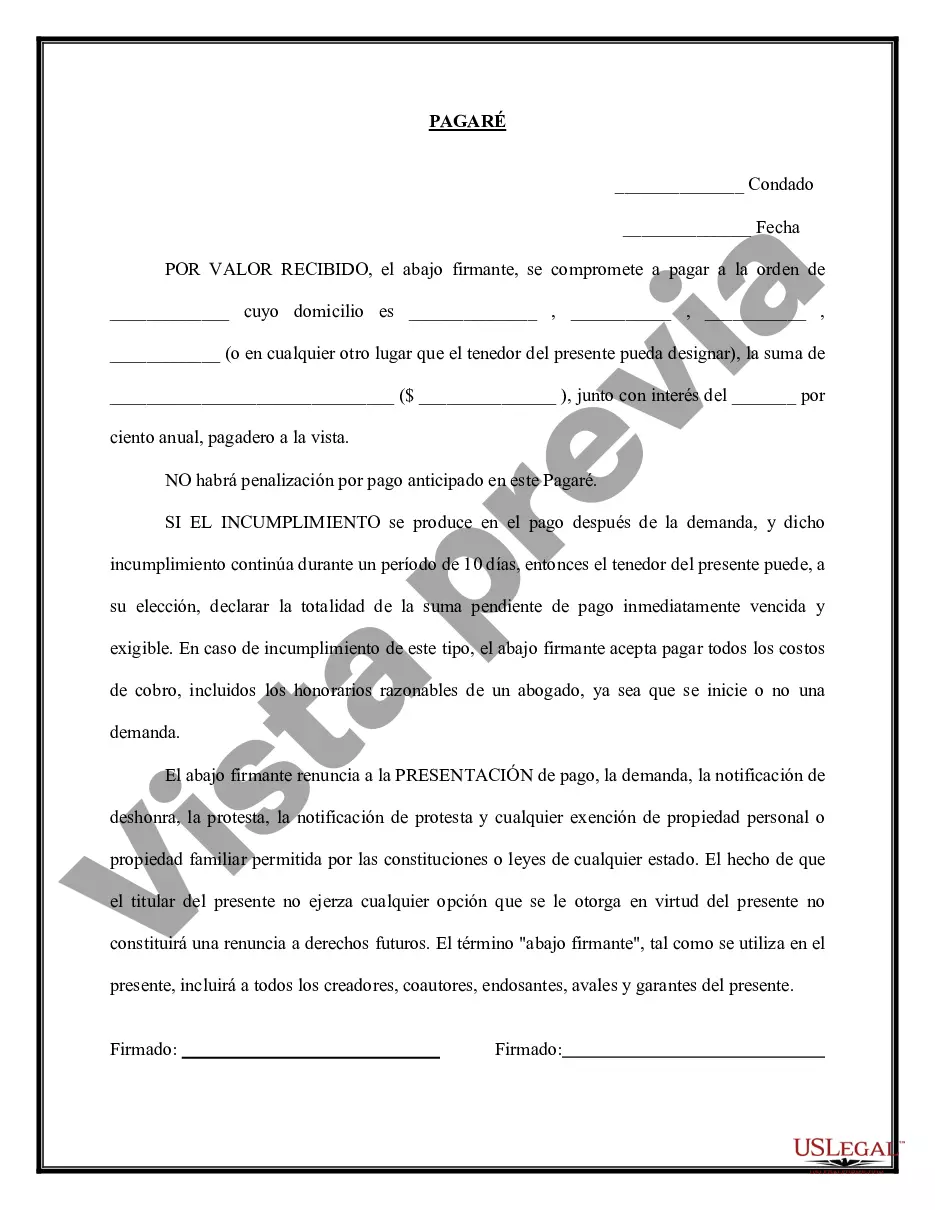

A Washington Promissory Note — Payable on Demand is a legally binding document that outlines the terms and conditions of a loan agreement between two parties — the lender and the borrower. In this type of promissory note, the borrower promises to repay the loan amount to the lender upon their demand or request. The note includes crucial information such as the names and contact details of both parties, the principal loan amount, the interest rate (if applicable), the repayment terms, and any additional provisions or agreements agreed upon by both parties. It serves as evidence of the loan transaction and the borrower's obligation to repay the debt. Keywords: Washington Promissory Note, Payable on Demand, legally binding document, loan agreement, lender, borrower, loan amount, interest rate, repayment terms, principal loan amount, additional provisions, obligation, debt. Different types of Washington Promissory Notes — Payable on Demand can include: 1. Personal Promissory Note — Payable on Demand: This type of promissory note is used for personal loans between individuals, friends, or family members. It allows for flexibility in terms of interest rates and repayment plans. 2. Business Promissory Note — Payable on Demand: This promissory note is specifically tailored for business-related loans. It can be used for various purposes such as financing business operations, purchasing assets, or investing in business ventures. 3. Secured Promissory Note — Payable on Demand: In this type of note, the borrower pledges collateral (e.g., real estate, vehicles, or valuable assets) to secure the loan. This provides the lender with an added layer of protection in case the borrower defaults on the loan. 4. Unsecured Promissory Note — Payable on Demand: Unlike a secured promissory note, an unsecured note does not require any collateral. This type of note is based solely on the borrower's creditworthiness and trustworthiness. 5. Demand Promissory Note for Loans with Interest: This promissory note includes an additional provision for charging interest on the loan amount. The interest rate is agreed upon by both parties and added to the principal loan amount, increasing the total repayment amount. Remember, it is essential to consult with a legal professional when drafting or using a promissory note to ensure it complies with Washington state laws and accurately reflects the agreed-upon terms between the lender and borrower.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Washington Pagaré - Pagadero a la vista - Promissory Note - Payable on Demand

Description

How to fill out Washington Pagaré - Pagadero A La Vista?

Discovering the right authorized papers template might be a have a problem. Naturally, there are tons of templates accessible on the Internet, but how will you find the authorized develop you need? Make use of the US Legal Forms site. The services delivers thousands of templates, like the Washington Promissory Note - Payable on Demand, that can be used for enterprise and personal requires. All of the kinds are examined by experts and satisfy state and federal demands.

If you are already registered, log in in your bank account and click on the Acquire switch to obtain the Washington Promissory Note - Payable on Demand. Utilize your bank account to search throughout the authorized kinds you have ordered in the past. Proceed to the My Forms tab of the bank account and get an additional backup in the papers you need.

If you are a brand new user of US Legal Forms, listed here are easy instructions for you to follow:

- Initial, be sure you have selected the appropriate develop for your personal area/region. You can check out the shape using the Review switch and look at the shape explanation to guarantee this is the right one for you.

- If the develop does not satisfy your needs, utilize the Seach field to discover the correct develop.

- Once you are certain the shape is suitable, select the Acquire now switch to obtain the develop.

- Select the pricing program you would like and enter the needed information and facts. Create your bank account and pay money for an order making use of your PayPal bank account or Visa or Mastercard.

- Opt for the file format and acquire the authorized papers template in your gadget.

- Total, modify and printing and indication the received Washington Promissory Note - Payable on Demand.

US Legal Forms is the biggest library of authorized kinds for which you can see different papers templates. Make use of the company to acquire skillfully-made papers that follow status demands.