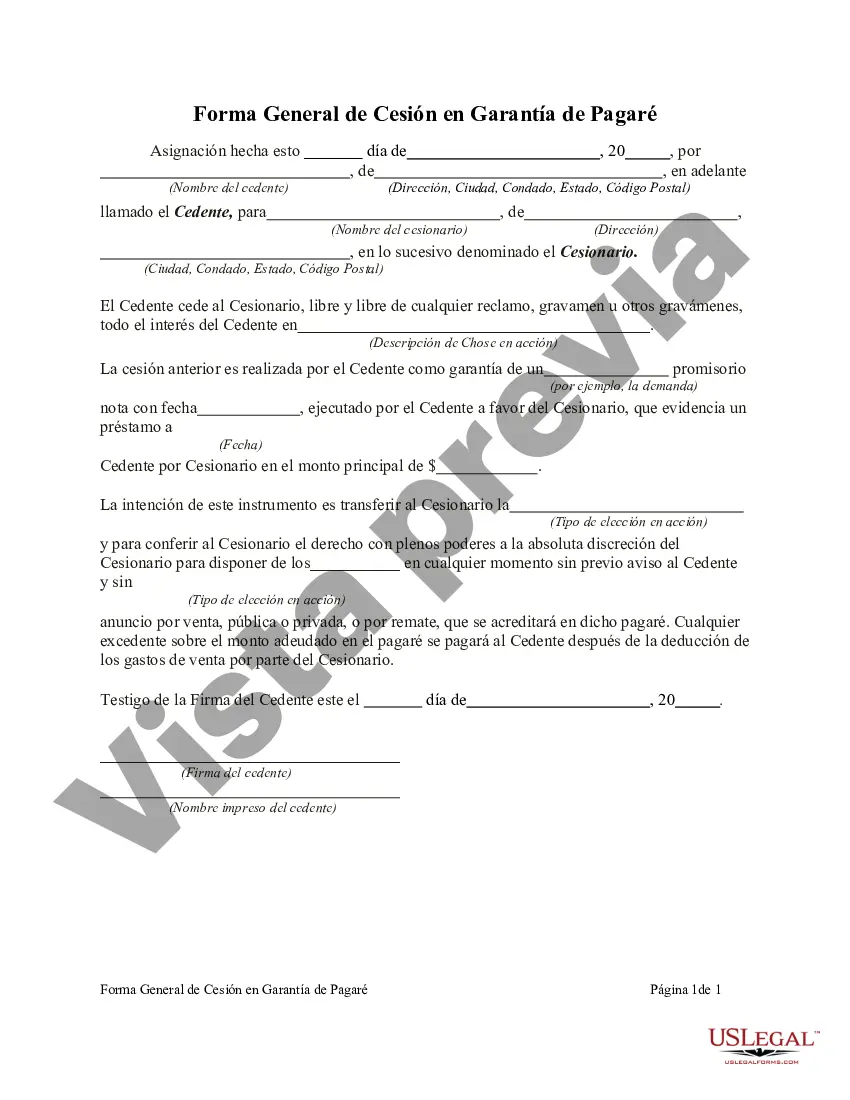

Vermont General Form of Assignment as Collateral for Note is a legal document used in Vermont to secure a promissory note with collateral. This detailed description provides an overview of its purpose, components, and variations. In Vermont, the General Form of Assignment as Collateral for Note is a crucial legal instrument that safeguards the rights and interests of lenders and borrowers, particularly in financial transactions involving collateralized loans. When entering into such an agreement, the borrower pledges certain assets as collateral to the lender to secure the repayment of the promissory note. The key components of the Vermont General Form of Assignment as Collateral for Note typically include: 1. Parties: The document identifies the lender (assignor) and the borrower (assignee) involved in the loan transaction. 2. Assignment of Collateral: It outlines the assignment of specific collateral by the borrower to the lender, describing the nature and details of the assets being pledged. 3. Rights and Liabilities: The agreement elaborates on the rights and liabilities of both parties, specifying the lender's right to enforce the security interest upon default by the borrower. 4. Default and Remedies: It delineates the consequences of default, such as the lender's right to seize and sell the collateral to recover the outstanding debt. 5. Governing Law: The document establishes that the agreement is governed by the laws of Vermont, ensuring all legal proceedings align with the state's jurisdiction. Regarding the different types of Vermont General Form of Assignment as Collateral for Note, variations may arise based on the nature of the collateral being pledged. Some common categories include: 1. Real Estate Collateral Assignment: This type of assignment is utilized when the collateral being pledged is a property or land. 2. Personal Property Collateral Assignment: If the collateral consists of movable assets like vehicles, equipment, or inventory, a personal property collateral assignment is employed. 3. Accounts Receivable Collateral Assignment: In cases where accounts receivable are being used as collateral, a specific assignment form may be required to document and transfer ownership rights. It is important to note that specific lenders may have their own variations or customized forms for documenting the assignment of collateral. Therefore, borrowers should carefully review all terms, conditions, and provisions outlined in the Vermont General Form of Assignment as Collateral for Note before signing to fully understand their obligations and rights. Additionally, seeking professional legal counsel is advisable to ensure compliance with Vermont state laws and to properly protect all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Vermont Forma General de Cesión en Garantía de Pagaré - General Form of Assignment as Collateral for Note

Description

How to fill out Vermont Forma General De Cesión En Garantía De Pagaré?

Finding the right legal file web template can be quite a have difficulties. Of course, there are a lot of themes available on the net, but how would you obtain the legal kind you require? Utilize the US Legal Forms internet site. The assistance gives a large number of themes, like the Vermont General Form of Assignment as Collateral for Note, that can be used for organization and private requires. Each of the types are checked by experts and satisfy state and federal requirements.

In case you are already listed, log in in your profile and then click the Acquire switch to have the Vermont General Form of Assignment as Collateral for Note. Use your profile to look through the legal types you possess ordered earlier. Check out the My Forms tab of your own profile and acquire one more duplicate from the file you require.

In case you are a new end user of US Legal Forms, here are basic directions that you can comply with:

- Initially, ensure you have selected the appropriate kind for the area/area. It is possible to examine the form while using Review switch and look at the form information to make sure this is the best for you.

- If the kind is not going to satisfy your expectations, use the Seach field to discover the right kind.

- When you are certain that the form would work, go through the Purchase now switch to have the kind.

- Choose the costs strategy you desire and enter in the required information and facts. Design your profile and pay money for the order utilizing your PayPal profile or bank card.

- Pick the submit formatting and obtain the legal file web template in your gadget.

- Comprehensive, change and print and indicator the obtained Vermont General Form of Assignment as Collateral for Note.

US Legal Forms is the most significant collection of legal types in which you can see various file themes. Utilize the service to obtain skillfully-made documents that comply with state requirements.