A Vermont Private Annuity Agreement is a financial arrangement that allows individuals to transfer assets and future income to a trust in exchange for guaranteed lifetime payments. It is a popular estate planning tool utilized by individuals looking to transfer wealth while receiving a steady income stream. One type of Vermont Private Annuity Agreement is the standard annuity agreement. It involves an individual, known as the annuitant, transferring assets, such as real estate, investments, or businesses, into an irrevocable trust. In return, the trust agrees to pay the annuitant a fixed income for the rest of their life. The annuitant effectively becomes the beneficiary of his or her own trust, receiving regular annuity payments. Another type is the self-canceling installment note (SKIN) annuity agreement. This arrangement is similar to a standard annuity agreement, with the exception that the payments may cease upon the annuitant's death, hence making it "self-canceling." In this case, if the annuitant passes away before the agreed annuity term is complete, the payments will cease, and the remaining assets in the trust would usually be distributed to beneficiaries as designated in the agreement. The use of a Vermont Private Annuity Agreement offers several benefits. Firstly, it allows the annuitant to transfer assets to the trust without incurring immediate income or gift tax liability. The annuitant can effectively remove the assets from their estate, reducing potential estate tax burdens upon their passing. Another advantage is the ability to achieve some level of income tax savings, as the annuitant receives payments over their life expectancy and is taxed on those payments, spreading the tax liability over time instead of in one lump sum. In addition, future appreciation or income generated by the transferred assets is typically removed from the annuitant's taxable estate. However, there are factors to consider before entering into a Vermont Private Annuity Agreement. It is crucial to consult with an experienced estate planning attorney or financial advisor familiar with annuity agreements to ensure compliance with applicable laws and regulations. Additionally, market conditions, interest rates, and the annuitant's life expectancy can affect the overall success of the agreement. As with any financial arrangement, careful consideration of personal circumstances, risk tolerance, and long-term goals is essential.

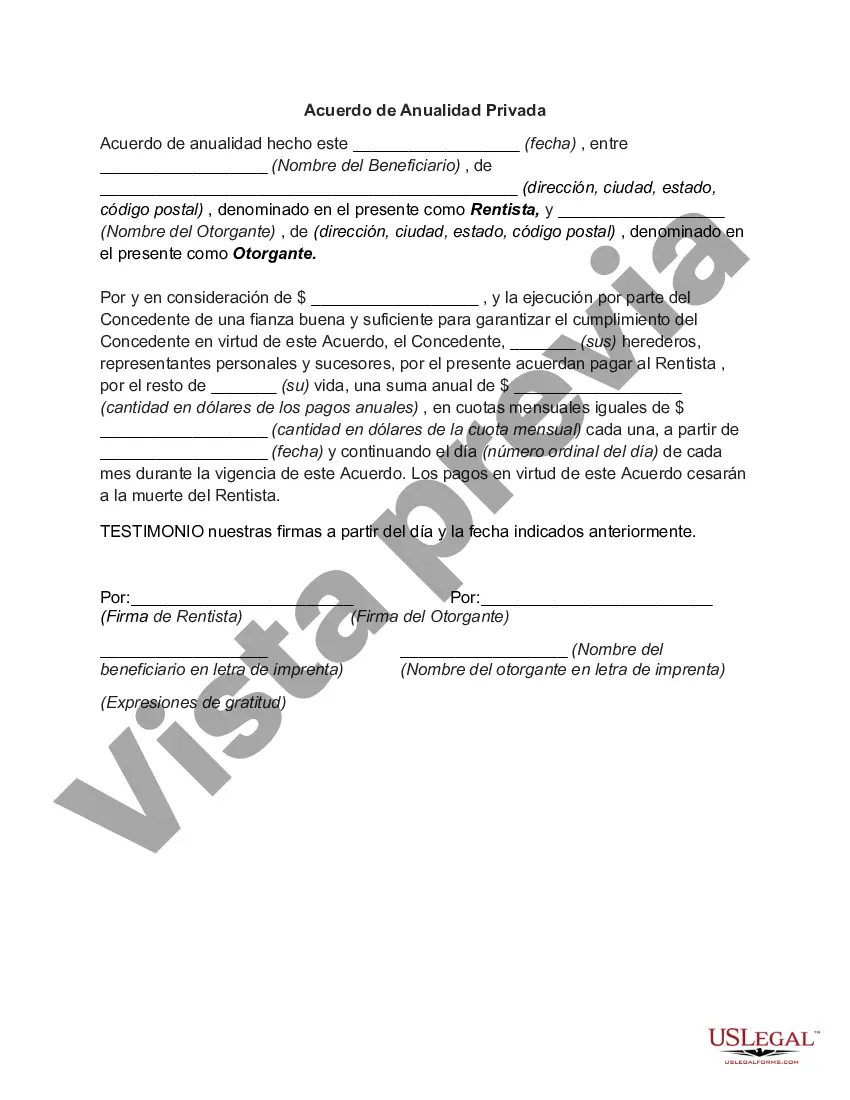

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Vermont Acuerdo de Anualidad Privada - Private Annuity Agreement

Description

How to fill out Vermont Acuerdo De Anualidad Privada?

Have you been in a place the place you need papers for either enterprise or individual purposes virtually every time? There are tons of legitimate record web templates accessible on the Internet, but getting versions you can rely is not straightforward. US Legal Forms gives a large number of form web templates, much like the Vermont Private Annuity Agreement, that happen to be published in order to meet federal and state demands.

Should you be currently knowledgeable about US Legal Forms website and possess a merchant account, basically log in. Following that, you may down load the Vermont Private Annuity Agreement template.

Should you not offer an profile and wish to start using US Legal Forms, abide by these steps:

- Get the form you will need and make sure it is to the correct town/region.

- Make use of the Preview key to check the form.

- Read the description to ensure that you have selected the correct form.

- When the form is not what you`re looking for, take advantage of the Search industry to obtain the form that fits your needs and demands.

- If you find the correct form, simply click Buy now.

- Pick the rates plan you want, complete the required details to generate your money, and pay money for the transaction making use of your PayPal or credit card.

- Select a convenient data file formatting and down load your duplicate.

Find each of the record web templates you possess purchased in the My Forms menu. You can get a further duplicate of Vermont Private Annuity Agreement at any time, if possible. Just go through the essential form to down load or print the record template.

Use US Legal Forms, by far the most extensive selection of legitimate forms, to conserve time as well as avoid blunders. The assistance gives skillfully produced legitimate record web templates which can be used for an array of purposes. Make a merchant account on US Legal Forms and start making your lifestyle easier.