Washington Consultant Agreement with Sharing of Software Revenues

Description

In this agreement, the consultant is not only paid an hourly rate, but is also paid a percentage of the net profits (as defined in the agreement) resulting from the software the consultant develops.

How to fill out Consultant Agreement With Sharing Of Software Revenues?

Are you in a situation where you often need documents for possibly business or particular purposes.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers a vast selection of form templates, including the Washington Consultant Agreement with Revenue Sharing of Software, designed to meet state and federal requirements.

Select the pricing plan you prefer, enter the necessary information to create your account, and complete the transaction using your PayPal or credit card.

Choose a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Washington Consultant Agreement with Revenue Sharing of Software template.

- If you do not have an account and want to start using US Legal Forms, follow these instructions.

- Obtain the required form and ensure it matches the correct region/state.

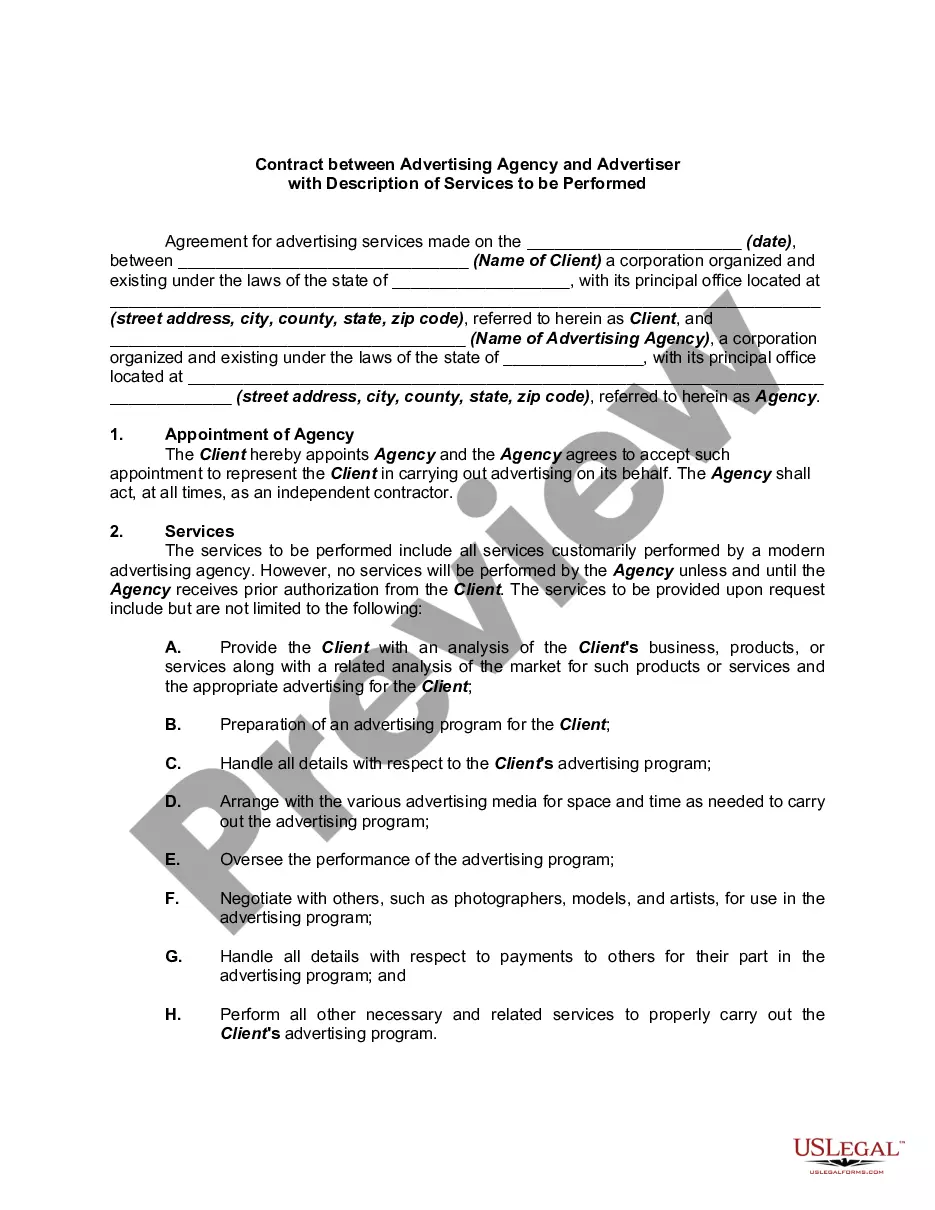

- Use the Review button to examine the form.

- Check the description to confirm you have chosen the right form.

- If the form is not what you are looking for, use the Lookup section to find the form that fits your needs.

- When you find the correct form, click Get now.

Form popularity

FAQ

When structuring a profit-sharing agreement, start by identifying each party’s contributions and responsibilities. A Washington Consultant Agreement with Sharing of Software Revenues should state how profits will be calculated and shared among partners. Clear terms lead to effective collaboration and help maintain a positive working relationship.

Structuring a profit-sharing agreement involves determining how profits will be distributed based on contributions and roles. In a Washington Consultant Agreement with Sharing of Software Revenues, establish what percentage each participant earns based on specific criteria, like sales targets. Crafting a well-defined agreement ensures that everyone understands the terms of profit distribution.

To structure a revenue-sharing agreement, clearly define the roles of each party involved. In a Washington Consultant Agreement with Sharing of Software Revenues, outline the revenue split, payment frequency, and any performance metrics needed for payments. This structured approach allows both parties to have aligned expectations and strengthens their collaboration.

The revenue-sharing rule provides a framework for how profits are allocated among partners. In context, a Washington Consultant Agreement with Sharing of Software Revenues includes detailed rules governing the sharing of income derived from software sales. This approach fosters transparency and helps maintain trusted relationships among stakeholders.

A revenue-sharing contract details the terms under which partners will split profits. For example, a Washington Consultant Agreement with Sharing of Software Revenues might specify that a consultant receives 30% of software sales revenue for their advisory role. Such contracts should clearly define roles, responsibilities, and payment schedules to prevent misunderstandings.

Typical revenue sharing percentages can vary widely depending on the industry and agreement specifics. In the case of a Washington Consultant Agreement with Sharing of Software Revenues, these percentages might range from 10% to 50%. Determining the right percentage involves assessing contributions from each party and aligning interests.

A revenue share structure defines how revenue is divided among parties involved in a business scenario. In a Washington Consultant Agreement with Sharing of Software Revenues, this structure helps partners understand their earnings based on specific percentages. Establishing a clear revenue share structure helps avoid disputes and promotes partnership success.

A revenue sharing agreement outlines how profits from a business venture are distributed among partners. For instance, in the context of a Washington Consultant Agreement with Sharing of Software Revenues, a software developer might agree to share profits with a consultant who helped create the software. This agreement specifies the percentage each party receives, ensuring clarity and fairness.