Washington Revocable Trust for Married Couple

Description

How to fill out Revocable Trust For Married Couple?

If you need to obtain, download, or create legal document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Leverage the site's straightforward and user-friendly search feature to locate the documents you require.

Many templates for business and personal use are organized by categories and states, or by keywords.

Every legal document template you download is yours permanently. You have access to all forms you’ve downloaded within your account.

Go to the My documents section and choose a form to print or download again. Complete and download, and print the Washington Revocable Trust for Married Couple with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to find the Washington Revocable Trust for Married Couple in just a few clicks.

- If you are a current customer of US Legal Forms, sign in to your account and click the Download button to retrieve the Washington Revocable Trust for Married Couple.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, refer to the steps below.

- Step 1. Ensure you have selected the form for your correct city/region.

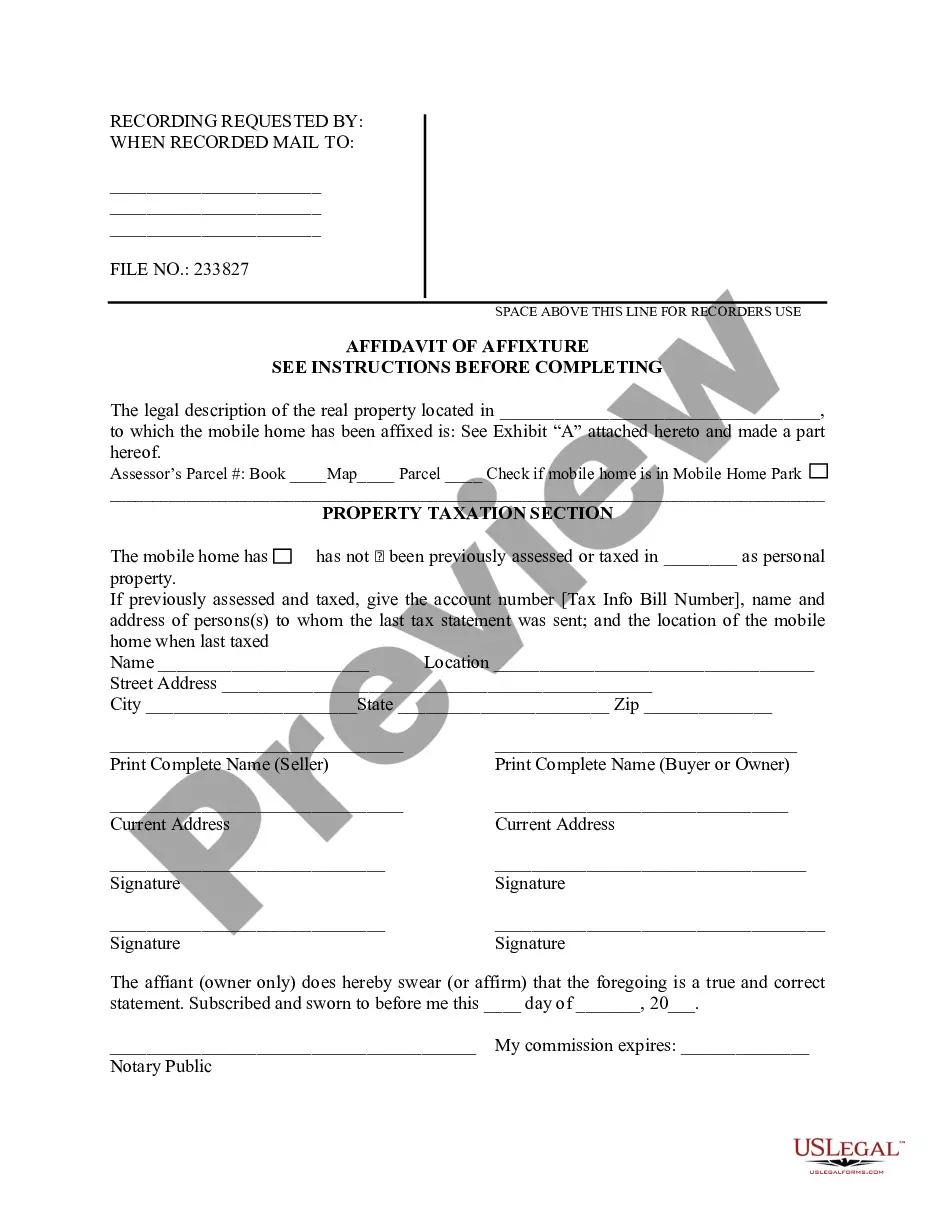

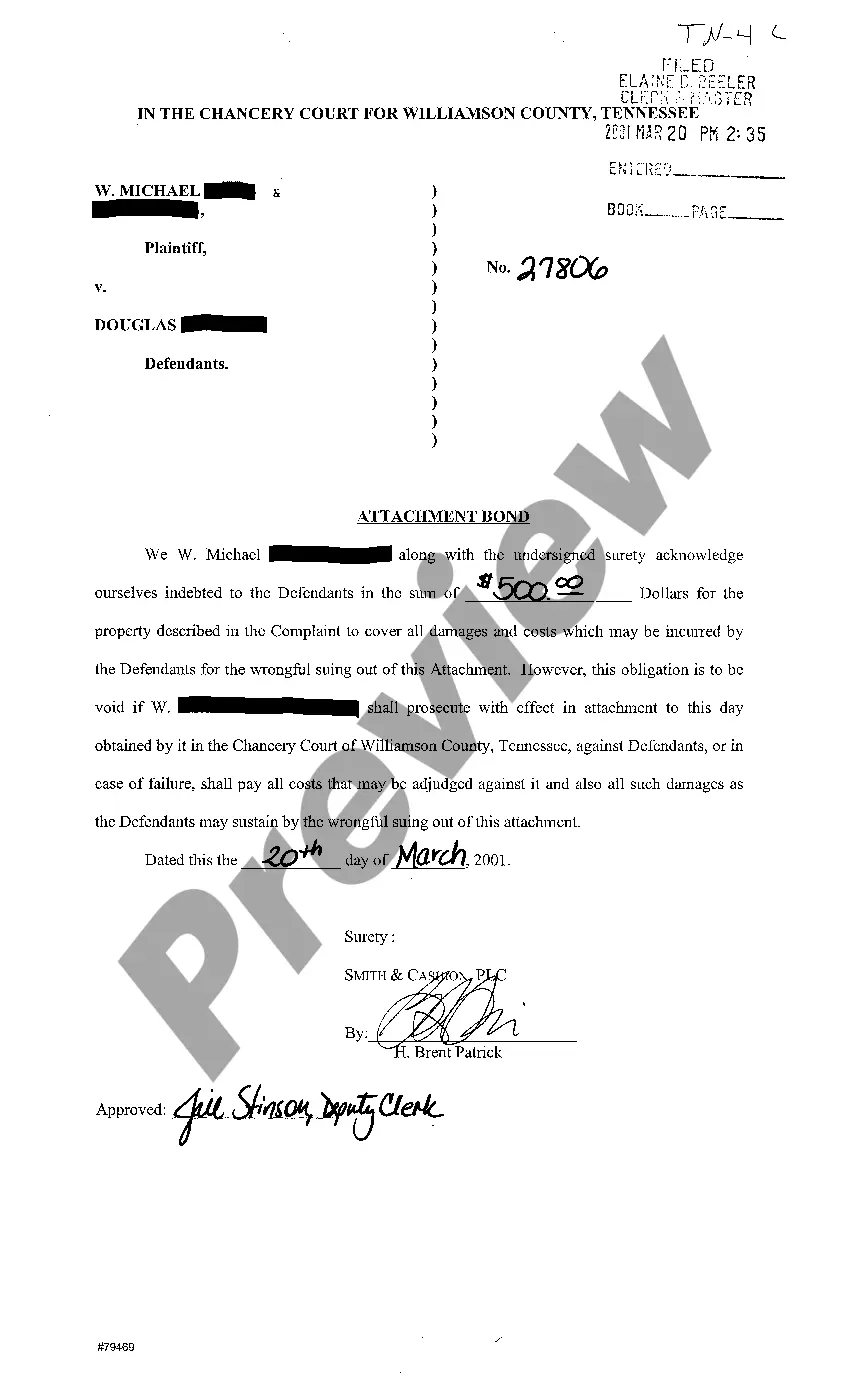

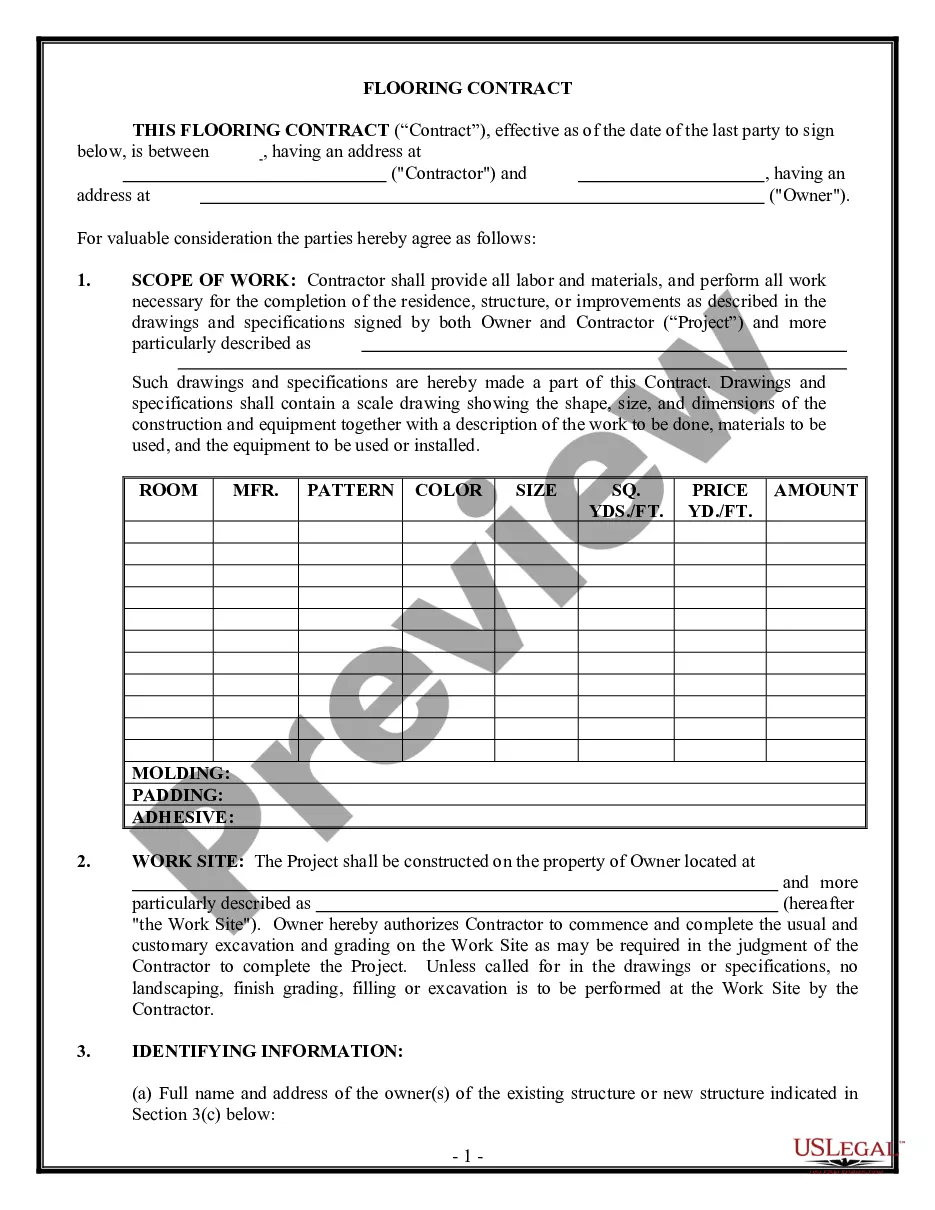

- Step 2. Use the Preview option to review the content of the form. Don’t forget to read the description.

- Step 3. If you are not happy with the form, make use of the Search box at the top of the screen to find other versions of the legal document template.

- Step 4. Once you have found the form you are looking for, click the Get now button. Choose the payment plan that suits you and provide your details to create an account.

- Step 5. Complete the payment process. You may use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of your legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Washington Revocable Trust for Married Couple.

Form popularity

FAQ

Remarried couples often find that a revocable trust, particularly a Washington Revocable Trust for Married Couple, suits their needs well. This type of trust enables spouses to manage shared assets while providing directives for children from previous marriages. It ensures that all parties are considered in estate planning, creating peace of mind for everyone involved.

The best living trust for a married couple is typically a revocable living trust, which provides flexibility and control. This type of trust allows both spouses to jointly manage their assets during their lifetime. By creating a Washington Revocable Trust for Married Couple, you can ensure your estate plan addresses your specific needs and goals.

To set up a revocable trust in Washington state, start by drafting a trust document that outlines your wishes regarding asset management and distribution. You may consider partnering with legal professionals or using platforms like uslegalforms for guidance. Establishing a Washington Revocable Trust for Married Couple can effectively secure your assets for your loved ones while allowing for changes in your life.

The most common living trust is the revocable living trust, particularly favored by married couples. This trust allows you to retain control over your assets while granting easy access for your spouse upon your passing. By utilizing a Washington Revocable Trust for Married Couple, you can establish a straightforward plan for asset distribution and avoid probate.

In Washington state, you do not have to register your revocable trust with the government. However, it is essential to hold your assets in the trust to ensure they are managed according to your wishes. A Washington Revocable Trust for Married Couple can simplify estate management without the need for cumbersome registration processes.

The most popular form of marital trust is the revocable trust, particularly beneficial for a married couple. This type of trust allows you to manage your assets during your lifetime while providing flexibility for changes as circumstances arise. With a Washington Revocable Trust for Married Couple, you can ensure that your legacy is protected and distributed according to your wishes.

In Washington state, a Washington Revocable Trust for Married Couple does not need to be registered with the state. However, it is crucial to fund the trust properly for it to be effective. This means transferring your assets into the trust, which can help avoid probate and provide greater control over your estate. Working with uslegalforms can simplify this funding process and ensure that all legal requirements are met.

Yes, you can write your own Washington Revocable Trust for Married Couple. However, it is essential to ensure that it meets all legal requirements in Washington state. If the trust document does not follow the state's laws, it may cause challenges down the line. Utilizing a platform like uslegalforms can help you navigate this process smoothly and create a legally binding trust.

In the UK, parents often overlook the importance of proper tax planning when establishing a trust fund. Failing to consider potential tax implications can diminish the funds available to beneficiaries. For parents setting up trusts in different jurisdictions, like using a Washington Revocable Trust for Married Couple, understanding local laws can prevent such missteps.

Many parents make the mistake of not clearly outlining the terms of the trust fund. This lack of clarity can lead to confusion or disputes among beneficiaries. It's crucial to communicate intentions clearly and consider how funds will be managed for the children's benefit. A Washington Revocable Trust for Married Couple can help address these issues, ensuring that parents’ wishes are followed.