Washington Bill of Sale for a Coin Collection

Description

How to fill out Bill Of Sale For A Coin Collection?

Are you presently in a circumstance where you need documentation for potential organizational or personal activities nearly every day.

There are numerous legal document templates accessible online, but finding reliable versions can be challenging.

US Legal Forms provides a vast array of form templates, such as the Washington Bill of Sale for a Coin Collection, specifically designed to meet federal and state requirements.

Once you find the correct form, click Get now.

Select the pricing plan you prefer, fill out the required information to create your account, and complete the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Afterward, you will be able to download the Washington Bill of Sale for a Coin Collection template.

- If you do not possess an account and wish to start using US Legal Forms, follow these instructions.

- Select the form you need and ensure it is for the correct area/region.

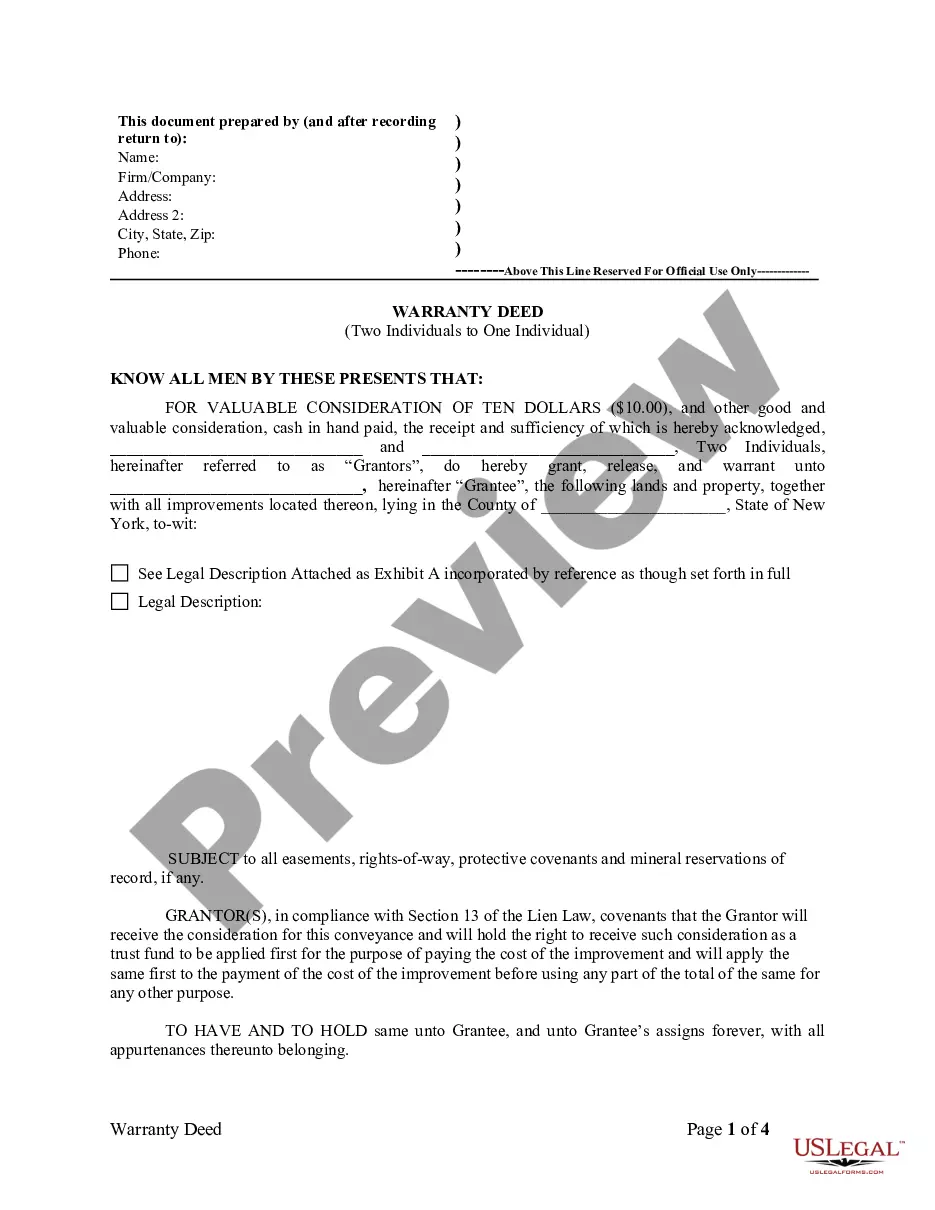

- Utilize the Preview button to review the form.

- Read the description to ensure you have chosen the correct form.

- If the form is not what you are looking for, use the Search box to find the form that matches your needs and requirements.

Form popularity

FAQ

To sell your coin collection wisely, start by researching reputable coin dealers in your area. Check reviews and seek recommendations from fellow collectors to ensure you find trustworthy individuals. Once you select a dealer, consider using a Washington Bill of Sale for a Coin Collection to document the transaction. This protects your interests and adds legitimacy to the sale.

When selling a large collection of coins, first organize them by type and condition to make the process easier. Utilize a Washington Bill of Sale for a Coin Collection to document each transaction, adding legitimacy to your sale. You might choose to auction the collection, sell it to a dealer, or use online marketplaces. Be sure to promote your collection accurately to attract serious buyers.

To obtain a title with a bill of sale in Washington state, you first need to complete the bill of sale accurately, detailing the coin collection being transferred. You will then submit this document to your local Department of Licensing, along with any other required forms and fees. This process ensures that you have a valid title that reflects the ownership of your coin collection, making a Washington Bill of Sale for a Coin Collection essential for a smooth transaction.

The best way to sell an old coin collection is to research and identify its value before initiating the sale. Consider selling to local coin shops, auction houses, or online marketplaces. Whichever method you choose, remember to create a Washington Bill of Sale for a Coin Collection to officially document the sale and protect both you and the buyer. This action provides peace of mind and solidifies the transaction.

In Washington state, you typically cannot transfer a title without a bill of sale. A bill of sale acts as proof of the transaction, which is necessary for titles, especially for vehicles but also applicable for valuable items like a coin collection. To ensure a straightforward transfer, always complete a Washington Bill of Sale for a Coin Collection, providing the necessary legal documentation required by the state.

To sell an inherited coin collection, first assess its value by consulting a professional appraiser or researching market prices. Next, consider whether to sell through an auction, private sale, or coin dealer. Be sure to create a Washington Bill of Sale for a Coin Collection to document the transaction, especially if the collection is valuable. Proper documentation ensures a smooth sale and protects your interests.

If you inherit a coin collection, the first step is to evaluate its value. Consider consulting an expert for appraisal. You can choose to keep the collection, sell it, or even donate it. If you decide to sell, a Washington Bill of Sale for a Coin Collection can help clarify the details of the transaction, ensuring everything is legally documented.

Yes, selling a coin collection can trigger tax implications. In the United States, profits from the sale of collectibles, like coins, are often treated as capital gains. It's important to consult with a tax professional to understand how the sale impacts your tax responsibilities, especially when using a Washington Bill of Sale for a Coin Collection to document the transaction.

Selling your entire coin collection can be an exciting venture. Start by assessing the value of your coins, either through professional appraisals or research. Once you have a clear idea of the worth, you can create a Washington Bill of Sale for a Coin Collection to document the sale. This will provide a clear record for both you and the buyer, ensuring a smooth transaction.

Tax stamps themselves can hold value as collectibles, depending on their rarity and demand. However, their use as a tax payment tool may depend on current regulations. If you plan to engage in transactions involving collectibles, consider generating a Washington Bill of Sale for a Coin Collection to document your purchases and sales properly.