As most commonly used in legal settings, an audit is an examination of financial records and documents and other evidence by a trained accountant. Audits are conducted of records of a business or governmental entity, with the aim of ensuring proper accounting practices, recommendations for improvements, and a balancing of the books. An audit performed by employees is called "internal audit," and one done by an independent (outside) accountant is an "independent audit." Auditors may refuse to sign the audit to guarantee its accuracy if only limited records are produced.

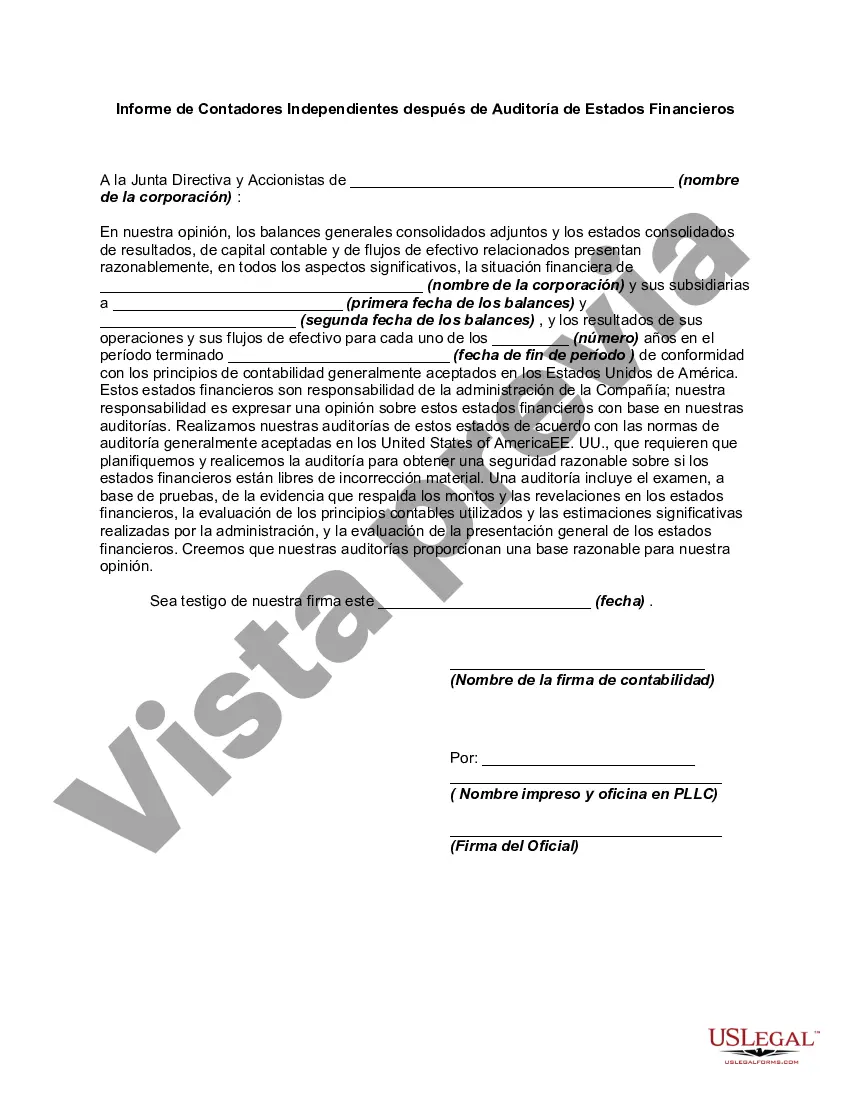

The Washington Report of Independent Accountants after Audit of Financial Statements is a comprehensive and vital document that summarizes the outcomes of an independent audit conducted by certified public accountants (CPA's) in Washington. This report is crucial for stakeholders, investors, and decision-makers as it provides an objective assessment of an organization's financial health and performance. The key objective of the Washington Report of Independent Accountants is to offer an unbiased evaluation of an entity's financial statements, ensuring that they adhere to Generally Accepted Accounting Principles (GAAP). The report also aims to ascertain the accuracy, completeness, and transparency of the financial records, thus promoting trust and confidence in the organization's financial reporting process. This report follows a standardized structure, including various sections that highlight the key findings and conclusions derived from the audit process. The primary sections typically incorporated in the Washington Report of Independent Accountants include: 1. Introduction: This section provides an overview of the audit scope, objectives, and methodologies employed by the independent accountants. It discusses the responsibilities of the auditors and management throughout the auditing process. 2. Management's Responsibility: This section outlines the responsibilities of the entity's management regarding the preparation, accuracy, and fair presentation of the financial statements. It stresses the importance of internal controls and the prevention of fraud or misrepresentation. 3. Auditor's Responsibility: Here, the independent accountants describe their responsibilities, emphasizing their obligation to plan and execute the audit in a manner that provides reasonable assurance of detecting material misstatements. It also discusses the limitations of an audit, highlighting that it does not guarantee the identification of all irregularities. 4. Opinion on Financial Statements: This critical section presents the auditor's opinion on the fairness of the financial statements. It may include a qualified opinion if significant issues or limitations were encountered during the audit process. The opinions commonly stated are "Unqualified Opinion," "Qualified Opinion," "Adverse Opinion," or "Disclaimer of Opinion." 5. Basis for Opinion: This section provides details on the audit procedures performed, including examining records, verification of assets and liabilities, assessment of internal controls, and evaluation of significant accounting policies. It explains the rationale behind the auditor's conclusions and justifies the expressed opinion. 6. Key Findings and Recommendations: This section highlights the major findings, risks, and weaknesses identified during the audit. It may include suggestions for improvements in financial reporting, internal controls, or compliance with relevant regulations. The Washington Report of Independent Accountants after Audit of Financial Statements may vary in types depending on the specific purpose or regulatory requirements. Some different types of reports associated with this process include: 1. Audit Report for Publicly Traded Companies: This report is specific to publicly traded companies and follows additional guidelines mandated by the Securities and Exchange Commission (SEC). It ensures compliance with disclosure requirements, including information related to internal controls, executive compensation, and risk management practices. 2. Report for Nonprofit Organizations: Nonprofit entities have unique reporting requirements, which necessitates a specific report tailored to their financial statements. This report may take into account the organization's tax-exempt status, compliance with grant agreements, and adherence to nonprofit accounting standards. 3. Compilation Reports: In certain cases, CPA's may provide compilation reports instead of full-fledged audit reports. Compilation reports primarily involve presenting financial statements without providing an opinion on their fairness. This type of report may be suitable for organizations with a lower risk profile or when financial statement users require a basic level of assurance. In summary, the Washington Report of Independent Accountants after Audit of Financial Statements is an essential document that delivers a comprehensive assessment of an organization's financial health and integrity. It provides stakeholders with valuable insights into the accuracy, transparency, and compliance of an entity's financial reporting, ultimately aiding in informed decision-making.The Washington Report of Independent Accountants after Audit of Financial Statements is a comprehensive and vital document that summarizes the outcomes of an independent audit conducted by certified public accountants (CPA's) in Washington. This report is crucial for stakeholders, investors, and decision-makers as it provides an objective assessment of an organization's financial health and performance. The key objective of the Washington Report of Independent Accountants is to offer an unbiased evaluation of an entity's financial statements, ensuring that they adhere to Generally Accepted Accounting Principles (GAAP). The report also aims to ascertain the accuracy, completeness, and transparency of the financial records, thus promoting trust and confidence in the organization's financial reporting process. This report follows a standardized structure, including various sections that highlight the key findings and conclusions derived from the audit process. The primary sections typically incorporated in the Washington Report of Independent Accountants include: 1. Introduction: This section provides an overview of the audit scope, objectives, and methodologies employed by the independent accountants. It discusses the responsibilities of the auditors and management throughout the auditing process. 2. Management's Responsibility: This section outlines the responsibilities of the entity's management regarding the preparation, accuracy, and fair presentation of the financial statements. It stresses the importance of internal controls and the prevention of fraud or misrepresentation. 3. Auditor's Responsibility: Here, the independent accountants describe their responsibilities, emphasizing their obligation to plan and execute the audit in a manner that provides reasonable assurance of detecting material misstatements. It also discusses the limitations of an audit, highlighting that it does not guarantee the identification of all irregularities. 4. Opinion on Financial Statements: This critical section presents the auditor's opinion on the fairness of the financial statements. It may include a qualified opinion if significant issues or limitations were encountered during the audit process. The opinions commonly stated are "Unqualified Opinion," "Qualified Opinion," "Adverse Opinion," or "Disclaimer of Opinion." 5. Basis for Opinion: This section provides details on the audit procedures performed, including examining records, verification of assets and liabilities, assessment of internal controls, and evaluation of significant accounting policies. It explains the rationale behind the auditor's conclusions and justifies the expressed opinion. 6. Key Findings and Recommendations: This section highlights the major findings, risks, and weaknesses identified during the audit. It may include suggestions for improvements in financial reporting, internal controls, or compliance with relevant regulations. The Washington Report of Independent Accountants after Audit of Financial Statements may vary in types depending on the specific purpose or regulatory requirements. Some different types of reports associated with this process include: 1. Audit Report for Publicly Traded Companies: This report is specific to publicly traded companies and follows additional guidelines mandated by the Securities and Exchange Commission (SEC). It ensures compliance with disclosure requirements, including information related to internal controls, executive compensation, and risk management practices. 2. Report for Nonprofit Organizations: Nonprofit entities have unique reporting requirements, which necessitates a specific report tailored to their financial statements. This report may take into account the organization's tax-exempt status, compliance with grant agreements, and adherence to nonprofit accounting standards. 3. Compilation Reports: In certain cases, CPA's may provide compilation reports instead of full-fledged audit reports. Compilation reports primarily involve presenting financial statements without providing an opinion on their fairness. This type of report may be suitable for organizations with a lower risk profile or when financial statement users require a basic level of assurance. In summary, the Washington Report of Independent Accountants after Audit of Financial Statements is an essential document that delivers a comprehensive assessment of an organization's financial health and integrity. It provides stakeholders with valuable insights into the accuracy, transparency, and compliance of an entity's financial reporting, ultimately aiding in informed decision-making.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.