Washington Contract for Sale of Goods on Consignment

Description

How to fill out Contract For Sale Of Goods On Consignment?

US Legal Forms - one of the largest collections of legitimate documents in the United States - offers a wide range of legal document templates that you can obtain or print.

By using the website, you can find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can access the latest versions of forms such as the Washington Contract for Sale of Goods on Consignment in moments.

If you already have a monthly subscription, Log In and obtain the Washington Contract for Sale of Goods on Consignment from your US Legal Forms library. The Download option will appear on every form you view. You can access all your previously saved forms in the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to finalize the transaction.

Select the format and download the form to your device.Make changes. Fill out, edit, print, and sign the saved Washington Contract for Sale of Goods on Consignment. Each document you add to your account has no expiration date and is yours to keep forever. Thus, if you want to download or print another copy, simply go to the My documents section and click on the form you need. Access the Washington Contract for Sale of Goods on Consignment with US Legal Forms, the most exhaustive collection of legal document templates. Utilize thousands of professional and state-specific templates that satisfy your business or personal requirements.

- Ensure you have selected the correct form for your area/state.

- Click on the Preview option to examine the form's details.

- Check the form description to confirm you have chosen the right one.

- If the form does not suit your needs, use the Search area at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now option.

- Then, select the pricing plan you prefer and provide your information to register for an account.

Form popularity

FAQ

Writing a consignment contract involves clearly defining the parties involved, detailing the goods, and specifying terms of sale. Be sure to include payment terms, duration, and responsibilities of each party in your Washington Contract for Sale of Goods on Consignment. Taking the time to create a thorough agreement will protect both the seller and the consignee and ensure smooth transactions.

Vendors who are incorporated or tax-exempt organizations are generally exempt from 1099 reporting. Additionally, payments made for services to non-resident aliens may not require a 1099. As you work through your Washington Contract for Sale of Goods on Consignment, understanding who qualifies for exemption can help streamline your accounting processes.

In most cases, you do not receive a 1099 for selling goods unless you are a business and meet specific reporting thresholds. Sales of products do not typically fall under the 1099 requirements. Therefore, if you operate under a Washington Contract for Sale of Goods on Consignment, the sale transactions may not require a 1099 form.

You do not send 1099 forms to corporations, except when they provide certain services. Moreover, payments made to tax-exempt organizations or for personal expenses do not require a 1099. It’s essential to familiarize yourself with the IRS guidelines to ensure compliance when dealing with a Washington Contract for Sale of Goods on Consignment.

Whether you need to issue a 1099 for consignment sales depends on the financial arrangements made during the sale. If you have a business relationship and reach a certain income threshold, you may need to issue a 1099 form to the consignee. It's advisable to keep detailed records of all income and consult a tax professional regarding the specifics of your arrangement. Your Washington Contract for Sale of Goods on Consignment should also address any tax implications to ensure clarity.

Writing a consignment agreement requires careful consideration of both parties' responsibilities. Start by clearly defining the goods involved, the duration of the agreement, and the percentage split of sales proceeds. Including terms related to shipping, storage, and any responsibilities for unsold goods is crucial. Utilizing US Legal Forms can simplify the process by providing you with a precise Washington Contract for Sale of Goods on Consignment template tailored to your needs.

A fair split for consignment sales typically involves a percentage division of the profits between the consignor and the consignee. While arrangements can vary, a common split might range from 60/40 to 50/50, depending on the type of goods and market conditions. It is important to clearly outline this division in your Washington Contract for Sale of Goods on Consignment to avoid any misunderstandings. Transparent communication about expectations fosters a more successful partnership.

The standard for consignment typically includes clear terms regarding payment, duration of the consignment period, and handling of unsold goods. In a Washington Contract for Sale of Goods on Consignment, it's essential to specify how the goods will be stored, marketed, and sold. This clarity helps avoid misunderstandings and establishes a cooperative relationship between the parties involved.

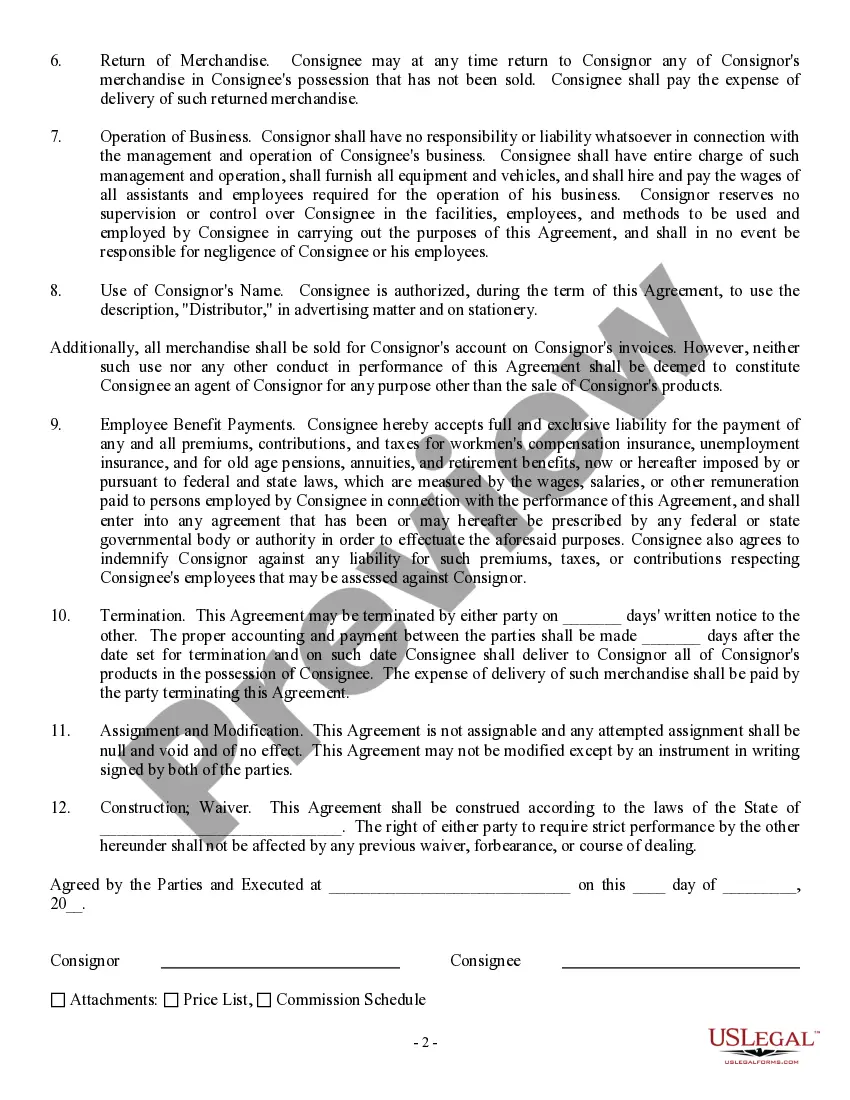

A Washington Contract for Sale of Goods on Consignment is an agreement that allows a consignor to provide goods to a consignee who sells them on behalf of the consignor. Under this arrangement, the consignor retains ownership of the goods until they are sold, which reduces risk for the consignor. This type of contract outlines the terms of sale, payment structures, and responsibilities of both parties.

The three main types of consignments are traditional, consignment inventory, and drop shipping. Traditional consignment involves handing over goods for sale while retaining ownership, whereas consignment inventory means the store holds stock but only pays once items are sold. Drop shipping, however, allows sellers to fulfill orders directly from suppliers. Utilizing a Washington Contract for Sale of Goods on Consignment can effectively govern any of these arrangements.