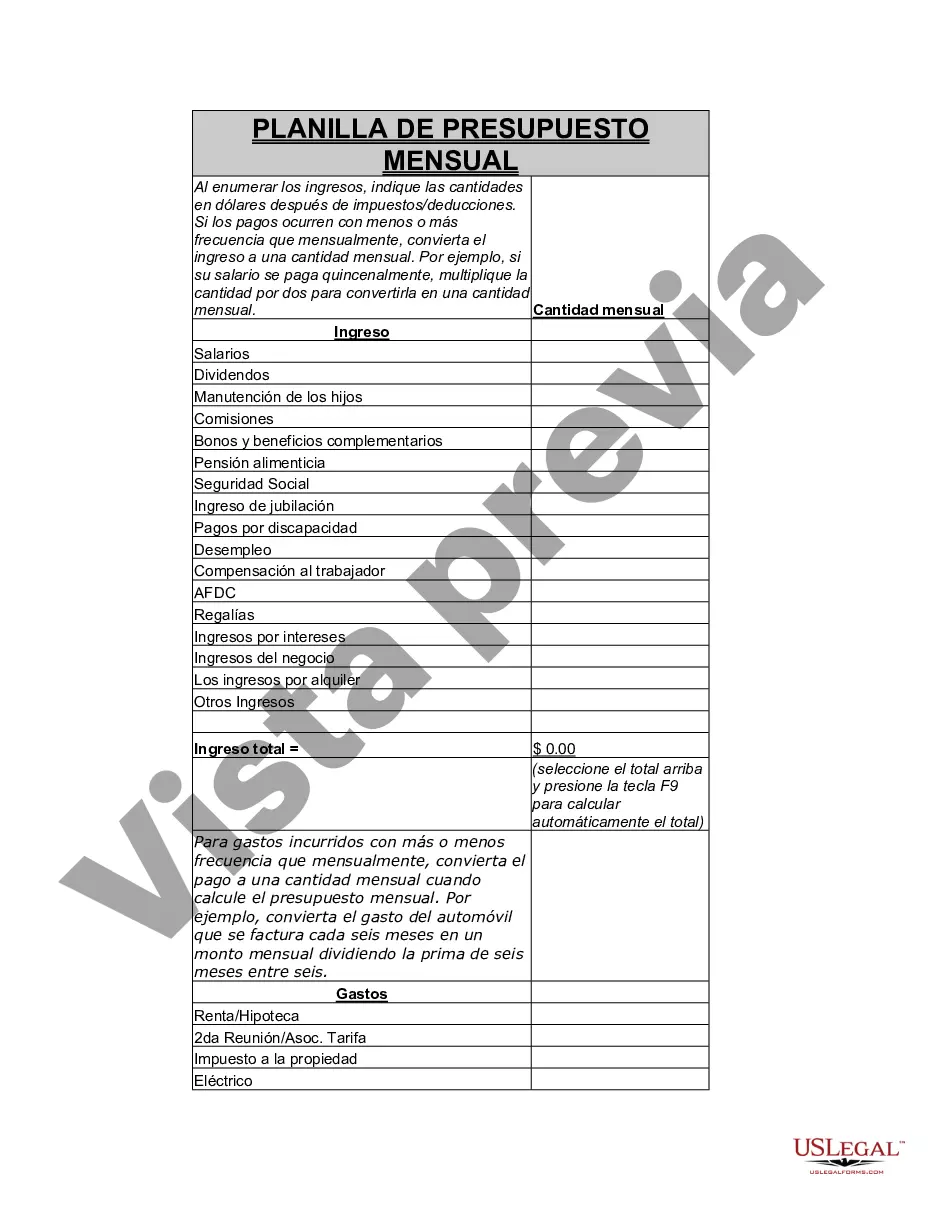

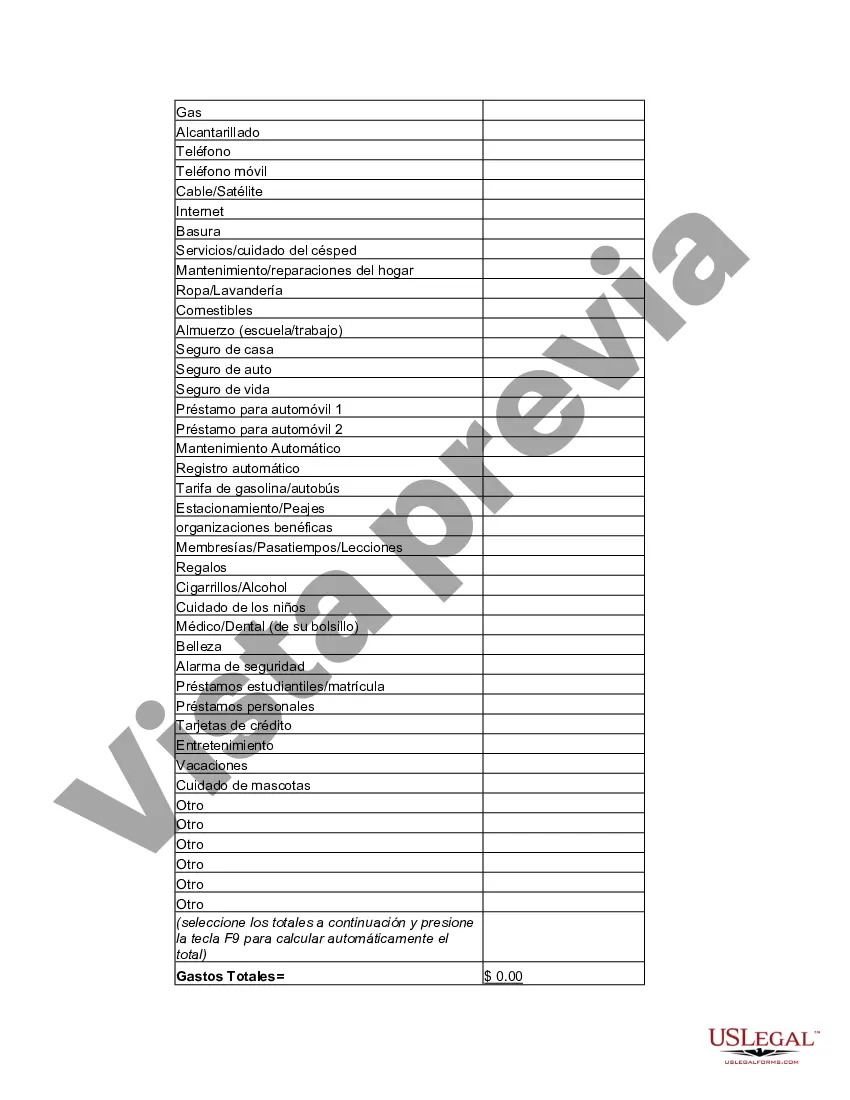

Vermont Personal Monthly Budget Worksheet serves as a practical tool to help individuals better manage their financial resources and effectively plan their expenses. This worksheet enables Vermonters to gain a comprehensive understanding of their income, track their expenses diligently, and ensure that their spending aligns with their financial goals. With the Vermont Personal Monthly Budget Worksheet, individuals can systematically analyze their income sources, which include salaries, wages, bonuses, investments, and other supplemental incomes. By accurately documenting these earnings, Vermonters can have a clear overview of their financial inflows. Moreover, this budget worksheet boasts a variety of expense categories, specifically tailored to the unique needs of Vermont residents. The worksheet typically includes comprehensive sections such as housing expenses (rent/mortgage payments, utilities), transportation costs (car payments, fuel, insurance), food expenditures (groceries, dining out), healthcare expenses (insurance premiums, medical bills), personal care (grooming, clothing), education or student loan payments, entertainment, and miscellaneous expenses. Vermont Personal Monthly Budget Worksheet also emphasizes the significance of tracking variable expenses, which tend to fluctuate each month. This section includes categories such as entertainment, vacation, home repairs, and other irregular expenses that may arise throughout the year. Furthermore, there may be different types of Vermont Personal Monthly Budget Worksheets available to cater to specific financial needs or goals. Some variations of these worksheets might focus on particular aspects of budgeting, such as debt repayment or savings goals. For instance, Vermont Personal Monthly Budget Worksheet for Debt Repayment may provide additional sections for documenting various debts, interest rates, and minimum monthly payments. On the other hand, Vermont Personal Monthly Budget Worksheet for Savings Goals may offer dedicated fields for tracking progress towards saving targets and organizing investment plans. In conclusion, Vermont Personal Monthly Budget Worksheet is an essential financial tool that allows individuals to establish a detailed overview of their income and expenses. By using this worksheet, Vermont residents can effectively manage their money, optimize their spending habits, and work towards achieving their financial objectives.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Vermont Hoja de trabajo de presupuesto mensual personal - Personal Monthly Budget Worksheet

Description

How to fill out Vermont Hoja De Trabajo De Presupuesto Mensual Personal?

US Legal Forms - one of the biggest libraries of lawful types in the United States - provides a variety of lawful file templates you are able to down load or produce. While using internet site, you can find 1000s of types for enterprise and person uses, sorted by groups, claims, or search phrases.You can find the latest types of types just like the Vermont Personal Monthly Budget Worksheet within minutes.

If you already have a membership, log in and down load Vermont Personal Monthly Budget Worksheet in the US Legal Forms library. The Acquire switch will show up on every develop you look at. You have accessibility to all in the past delivered electronically types within the My Forms tab of your profile.

If you would like use US Legal Forms the very first time, allow me to share simple instructions to obtain started:

- Be sure you have picked out the best develop for your personal city/area. Click on the Preview switch to check the form`s content material. Browse the develop description to actually have chosen the appropriate develop.

- In the event the develop does not suit your needs, make use of the Search industry near the top of the display to get the the one that does.

- In case you are happy with the form, affirm your selection by visiting the Buy now switch. Then, choose the pricing prepare you favor and give your qualifications to register on an profile.

- Process the financial transaction. Use your Visa or Mastercard or PayPal profile to finish the financial transaction.

- Select the file format and down load the form on the system.

- Make modifications. Fill out, edit and produce and signal the delivered electronically Vermont Personal Monthly Budget Worksheet.

Each web template you included with your account lacks an expiry time and it is your own property permanently. So, if you want to down load or produce one more version, just visit the My Forms area and then click on the develop you need.

Obtain access to the Vermont Personal Monthly Budget Worksheet with US Legal Forms, by far the most considerable library of lawful file templates. Use 1000s of professional and condition-certain templates that meet up with your small business or person requirements and needs.