A corporation is owned by its shareholders. An ownership interest in a corporation is represented by a share or stock certificate. A certificate of stock or share certificate evidences the shareholder's ownership of stock. The ownership of shares may be transferred by delivery of the certificate of stock endorsed by its owner in blank or to a specified person. Ownership may also be transferred by the delivery of the certificate along with a separate assignment. This form is a sample of an agreement to purchase common stock from another stockholder.

The Washington Agreement to Purchase Common Stock from another Stockholder is a legally binding document that outlines the terms and conditions under which one stockholder agrees to purchase common stock from another. This type of agreement is commonly used in corporate transactions, such as mergers and acquisitions or shareholder buyouts. The Washington Agreement provides a detailed roadmap for the transaction, including the purchase price, the number of shares to be acquired, and any conditions or contingencies that may apply. It also covers important aspects such as the timing of the transaction, the method of payment, and any relevant warranties or representations. There are several types of Washington Agreements to Purchase Common Stock, each catering to specific situations: 1. Washington Agreement to Purchase Common Stock in a Merger: This type of agreement is used when one corporation acquires another through a merger. It outlines the terms and conditions for the purchasing company to acquire the common stock of the target company's stockholders. 2. Washington Agreement to Purchase Common Stock in an Acquisition: In this scenario, a company acquires another company through a non-merger transaction, such as a stock purchase agreement or asset purchase agreement. The agreement governs the purchase of common stock from the selling stockholder(s). 3. Washington Agreement to Purchase Common Stock in a Shareholder Buyout: This agreement is used when a shareholder or group of shareholders wishes to buy out the shares of another shareholder(s) in a company. It covers the terms of the stock purchase, including any restrictions or conditions that may apply. Keywords: Washington Agreement, Purchase, Common Stock, Stockholder, Merger, Acquisition, Shareholder Buyout, Corporate Transactions, Terms, Conditions, Purchase Price, Shares, Timing, Payment Method, Warranties, Representations, Non-Merger Transaction, Stock Purchase Agreement, Asset Purchase Agreement, Selling Stockholder(s), Shareholder Buyout, Restrictions, Contingencies.The Washington Agreement to Purchase Common Stock from another Stockholder is a legally binding document that outlines the terms and conditions under which one stockholder agrees to purchase common stock from another. This type of agreement is commonly used in corporate transactions, such as mergers and acquisitions or shareholder buyouts. The Washington Agreement provides a detailed roadmap for the transaction, including the purchase price, the number of shares to be acquired, and any conditions or contingencies that may apply. It also covers important aspects such as the timing of the transaction, the method of payment, and any relevant warranties or representations. There are several types of Washington Agreements to Purchase Common Stock, each catering to specific situations: 1. Washington Agreement to Purchase Common Stock in a Merger: This type of agreement is used when one corporation acquires another through a merger. It outlines the terms and conditions for the purchasing company to acquire the common stock of the target company's stockholders. 2. Washington Agreement to Purchase Common Stock in an Acquisition: In this scenario, a company acquires another company through a non-merger transaction, such as a stock purchase agreement or asset purchase agreement. The agreement governs the purchase of common stock from the selling stockholder(s). 3. Washington Agreement to Purchase Common Stock in a Shareholder Buyout: This agreement is used when a shareholder or group of shareholders wishes to buy out the shares of another shareholder(s) in a company. It covers the terms of the stock purchase, including any restrictions or conditions that may apply. Keywords: Washington Agreement, Purchase, Common Stock, Stockholder, Merger, Acquisition, Shareholder Buyout, Corporate Transactions, Terms, Conditions, Purchase Price, Shares, Timing, Payment Method, Warranties, Representations, Non-Merger Transaction, Stock Purchase Agreement, Asset Purchase Agreement, Selling Stockholder(s), Shareholder Buyout, Restrictions, Contingencies.

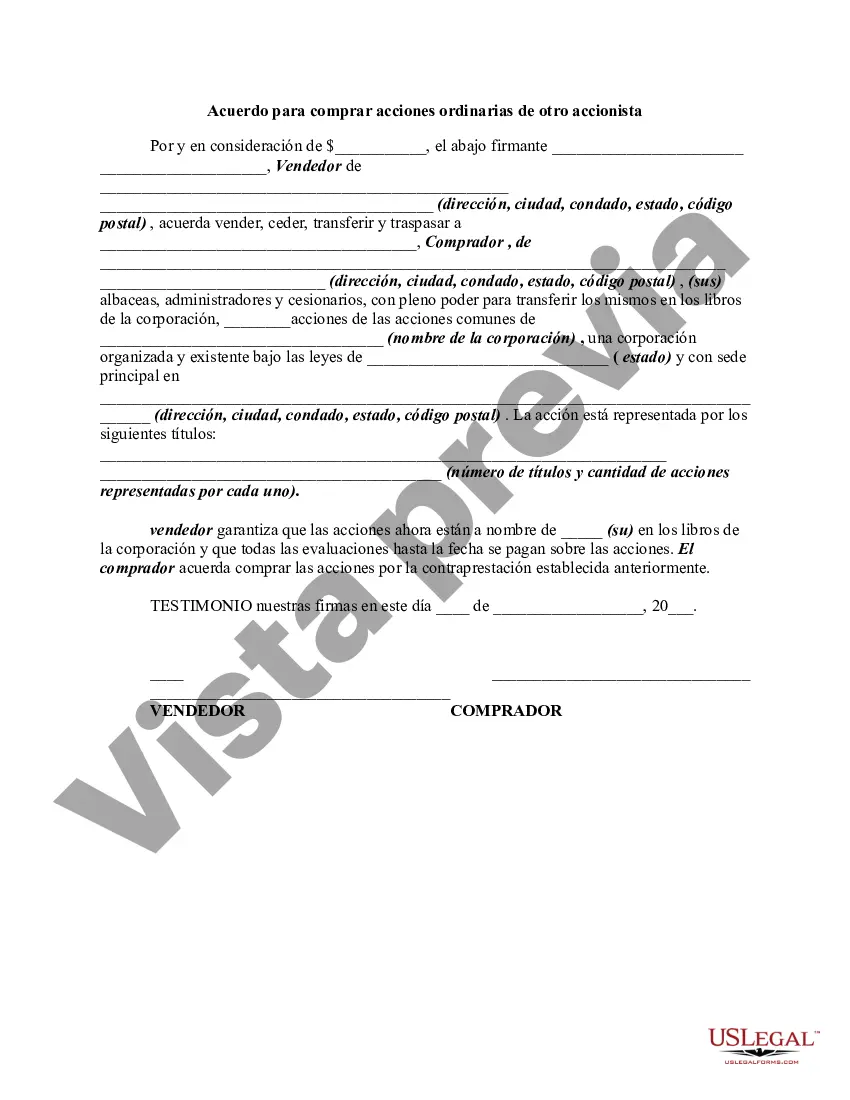

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.