- Instant access to the funds via an ATM or check card; - A check can be lost or stolen anywhere between the sender and the intended payee; - Payments made electronically can be less expensive to the payor.

Direct deposit eliminates mailing delays and alleviates the need to go somewhere to cash or deposit your check. Washington Direct Deposit Agreement refers to a legal contract between an employer or a government agency and an employee in the state of Washington, USA, wherein the employee gives their consent to have their salary or other forms of financial compensation directly deposited into their bank account. This agreement outlines the terms and conditions associated with the direct deposit service, ensuring a smooth and secure transfer of funds from the employer or the government agency to the employee's designated account. It provides a detailed description of the process, requirements, and responsibilities of both parties involved. The Washington Direct Deposit Agreement generally includes the following key elements: 1. Authorization: The agreement starts with the employee's authorization to participate in the direct deposit program and provides their consent to receive their payments electronically into their designated bank account. 2. Bank Account Information: The agreement requires the employee to provide accurate and up-to-date bank account information, including the routing and account numbers, to facilitate the direct deposit transactions. 3. Notification: The agreement specifies how the employer or government agency will notify the employee of the deposit details, such as the amount deposited, the date of deposit, and any accompanying information provided. 4. Deposit Process: It provides a comprehensive overview of the process involved in depositing funds directly into the employee's bank account, including the frequency of deposits (e.g., weekly, bi-weekly, or monthly) and the timeline for the funds to be available. 5. Accuracy and Liability: The agreement highlights the importance of providing accurate bank account information and holds the employee responsible for any loss or delay caused by inaccurate information or failure to update the information promptly. 6. Termination and Change: It outlines the procedure for terminating or modifying the direct deposit agreement, including the required notice period and any necessary forms or documentation. Multiple types of Washington Direct Deposit Agreements may exist, depending on the specific nature of the employee-employer relationship or the government agency involved. For instance, there might be separate agreements for traditional employees, contractors, or public sector employees. However, the overall purpose and content of the agreement tend to remain consistent across the different types.

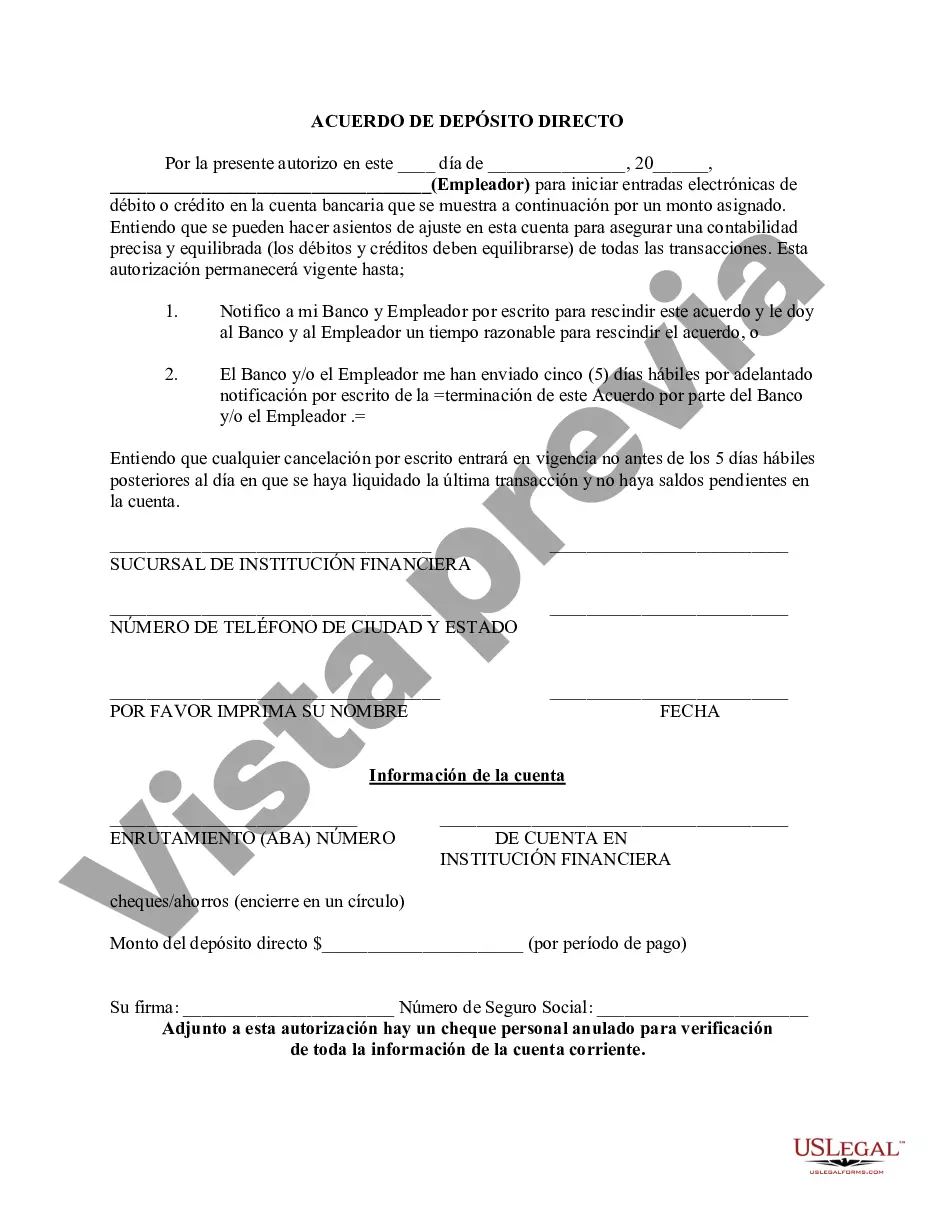

Washington Direct Deposit Agreement refers to a legal contract between an employer or a government agency and an employee in the state of Washington, USA, wherein the employee gives their consent to have their salary or other forms of financial compensation directly deposited into their bank account. This agreement outlines the terms and conditions associated with the direct deposit service, ensuring a smooth and secure transfer of funds from the employer or the government agency to the employee's designated account. It provides a detailed description of the process, requirements, and responsibilities of both parties involved. The Washington Direct Deposit Agreement generally includes the following key elements: 1. Authorization: The agreement starts with the employee's authorization to participate in the direct deposit program and provides their consent to receive their payments electronically into their designated bank account. 2. Bank Account Information: The agreement requires the employee to provide accurate and up-to-date bank account information, including the routing and account numbers, to facilitate the direct deposit transactions. 3. Notification: The agreement specifies how the employer or government agency will notify the employee of the deposit details, such as the amount deposited, the date of deposit, and any accompanying information provided. 4. Deposit Process: It provides a comprehensive overview of the process involved in depositing funds directly into the employee's bank account, including the frequency of deposits (e.g., weekly, bi-weekly, or monthly) and the timeline for the funds to be available. 5. Accuracy and Liability: The agreement highlights the importance of providing accurate bank account information and holds the employee responsible for any loss or delay caused by inaccurate information or failure to update the information promptly. 6. Termination and Change: It outlines the procedure for terminating or modifying the direct deposit agreement, including the required notice period and any necessary forms or documentation. Multiple types of Washington Direct Deposit Agreements may exist, depending on the specific nature of the employee-employer relationship or the government agency involved. For instance, there might be separate agreements for traditional employees, contractors, or public sector employees. However, the overall purpose and content of the agreement tend to remain consistent across the different types.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.