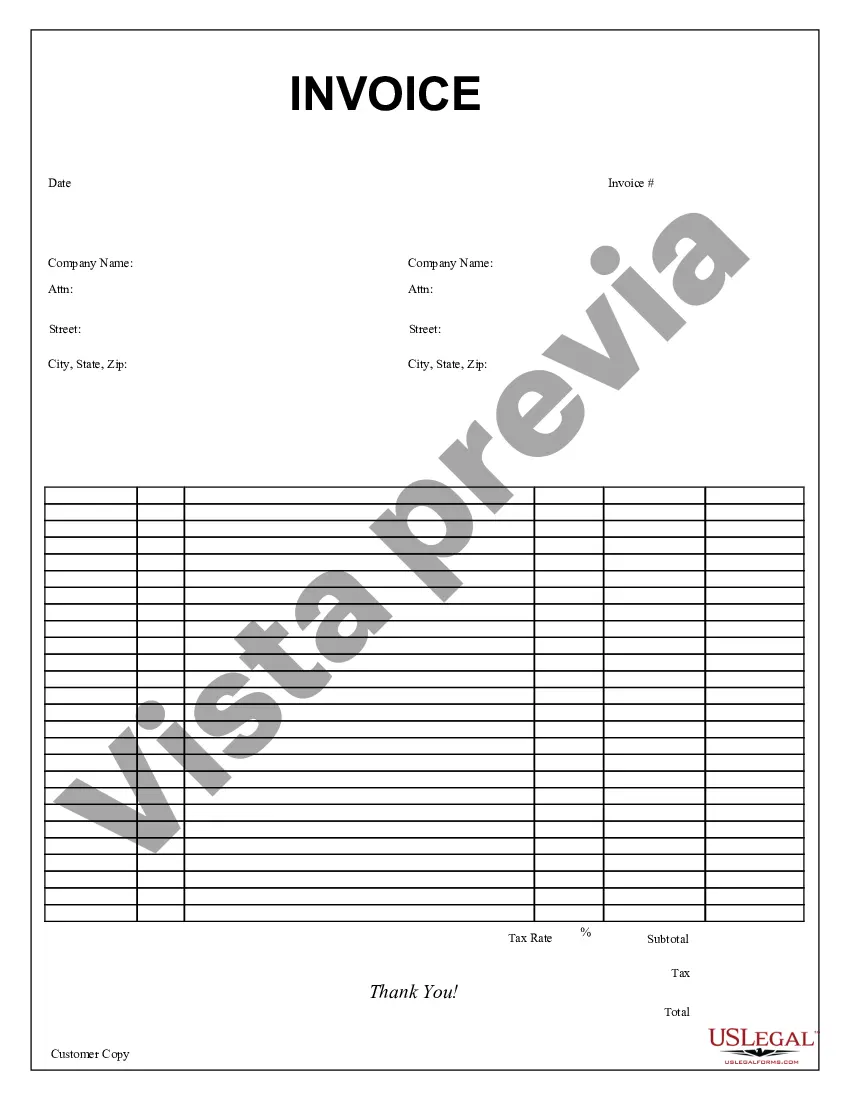

A Vermont Purchase Invoice is a document that outlines the details of a purchase made by a buyer from a seller based in Vermont. It serves as a proof of the transaction and includes vital information required for record-keeping and financial purposes. The typical components of a Vermont Purchase Invoice are: 1. Header: The invoice usually begins with the seller's contact information, including their name, address, phone number, and email. 2. Customer Information: The buyer's details follow next, including their name, address, and contact information. 3. Invoice Number: Each Vermont Purchase Invoice is assigned a unique identification number to facilitate easy referencing and tracking. 4. Invoice Date: This specifies the date when the purchase was made and the invoice was issued. 5. Payment Terms: The agreed-upon payment terms are mentioned, such as the due date for payment and any applicable discounts or penalties. 6. Itemized List: The invoice lists all the goods or services purchased, along with their descriptions, quantity, unit price, and total price. 7. Taxes and Total Amount: Vermont Purchase Invoices include any applicable sales tax or other taxes. Additionally, the invoice states the total amount payable, including taxes. 8. Payment Information: The seller provides details about the acceptable modes of payment, such as bank account details or payment platforms. 9. Terms and Conditions: A section may be dedicated to outlining the terms and conditions of the purchase, including any warranties, return policies, or disclaimers. 10. Seller's Signature: The Vermont Purchase Invoice concludes with the signature of the seller, validating the document. Different types of Vermont Purchase Invoices may include: 1. Standard Purchase Invoice: This is the most commonly used type, containing all the aforementioned components. 2. Recurring Invoice: If a buyer has a regularly scheduled purchase arrangement with a seller, they may receive invoices at regular intervals, such as monthly or quarterly. 3. Prepayment Invoice: In some cases, a seller may request partial or full payment in advance. In such instances, a prepayment invoice is issued to record the payment made. 4. Credit Invoice: This type of invoice is issued to reduce or eliminate the amount owed by the buyer due to returns, discounts, or other adjustments. 5. Proforma Invoice: Often used in international transactions, a proforma invoice provides a preliminary price quote before the goods or services are delivered. It is essential for businesses to maintain proper records of Vermont Purchase Invoices to ensure accurate accounting, tax compliance, and efficient financial management.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Vermont Factura de compra - Purchase Invoice

Description

How to fill out Vermont Factura De Compra?

Have you been in a position where you need paperwork for either organization or specific purposes almost every day? There are a variety of lawful record templates available on the Internet, but getting kinds you can trust isn`t effortless. US Legal Forms delivers a huge number of type templates, just like the Vermont Purchase Invoice, that happen to be published to fulfill state and federal needs.

When you are presently knowledgeable about US Legal Forms website and get an account, just log in. Next, you may acquire the Vermont Purchase Invoice format.

Unless you provide an bank account and wish to begin to use US Legal Forms, follow these steps:

- Discover the type you require and make sure it is for that proper metropolis/area.

- Make use of the Review switch to review the shape.

- See the outline to ensure that you have chosen the right type.

- In case the type isn`t what you`re looking for, use the Research field to discover the type that meets your needs and needs.

- If you obtain the proper type, click on Acquire now.

- Choose the costs prepare you would like, fill in the necessary details to create your account, and buy the order with your PayPal or bank card.

- Decide on a practical data file format and acquire your duplicate.

Get all of the record templates you may have bought in the My Forms food list. You may get a extra duplicate of Vermont Purchase Invoice anytime, if necessary. Just click on the necessary type to acquire or print out the record format.

Use US Legal Forms, the most substantial selection of lawful kinds, to conserve time as well as steer clear of mistakes. The support delivers expertly created lawful record templates which you can use for a selection of purposes. Create an account on US Legal Forms and initiate creating your life a little easier.