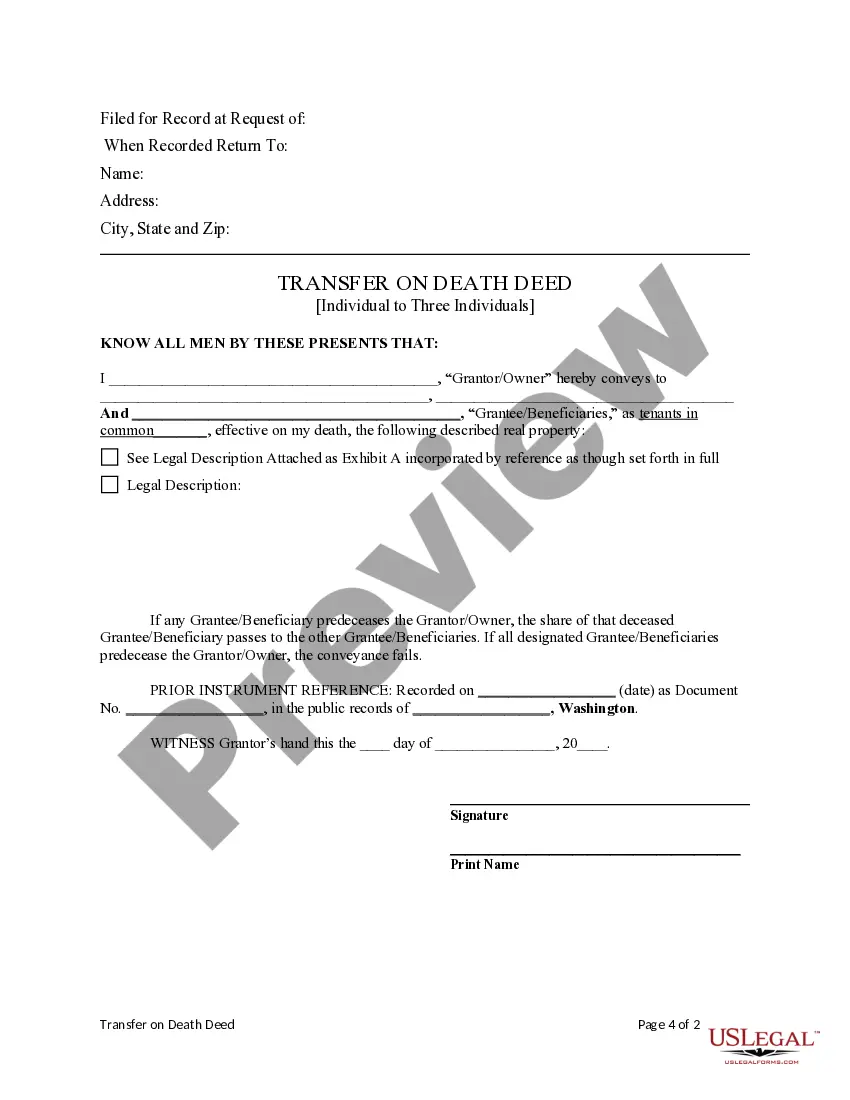

This form is a Transfer on Death Deed where the Grantor is an individual and the Grantees are three individuals. This transfer is revocable by Grantor until his or her death and effective only upon the death of the Grantor. This deed complies with all state statutory laws.

Washington Transfer on Death Deed - Individual to Three Individuals - Does NOT include Alternate Beneficiaries.

Description

How to fill out Washington Transfer On Death Deed - Individual To Three Individuals - Does NOT Include Alternate Beneficiaries.?

Out of the great number of platforms that offer legal templates, US Legal Forms offers the most user-friendly experience and customer journey while previewing templates before purchasing them. Its extensive library of 85,000 templates is grouped by state and use for efficiency. All of the forms on the platform have already been drafted to meet individual state requirements by qualified legal professionals.

If you already have a US Legal Forms subscription, just log in, search for the form, click Download and obtain access to your Form name in the My Forms; the My Forms tab keeps all your saved documents.

Stick to the tips below to obtain the form:

- Once you see a Form name, ensure it’s the one for the state you need it to file in.

- Preview the template and read the document description prior to downloading the sample.

- Look for a new template using the Search field in case the one you have already found isn’t appropriate.

- Simply click Buy Now and choose a subscription plan.

- Create your own account.

- Pay with a card or PayPal and download the template.

Once you have downloaded your Form name, you can edit it, fill it out and sign it with an web-based editor of your choice. Any form you add to your My Forms tab can be reused many times, or for as long as it remains the most up-to-date version in your state. Our service provides fast and easy access to samples that suit both lawyers as well as their customers.

Form popularity

FAQ

On a nonretirement account, designating a beneficiary or beneficiaries establishes a transfer on death (TOD) registration for the account. For an individual account, a TOD registration generally allows ownership of the account to be transferred to the designated beneficiary upon your death.

Accounts or assets with named beneficiaries may be transferred without going through the probate process.If there is a TOD on the account, the assets will only go to the beneficiary if both joint owners pass away. In either case, the asset will not likely go through probate.

A TOD designation supersedes a will. For bank accounts, you can set up a similar account known as payable-on-death, sometimes referred to as a Totten trust. Your beneficiaries can't touch the account while you're alive, and you're free to change beneficiaries or close the accounts at any time.

An account holder may choose to list both of their children as equal beneficiaries. However, an account holder can also choose to list individuals in unequal amounts. For example, you could designate a primary beneficiary to receive 50 percent of the funds and two secondary beneficiaries who receive 25 percent each.

The Washington transfer-on-death deed form allows property to be automatically transferred to a new owner when the current owner dies, without the need to go through probate. It also gives the current owner retained control over the property, including the right to change his or her mind about the transfer.

A TOD designation supersedes a will. For bank accounts, you can set up a similar account known as payable-on-death, sometimes referred to as a Totten trust. Your beneficiaries can't touch the account while you're alive, and you're free to change beneficiaries or close the accounts at any time.

Receiving an inheritance can be an unexpected windfall. In fact, transfer on death accounts are exposed to all the same income and capital gains taxes when the account owner is alive, as well as estate and inheritance taxes upon the owner's death.

TOD account holders can name multiple beneficiaries and divide assets any way they like.However, the beneficiaries have no access or rights to a TOD account while its owner is alive. Those beneficiaries can also be changed at any time, so long as the TOD account holder is deemed mentally competent.