It is essential to a contract that there be an offer and, while the offer is still in existence, it must be accepted without qualification. An offer expresses the willingness of the offeror to enter into a contract agreement regarding a particular subject. An invitation to negotiate is not an offer. An invitation to negotiate is merely a preliminary discussion or an invitation by one party to the other to negotiate or make an offer. This form is an invitation to negotiate.

Title: Vermont Business Purchase Proposal: Comprehensive Overview and Types Introduction: A Vermont Business Purchase Proposal is an in-depth document that outlines the terms, conditions, and specifics surrounding the acquisition of a business entity in the state of Vermont, United States. The proposal serves as a formal way to express a potential buyer's intent to purchase an existing business, covering various aspects such as valuation, financial arrangements, legal considerations, and strategic plans. Key Components: 1. Executive Summary: This section provides a concise overview of the proposed acquisition, highlighting the buyer's background, the target business, and the buyer's vision for the future of the acquired entity. 2. Business Overview: This section entails a detailed description of the target business, its industry, market positioning, history, assets, and current financial status. It also includes the reasons why the buyer believes the business presents a valuable investment opportunity. 3. Proposed Terms and Conditions: This section delineates the key terms of the proposed purchase, including the purchase price, payment structure, financing arrangements, and any contingencies or arbitration mechanisms. 4. Financial Analysis: A comprehensive financial analysis is provided, including the buyer's financial capability, funding sources, projected financial statements, and an assessment of the target business's financial performance, assets, and liabilities. This section emphasizes the potential return on investment and justifies the proposed purchase price. 5. Transition Plan: This section covers the proposed approach for transitioning ownership, management, and operations of the business. It may include a timeline, details about key personnel retention or replacement, and strategies to ensure a smooth transition while avoiding disruptions. Types of Vermont Business Purchase Proposals: 1. Asset Purchase Proposal: This type of proposal focuses on acquiring the assets of the target business, such as inventory, equipment, customer contracts, and intellectual property rights. The buyer does not assume the target business's liabilities or debts. 2. Stock Purchase Proposal: In this type of proposal, the buyer aims to acquire all or a controlling majority of the target business's shares. This includes ownership of the company's assets, liabilities, contracts, and existing agreements. 3. Merger or Acquisition Proposal: This proposal suggests a merger or acquisition of two or more businesses to create a new entity or expand an existing one. It involves combining assets, operations, or management structures to achieve strategic synergies and enhance market presence. 4. Franchise Purchase Proposal: This proposal focuses on the acquisition of an existing franchise location, enabling the buyer to benefit from an established brand, operational processes, marketing support, and customer base. Conclusion: A Vermont Business Purchase Proposal is a comprehensive document that outlines the details, financial aspects, and strategic plans involved in acquiring a business entity within Vermont. Whether it is an asset purchase, stock purchase, merger, or franchise acquisition proposal, it serves as a vital tool for expressing a buyer's intent and efficiently negotiating a successful business transaction.Title: Vermont Business Purchase Proposal: Comprehensive Overview and Types Introduction: A Vermont Business Purchase Proposal is an in-depth document that outlines the terms, conditions, and specifics surrounding the acquisition of a business entity in the state of Vermont, United States. The proposal serves as a formal way to express a potential buyer's intent to purchase an existing business, covering various aspects such as valuation, financial arrangements, legal considerations, and strategic plans. Key Components: 1. Executive Summary: This section provides a concise overview of the proposed acquisition, highlighting the buyer's background, the target business, and the buyer's vision for the future of the acquired entity. 2. Business Overview: This section entails a detailed description of the target business, its industry, market positioning, history, assets, and current financial status. It also includes the reasons why the buyer believes the business presents a valuable investment opportunity. 3. Proposed Terms and Conditions: This section delineates the key terms of the proposed purchase, including the purchase price, payment structure, financing arrangements, and any contingencies or arbitration mechanisms. 4. Financial Analysis: A comprehensive financial analysis is provided, including the buyer's financial capability, funding sources, projected financial statements, and an assessment of the target business's financial performance, assets, and liabilities. This section emphasizes the potential return on investment and justifies the proposed purchase price. 5. Transition Plan: This section covers the proposed approach for transitioning ownership, management, and operations of the business. It may include a timeline, details about key personnel retention or replacement, and strategies to ensure a smooth transition while avoiding disruptions. Types of Vermont Business Purchase Proposals: 1. Asset Purchase Proposal: This type of proposal focuses on acquiring the assets of the target business, such as inventory, equipment, customer contracts, and intellectual property rights. The buyer does not assume the target business's liabilities or debts. 2. Stock Purchase Proposal: In this type of proposal, the buyer aims to acquire all or a controlling majority of the target business's shares. This includes ownership of the company's assets, liabilities, contracts, and existing agreements. 3. Merger or Acquisition Proposal: This proposal suggests a merger or acquisition of two or more businesses to create a new entity or expand an existing one. It involves combining assets, operations, or management structures to achieve strategic synergies and enhance market presence. 4. Franchise Purchase Proposal: This proposal focuses on the acquisition of an existing franchise location, enabling the buyer to benefit from an established brand, operational processes, marketing support, and customer base. Conclusion: A Vermont Business Purchase Proposal is a comprehensive document that outlines the details, financial aspects, and strategic plans involved in acquiring a business entity within Vermont. Whether it is an asset purchase, stock purchase, merger, or franchise acquisition proposal, it serves as a vital tool for expressing a buyer's intent and efficiently negotiating a successful business transaction.

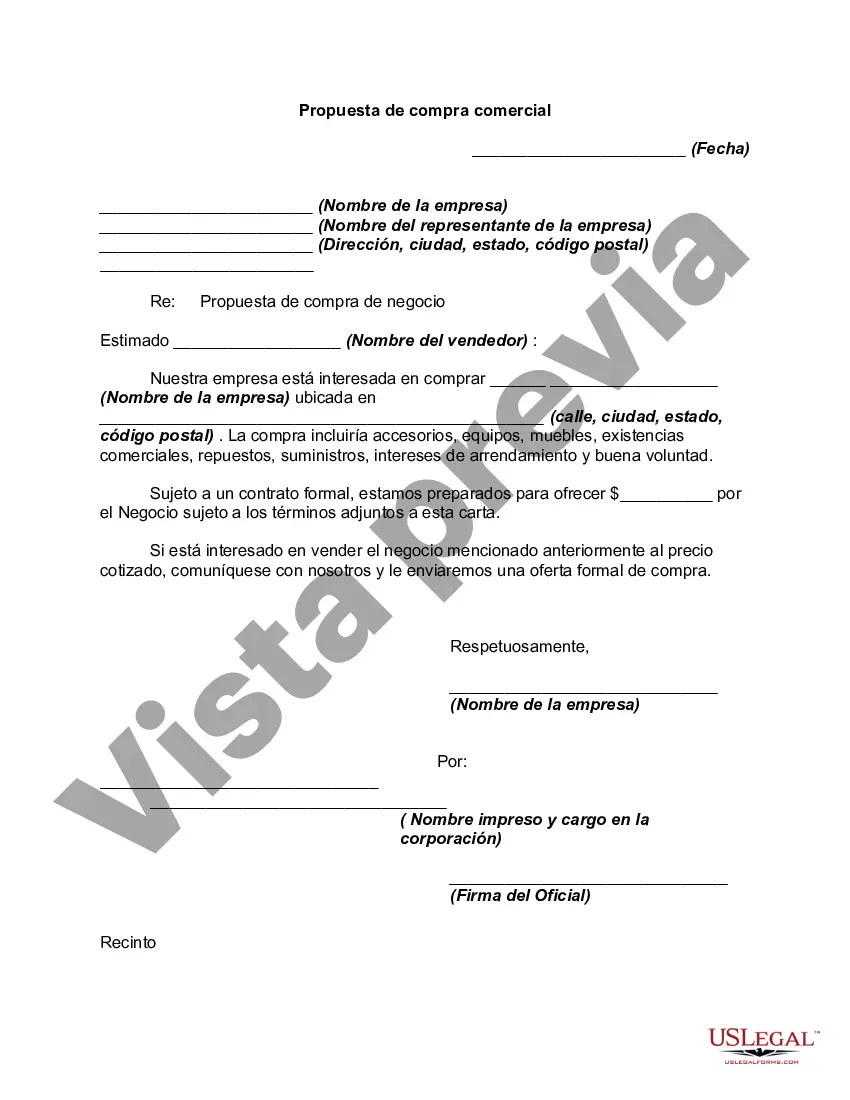

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.