Vermont Assignment Creditor's Claim Against Estate is the legal process through which a creditor seeks to recover unpaid debts from the assets of a deceased person's estate in the state of Vermont. In this type of claim, a creditor who is owed money by a deceased individual (the debtor) can assert their right to be repaid from the debtor's estate. When a person passes away, their assets, liabilities, and debts become part of their estate. Vermont's law allows creditors to file claims against the estate to collect any outstanding debts owed by the deceased. These claims are typically addressed during the probate process, where the court oversees the distribution of the deceased's assets and settles outstanding debts. To file a Vermont Assignment Creditor's Claim Against Estate, the creditor must meet certain requirements. First, they must have a valid claim or debt owed by the decedent. The claim should be properly documented, including details such as the amount owed, evidence of the debt (such as contracts or invoices), and any relevant supporting documentation. There are different types of creditor's claims against the estate in Vermont, including secured claims and unsecured claims. Secured claims are those backed by collateral, such as a mortgage or a car loan, that the creditor can repossess or liquidate to satisfy the debt. Unsecured claims, on the other hand, are not backed by collateral, and the creditor must rely on the assets of the estate for repayment. Once the creditor has gathered all the necessary documentation, they must file a formal written claim with the probate court handling the deceased person's estate. The claim should include the creditor's contact information, details of the debt, the amount owed, and any supporting documentation. It is important to ensure that the claim is filed within the designated timeframe set by Vermont state law, typically within a few months from the date of the decedent's death. Upon receiving the creditor's claim, the probate court will review it and evaluate its validity. The court will verify the existence of the debt and assess if it meets the necessary legal requirements. If the court finds the claim to be valid, it will consider the claim during the estate's distribution process, where the deceased person's assets are used to pay off any outstanding debts and liabilities. It is important to note that Vermont law prioritizes certain claims, such as funeral expenses and taxes, over other types of creditor claims. Therefore, if the deceased person's estate does not have sufficient assets to cover all claims, these priority claims will be satisfied before other creditors can collect their debts. In summary, Vermont Assignment Creditor's Claim Against Estate allows creditors to seek repayment from a deceased person's estate for valid debts owed. Different types of creditor claims can be filed, including secured and unsecured claims. It is crucial for creditors to ensure that their claims meet all legal requirements and are filed within the specified time frame to maximize their chances of recovering their debts from the estate.

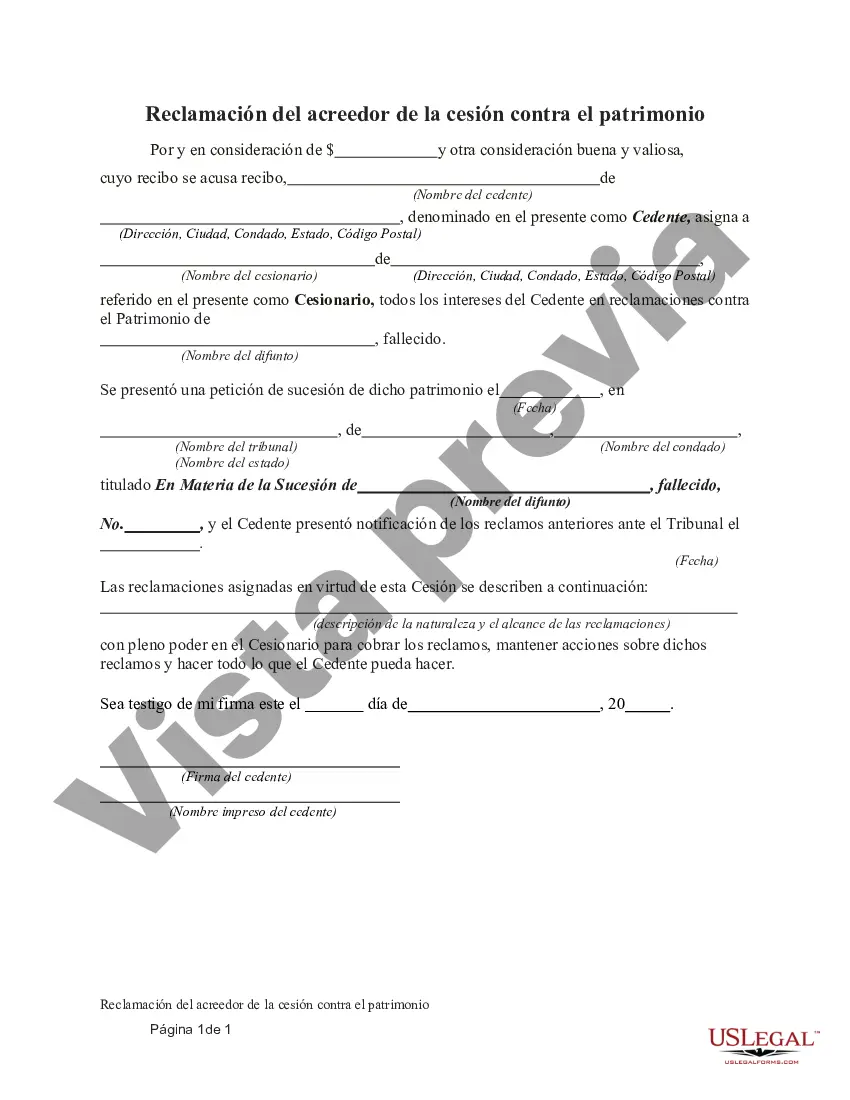

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Vermont Reclamación del acreedor de la cesión contra el patrimonio - Assignment Creditor's Claim Against Estate

Description

How to fill out Vermont Reclamación Del Acreedor De La Cesión Contra El Patrimonio?

US Legal Forms - one of several biggest libraries of legal types in the USA - offers a variety of legal record web templates you may obtain or print. While using web site, you will get 1000s of types for business and personal reasons, categorized by groups, says, or keywords and phrases.You will discover the most recent versions of types just like the Vermont Assignment Creditor's Claim Against Estate within minutes.

If you already possess a subscription, log in and obtain Vermont Assignment Creditor's Claim Against Estate from your US Legal Forms library. The Acquire option can look on each kind you perspective. You get access to all earlier acquired types from the My Forms tab of your respective account.

If you wish to use US Legal Forms the very first time, listed below are simple recommendations to help you began:

- Be sure to have picked out the proper kind for your personal metropolis/state. Select the Preview option to check the form`s articles. See the kind information to ensure that you have chosen the right kind.

- When the kind doesn`t fit your demands, utilize the Lookup industry at the top of the display to discover the one who does.

- Should you be satisfied with the shape, affirm your decision by simply clicking the Buy now option. Then, opt for the pricing prepare you favor and give your references to register to have an account.

- Method the financial transaction. Make use of your bank card or PayPal account to complete the financial transaction.

- Find the file format and obtain the shape in your product.

- Make alterations. Load, change and print and indicator the acquired Vermont Assignment Creditor's Claim Against Estate.

Each web template you included with your money does not have an expiration day and is also the one you have for a long time. So, if you want to obtain or print one more backup, just visit the My Forms section and then click around the kind you will need.

Obtain access to the Vermont Assignment Creditor's Claim Against Estate with US Legal Forms, the most considerable library of legal record web templates. Use 1000s of specialist and express-specific web templates that satisfy your business or personal requires and demands.