This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Vermont General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement is a legally binding document that outlines the terms and conditions of a sale of a business between a sole proprietor and a buyer. This agreement specifically pertains to the purchase of a business's assets rather than its entire entity. The agreement typically includes various sections covering important aspects of the transaction. These sections encompass details such as the identification of the buyer and seller, the purchase price, asset valuation, payment terms, and any conditions precedent or after the sale. Additionally, the agreement may address the allocation of liabilities, transfer of licenses and permits, intellectual property rights, and non-compete clauses. In Vermont, there may be different variations of the General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement, depending on specific industries or unique circumstances. Some possible types of this agreement may include: 1. Retail Business Sale Agreement: This type of agreement applies to the sale of a retail business, such as a clothing boutique, bookstore, or grocery store. It includes provisions addressing inventory, lease transfers, and existing customer relationships. 2. Service-based Business Sale Agreement: This variation is suitable for service-oriented businesses like consulting firms, salons, or IT companies. It outlines the transfer of client contracts, ongoing service obligations, and key personnel transition. 3. Manufacturing Business Sale Agreement: Designed for businesses involved in manufacturing or production activities, this agreement focuses on the transfer of machinery, equipment, inventory, and intellectual property related to the manufacturing process. 4. Restaurant or Hospitality Business Sale Agreement: Tailored for restaurant owners or those in the hospitality industry, this type of agreement emphasizes the transfer of permits, licenses, recipes, supplier contracts, and lease provisions specific to the establishment. 5. Professional Practice Sale Agreement: This form applies to the sale of professional practices, including medical, dental, legal, or accounting offices. It addresses patient or client transfer, non-solicitation agreements, and compliance with professional regulations and requirements. It is important to note that these variations are not exhaustive, and each agreement should be tailored to the unique circumstances of the specific business sale. Consulting legal professionals specializing in business transactions is highly advisable to ensure the agreement accurately reflects the intentions of the parties involved and is in compliance with Vermont state laws.The Vermont General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement is a legally binding document that outlines the terms and conditions of a sale of a business between a sole proprietor and a buyer. This agreement specifically pertains to the purchase of a business's assets rather than its entire entity. The agreement typically includes various sections covering important aspects of the transaction. These sections encompass details such as the identification of the buyer and seller, the purchase price, asset valuation, payment terms, and any conditions precedent or after the sale. Additionally, the agreement may address the allocation of liabilities, transfer of licenses and permits, intellectual property rights, and non-compete clauses. In Vermont, there may be different variations of the General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement, depending on specific industries or unique circumstances. Some possible types of this agreement may include: 1. Retail Business Sale Agreement: This type of agreement applies to the sale of a retail business, such as a clothing boutique, bookstore, or grocery store. It includes provisions addressing inventory, lease transfers, and existing customer relationships. 2. Service-based Business Sale Agreement: This variation is suitable for service-oriented businesses like consulting firms, salons, or IT companies. It outlines the transfer of client contracts, ongoing service obligations, and key personnel transition. 3. Manufacturing Business Sale Agreement: Designed for businesses involved in manufacturing or production activities, this agreement focuses on the transfer of machinery, equipment, inventory, and intellectual property related to the manufacturing process. 4. Restaurant or Hospitality Business Sale Agreement: Tailored for restaurant owners or those in the hospitality industry, this type of agreement emphasizes the transfer of permits, licenses, recipes, supplier contracts, and lease provisions specific to the establishment. 5. Professional Practice Sale Agreement: This form applies to the sale of professional practices, including medical, dental, legal, or accounting offices. It addresses patient or client transfer, non-solicitation agreements, and compliance with professional regulations and requirements. It is important to note that these variations are not exhaustive, and each agreement should be tailored to the unique circumstances of the specific business sale. Consulting legal professionals specializing in business transactions is highly advisable to ensure the agreement accurately reflects the intentions of the parties involved and is in compliance with Vermont state laws.

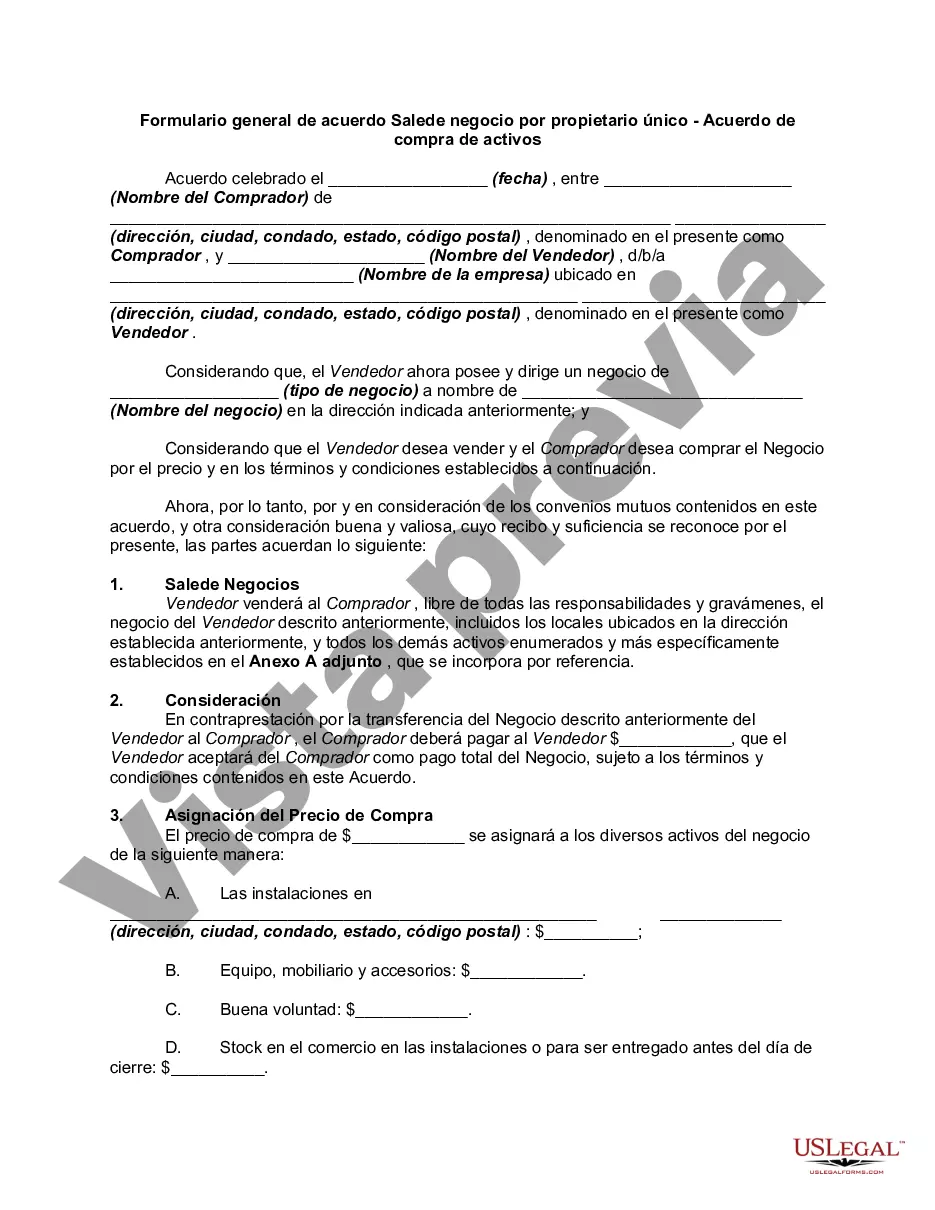

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.