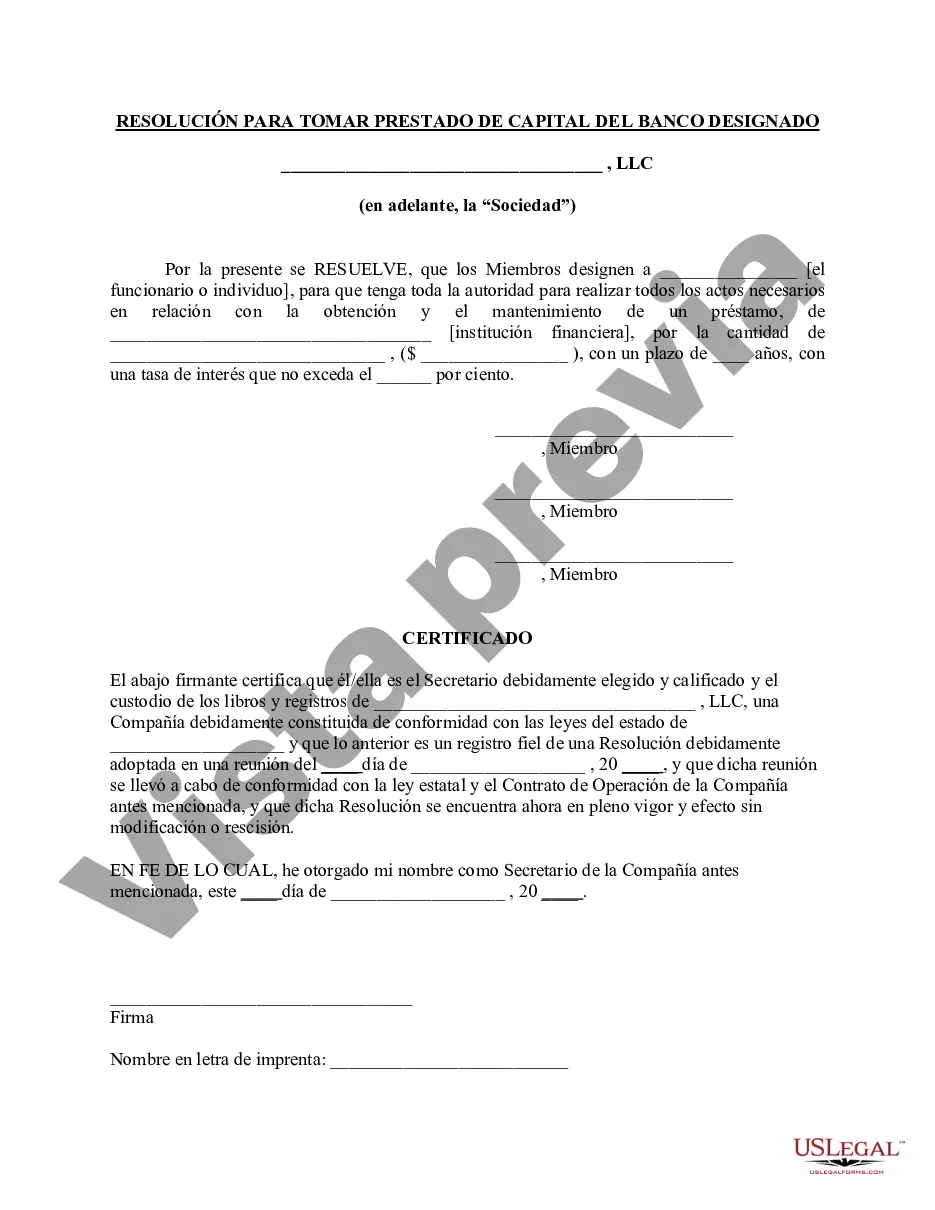

Title: Vermont Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank: A Comprehensive Guide to the Different Types Introduction: The Vermont Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank is a pivotal document that outlines the decision-making process within an LLC (Limited Liability Company) when it comes to borrowing capital from a designated bank. This article aims to provide a detailed description of this resolution, highlighting its purpose, key elements, and different types that may exist. Whether you are a stakeholder, a member, or an interested party, understanding these resolutions is crucial for shaping the financial future of an LLC. I. Purpose of the Resolution: The primary purpose of the Vermont Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank is to obtain official approval from LLC members to enter into a borrowing agreement with a designated bank. This resolution ensures that all members are aware of the intent to borrow capital, the terms and conditions involved, and the obligations incurred by the LLC. II. Key Elements of the Resolution: 1. Introduction: The resolution should begin with a formal introduction, stating the name and registered address of the LLC, as well as the purpose and context of the meeting. 2. Approval of Borrowing: This section outlines the LLC members' approval process for borrowing capital from a designated bank. It may detail the amount to be borrowed, how the funds will be utilized, and any limitations or conditions on the borrowing. 3. Designated Bank: The resolution should specify the name of the designated bank from which the LLC intends to borrow capital. Providing the bank's details, including name, address, and contact information, is crucial. 4. Terms and Conditions: This part elaborates on the terms and conditions of the borrowing, including interest rates, repayment schedule, collateral details (if applicable), and any penalties or fees associated with non-compliance. 5. Signatories and Effective Date: The resolution should indicate the names and signatures of LLC members approving the borrowing, ensuring they understand and agree to the terms. Additionally, the resolution's effective date should be clearly stated. III. Different Types of Vermont Resolutions for Borrowing Capital: 1. Special Resolution: A special resolution is passed when the borrowing amount exceeds a predetermined threshold set either in the LLC's operating agreement or based on legal requirements. It typically requires a higher majority vote (e.g., two-thirds or three-quarters of LLC members) for approval. 2. Ordinary Resolution: An ordinary resolution is passed when the borrowing amount falls within the specified limit or is a routine action. It requires a simple majority vote (e.g., more than 50% of LLC members) for approval. 3. Unanimous Resolution: A unanimous resolution is passed when all LLC members are required to approve the borrowing. This type of resolution is necessary if the LLC operating agreement specifies that all decisions must be unanimous. Conclusion: The Vermont Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank is a critical document that ensures transparency, accountability, and proper decision-making within an LLC. By understanding the purpose, key elements, and different types of resolutions related to borrowing capital, LLC members can make informed choices that positively impact the financial stability and growth of their business.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Vermont Resolución de la reunión de miembros de la LLC para pedir prestado capital del banco designado - Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank

Description

How to fill out Vermont Resolución De La Reunión De Miembros De La LLC Para Pedir Prestado Capital Del Banco Designado?

If you want to total, obtain, or produce legitimate papers web templates, use US Legal Forms, the largest selection of legitimate varieties, that can be found online. Make use of the site`s basic and hassle-free look for to discover the documents you need. Different web templates for company and person uses are categorized by types and states, or key phrases. Use US Legal Forms to discover the Vermont Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank within a number of mouse clicks.

If you are currently a US Legal Forms customer, log in to your bank account and click the Down load switch to obtain the Vermont Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank. You can also accessibility varieties you previously downloaded in the My Forms tab of your own bank account.

If you use US Legal Forms the very first time, refer to the instructions listed below:

- Step 1. Be sure you have chosen the shape for your right area/country.

- Step 2. Take advantage of the Preview option to look through the form`s content material. Never forget to see the explanation.

- Step 3. If you are not satisfied together with the kind, take advantage of the Lookup industry towards the top of the monitor to locate other variations of your legitimate kind design.

- Step 4. When you have identified the shape you need, go through the Purchase now switch. Select the prices strategy you prefer and add your accreditations to register on an bank account.

- Step 5. Method the transaction. You may use your Мisa or Ьastercard or PayPal bank account to perform the transaction.

- Step 6. Select the file format of your legitimate kind and obtain it on your own system.

- Step 7. Comprehensive, modify and produce or indicator the Vermont Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank.

Every legitimate papers design you buy is yours forever. You have acces to every single kind you downloaded within your acccount. Click the My Forms segment and choose a kind to produce or obtain once more.

Remain competitive and obtain, and produce the Vermont Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank with US Legal Forms. There are millions of specialist and state-certain varieties you may use to your company or person requires.