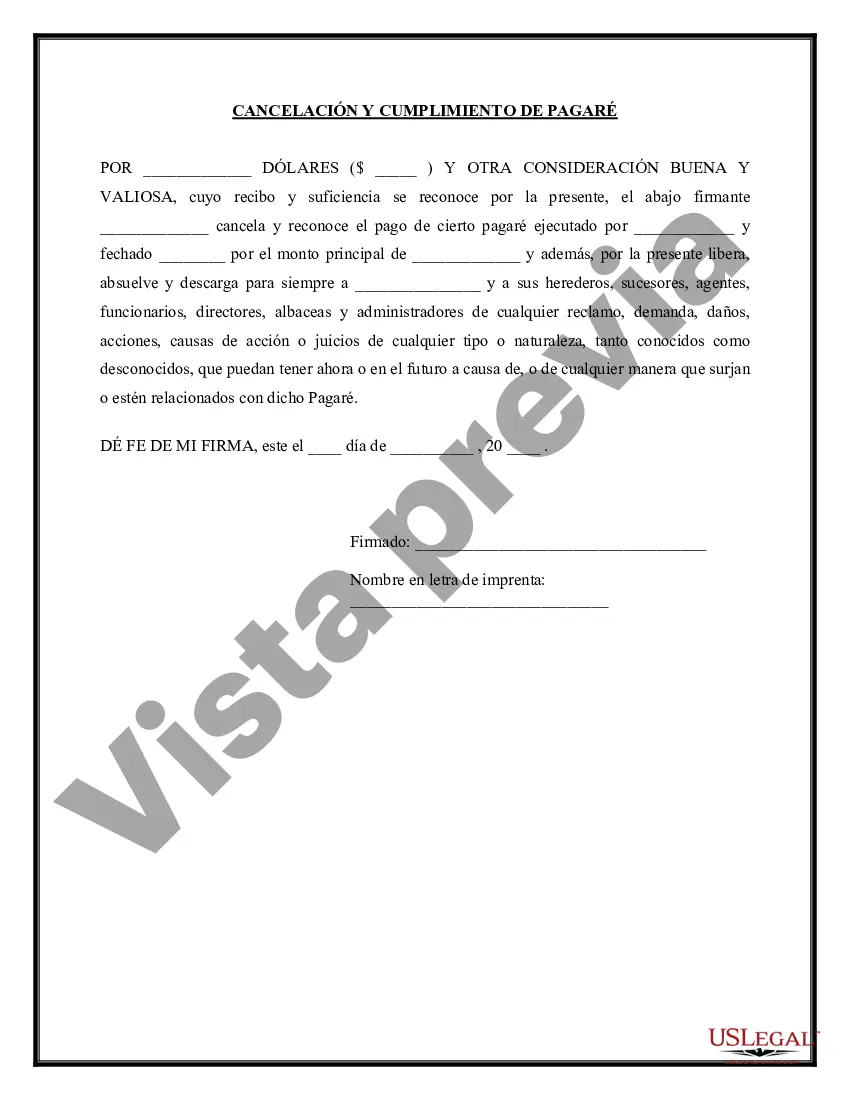

The Washington Promissory Note — Satisfaction and Release is a legal document commonly used in Washington state to settle the repayment of a loan or debt. This document serves as proof that the borrower has fulfilled their financial obligations and the lender has been satisfied with the repayment. Keywords: Washington Promissory Note, Satisfaction and Release, legal document, repayment, loan, debt, borrower, lender, financial obligations. In Washington, there are various types of Promissory Note — Satisfaction and Release, depending on the specific circumstances of the loan agreement. Some of these types include: 1. Simple Satisfaction and Release: This type of satisfaction and release is used when a borrower repays the entire loan amount in a lump sum or through installments, satisfying the financial obligation completely. The lender acknowledges the repayment and releases the borrower from any further obligations. 2. Conditional Satisfaction and Release: In certain cases, the lender may agree to provide a conditional satisfaction and release, which means that the borrower must fulfill additional terms or conditions before being released from the debt. This type ensures that all obligations of the loan agreement are met before granting a full release. 3. Partial Satisfaction and Release: If only a portion of the loan is repaid, a partial satisfaction and release can be employed. This document acknowledges the partial repayment made by the borrower, resulting in a release from a certain percentage of the initial debt while preserving the lender's right to collect the remaining balance. 4. Release of Collateral: A Promissory Note — Satisfaction and Release can also be used to release collateral secured against the loan. For instance, if a borrower used their car as collateral, and upon full repayment of the loan, the lender can release the lien or security interest on the vehicle using this document. 5. Release of Guarantor: In some cases, a guarantor may have co-signed the loan and assumed responsibility for the debt. When the borrower repays the loan in full, the Promissory Note — Satisfaction and Release can be used to release the guarantor from their obligations, provided the lender agrees. It is essential to consult with legal professionals or attorneys experienced in Washington state's laws and regulations while drafting and executing a Promissory Note — Satisfaction and Release. This ensures that all requirements are met, and the document holds legal validity in Washington state courts.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Washington Pagaré - Satisfacción y Liberación - Promissory Note - Satisfaction and Release

Description

How to fill out Washington Pagaré - Satisfacción Y Liberación?

Discovering the right legitimate papers format might be a have difficulties. Needless to say, there are a lot of templates available on the net, but how will you find the legitimate type you require? Take advantage of the US Legal Forms internet site. The services delivers thousands of templates, including the Washington Promissory Note - Satisfaction and Release, which you can use for company and private requires. All of the varieties are checked out by professionals and meet up with federal and state needs.

In case you are currently listed, log in to the account and click the Download button to find the Washington Promissory Note - Satisfaction and Release. Use your account to appear throughout the legitimate varieties you might have purchased earlier. Go to the My Forms tab of the account and get another version from the papers you require.

In case you are a new end user of US Legal Forms, here are basic guidelines so that you can stick to:

- Initial, make certain you have selected the right type for your area/state. You can check out the form making use of the Preview button and study the form outline to ensure this is the best for you.

- When the type fails to meet up with your preferences, utilize the Seach discipline to find the right type.

- When you are certain that the form is suitable, go through the Acquire now button to find the type.

- Pick the prices program you desire and type in the required info. Create your account and buy the transaction making use of your PayPal account or charge card.

- Pick the submit format and acquire the legitimate papers format to the gadget.

- Full, edit and produce and sign the acquired Washington Promissory Note - Satisfaction and Release.

US Legal Forms will be the largest collection of legitimate varieties for which you can find various papers templates. Take advantage of the service to acquire appropriately-manufactured paperwork that stick to express needs.