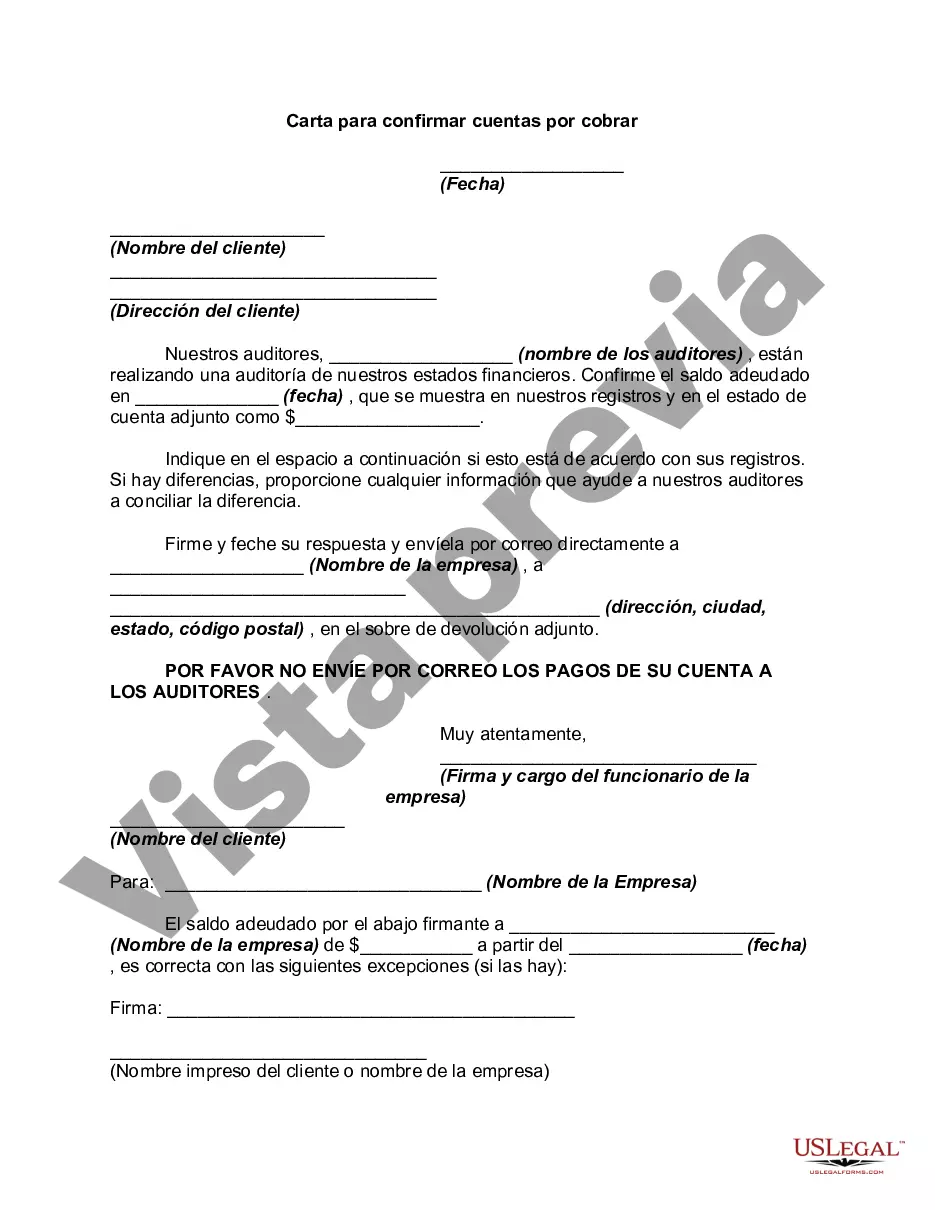

The Washington Letter to Confirm Accounts Receivable is a formal document used in the accounting and financial industry to verify the accuracy and validity of a company's accounts receivable. This letter serves as a confirmation request sent by an entity's auditor or accountant to its customers or clients who owe outstanding amounts. The purpose of the Washington Letter to Confirm Accounts Receivable is to obtain independent, third-party confirmation of the existence and amount of accounts receivable balances. It is an essential part of the audit process, providing important evidence to support the accuracy and completeness of a company's financial statements. Several types of Washington Letters to Confirm Accounts Receivable exist to cater to unique needs and circumstances. These include: 1. Standard Washington Letter: This is a widely used template that requests confirmation of outstanding balances, payment terms, and other pertinent information related to accounts receivable. It is typically sent to a wide range of customers. 2. Positive Confirmation Washington Letter: This type of letter requires customers to respond directly, confirming the accuracy of their account balances or indicating any discrepancies. Positive confirmation letters are considered more reliable since they require explicit, written confirmation. 3. Negative Confirmation Washington Letter: In contrast to positive confirmation, this letter assumes account balances are accurate unless the customer responds with discrepancies. It is used when the client has many small-dollar balances, making it cost-effective to rely on silence as an implicit agreement. 4. Blank Confirmation Washington Letter: This letter requests customers to fill in their account balances and return the letter directly to the auditor. Although less common, it can be used in specific situations where other methods might not be effective. It is crucial to note that the specific format and content of the Washington Letter to Confirm Accounts Receivable may vary depending on the organization's requirements, accounting standards, and local regulations. In conclusion, the Washington Letter to Confirm Accounts Receivable is a vital tool for auditors and accountants to verify the existence and accuracy of a company's outstanding receivables. It aids in ensuring the reliability of financial statements, reducing the risk of fraudulent reporting, and enhancing the overall transparency of a business's financial position.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Washington Carta para confirmar cuentas por cobrar - Letter to Confirm Accounts Receivable

Description

How to fill out Washington Carta Para Confirmar Cuentas Por Cobrar?

Choosing the right legal record web template can be a battle. Naturally, there are plenty of web templates available on the Internet, but how can you discover the legal kind you need? Utilize the US Legal Forms internet site. The support gives thousands of web templates, such as the Washington Letter to Confirm Accounts Receivable, that you can use for business and private requirements. All the forms are examined by experts and fulfill state and federal demands.

In case you are previously listed, log in in your profile and then click the Obtain key to have the Washington Letter to Confirm Accounts Receivable. Make use of profile to check from the legal forms you might have ordered formerly. Proceed to the My Forms tab of your own profile and obtain yet another copy in the record you need.

In case you are a whole new consumer of US Legal Forms, listed below are simple guidelines so that you can follow:

- Very first, make sure you have selected the proper kind for your city/state. It is possible to look through the form using the Preview key and look at the form outline to ensure this is basically the best for you.

- When the kind does not fulfill your preferences, make use of the Seach discipline to discover the correct kind.

- Once you are sure that the form is suitable, go through the Get now key to have the kind.

- Opt for the rates program you desire and enter in the required information and facts. Design your profile and pay money for your order utilizing your PayPal profile or Visa or Mastercard.

- Choose the submit structure and download the legal record web template in your device.

- Full, revise and printing and sign the received Washington Letter to Confirm Accounts Receivable.

US Legal Forms will be the greatest library of legal forms in which you can see a variety of record web templates. Utilize the company to download expertly-made papers that follow express demands.

Form popularity

FAQ

Accounts receivable confirmation is a technique used in the auditing process to verify a company's records. The auditor sends communications directly to customers, asking them to confirm the records maintained by the company.

RECEIVABLE CONFIRMATIONS ARE NOT ALWAYS required if accounts receivable are immaterial, the use of confirmations would be ineffective or combined inherent risk and control risk are low and analytics or other substantive tests would detect misstatements.

Normally, account payable confirmation is used to verify the accuracy and existence of account payable at the end of the accounting period that claims to be existing by the client.

Thus, there is a presumption that the auditor will request the confirmation of accounts receivable during an audit unless one of the following is true: Accounts receivable are immaterial to the financial statements. The use of confirmations would be ineffective.

What is an Accounts Receivable Confirmation? When an auditor is examining the accounting records of a client company, a primary technique for verifying the existence of accounts receivable is to confirm them with the company's customers. The auditor does so with an accounts receivable confirmation.

How to Audit Accounts ReceivableTrace receivable report to general ledger.Calculate the receivable report total.Investigate reconciling items.Test invoices listed in receivable report.Match invoices to shipping log.Confirm accounts receivable.Review cash receipts.Assess the allowance for doubtful accounts.More items...?

Once the confirmation is ready to be sent, the auditor is the one who sends the confirmation to the client's customers. The confirmation should not send by the client to its customer. This is to confirm that evidence that is collected from the confirmation is considered third-party information.

The auditor does so with an accounts receivable confirmation. This is a letter signed by a company officer (but mailed by the auditor) to customers selected by the auditors from the company's accounts receivable aging report.

There are two main types of accounts receivable confirmations, positive and negative accounts receivable confirmations. In case of nonresponses to accounts receivable confirmations or if the auditors deem necessary, alternative procedures must be applied to confirm accounts receivable balances.

With my solid experience in accounts receivable and collections, coupled with keen financial acumen and dedication to quality customer service, I am confident that I could quickly exceed your expectations in this role. I look forward to discussing the position in further detail. Thank you for your consideration.