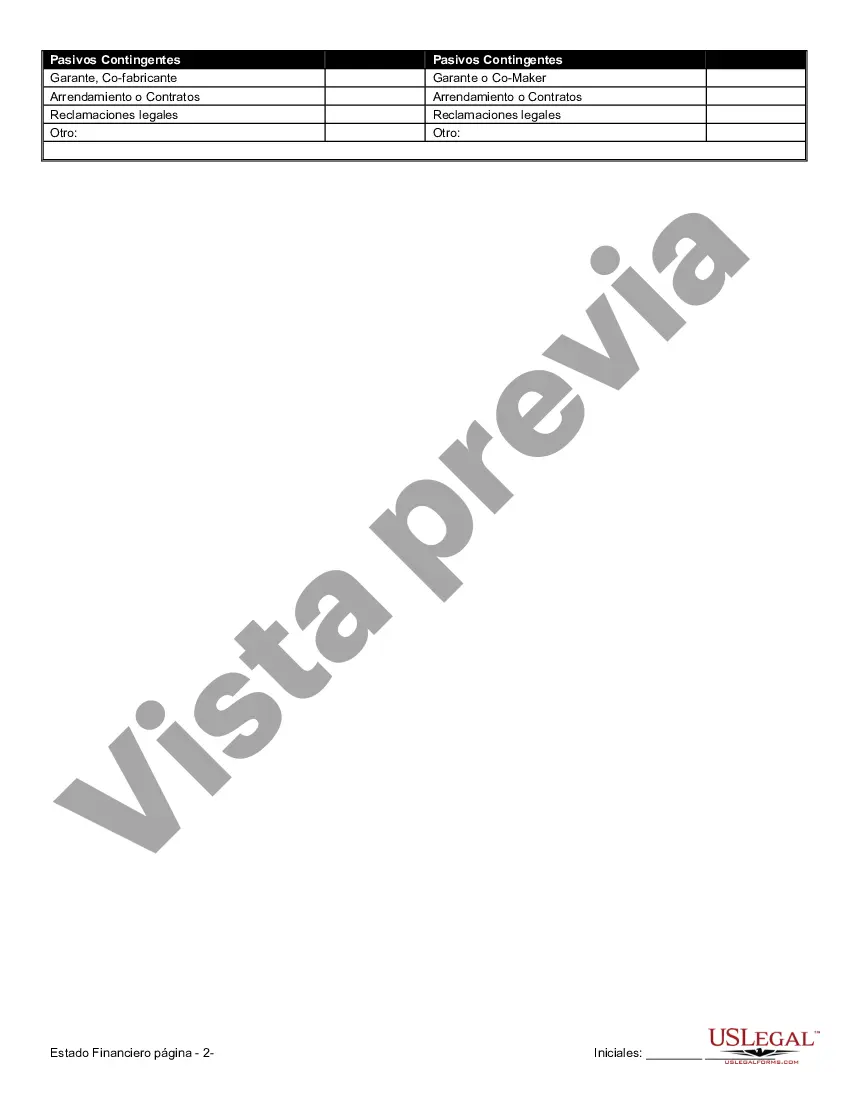

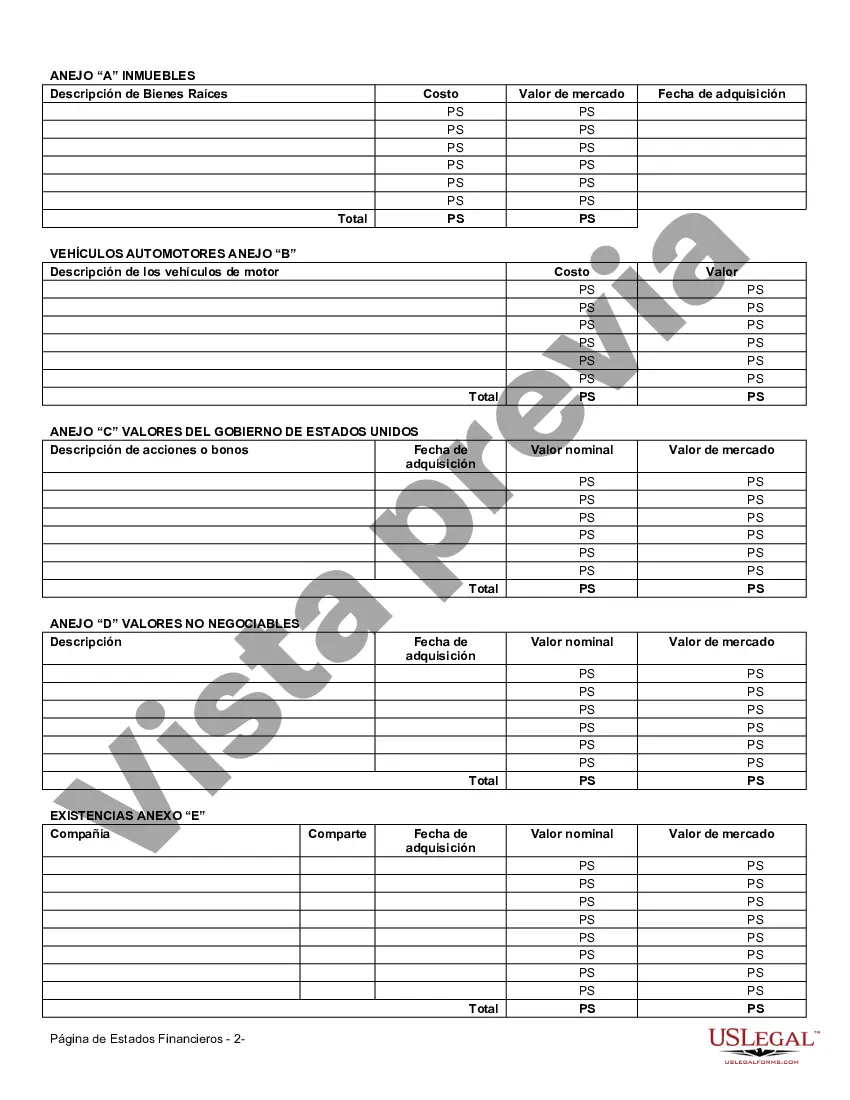

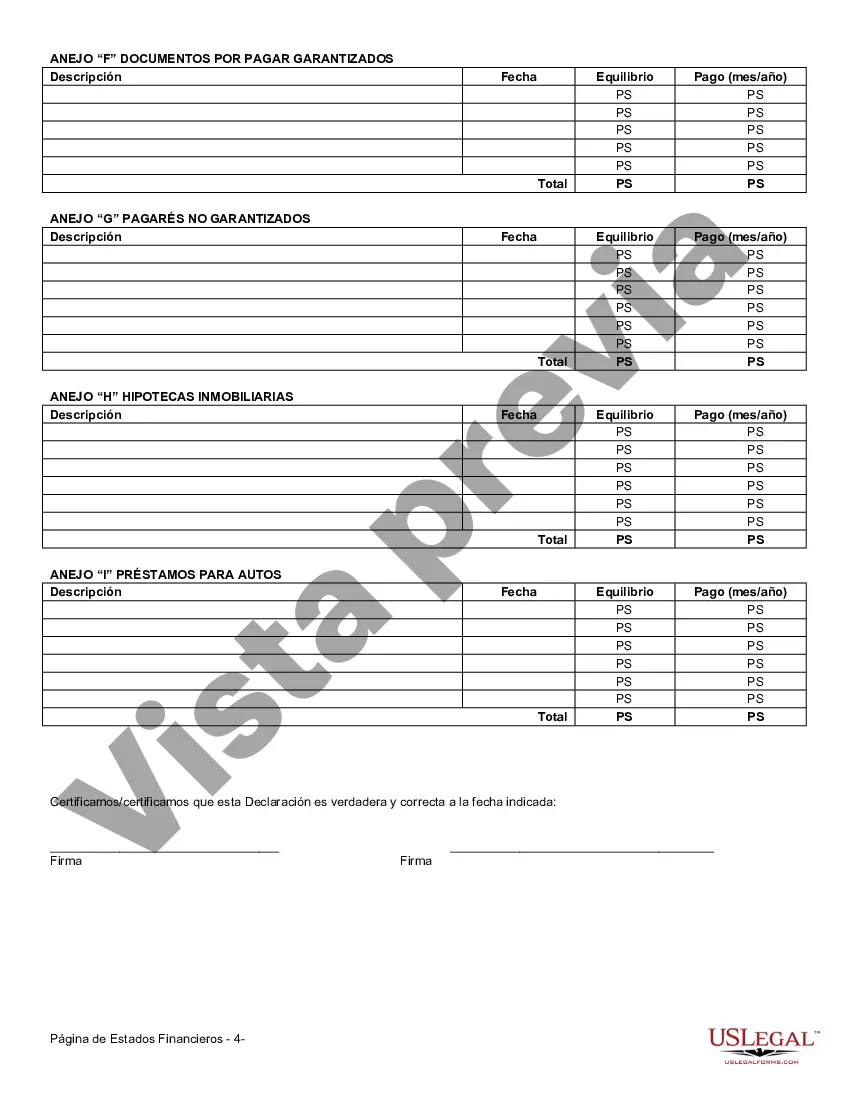

The Vermont Financial Statement Form — Husband and Wife Joint is a crucial document used in legal proceedings relating to financial matters during divorce proceedings in Vermont. This form is specifically designed for couples who are getting divorced and need to disclose their respective financial situations accurately. The purpose of the Vermont Financial Statement Form — Husband and Wife Joint is to provide a comprehensive overview of the financial status of both spouses. It ensures transparency and fairness in the division of assets, liabilities, income, and expenses between the couple. In this financial statement, spouses are required to provide detailed information about their incomes, including salaries, bonuses, commissions, self-employment earnings, rental incomes, and any other sources of income. They must also disclose information about their assets, such as real estate properties, vehicles, investments, retirement accounts, bank accounts, and personal belongings of significant value. Liabilities also need to be documented on the financial statement form, including mortgages, loans, credit card debts, tax obligations, and any other outstanding debts. Additionally, monthly expenses related to housing, utilities, groceries, transportation, healthcare, and childcare should be included. While the main form is referred to as the Vermont Financial Statement Form — Husband and Wife Joint, there may be variations or additional forms associated with it, such as: 1. Schedule A: This is an attachment to the main form and provides a breakdown of the monthly expenses of the couple. It includes categories like housing, utilities, transportation, food, clothing, medical expenses, insurance costs, and other miscellaneous expenses. 2. Schedule B: This attachment specifically focuses on the income section, where spouses need to provide detailed information about their sources of income. It includes sections to disclose salary, bonuses, tips, self-employment income, partnerships, rental income, pensions, retirement benefits, and any other income sources. 3. Schedule C: This form is typically used when one or both spouses have significant assets, such as real estate properties or investments. It requires detailed information about these assets, including their current market value, outstanding mortgages, and any income generated from them. 4. Schedule D: In case the couple has any debts or liabilities that require further explanation or clarification, Schedule D can be used to provide additional details about those specific debts, such as the creditor's name, account numbers, outstanding balances, and any repayment plans. It is important to note that the exact variations or additional forms associated with the Vermont Financial Statement Form — Husband and Wife Joint may vary depending on the specific requirements of the court or the divorce attorney handling the case.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Vermont Formulario de estado financiero: conjunto de marido y mujer - Financial Statement Form - Husband and Wife Joint

Description

How to fill out Vermont Formulario De Estado Financiero: Conjunto De Marido Y Mujer?

If you need to total, acquire, or produce legal record themes, use US Legal Forms, the largest assortment of legal types, which can be found on the web. Utilize the site`s simple and handy look for to find the papers you will need. Different themes for business and personal purposes are sorted by classes and says, or keywords and phrases. Use US Legal Forms to find the Vermont Financial Statement Form - Husband and Wife Joint with a couple of clicks.

If you are presently a US Legal Forms buyer, log in for your profile and then click the Acquire button to find the Vermont Financial Statement Form - Husband and Wife Joint. Also you can gain access to types you in the past delivered electronically in the My Forms tab of the profile.

If you work with US Legal Forms for the first time, follow the instructions under:

- Step 1. Ensure you have selected the shape for that correct town/land.

- Step 2. Use the Preview method to examine the form`s content material. Do not forget to read through the description.

- Step 3. If you are not satisfied together with the kind, use the Lookup discipline near the top of the screen to get other versions from the legal kind format.

- Step 4. When you have identified the shape you will need, select the Get now button. Pick the pricing prepare you favor and add your qualifications to register on an profile.

- Step 5. Procedure the transaction. You can use your charge card or PayPal profile to accomplish the transaction.

- Step 6. Choose the structure from the legal kind and acquire it on the system.

- Step 7. Complete, revise and produce or signal the Vermont Financial Statement Form - Husband and Wife Joint.

Every legal record format you acquire is your own for a long time. You might have acces to each kind you delivered electronically in your acccount. Select the My Forms segment and decide on a kind to produce or acquire once again.

Remain competitive and acquire, and produce the Vermont Financial Statement Form - Husband and Wife Joint with US Legal Forms. There are many expert and status-particular types you can utilize for the business or personal requirements.