A Vermont simple promissory note for school is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower in the state of Vermont. It is commonly used when a student or their parent(s) require financial assistance to fund their education expenses. The Vermont simple promissory note for school serves as a written contract and enables both parties to clearly define the terms of the loan, including the amount borrowed, the interest rate (if applicable), the repayment schedule, and any other specific agreements or conditions. This document provides legal protection to both the lender and the borrower, ensuring that all parties are aware of their obligations and rights. The key elements typically included in a Vermont simple promissory note for school are: 1. Names and contact information of the lender(s) and borrower(s): The note should clearly state the full legal names, addresses, and contact numbers of all parties involved. 2. Loan amount: The note should specify the exact amount of money being loaned to the borrower. This amount may cover tuition fees, books, accommodation expenses, or any other educational costs. 3. Repayment terms: The note should outline the repayment terms agreed upon by both parties. This includes the frequency of the payments (monthly, quarterly, or annually), the duration of the loan, and the due date for the first payment. 4. Interest rate: If applicable, the note should state the interest rate charged on the borrowed amount. It's important to comply with Vermont state laws regarding interest rates to avoid legal issues. 5. Late payment penalties: The note may include provisions for late payments, specifying any penalties or additional fees that may be imposed when the borrower fails to make timely repayments. 6. Collateral (if applicable): In certain cases, the lender may require collateral as security for the loan. If this applies, the note should clearly state the collateral details. 7. Governing law: The note should state that it is governed by the laws of the State of Vermont, ensuring that any legal disputes will be resolved according to the state's legal system. Different types of Vermont simple promissory notes for school may include variations in repayment terms, associated fees, or additional clauses specific to the loan arrangement. Some examples include fixed-rate promissory notes, variable-rate promissory notes, interest-only promissory notes, or promissory notes with deferred payment options. These varieties allow for flexibility in meeting the unique needs and circumstances of borrowers and lenders involved in educational loan agreements within Vermont.

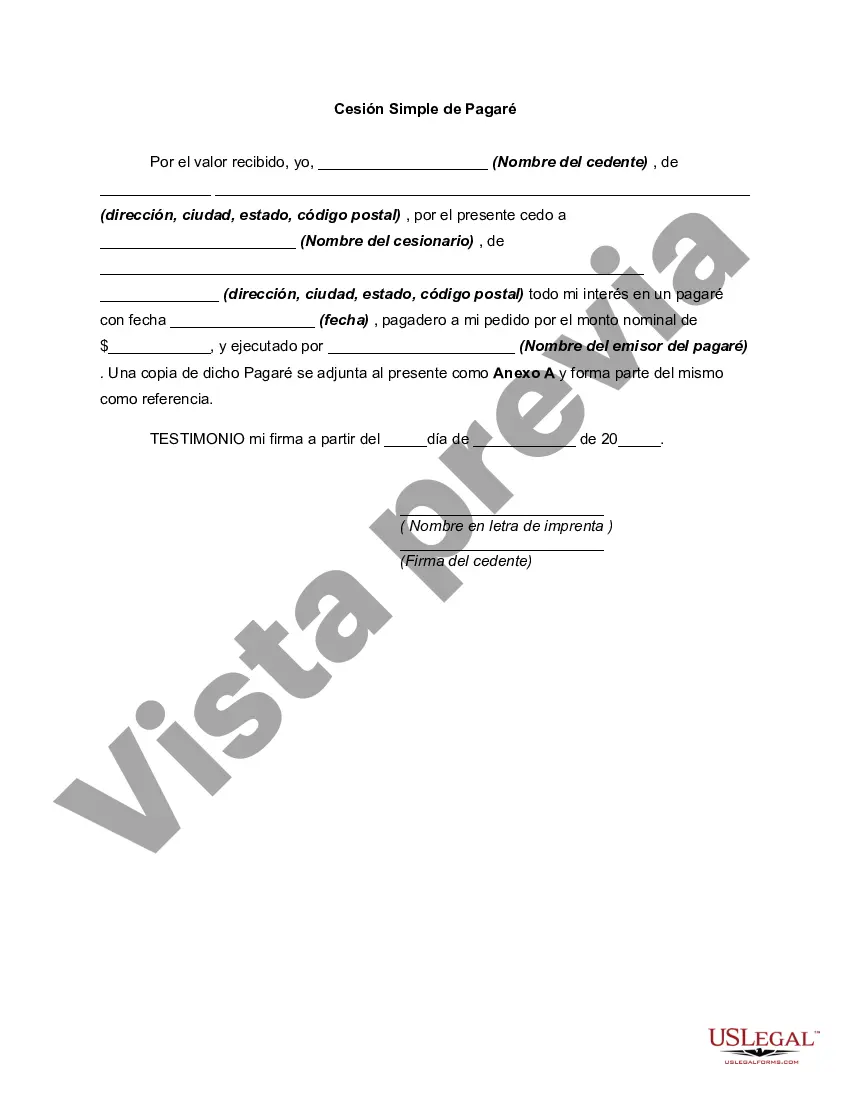

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Vermont Pagaré simple para la escuela - Simple Promissory Note for School

Description

How to fill out Vermont Pagaré Simple Para La Escuela?

Are you presently inside a placement that you need paperwork for sometimes company or individual reasons just about every time? There are tons of authorized document themes available on the net, but finding kinds you can trust is not straightforward. US Legal Forms delivers thousands of form themes, just like the Vermont Simple Promissory Note for School, which are created in order to meet state and federal needs.

Should you be currently familiar with US Legal Forms website and have a merchant account, merely log in. Following that, you may download the Vermont Simple Promissory Note for School web template.

If you do not come with an bank account and wish to begin using US Legal Forms, follow these steps:

- Obtain the form you need and make sure it is to the correct area/region.

- Utilize the Preview key to check the form.

- Read the information to actually have selected the proper form.

- When the form is not what you are seeking, take advantage of the Research industry to obtain the form that meets your requirements and needs.

- If you obtain the correct form, just click Buy now.

- Pick the costs prepare you would like, submit the required information to create your bank account, and purchase the transaction using your PayPal or credit card.

- Choose a handy file structure and download your version.

Find each of the document themes you possess purchased in the My Forms food selection. You can obtain a extra version of Vermont Simple Promissory Note for School at any time, if required. Just select the necessary form to download or print out the document web template.

Use US Legal Forms, by far the most extensive variety of authorized forms, to save lots of time and avoid errors. The services delivers appropriately produced authorized document themes that can be used for a range of reasons. Generate a merchant account on US Legal Forms and begin producing your lifestyle easier.