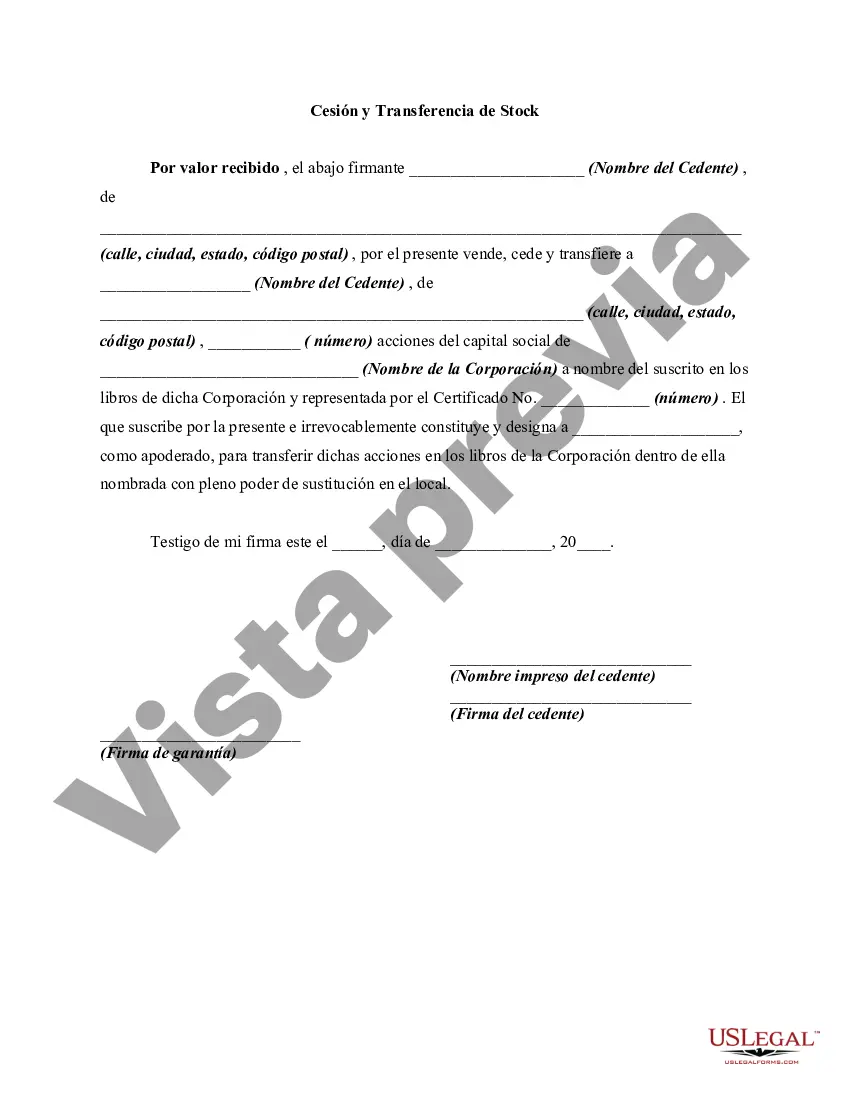

Vermont Assignment and Transfer of Stock refers to the legal process through which ownership rights to shares of stock in a Vermont corporation are transferred from one party to another. This allows for the buying, selling, gifting, or transfer of ownership of stocks among individuals and entities within the state of Vermont. Such transactions require the completion of specific documentation and adherence to state laws and regulations. The process typically involves the completion of a Stock Assignment and Transfer Form, which functions as an agreement between the current owner (assignor) and the new owner (assignee). This form contains essential details such as the name of the corporation, the stockholder's name and contact information, the stock certificate number, the number of shares being transferred, and the date of transfer. Additionally, any restrictions or conditions on the transfer of stock must be specified in the form. The Vermont Assignment and Transfer of Stock process often requires the involvement of a third party, such as a financial institution or a brokerage firm, to facilitate the transfer and update the ownership records with the corporation. Once the transfer is completed, the assignee becomes the new legal owner of the stock and is entitled to all the associated rights, including voting rights and dividends. In Vermont, there are different types of assignment and transfer of stock, including: 1. Voluntary Assignment and Transfer: This occurs when a stockholder voluntarily makes the decision to transfer ownership of their stock. It could be due to a sale, gift, or exchange of the shares. 2. Involuntary Assignment and Transfer: Unlike the voluntary transfer, this type of assignment occurs without the consent of the stockholder. It may happen in cases of bankruptcy, divorce settlements, or court-ordered transfers. 3. Inter Vivos Transfer: This refers to the transfer of stock between living individuals or entities. It includes the typical buying and selling of shares on the open market or through private transactions. 4. Testamentary Transfer: This type of transfer occurs upon the death of a stockholder. The stockholder's ownership rights are transferred as per their will or through intestate succession if no will exists. In conclusion, the Vermont Assignment and Transfer of Stock process involves the legal transfer of ownership rights to stocks in a Vermont corporation. It requires the completion of specific documentation and adherence to state laws and regulations. Different types of transfers exist, including voluntary and involuntary transfers, inter vivos transfers, and testamentary transfers. Consulting legal professionals or financial advisors is recommended to ensure compliance with all necessary requirements and procedures.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Vermont Cesión y Transferencia de Stock - Assignment and Transfer of Stock

Description

How to fill out Vermont Cesión Y Transferencia De Stock?

It is possible to devote hrs online trying to find the lawful papers format that meets the federal and state specifications you want. US Legal Forms supplies thousands of lawful forms which are examined by specialists. It is possible to acquire or print the Vermont Assignment and Transfer of Stock from my services.

If you have a US Legal Forms bank account, you are able to log in and click the Acquire option. Following that, you are able to total, edit, print, or indication the Vermont Assignment and Transfer of Stock. Every lawful papers format you get is the one you have for a long time. To obtain another backup associated with a bought develop, go to the My Forms tab and click the related option.

Should you use the US Legal Forms internet site for the first time, adhere to the simple guidelines beneath:

- Initially, make certain you have selected the right papers format for that area/town of your choosing. See the develop outline to ensure you have selected the correct develop. If readily available, utilize the Review option to search with the papers format at the same time.

- If you would like find another edition of the develop, utilize the Look for discipline to get the format that suits you and specifications.

- After you have discovered the format you want, simply click Buy now to continue.

- Find the costs prepare you want, type in your qualifications, and register for an account on US Legal Forms.

- Comprehensive the transaction. You may use your charge card or PayPal bank account to cover the lawful develop.

- Find the structure of the papers and acquire it to your system.

- Make alterations to your papers if possible. It is possible to total, edit and indication and print Vermont Assignment and Transfer of Stock.

Acquire and print thousands of papers layouts utilizing the US Legal Forms web site, that provides the largest selection of lawful forms. Use expert and status-specific layouts to tackle your business or individual requires.