A joint venture is a relationship between two or more people who combine their labor or property for a single business undertaking. They share profits and losses equally, or as otherwise provided in the joint venture agreement. The single business undertaking aspect is a key to determining whether or not a business entity is a joint venture as opposed to a partnership.

A joint venture is very similar to a partnership. In fact, some States treat joint ventures the same as partnerships with regard to partnership statutes such as the Uniform Partnership Act. The main difference between a partnership and a joint venture is that a joint venture usually relates to the pursuit of a single transaction or enterprise even though this may require several years to accomplish. A partnership is generally a continuing or ongoing business or activity. While a partnership may be expressly created for a single transaction, this is very unusual. Most Courts hold that joint ventures are subject to the same principles of law as partnerships.

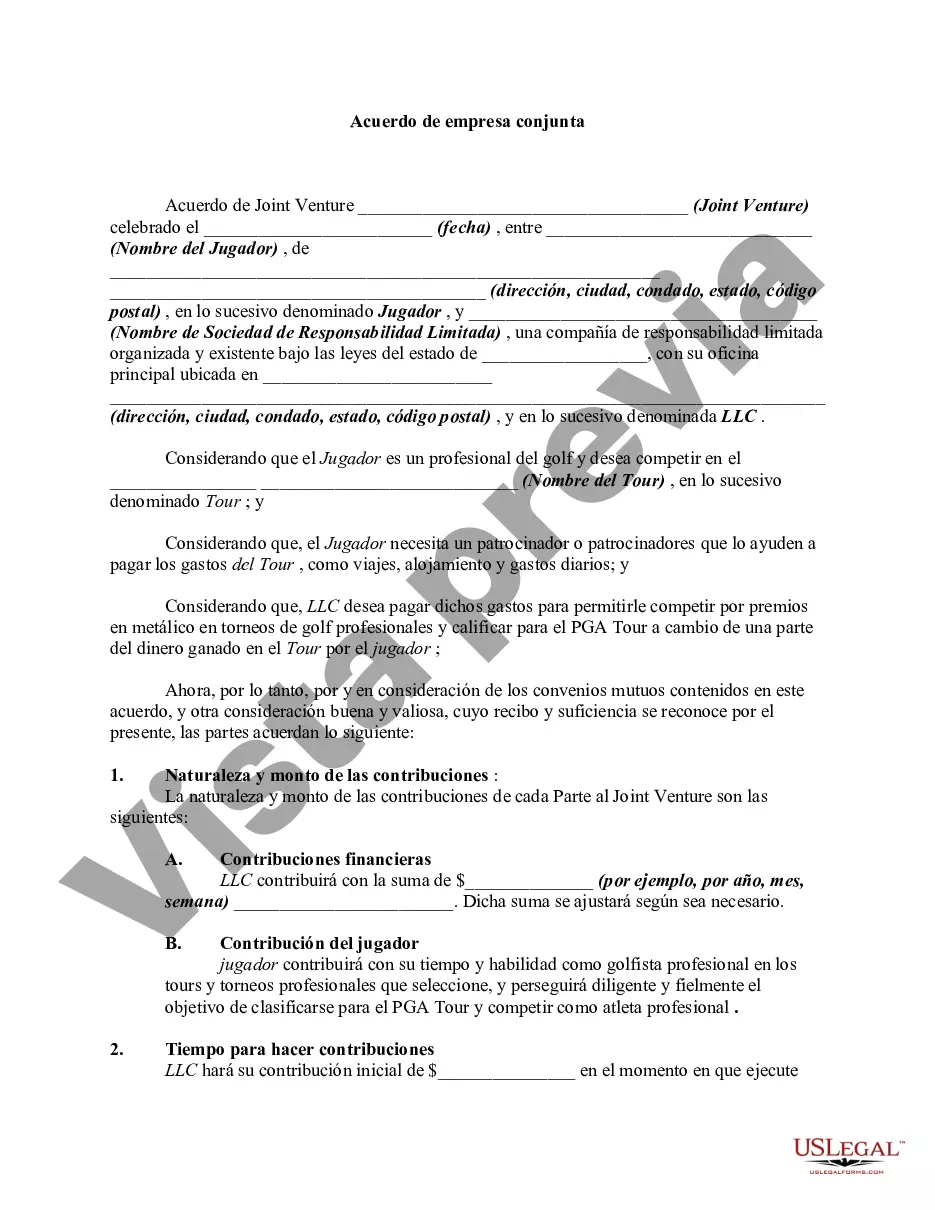

Title: Vermont Joint Venture Agreement between a Limited Liability Company and Professional Golfer to Sponsor and Provide Funds Introduction: A Vermont Joint Venture Agreement between a Limited Liability Company (LLC) and a Professional Golfer signifies a legal partnership established for the purpose of sponsoring and providing financial assistance to the golfer. This mutually beneficial agreement allows both parties to combine their resources, expertise, and financial capabilities with the aim of achieving common goals in the golfing industry. In this article, we will explore the details of such an agreement, its benefits, and potential variations. 1. Key elements of a Vermont Joint Venture Agreement: — Parties involved: The agreement identifies the Limited Liability Company and the Professional Golfer as the participating entities. — Objective: The agreement clearly states the purpose of the joint venture, explaining the specific goals or projects to be accomplished. — Contributions: It outlines the financial, expertise, and resource contributions from each party, ensuring a fair and transparent distribution of responsibilities. — Management and decision-making: The agreement defines the decision-making process, managerial roles, and responsibilities of each party. — Profit and loss sharing: It specifies how the profits and losses generated by the joint venture will be divided between the parties involved. — Duration and termination: The agreement establishes the duration of the joint venture and outlines the conditions under which it can be terminated or extended. 2. Benefits of a Vermont Joint Venture Agreement: — Increased financial capacity: By combining the resources of the LLC and the Professional Golfer, the joint venture can secure larger sponsorship deals, procure better training facilities, and organize prestigious tournaments. — Enhanced expertise: The collaboration between the LLC and the Professional Golfer allows for the sharing of knowledge, skills, and experience, leading to better strategic decision-making and improved performance in the golfing industry. — Mitigated risks: The joint venture enables the sharing of potential financial losses, reducing the burden on each party and providing a safety net for unforeseen circumstances. — Expanded networking opportunities: Through the joint venture, both the LLC and the Professional Golfer gain access to each other's networks, creating valuable connections within the golfing community and potentially leading to new business opportunities. 3. Types of Vermont Joint Venture Agreements: a) Equity-based joint venture: In this type of agreement, the LLC and the Professional Golfer jointly own and operate a new entity, sharing both control and profit within the venture. b) Contractual joint venture: This agreement involves a defined collaboration between the LLC and the Professional Golfer for a specific project or set duration, where both parties contribute resources without establishing a separate legal entity. c) Co-marketing joint venture: The LLC and the Professional Golfer join forces to align their marketing efforts, promoting each other's brands and products while sharing the associated costs and benefits. d) Resource-sharing joint venture: This type of agreement focuses on sharing specific resources or facilities, such as training centers or equipment, between the LLC and the Professional Golfer, eliminating duplicate costs and increasing operational efficiency. Conclusion: A Vermont Joint Venture Agreement between a Limited Liability Company and Professional Golfer provides a platform for collaboration and investment in the golfing industry. By combining their resources and expertise, both parties can achieve common objectives, enhance their professional careers, and contribute to the growth of the sport. Whether it is an equity-based, contractual, co-marketing, or resource-sharing joint venture, this legal partnership offers various opportunities for success in the competitive world of golf.Title: Vermont Joint Venture Agreement between a Limited Liability Company and Professional Golfer to Sponsor and Provide Funds Introduction: A Vermont Joint Venture Agreement between a Limited Liability Company (LLC) and a Professional Golfer signifies a legal partnership established for the purpose of sponsoring and providing financial assistance to the golfer. This mutually beneficial agreement allows both parties to combine their resources, expertise, and financial capabilities with the aim of achieving common goals in the golfing industry. In this article, we will explore the details of such an agreement, its benefits, and potential variations. 1. Key elements of a Vermont Joint Venture Agreement: — Parties involved: The agreement identifies the Limited Liability Company and the Professional Golfer as the participating entities. — Objective: The agreement clearly states the purpose of the joint venture, explaining the specific goals or projects to be accomplished. — Contributions: It outlines the financial, expertise, and resource contributions from each party, ensuring a fair and transparent distribution of responsibilities. — Management and decision-making: The agreement defines the decision-making process, managerial roles, and responsibilities of each party. — Profit and loss sharing: It specifies how the profits and losses generated by the joint venture will be divided between the parties involved. — Duration and termination: The agreement establishes the duration of the joint venture and outlines the conditions under which it can be terminated or extended. 2. Benefits of a Vermont Joint Venture Agreement: — Increased financial capacity: By combining the resources of the LLC and the Professional Golfer, the joint venture can secure larger sponsorship deals, procure better training facilities, and organize prestigious tournaments. — Enhanced expertise: The collaboration between the LLC and the Professional Golfer allows for the sharing of knowledge, skills, and experience, leading to better strategic decision-making and improved performance in the golfing industry. — Mitigated risks: The joint venture enables the sharing of potential financial losses, reducing the burden on each party and providing a safety net for unforeseen circumstances. — Expanded networking opportunities: Through the joint venture, both the LLC and the Professional Golfer gain access to each other's networks, creating valuable connections within the golfing community and potentially leading to new business opportunities. 3. Types of Vermont Joint Venture Agreements: a) Equity-based joint venture: In this type of agreement, the LLC and the Professional Golfer jointly own and operate a new entity, sharing both control and profit within the venture. b) Contractual joint venture: This agreement involves a defined collaboration between the LLC and the Professional Golfer for a specific project or set duration, where both parties contribute resources without establishing a separate legal entity. c) Co-marketing joint venture: The LLC and the Professional Golfer join forces to align their marketing efforts, promoting each other's brands and products while sharing the associated costs and benefits. d) Resource-sharing joint venture: This type of agreement focuses on sharing specific resources or facilities, such as training centers or equipment, between the LLC and the Professional Golfer, eliminating duplicate costs and increasing operational efficiency. Conclusion: A Vermont Joint Venture Agreement between a Limited Liability Company and Professional Golfer provides a platform for collaboration and investment in the golfing industry. By combining their resources and expertise, both parties can achieve common objectives, enhance their professional careers, and contribute to the growth of the sport. Whether it is an equity-based, contractual, co-marketing, or resource-sharing joint venture, this legal partnership offers various opportunities for success in the competitive world of golf.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.