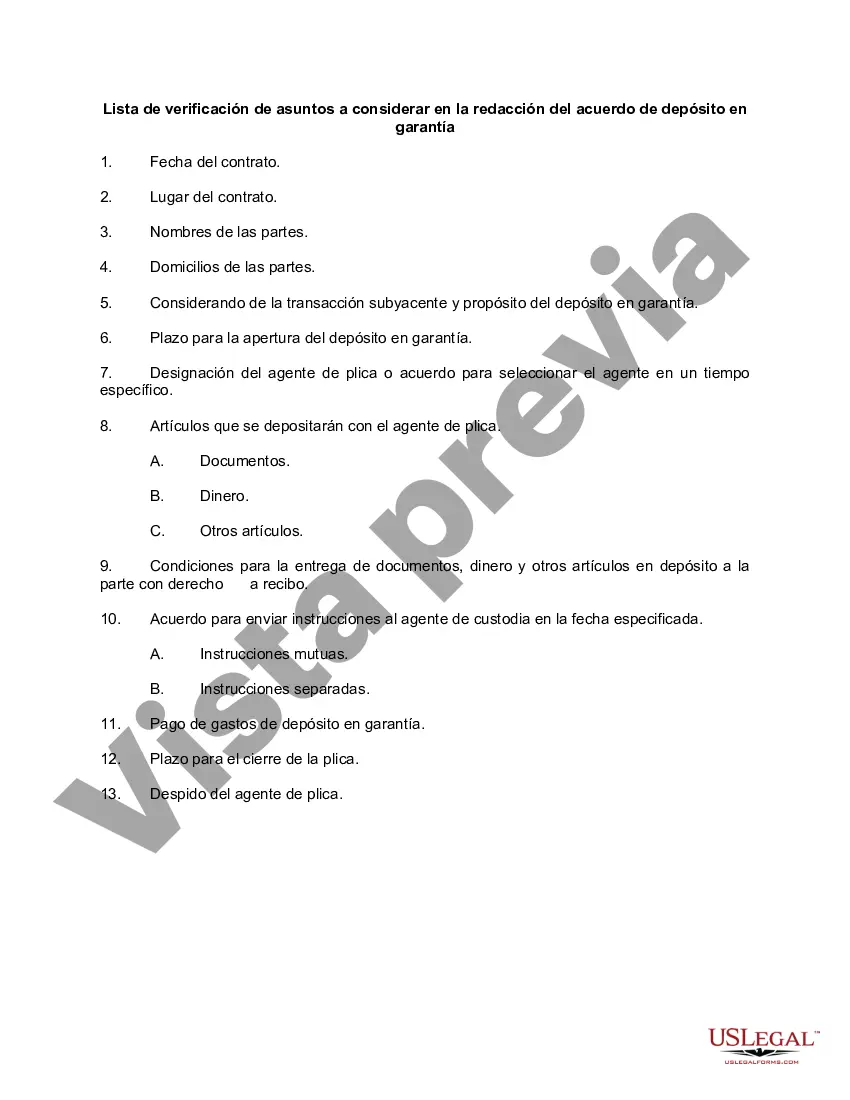

Washington Checklist of Matters to be Considered in Drafting Escrow Agreement In the state of Washington, when drafting an escrow agreement, certain important matters must be considered to ensure a legally sound and comprehensive document. This checklist outlines the essential items to review and include in a Washington escrow agreement. 1. Parties Involved: Clearly identify and include the names, addresses, and contact details of all parties involved in the escrow agreement, such as the buyer, seller, escrow agent, and any additional stakeholders. 2. Description of the Transaction: Provide a detailed description of the underlying transaction for which the escrow agreement is being established. Include relevant information about the property or assets involved, purchase price, and any specific terms or conditions. 3. Escrow Obligations: Specify the obligations and responsibilities of the escrow agent in detail. This may include handling funds, documentation, disbursements, and any other specific duties expected of the escrow agent during the course of the transaction. 4. Escrow Instructions: Include clear and concise instructions for the escrow agent to follow. These instructions should cover the handling of funds, conditions for release or transfer of assets, and any specific actions the escrow agent needs to take according to the terms of the agreement. 5. Contingencies and Conditions: Identify any contingencies or conditions that need to be met before the release of funds or assets from escrow. This may involve inspections, approvals, or other prerequisites established during the negotiation phase. 6. Dispute Resolution: Provide a mechanism for resolving disputes that may arise during the escrow period. Consider incorporating alternative dispute resolution methods, such as mediation or arbitration, to avoid lengthy court proceedings. 7. Confidentiality and Data Protection: Include provisions to safeguard the confidentiality of sensitive information shared during the escrow process. Address how personal data will be collected, stored, and protected in compliance with relevant data protection laws. 8. Timeframes and Deadlines: Specify realistic timeframes and deadlines for various stages of the escrow process, including the delivery of documents, inspections, and the completion of required actions. 9. Termination and Cancellation: Outline the conditions that may lead to the termination or cancellation of the escrow agreement, including default by any party, breach of terms, or other unforeseen circumstances. Include provisions for the distribution of funds or return of assets upon termination. Different Types of Washington Checklist of Matters to be Considered in Drafting Escrow Agreements: 1. Real Estate Escrow Agreement: A specific checklist tailored to real estate transactions, which may include additional items such as title searches, liens, and encumbrances, prorated taxes, and insurance requirements. 2. Business Asset Escrow Agreement: Designed for escrow agreements related to the transfer of business assets, this checklist may cover topics such as inventory, intellectual property rights, licenses, contracts, and creditor claims. 3. Financial Escrow Agreement: Focused on financial transactions, this checklist may address matters like loan agreements, interest rates, repayments, and the release of funds upon specific triggers stipulated in the agreement. By meticulously addressing these matters in a Washington escrow agreement, all involved parties can ensure a smooth and transparent transaction while protecting their respective interests.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Washington Lista de verificación de asuntos a considerar en la redacción del acuerdo de depósito en garantía - Checklist of Matters to be Considered in Drafting Escrow Agreement

Description

How to fill out Washington Lista De Verificación De Asuntos A Considerar En La Redacción Del Acuerdo De Depósito En Garantía?

US Legal Forms - one of many greatest libraries of legal forms in the USA - delivers a wide array of legal record themes you may down load or print. Using the site, you will get 1000s of forms for business and individual functions, categorized by types, claims, or key phrases.You will discover the newest models of forms such as the Washington Checklist of Matters to be Considered in Drafting Escrow Agreement in seconds.

If you currently have a subscription, log in and down load Washington Checklist of Matters to be Considered in Drafting Escrow Agreement in the US Legal Forms local library. The Download option will appear on every type you perspective. You get access to all formerly downloaded forms inside the My Forms tab of your respective bank account.

If you want to use US Legal Forms for the first time, here are straightforward directions to help you get began:

- Make sure you have picked out the right type to your area/region. Select the Review option to analyze the form`s content. Read the type description to actually have selected the proper type.

- When the type doesn`t satisfy your demands, utilize the Look for field near the top of the display screen to discover the the one that does.

- Should you be happy with the form, verify your option by clicking on the Buy now option. Then, opt for the prices program you favor and supply your qualifications to register for the bank account.

- Procedure the deal. Utilize your Visa or Mastercard or PayPal bank account to finish the deal.

- Choose the file format and down load the form in your product.

- Make modifications. Fill out, edit and print and signal the downloaded Washington Checklist of Matters to be Considered in Drafting Escrow Agreement.

Each design you added to your bank account lacks an expiry time and is also your own for a long time. So, in order to down load or print one more duplicate, just check out the My Forms section and then click about the type you want.

Obtain access to the Washington Checklist of Matters to be Considered in Drafting Escrow Agreement with US Legal Forms, one of the most comprehensive local library of legal record themes. Use 1000s of skilled and condition-specific themes that meet up with your organization or individual requirements and demands.