Title: Understanding Washington Employment Verification Letter for Bank Description: A Washington Employment Verification Letter for Bank serves as crucial proof of employment when individuals apply for various financial purposes. This detailed description provides valuable insights into different types of verification letters and highlights their significance in banking-related transactions. Keywords: — Washington employment verification letter — Bank employment verificatioletterte— - Washington verification letter for bank — Verification letter for banking purposes — Types of employment verification letter for bank in Washington Types of Washington Employment Verification Letters for Bank: 1. Standard Employment Verification Letter: The most common type of Washington Employment Verification Letter for Bank, this document confirms an individual's current employment status, job title, start and end dates (if applicable), and monthly or annual income. Banks utilize this letter to assess an individual's financial capability for loan approvals or mortgage applications. 2. Salary Verification Letter: This type of Employment Verification Letter focuses specifically on an individual's salary-related information, including base salary, bonuses, commission, allowances, and any additional income streams. It substantiates the applicant's earning potential and assists banks in evaluating loan repayment capacity. 3. Length of Employment Verification Letter: Sometimes, banks require proof of an individual's length of service with an employer. This Letter highlights the duration of employment, confirming the start and end dates with a particular company. It helps build trust by demonstrating a stable employment history and commitment, which might positively influence the bank's decision-making process. 4. Address Verification Letter: In certain cases, banks may request an Address Verification Letter to confirm an individual's residential address. This Letter usually includes the individual's full name, current address, and the period of residence at that address. It provides an additional layer of authentication for the bank, ensuring the applicant resides at a legitimate address. 5. Verification Letter for Self-Employed Individuals: For individuals who are self-employed or own a business, Washington banks may require a specialized Verification Letter. This document validates the existence and nature of the business, including income details, tax filings, and any relevant financial records. It helps banks evaluate the applicant's financial stability and assess the risk associated with lending. Conclusion: Washington Employment Verification Letters for Bank play a crucial role in financial transactions. Whether it's for loan applications, mortgage approvals, or assessing an individual's financial status, these letters provide the necessary proof of employment and income verification. Understanding the different types of verification letters enables individuals to prepare the required documents accurately, ensuring a smooth banking experience.

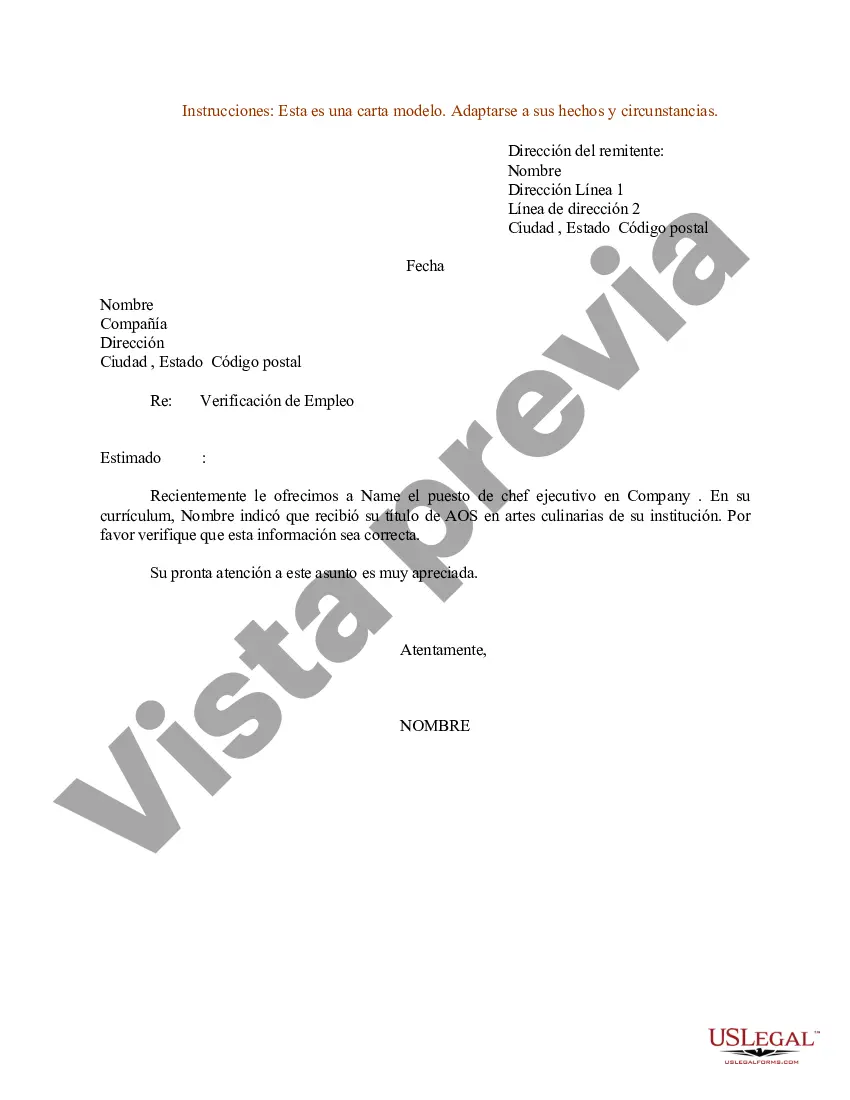

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Washington Carta de verificación de empleo para el banco - Employment Verification Letter for Bank

Description

How to fill out Washington Carta De Verificación De Empleo Para El Banco?

US Legal Forms - one of several largest libraries of lawful forms in the States - offers a variety of lawful papers web templates it is possible to down load or print out. Using the site, you may get a huge number of forms for company and person purposes, categorized by classes, says, or keywords.You will discover the most recent variations of forms such as the Washington Employment Verification Letter for Bank within minutes.

If you already possess a subscription, log in and down load Washington Employment Verification Letter for Bank from your US Legal Forms catalogue. The Download switch will show up on each kind you perspective. You have accessibility to all formerly downloaded forms from the My Forms tab of the bank account.

If you wish to use US Legal Forms initially, listed below are straightforward recommendations to help you get started:

- Be sure to have chosen the proper kind to your city/state. Click the Preview switch to check the form`s information. Browse the kind explanation to actually have chosen the appropriate kind.

- In case the kind doesn`t fit your demands, use the Lookup area near the top of the monitor to obtain the one which does.

- When you are happy with the form, confirm your selection by clicking on the Get now switch. Then, choose the costs strategy you like and provide your references to sign up on an bank account.

- Approach the deal. Make use of your charge card or PayPal bank account to accomplish the deal.

- Choose the formatting and down load the form in your product.

- Make changes. Fill up, revise and print out and sign the downloaded Washington Employment Verification Letter for Bank.

Each web template you included in your account does not have an expiry particular date and is also your own for a long time. So, if you want to down load or print out another version, just go to the My Forms area and click on the kind you will need.

Get access to the Washington Employment Verification Letter for Bank with US Legal Forms, one of the most comprehensive catalogue of lawful papers web templates. Use a huge number of expert and status-particular web templates that meet up with your company or person demands and demands.