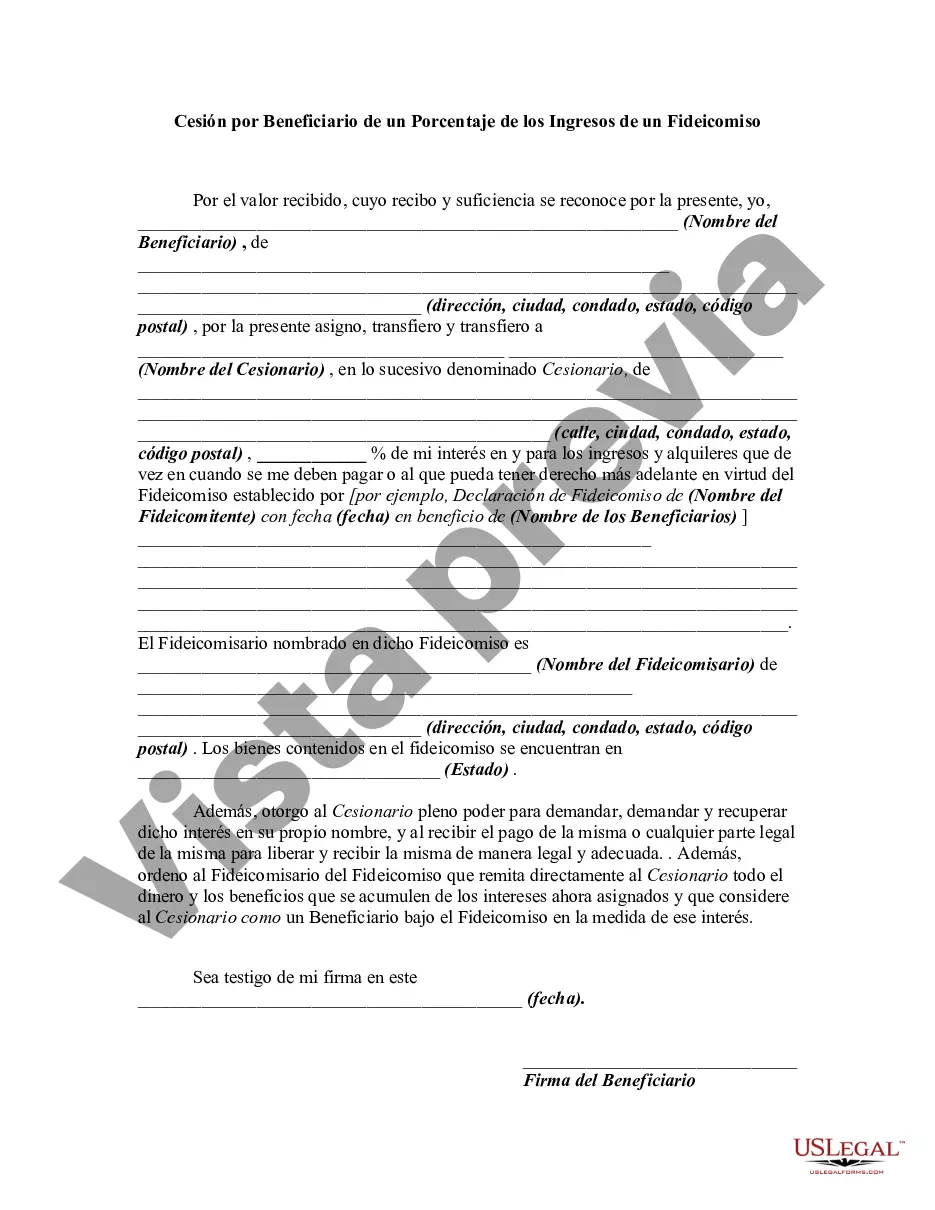

An assignment by a beneficiary of a portion of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

In Washington, Assignment by Beneficiary of a Percentage of the Income of a Trust refers to a unique arrangement where a beneficiary of a trust decides to transfer a portion of their income entitlement to another individual or entity. This type of assignment is a common practice in trust law and allows beneficiaries to manage their finances effectively or satisfy certain obligations. There is a range of scenarios in which a Washington Assignment by Beneficiary of a Percentage of the Income of a Trust can occur, including: 1. Charitable assignments: Beneficiaries may choose to assign a percentage of their trust income to a charitable organization as a means of supporting a cause or fulfilling philanthropic desires. These assignments often require compliance with specific legal requirements, ensuring the chosen charity qualifies for such benefits. 2. Spousal assignments: In some cases, a beneficiary may choose to assign a percentage of their trust income to their spouse to help fulfill financial responsibilities or assist with family obligations. These assignments can be beneficial when one beneficiary requires additional income support or when there is a significant discrepancy in the spouses' financial situations. 3. Assignment for debt settlement: A beneficiary may also choose to assign a portion of their trust income to settle a debt with a creditor. This type of assignment can help them manage outstanding obligations effectively while ensuring the trust continues to provide financial support. 4. Assignments for business purposes: In certain situations, a beneficiary may decide to assign a percentage of their trust income to a business venture they are involved in. This can be helpful for funding business operations or investments, providing an additional source of income to support entrepreneurship. It is important to note that any Washington Assignment by Beneficiary of a Percentage of the Income of a Trust must comply with state and federal laws governing trusts and estate planning. Beneficiaries must engage with an attorney specializing in trust and estate matters to ensure all legal requirements are met and the assignment is properly executed. In conclusion, a Washington Assignment by Beneficiary of a Percentage of the Income of a Trust allows a trust beneficiary to allocate a portion of their income entitlement to another individual or entity. Whether it is for charitable purposes, spousal assistance, debt settlement, or business investments, this arrangement offers flexibility and financial management options for trust beneficiaries. Seek legal counsel to ensure compliance with all applicable laws and regulations governing trust assignments in Washington.In Washington, Assignment by Beneficiary of a Percentage of the Income of a Trust refers to a unique arrangement where a beneficiary of a trust decides to transfer a portion of their income entitlement to another individual or entity. This type of assignment is a common practice in trust law and allows beneficiaries to manage their finances effectively or satisfy certain obligations. There is a range of scenarios in which a Washington Assignment by Beneficiary of a Percentage of the Income of a Trust can occur, including: 1. Charitable assignments: Beneficiaries may choose to assign a percentage of their trust income to a charitable organization as a means of supporting a cause or fulfilling philanthropic desires. These assignments often require compliance with specific legal requirements, ensuring the chosen charity qualifies for such benefits. 2. Spousal assignments: In some cases, a beneficiary may choose to assign a percentage of their trust income to their spouse to help fulfill financial responsibilities or assist with family obligations. These assignments can be beneficial when one beneficiary requires additional income support or when there is a significant discrepancy in the spouses' financial situations. 3. Assignment for debt settlement: A beneficiary may also choose to assign a portion of their trust income to settle a debt with a creditor. This type of assignment can help them manage outstanding obligations effectively while ensuring the trust continues to provide financial support. 4. Assignments for business purposes: In certain situations, a beneficiary may decide to assign a percentage of their trust income to a business venture they are involved in. This can be helpful for funding business operations or investments, providing an additional source of income to support entrepreneurship. It is important to note that any Washington Assignment by Beneficiary of a Percentage of the Income of a Trust must comply with state and federal laws governing trusts and estate planning. Beneficiaries must engage with an attorney specializing in trust and estate matters to ensure all legal requirements are met and the assignment is properly executed. In conclusion, a Washington Assignment by Beneficiary of a Percentage of the Income of a Trust allows a trust beneficiary to allocate a portion of their income entitlement to another individual or entity. Whether it is for charitable purposes, spousal assistance, debt settlement, or business investments, this arrangement offers flexibility and financial management options for trust beneficiaries. Seek legal counsel to ensure compliance with all applicable laws and regulations governing trust assignments in Washington.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.