A private placement memorandum is a legal document that sets out the terms upon which securities are offered to potential private investors. It can refer to any kind of offering of securities to any number of private accredited investors. It lays out for the prospective client almost all the details of an investment opportunity. The principal purpose of this document is to give the company the opportunity to present all potential risks to the investor. A Private Placement Memorandum is in fact a plan for the company. It plainly identifies the nature and purpose of the company.

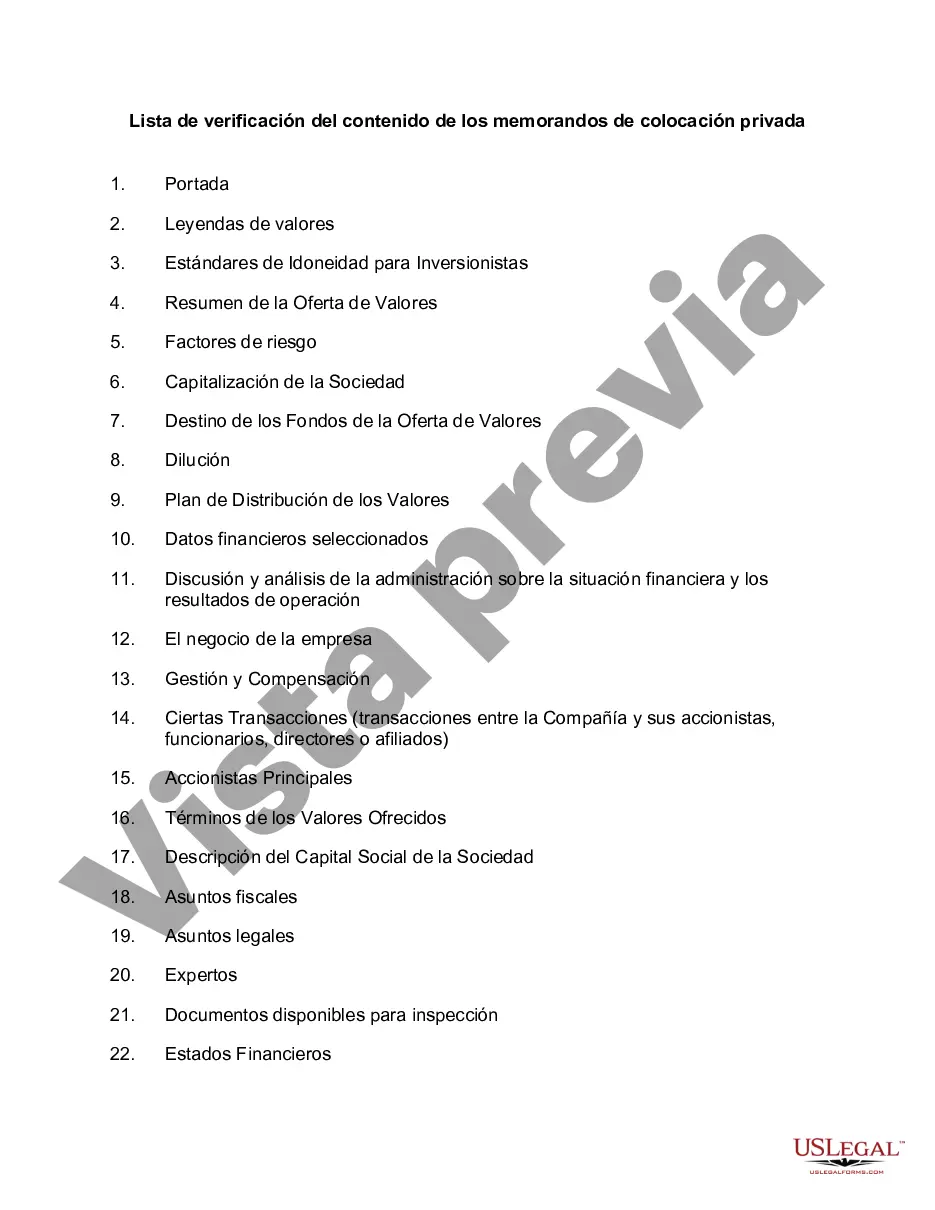

This is a simple checklist regarding matters to be included in a private placement memorandum for a securities offering intended to meet certain disclosure requirements of SEC Regulation D.

Title: Vermont Checklist for Contents of Private Placement Memorandum — A Comprehensive Overview Introduction: In Vermont, private placement offerings are subject to specific guidelines and regulations. A key component of such offerings is the Private Placement Memorandum (PPM), which serves as a crucial document containing essential information for potential investors. This detailed description will outline the contents typically included in a Vermont Checklist for Ppm, ensuring compliance with local laws and facilitating investor decision-making. Vermont Checklist for Contents of Private Placement Memorandum: 1. Executive Summary: The executive summary provides a high-level overview of the offering, introducing the issuer, investment opportunity, and key investment terms. This section should be concise but robust enough to entice potential investors. 2. Offering Summary: This section provides a comprehensive description of the proposed offering, including the purpose, size, issuance structure, pricing terms, and targeted investor base. It will establish a foundation for subsequent sections of the PPM. 3. Terms of the Offering: This segment outlines the specific terms and conditions governing the investment, such as the securities offered, voting rights, dividend provisions, redemption rights, and potential dilution. Explicitly stating the terms avoids confusion and provides clarity to investors. 4. Risk Factors: An indispensable section of the PPM, the risk factors segment highlights potential risks and uncertainties associated with the investment opportunity. It should identify and disclose significant risks, regulatory challenges, market volatility, and any other elements that may impact investment outcomes. 5. Business Overview: Here, the PPM provides a detailed description of the issuer's background, industry outlook, competitive landscape, business strategies, growth potential, and any material contracts or relationships. It aims to offer investors a comprehensive understanding of the issuer's operations and future prospects. 6. Management Team: This section focuses on providing detailed profiles of key management personnel, highlighting their qualifications, experience, track record, and their roles within the company. Investors seek assurance in the competence of the management team and their ability to execute the business plan. 7. Use of Proceeds: The use of proceeds section outlines how the funds raised through the offering will be utilized. A transparent breakdown of investment allocations, capital expenditure plans, debt repayment, expansion strategies, and contingencies instills confidence in potential investors. 8. Financial Information: Providing comprehensive financial information is essential for investors to evaluate the issuer's financial health, stability, and growth prospects. This section includes audited financial statements, balance sheets, income statements, cash flow statements, and any relevant footnotes. 9. Legal and Regulatory: The legal and regulatory section outlines any material legal proceedings, contracts, licenses, permits, and regulatory considerations pertinent to the issuer's operations. Compliance with Vermont securities laws, federal regulations, and disclosure obligations must be addressed. 10. Subscription Agreement: This section includes the terms and conditions surrounding the subscription process, investor qualification criteria, disclosure acknowledgments, and subscription forms. It helps ensure that investors understand the terms of their investment and facilitates accurate record-keeping. Types of Vermont Checklists for Contents of Private Placement Memorandum: 1. Equity-Based Private Placement Memorandum Checklist: This checklist specifically focuses on equity-based offerings, which could include common stock, preferred stock, or other equity instruments. 2. Debt-Based Private Placement Memorandum Checklist: This checklist caters to offerings involving debt instruments, such as corporate bonds, notes, or debentures. 3. Real Estate-Based Private Placement Memorandum Checklist: This type of checklist pertains to private placements associated with real estate projects, including commercial developments, residential complexes, or other real estate investment opportunities. Conclusion: Adhering to the Vermont Checklist for Contents of Private Placement Memorandum ensures that issuers meet regulatory requirements and provides potential investors with comprehensive and transparent information. By customizing the PPM to match the specific type of offering, whether equity-based, debt-based, or real estate-related, investors can make informed decisions regarding their investment while mitigating risks.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.