A Vermont Estoppel Affidavit of Mortgagor is a legal document used in real estate transactions in the state of Vermont. This document is typically prepared by a mortgagor (borrower) and is provided to the lender or title company. It serves as a declaration by the mortgagor, affirming certain facts and details about their mortgage. The purpose of the Vermont Estoppel Affidavit of Mortgagor is to prevent any potential misrepresentation or dispute that may arise during the sale or refinancing of a property. It confirms the accuracy and authenticity of the mortgagor's statements regarding their mortgage, providing assurances to the lender or buyer. The content of a Vermont Estoppel Affidavit of Mortgagor may vary depending on the specific circumstances of the mortgage. However, it generally includes the following information: 1. Identification: The affidavit will commonly include the legal names and contact details of both the mortgagor and the mortgagee (lender). 2. Property Description: The affidavit will detail the property being mortgaged, including the legal description, address, and any relevant information to identify it accurately. 3. Mortgage Details: The affidavit will outline the terms and conditions of the mortgage, such as the principal amount, interest rate, maturity date, and any additional provisions or agreements. 4. Loan Payment Status: The mortgagor will confirm the current status of their loan, including if it is in good standing, any outstanding balances, or if there are any issues or disputes with the lender. 5. Liens or Encumbrances: The affidavit will disclose any other liens or encumbrances on the property, such as additional mortgages, judgments, or other claims that may affect the property's title. 6. Insurance and Taxes: The mortgagor will provide information about insurance coverage for the property, including the policy details and the insurance carrier. It may also include information about the payment of property taxes. 7. Assurances: The mortgagor will assert that all the information provided in the affidavit is true and accurate to the best of their knowledge. They will also state that they have not transferred or assigned the mortgage without proper documentation. Types of Vermont Estoppel Affidavit of Mortgagor may include: 1. Standard Vermont Estoppel Affidavit of Mortgagor: This is the typical form used in most real estate transactions, covering the essential information mentioned above. 2. Modified Vermont Estoppel Affidavit of Mortgagor: In certain cases, additional clauses or information may be added based on specific requirements or unique circumstances of the mortgage. These modifications are made to ensure all necessary details are disclosed accurately. It is important to note that legal requirements for the content and format of a Vermont Estoppel Affidavit of Mortgagor may vary. Consultation with a qualified attorney or real estate professional is recommended to ensure compliance with all relevant laws and regulations.

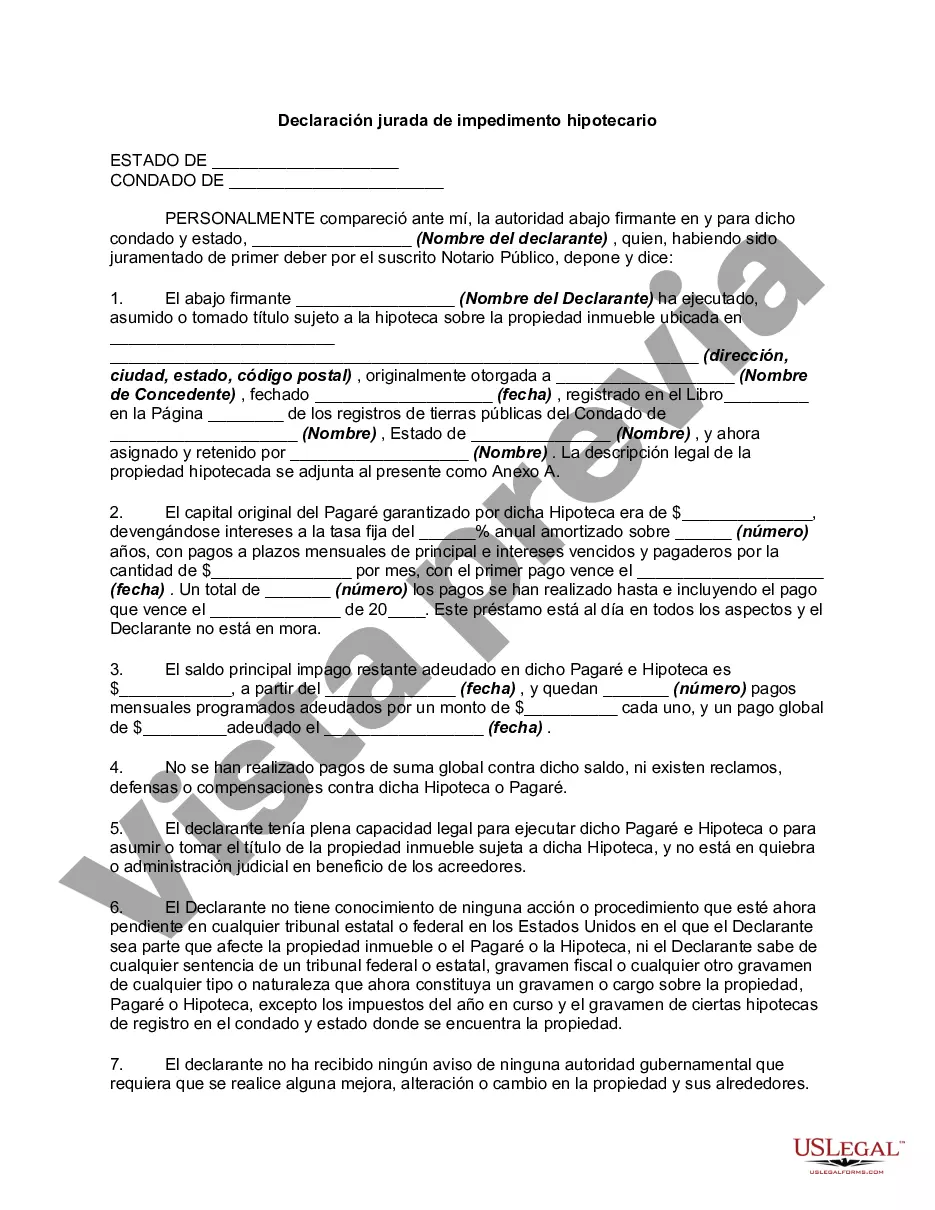

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Vermont Declaración jurada de impedimento hipotecario - Estoppel Affidavit of Mortgagor

Description

How to fill out Vermont Declaración Jurada De Impedimento Hipotecario?

If you want to total, acquire, or print out legal record layouts, use US Legal Forms, the greatest variety of legal types, which can be found on the web. Utilize the site`s simple and practical research to find the documents you want. A variety of layouts for company and person purposes are sorted by types and claims, or keywords and phrases. Use US Legal Forms to find the Vermont Estoppel Affidavit of Mortgagor in a couple of mouse clicks.

If you are previously a US Legal Forms client, log in to the accounts and click the Obtain switch to obtain the Vermont Estoppel Affidavit of Mortgagor. You can even access types you formerly saved from the My Forms tab of your respective accounts.

Should you use US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Be sure you have chosen the form for the appropriate area/nation.

- Step 2. Make use of the Preview method to look over the form`s information. Don`t forget to see the outline.

- Step 3. If you are unhappy using the develop, take advantage of the Research discipline near the top of the display screen to find other variations from the legal develop design.

- Step 4. When you have identified the form you want, go through the Buy now switch. Pick the costs program you like and put your references to register for an accounts.

- Step 5. Process the financial transaction. You can use your credit card or PayPal accounts to perform the financial transaction.

- Step 6. Find the file format from the legal develop and acquire it on your system.

- Step 7. Total, edit and print out or indication the Vermont Estoppel Affidavit of Mortgagor.

Each legal record design you purchase is your own property for a long time. You have acces to each develop you saved in your acccount. Click the My Forms section and select a develop to print out or acquire again.

Contend and acquire, and print out the Vermont Estoppel Affidavit of Mortgagor with US Legal Forms. There are millions of expert and status-distinct types you may use for your company or person demands.