Description: Washington Resolution Selecting Bank for Corporation and Account Signatories — Corporate Resolutions A Washington Resolution Selecting Bank for Corporation and Account Signatories is a crucial corporate resolution document used to authorize the selection of a bank for a corporation's financial transactions and determine the individuals who will be the official signatories on the corporation's bank accounts. This resolution ensures that the corporation's financial affairs are effectively managed and conducted within legal parameters. The Washington Resolution Selecting Bank for Corporation and Account Signatories outlines the specific details of the bank selection process and the duties and responsibilities of the chosen signatories. It provides a formal framework for the corporation to establish banking relationships and oversee financial activities, such as depositing and withdrawing funds, issuing checks, managing electronic transactions, and other essential banking services. This resolution is especially relevant for Washington-based corporations as it adheres to the state's legal requirements and guidelines governing corporate bank selection and account signatories. It ensures that the corporation complies with all applicable laws and regulations and maintains transparency and accountability in its financial operations. Different Types of Washington Resolution Selecting Bank for Corporation and Account Signatories — Corporate Resolutions: 1. General Washington Resolution Selecting Bank for Corporation and Account Signatories — This is the standard resolution used by corporations in Washington to authorize the selection of a bank for their financial needs. It outlines the general procedures and guidelines for bank selection and identifies the individuals who will act as signatories on behalf of the corporation. 2. Specific Purpose Resolution — Corporate resolutions can also be tailored to address specific purposes or needs of the corporation. For instance, a resolution may be drafted solely for the selection of a bank to handle international transactions or for a specific subsidiary or company division, depending on the corporation's requirements. 3. Multi-Signatory Resolution — In some cases, a corporation may require multiple signatories for its bank accounts to ensure adequate checks and balances within the financial management system. A multi-signatory resolution identifies and authorizes multiple individuals to act as signatories on behalf of the corporation, providing an additional layer of oversight to mitigate risks. 4. Additional Authorized Signatories — This type of resolution allows corporations to amend their existing resolution and add new signatories to their bank accounts. It may be necessary when there are changes in the corporation's leadership or when new individuals need to assume signatory responsibilities. Each of these resolutions serves a specific purpose in facilitating the selection of a bank and determining account signatories for Washington-based corporations. By customizing the resolution to meet the corporation's needs, it ensures compliance with Washington's legal requirements and streamlines the corporation's financial management processes.

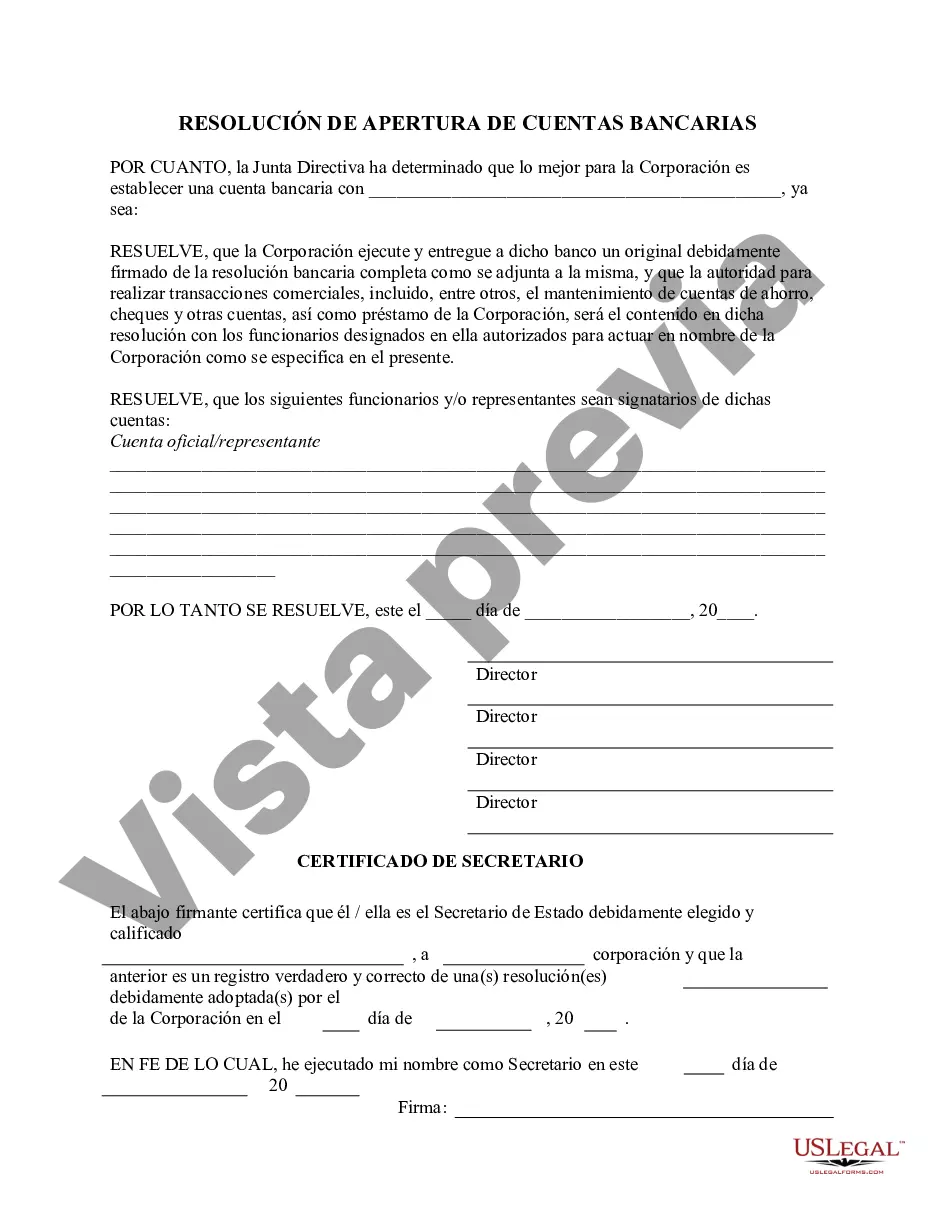

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Washington Resolución de Selección de Banco para Sociedades Anónimas y Signatarios de Cuentas - Resoluciones Corporativas - Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions

Description

How to fill out Washington Resolución De Selección De Banco Para Sociedades Anónimas Y Signatarios De Cuentas - Resoluciones Corporativas?

If you want to full, download, or produce legitimate record web templates, use US Legal Forms, the most important variety of legitimate kinds, that can be found on the web. Take advantage of the site`s basic and convenient look for to obtain the papers you want. A variety of web templates for enterprise and individual uses are categorized by classes and states, or search phrases. Use US Legal Forms to obtain the Washington Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions within a few click throughs.

When you are presently a US Legal Forms customer, log in to your bank account and click the Obtain option to get the Washington Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions. You may also gain access to kinds you formerly delivered electronically in the My Forms tab of your own bank account.

Should you use US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Be sure you have selected the shape for that proper area/nation.

- Step 2. Use the Preview method to examine the form`s content material. Don`t forget to learn the explanation.

- Step 3. When you are unhappy with all the kind, make use of the Lookup field near the top of the monitor to discover other variations of your legitimate kind design.

- Step 4. After you have identified the shape you want, click on the Get now option. Choose the costs prepare you choose and add your accreditations to register for the bank account.

- Step 5. Process the transaction. You should use your Мisa or Ьastercard or PayPal bank account to perform the transaction.

- Step 6. Choose the formatting of your legitimate kind and download it on your device.

- Step 7. Comprehensive, revise and produce or indicator the Washington Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions.

Each legitimate record design you purchase is your own for a long time. You possess acces to each kind you delivered electronically inside your acccount. Go through the My Forms portion and pick a kind to produce or download yet again.

Be competitive and download, and produce the Washington Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions with US Legal Forms. There are many skilled and express-particular kinds you can use for your personal enterprise or individual needs.