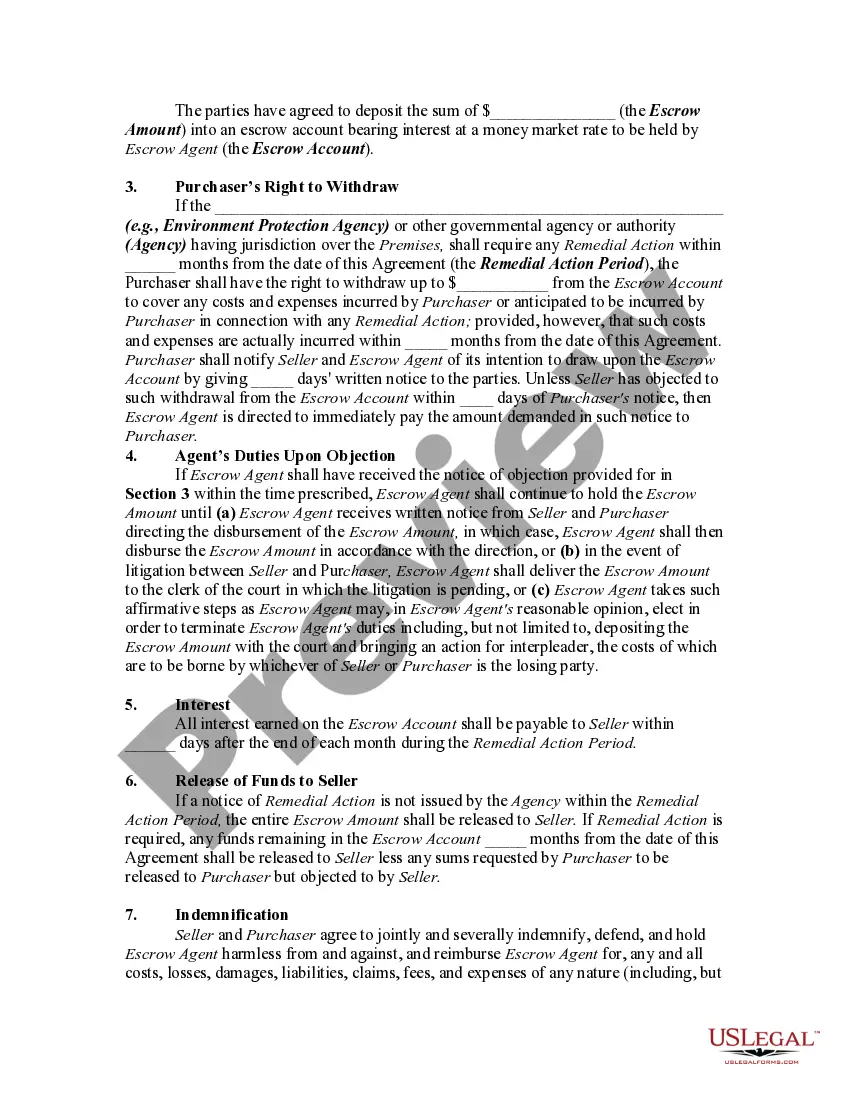

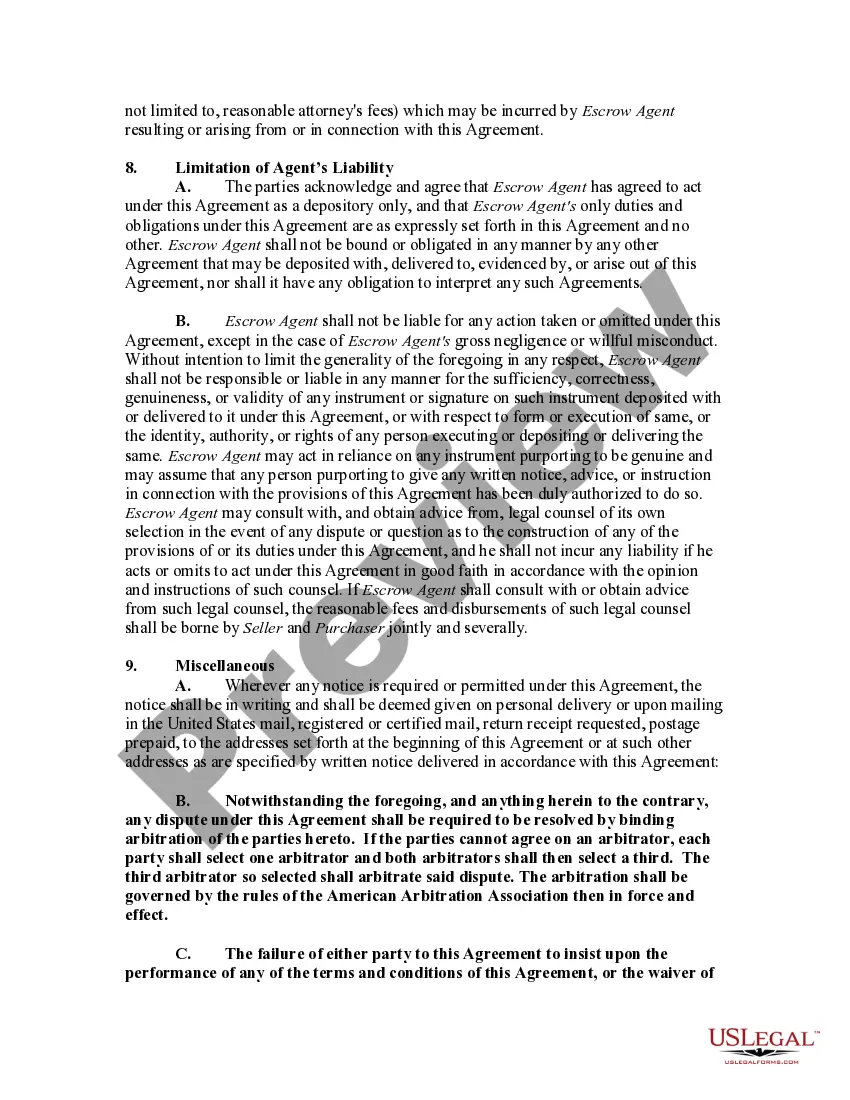

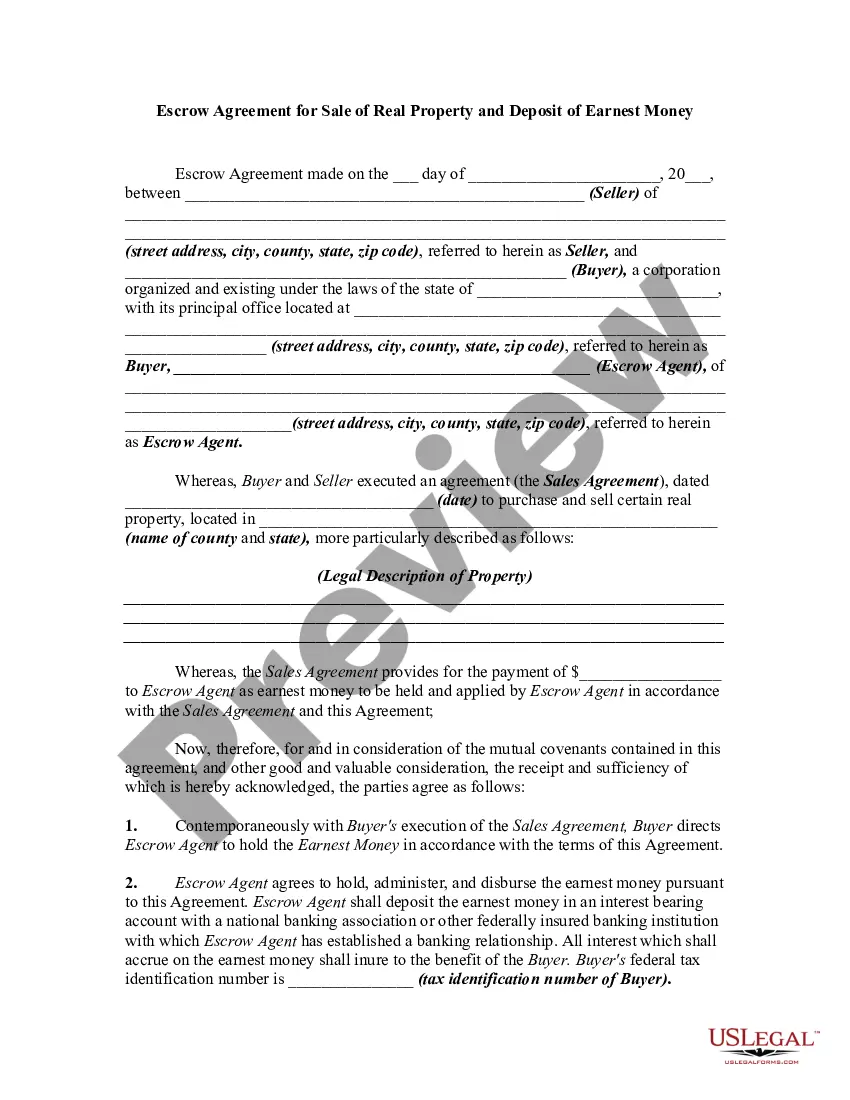

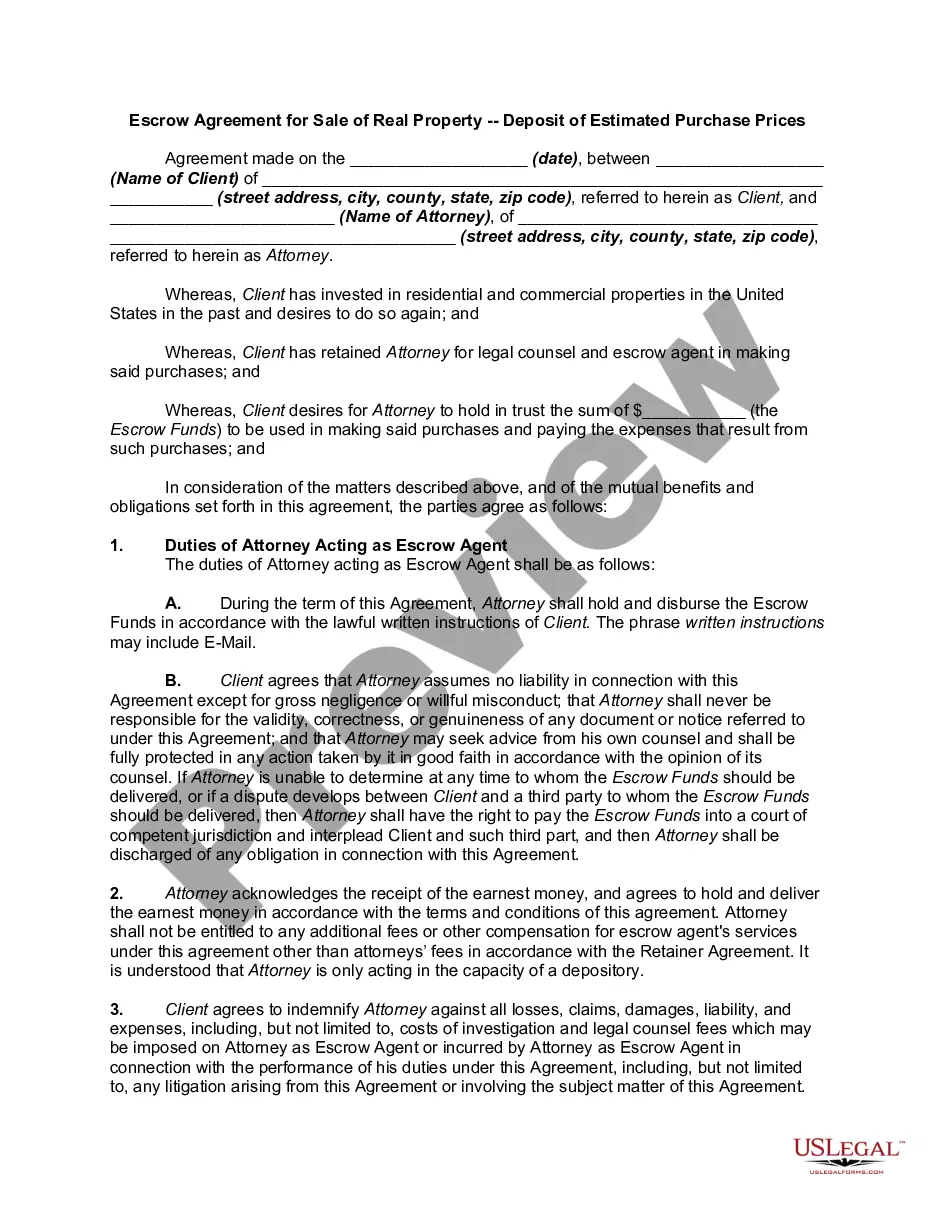

An escrow is the deposit of a written instrument or something of value with a third person with instructions to deliver it to another when a stated condition is performed or a specified event occurs. The use of an escrow in this form is to protect the purchaser of real property from having to pay for a possible defect in the real property after the sale has been made.

Vermont Escrow Agreement for Sale of Real Property and Deposit to Protect Purchaser Against Cost of Required Remedial Action

Description

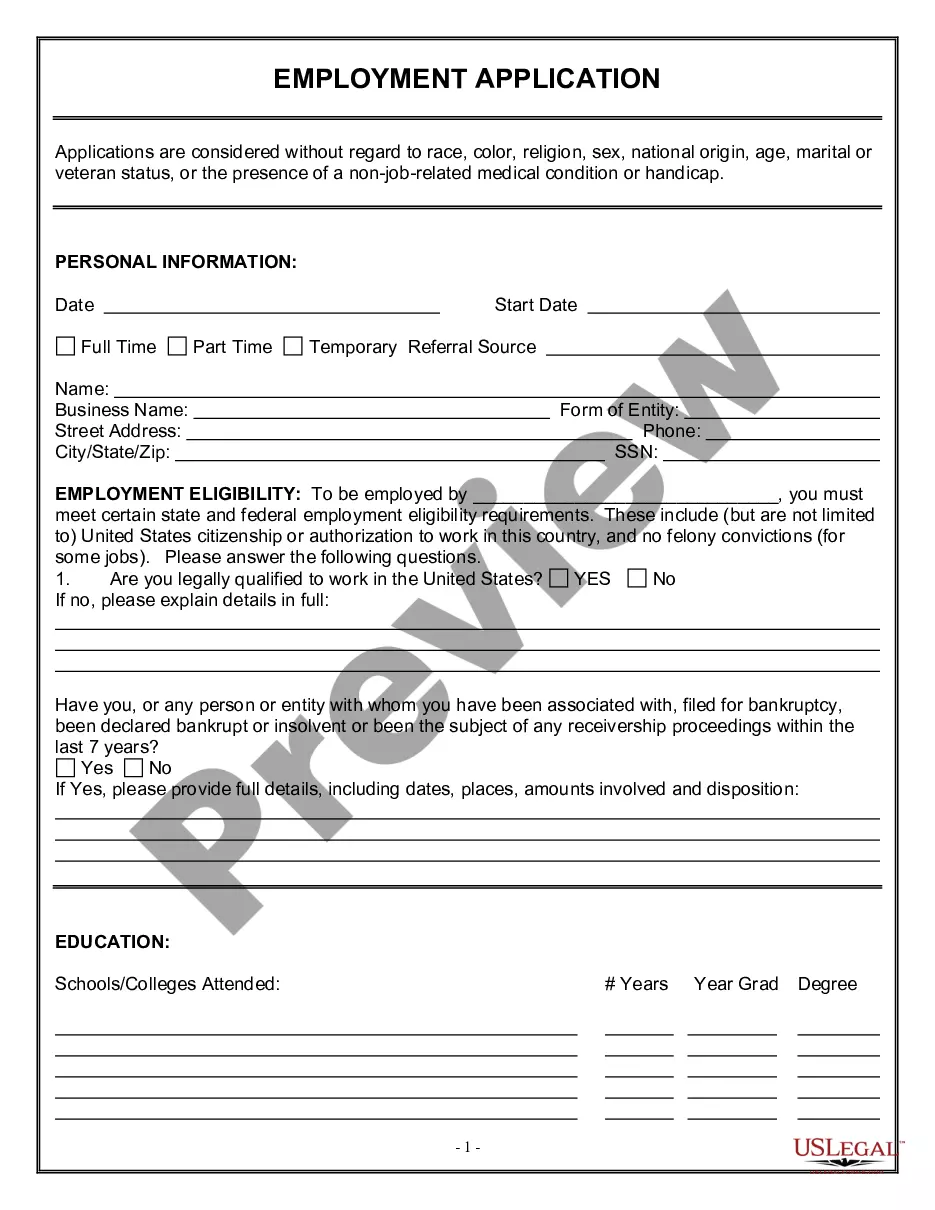

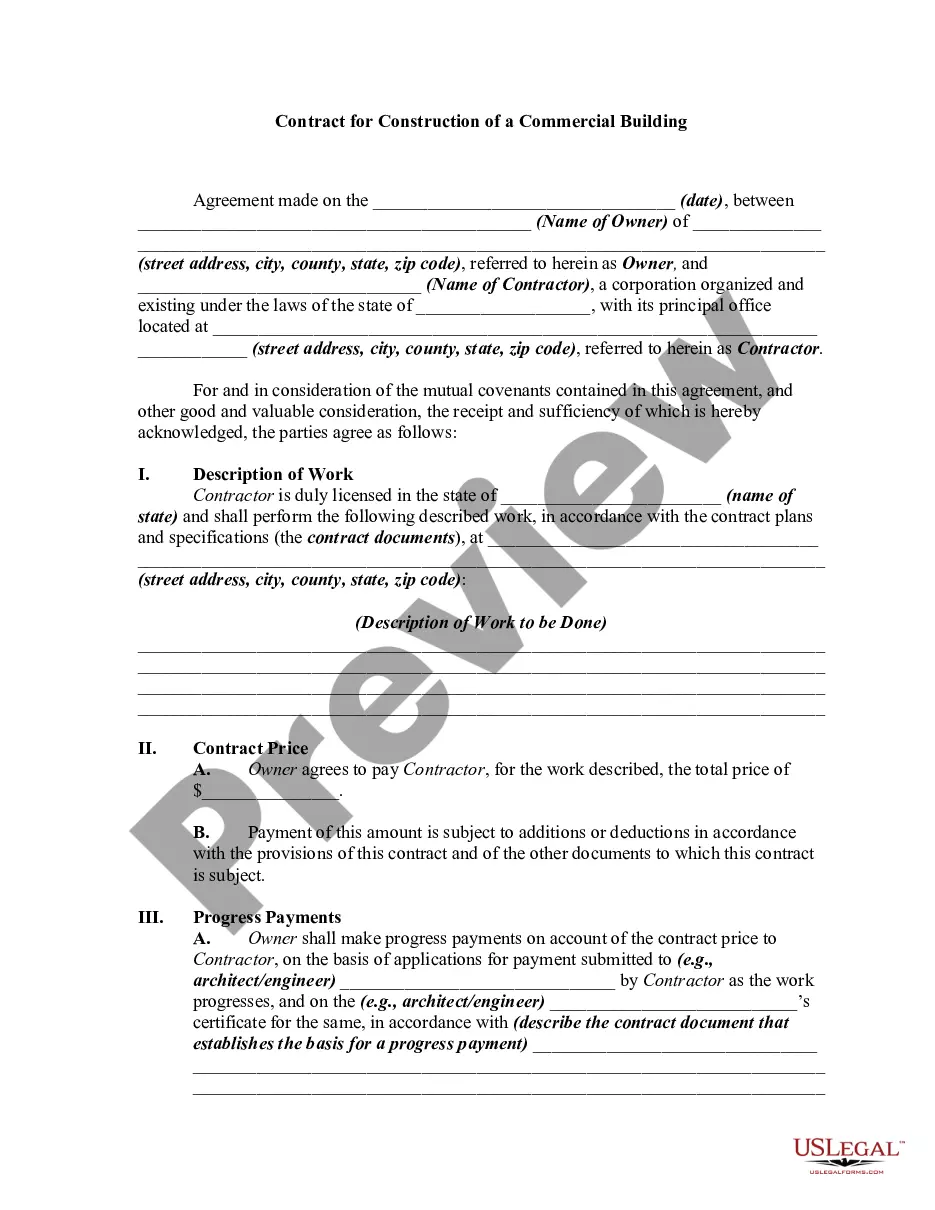

How to fill out Escrow Agreement For Sale Of Real Property And Deposit To Protect Purchaser Against Cost Of Required Remedial Action?

You can spend hours online searching for the legal document template that meets the state and federal requirements you need.

US Legal Forms offers a vast array of legal forms that are reviewed by professionals.

You can easily download or print the Vermont Escrow Agreement for Sale of Real Property and Deposit to Protect Purchaser Against Cost of Required Remedial Action from our service.

If available, use the Preview button to view the document template as well.

- If you already have a US Legal Forms account, you can Log In and then click the Download button.

- Then, you can fill out, modify, print, or sign the Vermont Escrow Agreement for Sale of Real Property and Deposit to Protect Purchaser Against Cost of Required Remedial Action.

- Every legal document template you acquire is yours permanently.

- To obtain another copy of the purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the state/city of your choice. Check the form description to confirm you have chosen the right form.

Form popularity

FAQ

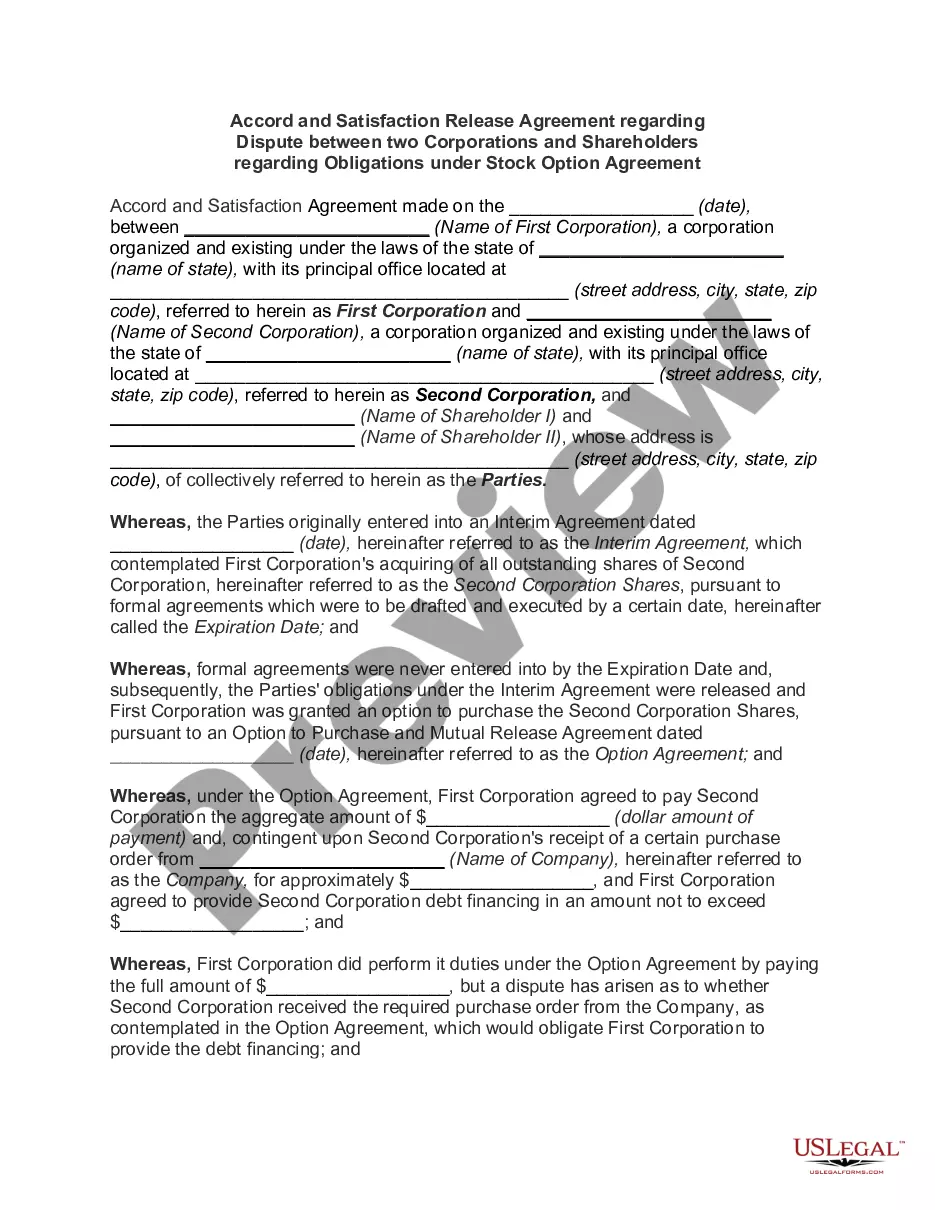

Can a seller back out after a low home appraisal? Only the buyer can back out of a contract if the home's appraisal comes in too low. This also is dependent on the buyer having an appraisal clause in their purchase agreement.

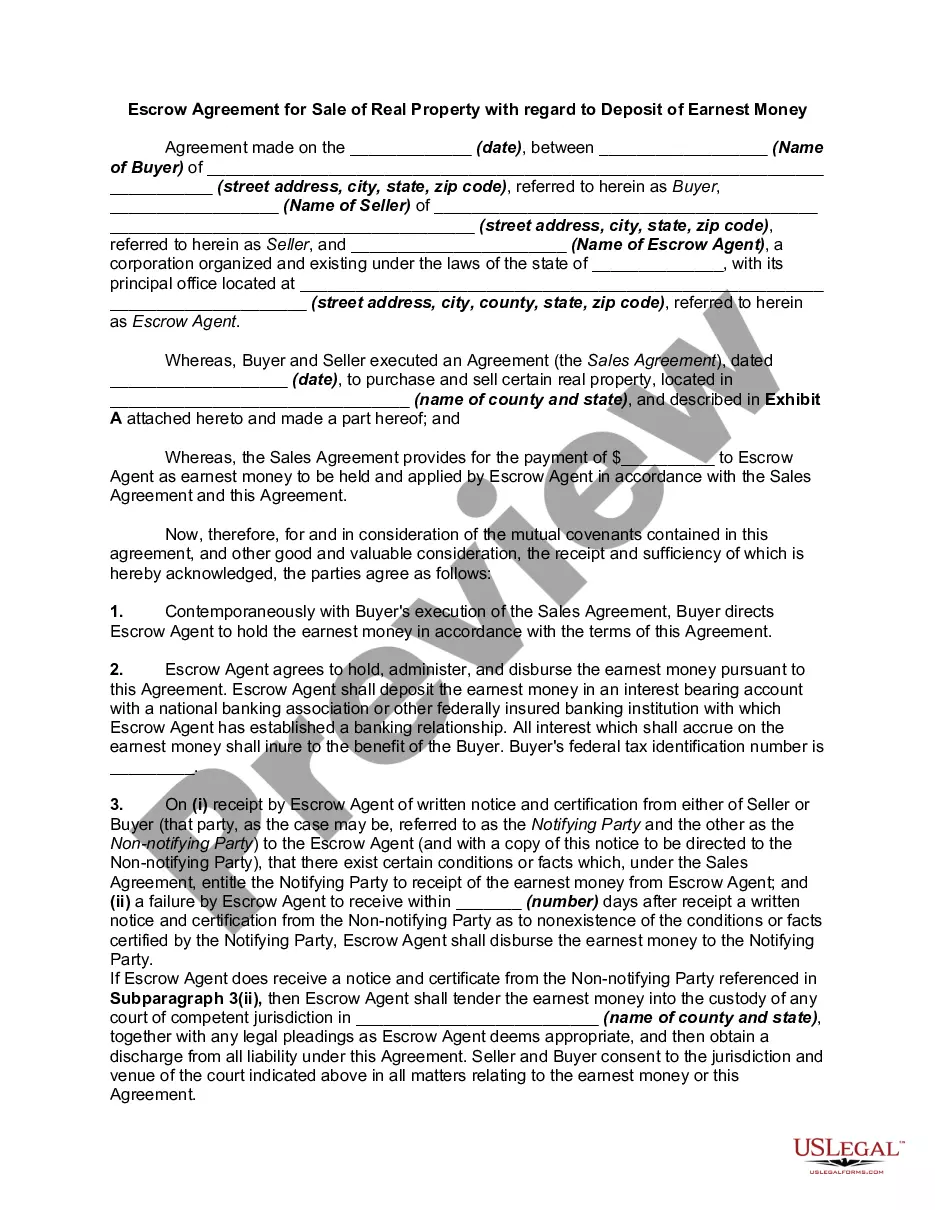

Here's how to hold money in escrow:The buyer and seller agree to the terms of the transaction.Payment is sent to the escrow company.Seller ships the goods or provides the service to the buyer.Buyer accepts the goods or services.More items...

Earnest money is always returned to the buyer if the seller terminates the deal. While the buyer and seller can negotiate the earnest money deposit, it often ranges between 1% and 2% of the home's purchase price, depending on the market.

How to Protect Your Earnest Money DepositNever give an earnest money deposit directly to the seller.Make the deposit payable to a reputable third party, such as a well-known and established real estate brokerage, legal firm, escrow company, or title company.More items...

Example of EscrowThe offer is accepted and he must put his earnest money, say $5,000, into escrow. The money put in escrow allows the seller to know you're serious about potentially buying the property, and in return, the seller will take the property off the market and finalize repairs, etc.

Reasons you can lose earnest money Two scenarios that may lead to the forfeiture of your good faith deposit are: Waiving your contingencies. Financing and inspection contingencies protect your earnest money if your mortgage doesn't go through or the house is beyond repair.

What Is An Escrow Account? In real estate, escrow is typically used for two reasons: To protect the buyer's good faith deposit so the money goes to the right party according to the conditions of the sale. To hold a homeowner's funds for property taxes and homeowners insurance.

An escrow agreement is a legal agreement, which describes the terms and conditions applicable to the participants involved. An escrow agreement contains a detailed responsibility of the parties involved. An escrow agreement typically includes a nonpartisan party who is referred to as the escrow agent.

1 A contract of sale is consensual because the contract is perfected by mere consent. This is different from a real contract (perfected by delivery).

Tip: It is possible for sellers to negotiate for earnest money to become non-refundable after inspection. If buyers are looking for ways to strengthen their offer, they might consider this option. Non-refundable deposits, common with new construction, differ from earnest money.