An assignment is a transfer of rights that a party has under a contract to another person, called an assignee. The assigning party is called the assignor. If the obligor (person obligated to pay) is notified that there has been an assignment and that any money due must be paid to the assignee, the obligor's obligation can only be discharged by making payment to the assignee. In other words, payment to the assignor would not satisfy the contract after notice. If the obligor does not know of the assignment and makes payments to the assignor who does not turn the money over to the assignee, the assignee cannot sue the obligor, but does have a remedy against the assignor. However, if the obligor both knows of the assignment and has been notified to make future payments to the assignee, any payments made by the obligor to the assignor have no effect and do not reduce the debt of the obligor.

The Washington Notice of Assignment is a legal document that serves to notify a debtor of the assignment or transfer of a debt to another party. It is an essential part of the debt collection process and is governed by the laws of Washington state. In Washington, there are primarily two types of Notice of Assignment: the Notice of Assignment of Accounts Receivable and the Notice of Assignment of Promissory Notes. The Notice of Assignment of Accounts Receivable is used when a business assigns its accounts receivable, which are the outstanding payments owed to the business by its customers, to a third party. This transfer of debt is typically done to improve cash flow or to streamline the collection process. The Notice of Assignment of Accounts Receivable informs the debtor that payment must now be made to the assignee, as they are now the rightful owner of the debt. The Notice of Assignment of Promissory Notes, on the other hand, is employed when there is a transfer of a promissory note, which is a written promise to repay a loan. This type of notice is often used in situations such as the sale of a loan portfolio by a financial institution or the assignment of a loan by an individual or company to another party. By providing the Notice of Assignment of Promissory Notes, the debtor is informed that they should make future loan payments to the assignee, as they are now the new holder of the promissory note. It's important to note that both types of Washington Notice of Assignment should contain certain key elements to be considered valid. These elements typically include the name and contact information of the assignor (original creditor), the name and contact information of the assignee (new creditor), the original account or promissory note details, the effective date of assignment, and any additional terms or instructions relevant to the debtor. In conclusion, the Washington Notice of Assignment is a crucial document that ensures transparency and proper communication between debtors, assignors, and assignees in debt transfer scenarios. Whether it is the Notice of Assignment of Accounts Receivable or the Notice of Assignment of Promissory Notes, both serve the purpose of clarifying the change in ownership of debt and guiding debtors on where to direct future payments.The Washington Notice of Assignment is a legal document that serves to notify a debtor of the assignment or transfer of a debt to another party. It is an essential part of the debt collection process and is governed by the laws of Washington state. In Washington, there are primarily two types of Notice of Assignment: the Notice of Assignment of Accounts Receivable and the Notice of Assignment of Promissory Notes. The Notice of Assignment of Accounts Receivable is used when a business assigns its accounts receivable, which are the outstanding payments owed to the business by its customers, to a third party. This transfer of debt is typically done to improve cash flow or to streamline the collection process. The Notice of Assignment of Accounts Receivable informs the debtor that payment must now be made to the assignee, as they are now the rightful owner of the debt. The Notice of Assignment of Promissory Notes, on the other hand, is employed when there is a transfer of a promissory note, which is a written promise to repay a loan. This type of notice is often used in situations such as the sale of a loan portfolio by a financial institution or the assignment of a loan by an individual or company to another party. By providing the Notice of Assignment of Promissory Notes, the debtor is informed that they should make future loan payments to the assignee, as they are now the new holder of the promissory note. It's important to note that both types of Washington Notice of Assignment should contain certain key elements to be considered valid. These elements typically include the name and contact information of the assignor (original creditor), the name and contact information of the assignee (new creditor), the original account or promissory note details, the effective date of assignment, and any additional terms or instructions relevant to the debtor. In conclusion, the Washington Notice of Assignment is a crucial document that ensures transparency and proper communication between debtors, assignors, and assignees in debt transfer scenarios. Whether it is the Notice of Assignment of Accounts Receivable or the Notice of Assignment of Promissory Notes, both serve the purpose of clarifying the change in ownership of debt and guiding debtors on where to direct future payments.

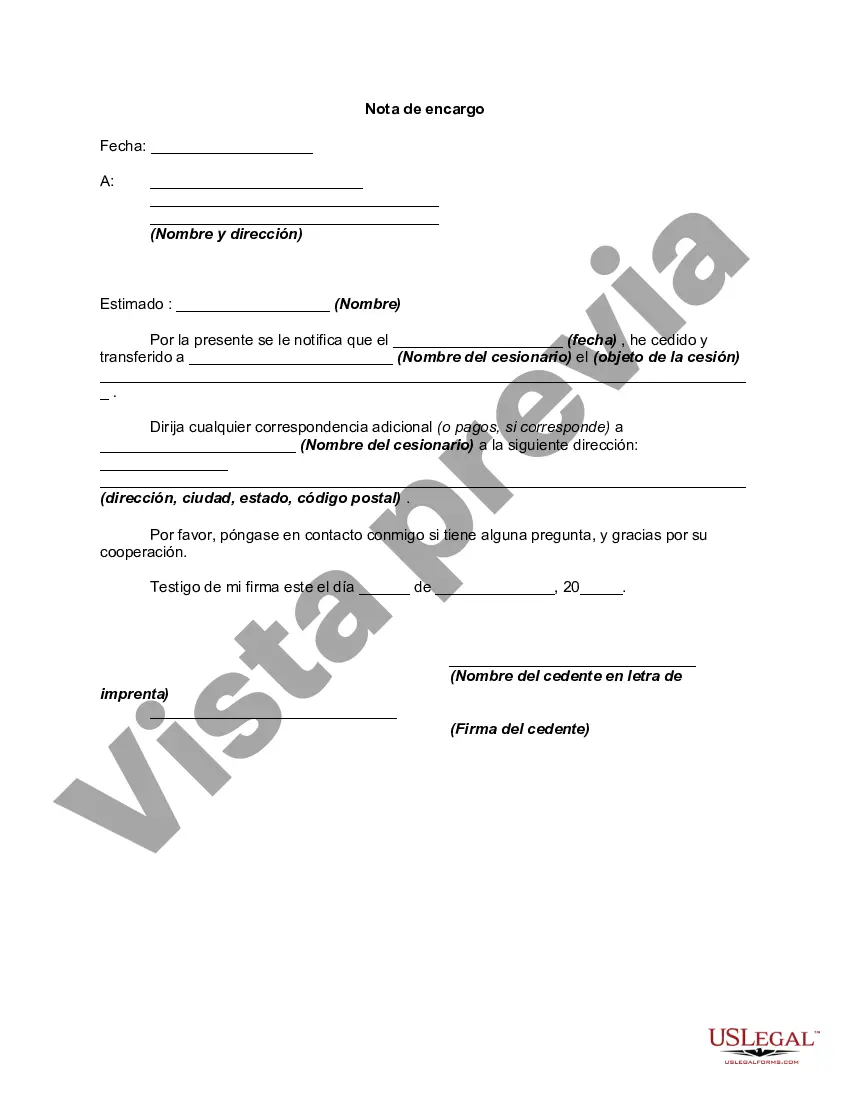

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.