The letter or notice by which a claim is transferred to a collection agency need not take any particular form. However, since collection agencies handle overdue accounts on a volume basis and generally develop regular clients, it may be desirable that such instruments be standardized. The letter or notice should be clear as to whether it is an assignment of the claim and, thus, enables the agency to bring suit on the claim in its own name. Whether a collection agency may solicit and accept assignments of claims from creditors depends on the law of the particular jurisdiction. Local statutes should be consulted to determine the allowable scope of activities of collection agencies.

No particular language is necessary for the acceptance or rejection of a claim or for subsequent notices and reports so long as the instruments used clearly convey the necessary information.

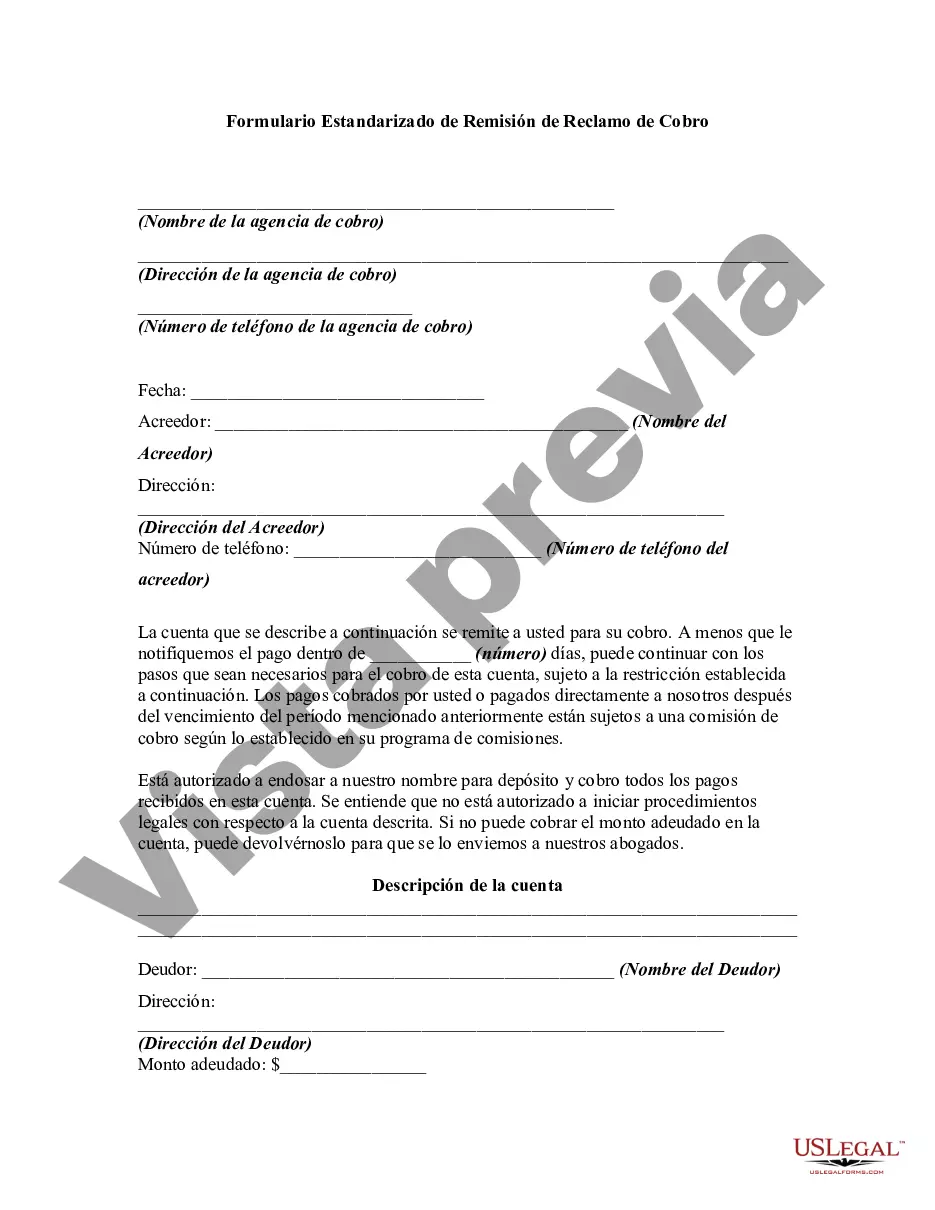

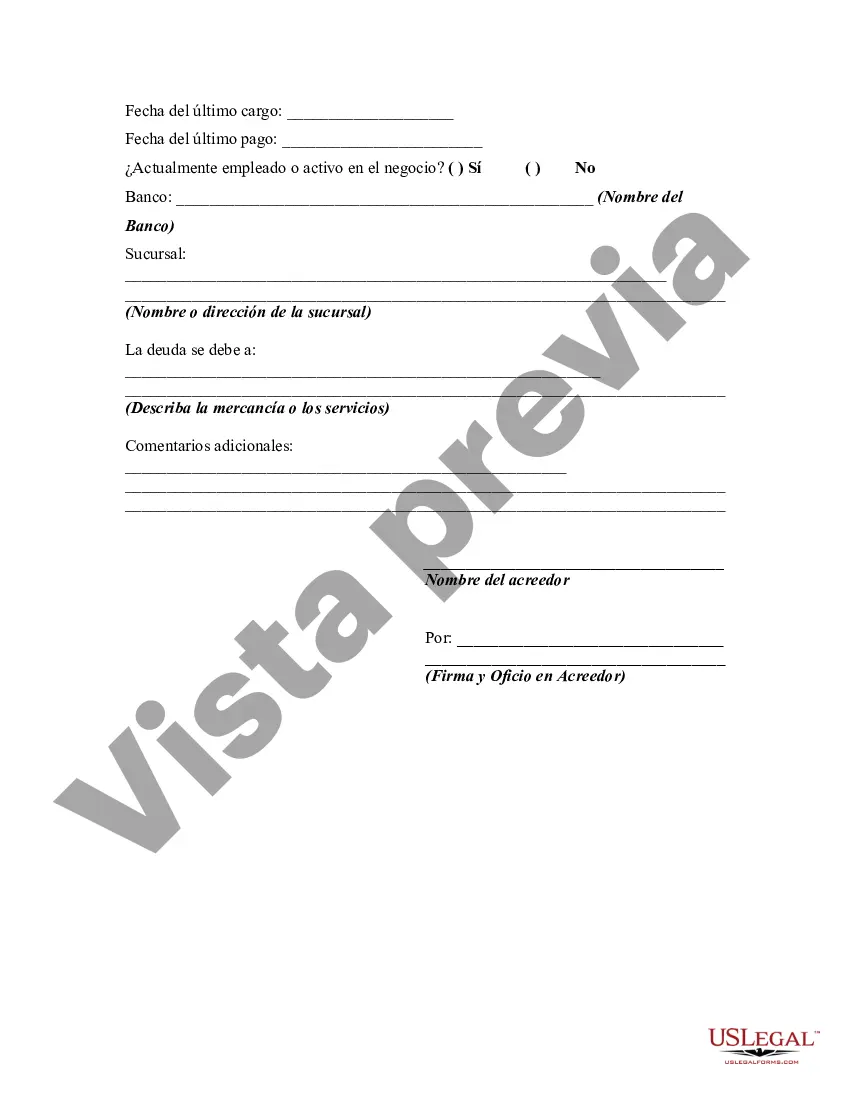

The Washington Standardized Form for Referral of Claim for Collection is a crucial document used in the state of Washington for referring claims to collection agencies or debt collectors. This standardized form helps ensure accuracy, transparency, and legality in the collection process. Designed to streamline the referral process, the form collects essential information about the debtor and the creditor, providing a detailed description of the claim being referred. It serves as a formal notification to the collection agency about the debt, enabling them to take appropriate action to collect the outstanding amount on behalf of the creditor. Some key elements covered in the Washington Standardized Form for Referral of Claim for Collection include the following: 1. Creditor Information: The form requires the creditor's name, address, phone number, and other contact details. This information establishes the basis for communication between the collection agency and the creditor. 2. Debtor Information: The debtor's name, address, phone number, and any other available contact details are recorded on the form. These details help the collection agency locate and communicate with the debtor effectively. 3. Claim Description: This section of the form provides a detailed description of the claim, including the original amount owed, any interest or penalties, and additional fees associated with the debt. It may also include information about the products or services provided by the creditor. 4. Supporting Documentation: The form allows the creditor to attach supporting documents relevant to the claim, such as invoices, contracts, or any other records that validate the debt. These documents strengthen the collection agency's case when pursuing the debtor. 5. Collection Agency Selection: The creditor selects a preferred collection agency from a list of authorized agencies to handle the claim. This ensures that the debt is entrusted to a reputable and licensed entity. 6. Signatures and Dates: The form requires both the creditor's and collection agency's authorized representatives to sign and date the document. These signatures indicate their acknowledgment and agreement to proceed with the collection process. Different types of Washington Standardized Forms for Referral of Claim for Collection can be categorized based on the specific agency or institution involved. For example: — Washington Standardized Form for Referral of Claim for Collection for Financial Institutions: This form is designed specifically for banks, credit unions, and other financial institutions to refer claims to collection agencies. — Washington Standardized Form for Referral of Claim for Collection for Healthcare Providers: This version of the form is tailored to healthcare providers, such as hospitals and medical clinics, to refer outstanding medical bills or healthcare-related debts to collection agencies. — Washington Standardized Form for Referral of Claim for Collection for Small Businesses: Small businesses can utilize this form to refer unpaid invoices or outstanding debts to collection agencies, ensuring a standardized and efficient process. In conclusion, the Washington Standardized Form for Referral of Claim for Collection is a comprehensive document that facilitates the referral process of debts to collection agencies, ensuring transparency and compliance with collection regulations in the state. It provides creditors and collection agencies with a standardized framework to streamline debt collection efforts effectively.The Washington Standardized Form for Referral of Claim for Collection is a crucial document used in the state of Washington for referring claims to collection agencies or debt collectors. This standardized form helps ensure accuracy, transparency, and legality in the collection process. Designed to streamline the referral process, the form collects essential information about the debtor and the creditor, providing a detailed description of the claim being referred. It serves as a formal notification to the collection agency about the debt, enabling them to take appropriate action to collect the outstanding amount on behalf of the creditor. Some key elements covered in the Washington Standardized Form for Referral of Claim for Collection include the following: 1. Creditor Information: The form requires the creditor's name, address, phone number, and other contact details. This information establishes the basis for communication between the collection agency and the creditor. 2. Debtor Information: The debtor's name, address, phone number, and any other available contact details are recorded on the form. These details help the collection agency locate and communicate with the debtor effectively. 3. Claim Description: This section of the form provides a detailed description of the claim, including the original amount owed, any interest or penalties, and additional fees associated with the debt. It may also include information about the products or services provided by the creditor. 4. Supporting Documentation: The form allows the creditor to attach supporting documents relevant to the claim, such as invoices, contracts, or any other records that validate the debt. These documents strengthen the collection agency's case when pursuing the debtor. 5. Collection Agency Selection: The creditor selects a preferred collection agency from a list of authorized agencies to handle the claim. This ensures that the debt is entrusted to a reputable and licensed entity. 6. Signatures and Dates: The form requires both the creditor's and collection agency's authorized representatives to sign and date the document. These signatures indicate their acknowledgment and agreement to proceed with the collection process. Different types of Washington Standardized Forms for Referral of Claim for Collection can be categorized based on the specific agency or institution involved. For example: — Washington Standardized Form for Referral of Claim for Collection for Financial Institutions: This form is designed specifically for banks, credit unions, and other financial institutions to refer claims to collection agencies. — Washington Standardized Form for Referral of Claim for Collection for Healthcare Providers: This version of the form is tailored to healthcare providers, such as hospitals and medical clinics, to refer outstanding medical bills or healthcare-related debts to collection agencies. — Washington Standardized Form for Referral of Claim for Collection for Small Businesses: Small businesses can utilize this form to refer unpaid invoices or outstanding debts to collection agencies, ensuring a standardized and efficient process. In conclusion, the Washington Standardized Form for Referral of Claim for Collection is a comprehensive document that facilitates the referral process of debts to collection agencies, ensuring transparency and compliance with collection regulations in the state. It provides creditors and collection agencies with a standardized framework to streamline debt collection efforts effectively.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.