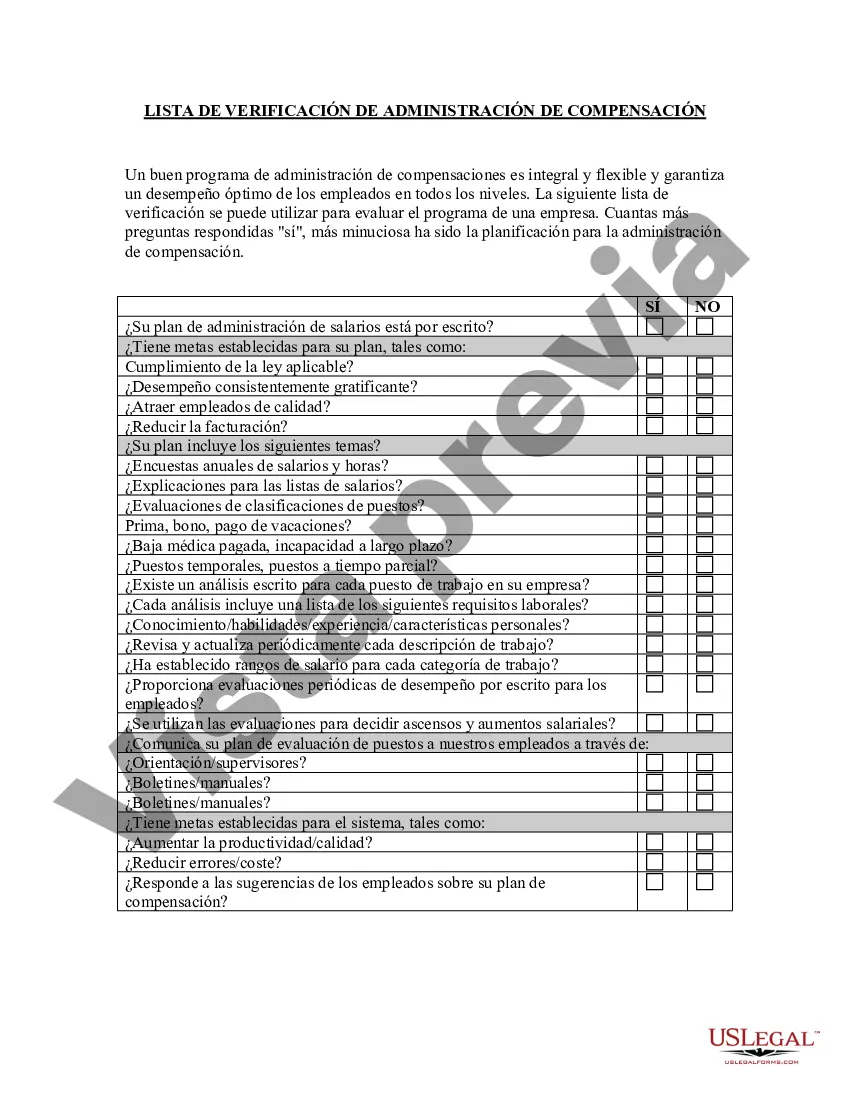

Vermont Compensation Administration Checklist is a comprehensive tool designed to ensure that businesses in Vermont adhere to the state's compensation laws and regulations. It is essential for employers to have a thorough understanding of the Vermont Compensation Administration Checklist to avoid legal repercussions and provide fair compensation to their workforce. Here is a detailed description of what this checklist entails: 1. Minimum Wage Compliance: The Vermont Compensation Administration Checklist includes a section dedicated to minimum wage compliance. It covers the current minimum wage rates set by the state, any future updates, and guidelines for calculating overtime pay if applicable. 2. Equal Pay Compliance: Employers must comply with Vermont's equal pay laws, which aim to eliminate gender-based wage disparities. The checklist provides guidance on maintaining pay equity, conducting internal audits, and ensuring fair compensation practices for all employees. 3. Family and Medical Leave Act (FMLA) Compliance: The checklist outlines the requirements and obligations under the Vermont Family and Medical Leave Act. It helps employers understand their responsibilities when granting leave to employees for personal or family-related medical reasons. 4. Workers' Compensation Compliance: Vermont employers must carry workers' compensation insurance to provide coverage for workplace injuries or illnesses. The compensation administration checklist explains the necessary steps for complying with workers' compensation laws, such as maintaining appropriate insurance coverage, reporting incidents promptly, and assisting injured employees. 5. Unemployment Insurance Compliance: The checklist includes information on Vermont's unemployment insurance program. Employers will find guidelines on registering for unemployment insurance, reporting wages accurately, and handling unemployment claims. 6. Wage and Hour Compliance: Employers must comply with Vermont's wage and hour laws to avoid wage theft and unfair labor practices. The checklist provides guidance on issues such as employee classification, overtime calculations, breaks, and record-keeping requirements. 7. Prevailing Wage Compliance: For employers engaged in public works projects, the checklist covers the obligations related to prevailing wage rates, certified payrolls, and compliance audits. 8. Payroll Tax Withholding Compliance: Employers are responsible for accurately withholding and remitting various payroll taxes, such as federal income tax, state income tax, and social security tax. The checklist provides guidance on calculating and reporting these taxes correctly. 9. Record-Keeping Requirements: The administration checklist emphasizes the importance of maintaining accurate records related to compensation, such as payroll records, time and attendance records, and documentation for salary adjustments or bonuses. 10. Resources and Contact Information: To assist employers, the checklist includes valuable resources such as contact information for the Vermont Department of Labor, links to relevant websites, and additional references for further guidance. In conclusion, the Vermont Compensation Administration Checklist is a vital tool for employers operating in Vermont. It covers a range of compensation-related areas, including minimum wage compliance, equal pay, family and medical leave, workers' compensation, unemployment insurance, wage and hour regulations, prevailing wage compliance, payroll tax withholding, and record-keeping requirements. Adhering to this checklist helps ensure fair compensation practices, maintain compliance with state laws, and mitigate legal risks.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Vermont Lista de verificación de administración de compensación - Compensation Administration Checklist

Description

How to fill out Vermont Lista De Verificación De Administración De Compensación?

It is possible to invest several hours on the web searching for the lawful file design which fits the federal and state requirements you will need. US Legal Forms supplies thousands of lawful varieties that happen to be analyzed by professionals. It is possible to acquire or print out the Vermont Compensation Administration Checklist from the services.

If you currently have a US Legal Forms bank account, you can log in and click the Acquire switch. Next, you can complete, modify, print out, or sign the Vermont Compensation Administration Checklist. Every lawful file design you purchase is your own forever. To get one more copy for any obtained kind, proceed to the My Forms tab and click the corresponding switch.

Should you use the US Legal Forms internet site for the first time, keep to the simple directions beneath:

- First, be sure that you have selected the right file design for the state/area that you pick. Read the kind explanation to ensure you have picked out the correct kind. If readily available, make use of the Preview switch to check from the file design too.

- If you would like get one more variation of the kind, make use of the Look for field to find the design that suits you and requirements.

- After you have identified the design you would like, click Acquire now to carry on.

- Select the prices prepare you would like, type in your accreditations, and sign up for your account on US Legal Forms.

- Full the financial transaction. You can use your Visa or Mastercard or PayPal bank account to pay for the lawful kind.

- Select the format of the file and acquire it to your gadget.

- Make adjustments to your file if required. It is possible to complete, modify and sign and print out Vermont Compensation Administration Checklist.

Acquire and print out thousands of file layouts while using US Legal Forms web site, that provides the largest variety of lawful varieties. Use specialist and state-specific layouts to take on your small business or personal needs.