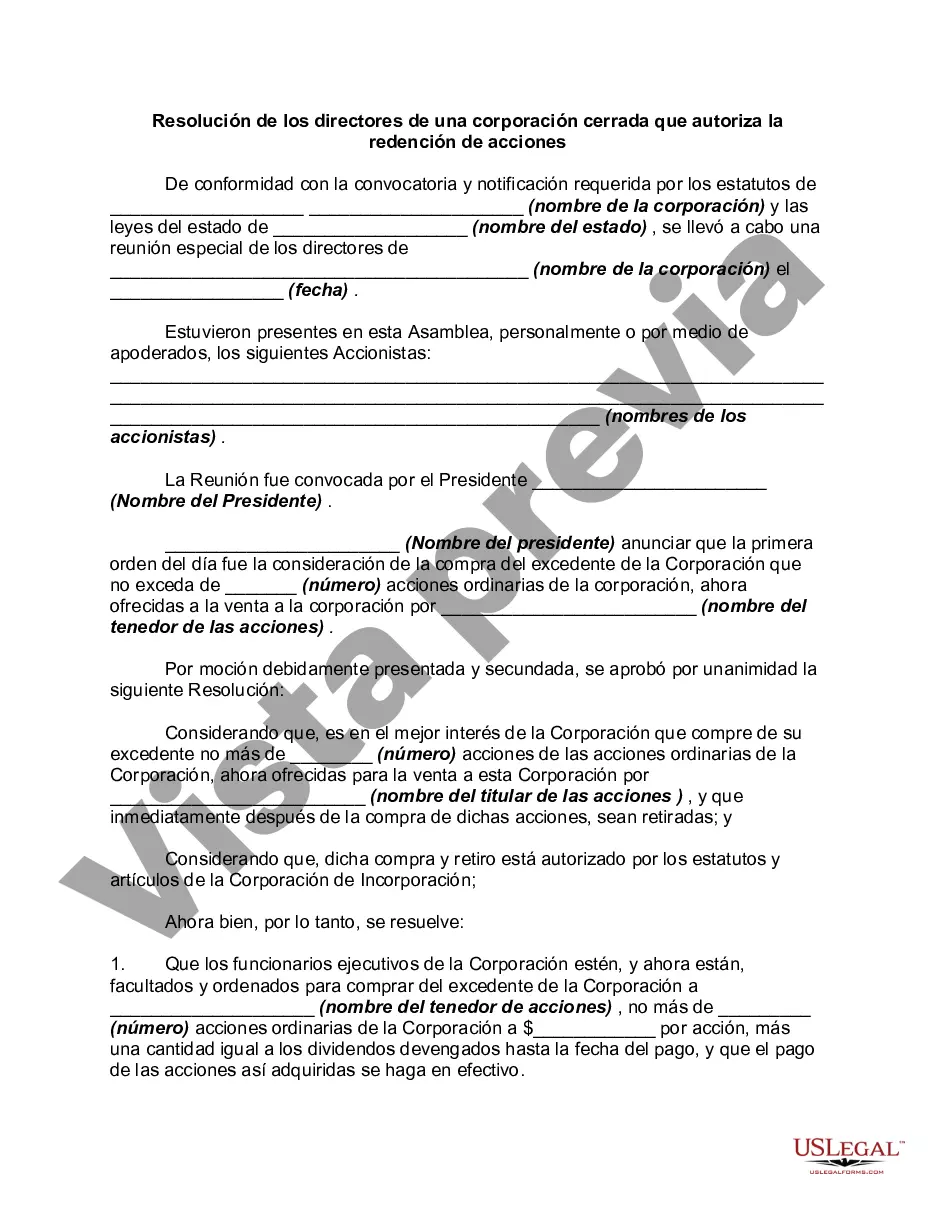

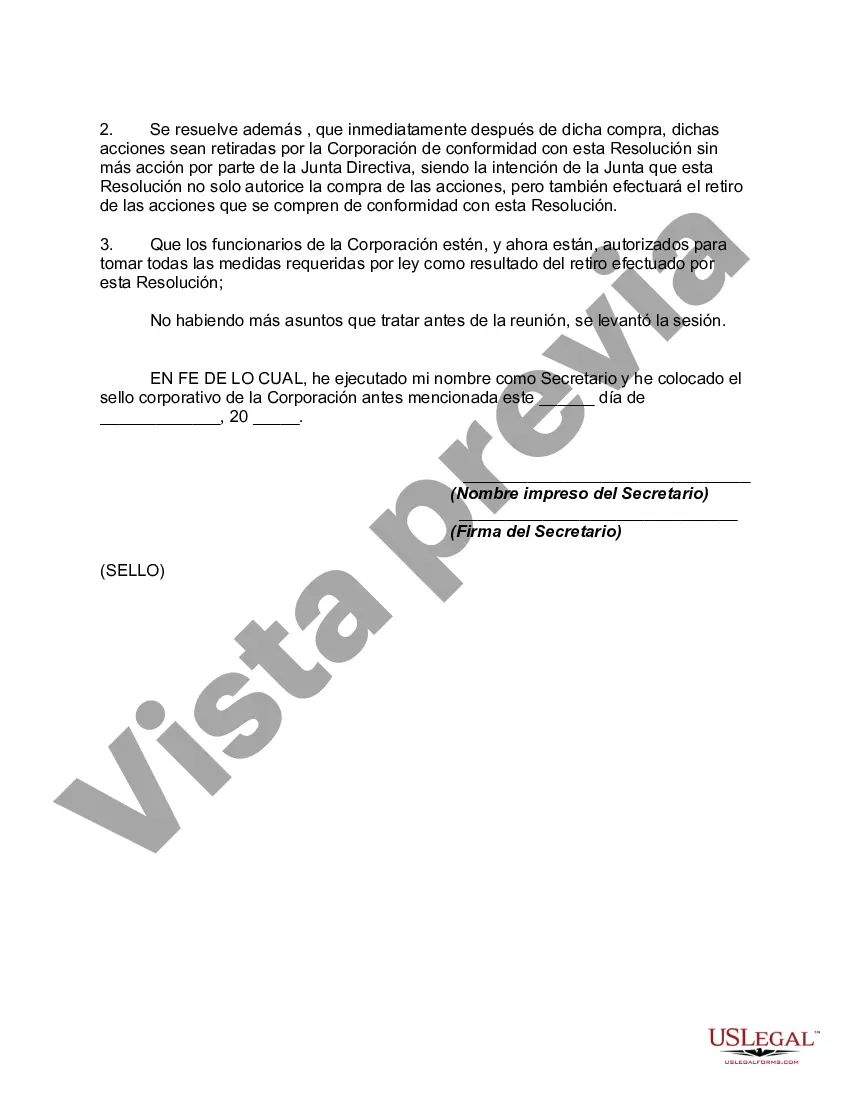

Title: Vermont Resolution of Directors of a Close Corporation Authorizing Redemption of Stock Introduction: A Vermont Resolution of Directors of a Close Corporation Authorizing Redemption of Stock refers to a legally binding document enacted by the board of directors of a close corporation in the state of Vermont. This resolution outlines the process and conditions under which the corporation can redeem its own stock. The redemption of stock can occur for various reasons, such as retiring shares, managing ownership changes, or facilitating the departure of a shareholder. Types of Vermont Resolution of Directors of a Close Corporation Authorizing Redemption of Stock: 1. Standard Redemption: This type of resolution enables the close corporation's directors to authorize the redemption of stock in accordance with predetermined guidelines and procedures. It ensures the corporation can buy back shares from shareholders who wish to sell their stock or divest their interest in the company. 2. Planned Retirement Redemption: This resolution allows the close corporation's directors to outline a specific planned retirement redemption program. It details the orderly repurchase of shares from shareholders who are retiring based on predetermined criteria, such as age, service years, or specific contractual agreements. 3. Shareholder Departure Redemption: In cases where a shareholder wishes to leave the corporation due to various reasons such as retirement, personal circumstances, or disputes, this resolution empowers the directors to authorize the redemption of their stock. It encompasses the legal process, valuation mechanism, and payment terms for the departing shareholder. Key Elements of a Vermont Resolution of Directors of a Close Corporation Authorizing Redemption of Stock: 1. Identification of Corporation: The resolution should clearly state the full legal name and registered address of the close corporation for which the resolution is being adopted. 2. Statement of Intent: The resolution should express the objective of redeeming shares, providing reasons and justifications supporting such redemption. 3. Redemption Guidelines: The resolution should outline the conditions and procedures that govern the redemption process, including shareholders eligible for redemption, the number of shares, redemption price determination, timeframes, and any limitations or restrictions. 4. Valuation Method: Specify the methodology of determining the price at which the shares will be redeemed, such as book value, market value, or a predetermined formula mentioned in the corporation's operating agreement or other governing documents. 5. Funding Source: Indicate the source of funding for the redemption, such as cash reserves, operating profits, debt financing, or other available resources. 6. Required Shareholder Consent: Include language acknowledging the need for shareholder approval if any, as per the corporation's governing documents or applicable laws. 7. Effective Date: Establish the effective date of the resolution, serving as the official starting point for the redemption process's implementation. Conclusion: A Vermont Resolution of Directors of a Close Corporation Authorizing Redemption of Stock is a vital legal document that empowers the board of directors to repurchase shares from shareholders, helping manage ownership changes, facilitate planned retirements, and accommodate shareholders' departures. By adopting a suitable resolution, close corporations in Vermont can ensure a smooth and transparent process for redeeming stock while protecting the interests of both the corporation and its shareholders.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Vermont Resolución de los directores de una corporación cerrada que autoriza la redención de acciones - Resolution of Directors of a Close Corporation Authorizing Redemption of Stock

Description

How to fill out Vermont Resolución De Los Directores De Una Corporación Cerrada Que Autoriza La Redención De Acciones?

If you have to total, download, or print legitimate file templates, use US Legal Forms, the most important collection of legitimate types, which can be found on the web. Use the site`s simple and easy handy research to obtain the documents you require. Different templates for organization and personal functions are sorted by categories and states, or key phrases. Use US Legal Forms to obtain the Vermont Resolution of Directors of a Close Corporation Authorizing Redemption of Stock within a number of mouse clicks.

Should you be previously a US Legal Forms consumer, log in to your account and click on the Obtain switch to find the Vermont Resolution of Directors of a Close Corporation Authorizing Redemption of Stock. Also you can accessibility types you formerly delivered electronically from the My Forms tab of the account.

Should you use US Legal Forms for the first time, follow the instructions under:

- Step 1. Ensure you have selected the shape for the right city/country.

- Step 2. Take advantage of the Preview solution to look through the form`s content material. Never neglect to learn the outline.

- Step 3. Should you be unsatisfied with all the type, use the Search industry on top of the screen to discover other types of the legitimate type format.

- Step 4. After you have located the shape you require, click on the Acquire now switch. Pick the prices program you favor and include your accreditations to register for an account.

- Step 5. Process the deal. You should use your charge card or PayPal account to perform the deal.

- Step 6. Pick the formatting of the legitimate type and download it on your own system.

- Step 7. Comprehensive, change and print or indication the Vermont Resolution of Directors of a Close Corporation Authorizing Redemption of Stock.

Every legitimate file format you acquire is your own for a long time. You might have acces to each and every type you delivered electronically in your acccount. Go through the My Forms area and pick a type to print or download yet again.

Compete and download, and print the Vermont Resolution of Directors of a Close Corporation Authorizing Redemption of Stock with US Legal Forms. There are thousands of expert and condition-certain types you can use for the organization or personal requires.