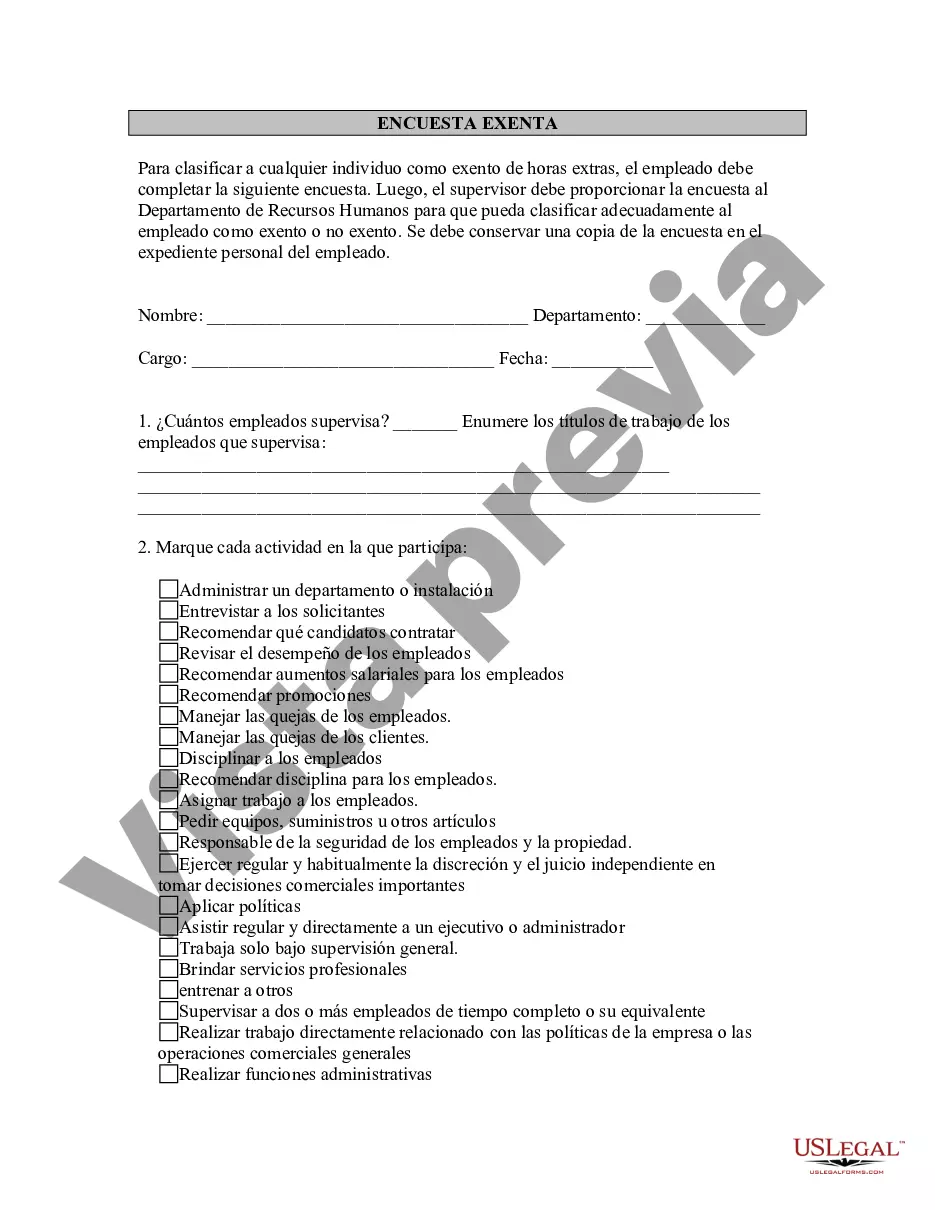

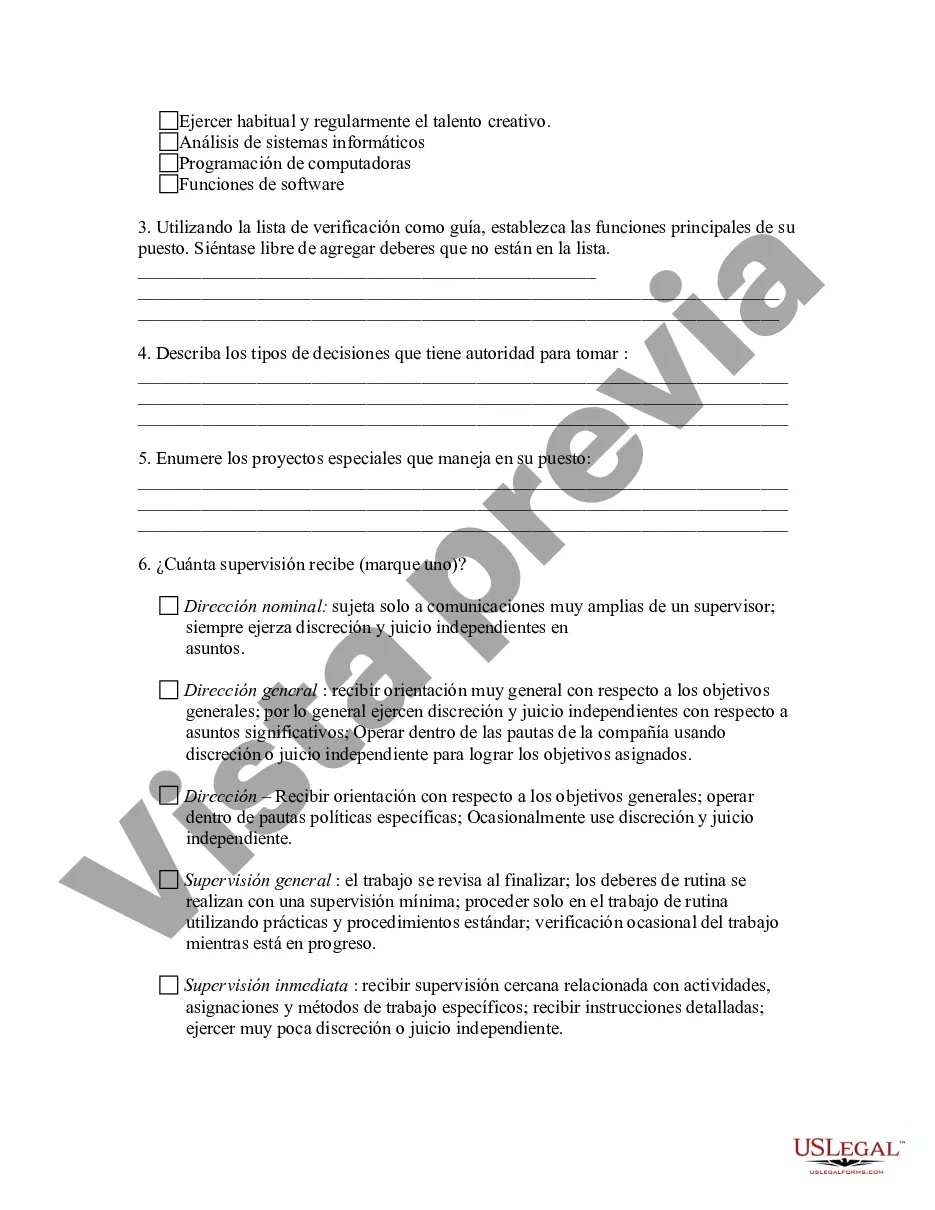

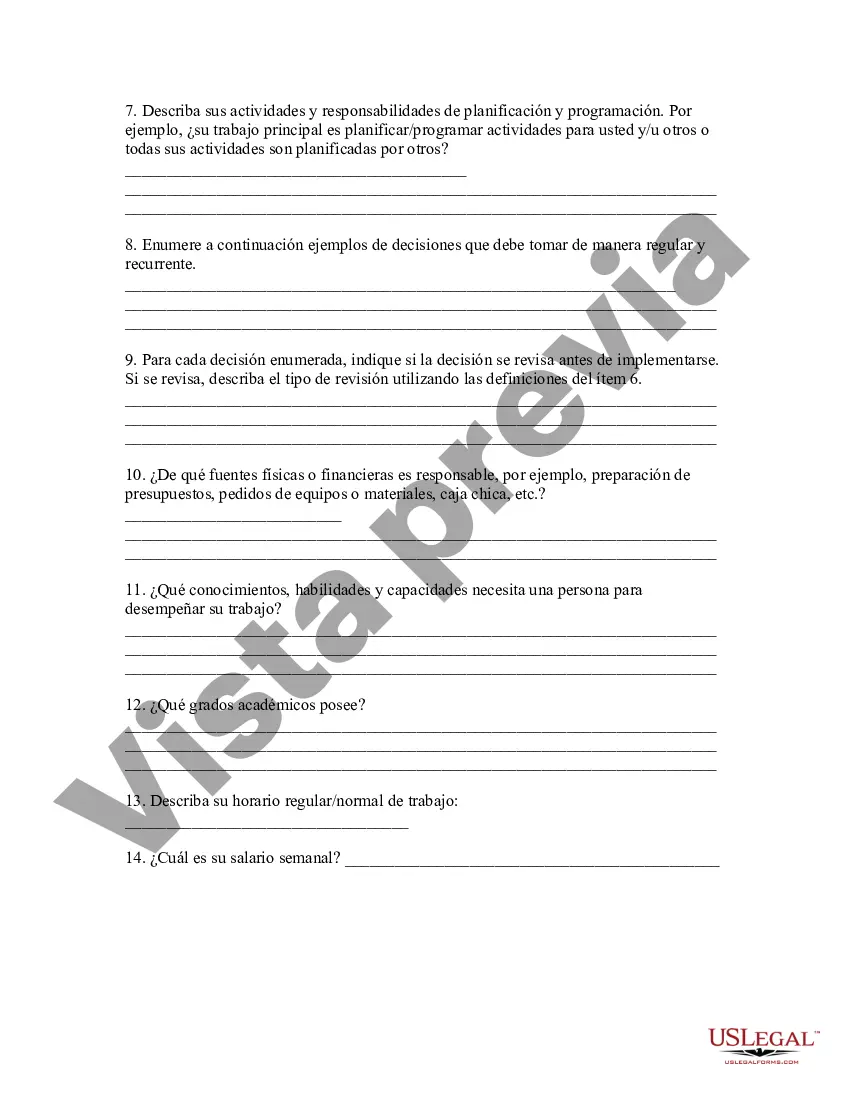

Vermont Exempt Survey refers to a crucial process conducted by the Vermont Department of Taxes to determine the eligibility of individuals or organizations for tax exemptions. This survey plays a pivotal role in ensuring that appropriate exemptions are granted based on specific circumstances and criteria. A Vermont Exempt Survey is primarily carried out to assess whether the applicant meets the required criteria to qualify for tax exemptions in the state. This survey encompasses various categories, including but not limited to, nonprofit organizations, religious institutions, educational institutions, government entities, and healthcare organizations. The Vermont Exempt Survey serves as an essential tool for the Department of Taxes to evaluate the applicant's eligibility for tax exemptions. It helps in identifying organizations or individuals who engage in activities that align with the state's objectives and qualify for reduced or waived taxes. Different types of Vermont Exempt Surveys can be categorized based on the nature of the applicant: 1. Nonprofit Organizations: Nonprofit organizations play a vital role in the Vermont community, and the exempt survey evaluates their eligibility for tax exemptions based on their charitable, educational, scientific, or religious activities. This survey ensures that such organizations meet the necessary qualifications to avail of tax benefits. 2. Religious Institutions: Vermont Exempt Survey also examines religious institutions, such as churches, mosques, synagogues, or temples, to determine if they satisfy the criteria for tax exemption. The survey focuses on verifying the institution's religious purpose, regular worship activities, and community involvement. 3. Educational Institutions: The survey includes educational institutions like schools, colleges, and universities, assessing their qualifications for tax exemptions. The Department of Taxes scrutinizes these institutions to ensure compliance with educational objectives, accreditation status, and not-for-profit activities. 4. Government Entities: Government entities may also undergo a Vermont Exempt Survey to determine their eligibility for tax exemptions. This survey validates the government organization's exempt status based on its public service provision and alignment with the mission of benefiting the community. 5. Healthcare Organizations: Healthcare organizations, such as hospitals, clinics, and medical research centers, must undergo a Vermont Exempt Survey to validate their eligibility for tax exemptions. The survey investigates the provision of affordable healthcare services, community outreach programs, and compliance with state guidelines. Overall, the Vermont Exempt Survey is a comprehensive evaluation process conducted by the Vermont Department of Taxes to determine an individual or organization's eligibility for tax exemptions. This assessment helps in ensuring that exempt status is rightly granted only to those who meet the specified criteria, maintaining the integrity of the taxation system in the state.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Vermont Encuesta exenta - Exempt Survey

Description

How to fill out Vermont Encuesta Exenta?

US Legal Forms - among the most significant libraries of lawful forms in the United States - gives a wide array of lawful file web templates you are able to acquire or print. Using the web site, you can get a large number of forms for organization and individual reasons, sorted by classes, claims, or search phrases.You can find the most up-to-date versions of forms such as the Vermont Exempt Survey in seconds.

If you currently have a monthly subscription, log in and acquire Vermont Exempt Survey from your US Legal Forms local library. The Download key can look on each and every develop you look at. You have accessibility to all previously acquired forms in the My Forms tab of your account.

In order to use US Legal Forms the very first time, listed below are straightforward instructions to help you get began:

- Make sure you have selected the right develop for your town/region. Click on the Preview key to review the form`s information. Read the develop description to ensure that you have chosen the right develop.

- In case the develop does not match your demands, take advantage of the Look for area towards the top of the display screen to get the one who does.

- Should you be content with the form, validate your option by clicking on the Purchase now key. Then, choose the costs plan you prefer and provide your qualifications to sign up on an account.

- Procedure the deal. Make use of your credit card or PayPal account to accomplish the deal.

- Select the format and acquire the form on your own device.

- Make adjustments. Complete, edit and print and indication the acquired Vermont Exempt Survey.

Every single template you added to your bank account does not have an expiry day and is also your own property forever. So, if you want to acquire or print yet another copy, just check out the My Forms portion and then click on the develop you will need.

Obtain access to the Vermont Exempt Survey with US Legal Forms, probably the most considerable local library of lawful file web templates. Use a large number of skilled and condition-particular web templates that meet your company or individual requires and demands.