A Vermont Revenue Sharing Agreement for Income from the Licensing and Custom Modification of Software is a legal contract that outlines the terms and conditions for sharing revenue generated from the licensing and customization of software in the state of Vermont. This agreement ensures a fair distribution of income between the parties involved, typically the software developer or licensor and the licensee or distributor. This agreement serves as a safeguard for both parties, as it clearly defines the revenue sharing arrangements, licensing terms, and any custom modification provisions related to the software. It helps create a transparent and mutually beneficial relationship, promoting business growth and fostering innovation in the software industry. The Vermont Revenue Sharing Agreement for Income from the Licensing and Custom Modification of Software can encompass different types, depending on various factors such as the nature of the software, the scope of licensing, and the level of customization allowed. Some specific types of agreements in this context include: 1. Standard Revenue Sharing Agreement: This agreement lays out the basic revenue sharing terms between the software developer and the licensee, typically specifying the percentage of revenue each party will receive from software licensing activities. 2. Royalty Agreement: This type of agreement focuses on the payment of royalties for the use of licensed software. It outlines the terms, rates, and frequency of royalty payments to the licensor, based on the agreed upon revenue sharing model. 3. Customization and Development Agreement: In certain cases, the revenue sharing agreement may involve customization or modification of the software as per the licensee's specific requirements. This type of agreement defines the terms and conditions related to customization, including the fees, ownership rights, and revenue sharing pertaining to the customized version of the software. 4. Distribution Agreement: This agreement is used when a software developer grants a licensee the right to distribute the software to end-users. It outlines the revenue sharing terms between the developer and the distributor, including any licensing fees or commissions. Key provisions included in a Vermont Revenue Sharing Agreement for Income from the Licensing and Custom Modification of Software may encompass the following: a. Revenue Sharing Model: This outlines the agreed percentage or formula for revenue distribution between the parties involved, ensuring a fair and equitable sharing of income. b. Licensing Terms: This section defines the permissions granted to the licensee regarding the use, distribution, and potential sub-licensing of the software. c. Custom Modification Provisions: If customization services are offered, this provision covers the details regarding fees, specifications, ownership of customizations, and any revenue sharing specific to the customized version. d. Payment Terms: This section specifies the frequency and method of revenue payments, ensuring clarity and timely distribution of income. e. Intellectual Property Rights: It is crucial for the agreement to address ownership and usage rights of the underlying software, including any modifications or customizations made during the agreement's term. f. Term and Termination: This section specifies the duration of the agreement and the conditions under which it can be terminated, protecting the interests of both parties. In conclusion, a Vermont Revenue Sharing Agreement for Income from the Licensing and Custom Modification of Software provides a comprehensive framework to govern the revenue distribution, licensing, and customization aspects of software in a fair and legally compliant manner.

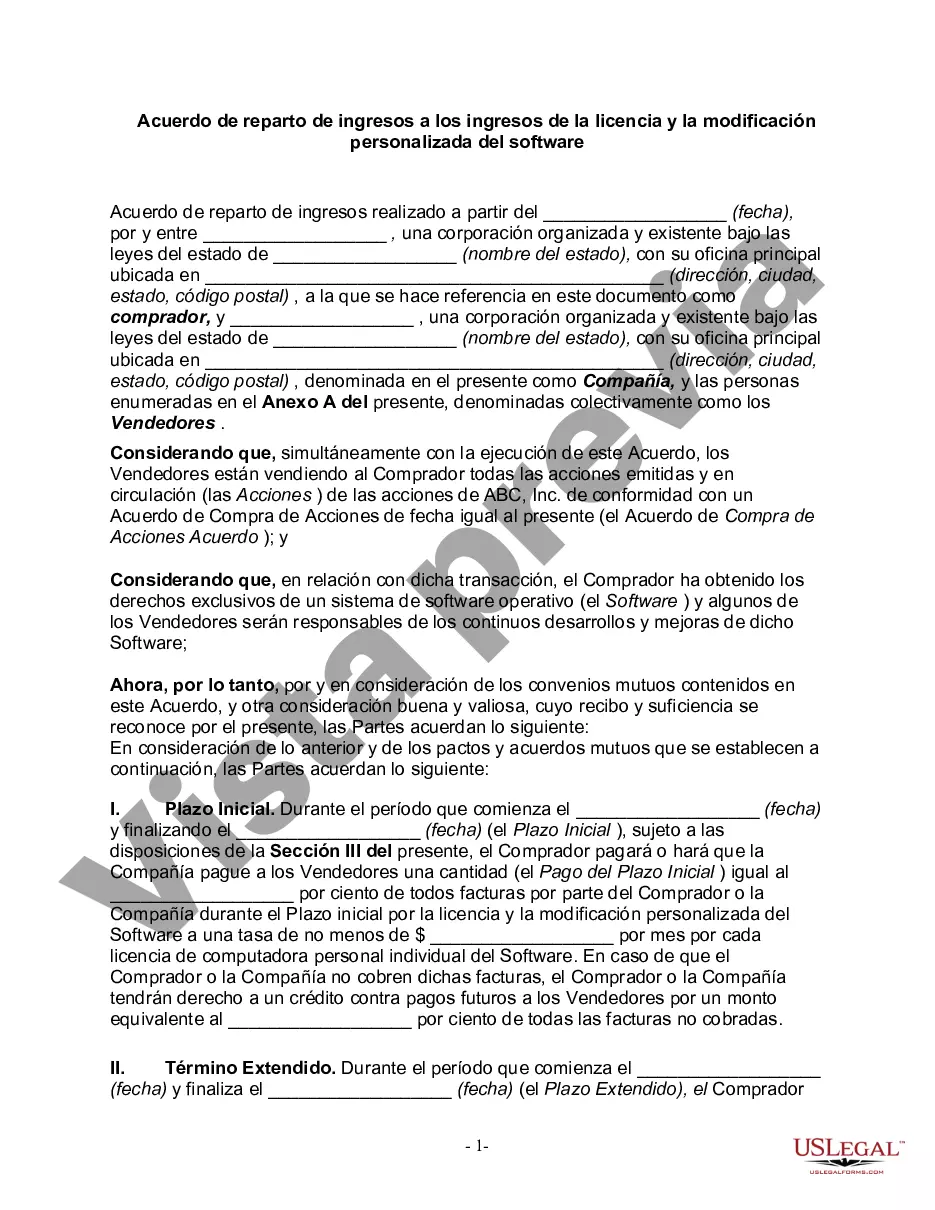

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Vermont Acuerdo de reparto de ingresos a los ingresos de la licencia y la modificación personalizada del software - Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software

Description

How to fill out Vermont Acuerdo De Reparto De Ingresos A Los Ingresos De La Licencia Y La Modificación Personalizada Del Software?

Finding the right legal file format might be a struggle. Of course, there are tons of layouts available on the Internet, but how will you obtain the legal kind you need? Take advantage of the US Legal Forms web site. The assistance offers thousands of layouts, such as the Vermont Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software, that can be used for company and personal requirements. All the types are inspected by specialists and fulfill federal and state specifications.

In case you are already listed, log in to the bank account and click on the Acquire button to find the Vermont Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software. Use your bank account to check with the legal types you have bought earlier. Visit the My Forms tab of the bank account and obtain one more version from the file you need.

In case you are a brand new user of US Legal Forms, listed here are easy instructions for you to stick to:

- Initially, ensure you have selected the appropriate kind to your area/area. You can examine the shape making use of the Review button and read the shape information to make certain this is the best for you.

- In case the kind will not fulfill your expectations, make use of the Seach industry to get the appropriate kind.

- Once you are positive that the shape is suitable, select the Buy now button to find the kind.

- Choose the costs program you need and type in the required details. Design your bank account and pay for the order using your PayPal bank account or credit card.

- Pick the data file formatting and acquire the legal file format to the gadget.

- Comprehensive, modify and printing and indicator the obtained Vermont Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software.

US Legal Forms is definitely the greatest library of legal types in which you can find different file layouts. Take advantage of the service to acquire appropriately-produced files that stick to condition specifications.