Washington Promissory Note with Payments Amortized for a Certain Number of Years

Description

How to fill out Promissory Note With Payments Amortized For A Certain Number Of Years?

Are you in a position where you require documents for both business or personal purposes almost every day.

There are numerous legitimate document templates available online, but locating ones you can trust is challenging.

US Legal Forms offers thousands of form templates, including the Washington Promissory Note with Payments Amortized for a Certain Number of Years, designed to comply with state and federal regulations.

Once you find the correct form, click on Buy now.

Select the pricing plan you want, enter the necessary information to process your payment, and place an order using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, just sign in.

- After that, you can download the Washington Promissory Note with Payments Amortized for a Certain Number of Years template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct area/region.

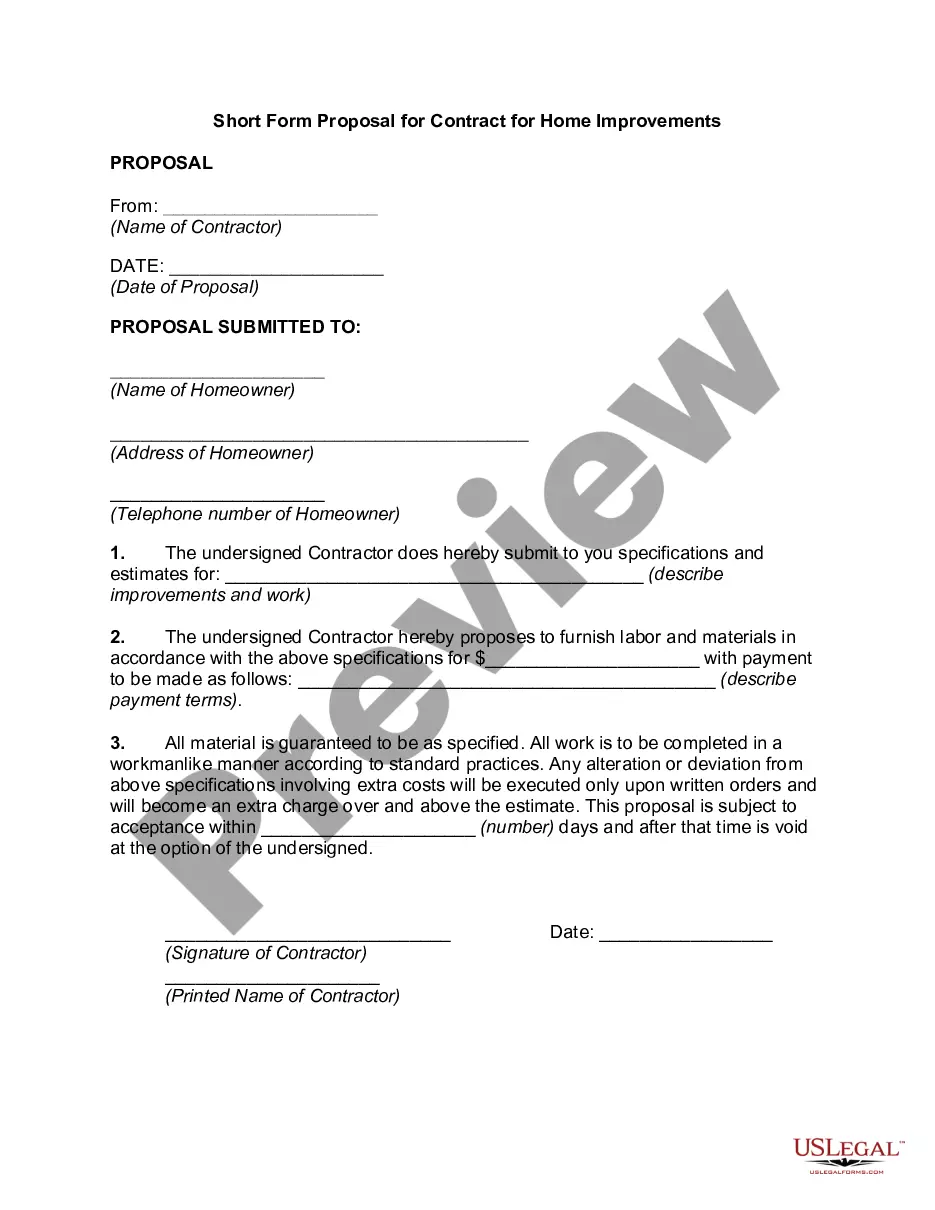

- Utilize the Review button to examine the form.

- Check the details to verify that you have chosen the correct form.

- If the form does not match your requirements, use the Search field to find the form that meets your needs.

Form popularity

FAQ

Common examples of amortized loans include traditional mortgages, car loans, and personal loans. Each of these loans involves making scheduled payments over a set period, such as years or months. By using a Washington Promissory Note with Payments Amortized for a Certain Number of Years, you can clearly understand your repayment plan, which helps you stay organized and informed.

Promissory notes do not 'expire' in the traditional sense, but they can become inactive after a certain period. In Washington, the statute of limitations on enforcing a promissory note is typically six years. However, if you possess a Washington Promissory Note with Payments Amortized for a Certain Number of Years, understanding the implications of this time limit is essential for ensuring you can enforce your rights. Consult uslegalforms for support in these matters.

Yes, a promissory note generally has a time limit, which is determined by the terms outlined within the document. Specifically, for a Washington Promissory Note with Payments Amortized for a Certain Number of Years, the repayment schedule specifies the duration for payments. If you need clarity on specific time frames, reviewing the document for your specific note is crucial. Remember, keeping track of this can help avoid any potential legal issues in the future.

Generally, repayment of the principal amount from a Washington Promissory Note with Payments Amortized for a Certain Number of Years is not considered taxable income. However, any interest earned on the repayment may be taxable. It's crucial to differentiate between principal and interest for accurate tax reporting. Seeking guidance from tax experts can ensure you remain compliant with tax laws.

A promissory note repayment refers to the process in which the borrower makes scheduled payments to the lender. In the case of a Washington Promissory Note with Payments Amortized for a Certain Number of Years, these payments often include both principal and interest components. This structured repayment plan helps borrowers manage their finances effectively while ensuring lenders receive their expected returns. Understanding this process can help you navigate your financial commitments more confidently.

When you receive payments from a Washington Promissory Note with Payments Amortized for a Certain Number of Years, the tax implications can vary. Typically, the principal amount you receive is not taxable, but the interest component may be subject to taxation. It's essential to keep accurate records of your payments, noting what portion goes toward interest. Consulting with a tax professional can provide clarity specific to your situation.

The rules for promissory notes typically include the necessity for mutual consent, clear identification of parties, and specific details like payment terms and interest rates. For a Washington Promissory Note with Payments Amortized for a Certain Number of Years, adherence to these rules is essential for legal enforceability. Utilizing a platform like US Legal Forms can help you create a compliant promissory note tailored to your needs, ensuring proper coverage of all legal aspects.

The limitation of a promissory note primarily involves its enforceability. For a Washington Promissory Note with Payments Amortized for a Certain Number of Years, one limitation is the time period for which legal actions can be taken, usually six years. Additionally, borrowers must adhere to the agreed-upon terms, or they might face default. Understanding these limitations helps protect both lenders and borrowers.

The promissory rule refers to the legal principle that governs the enforceability of a promissory note. When discussing a Washington Promissory Note with Payments Amortized for a Certain Number of Years, this rule establishes that the intent to repay must be clear and documented. This ensures that a borrower’s commitment is legally valid and can be enforced if necessary.

The promissory note policy refers to the guidelines and regulations that govern the creation, execution, and enforcement of promissory notes. For a Washington Promissory Note with Payments Amortized for a Certain Number of Years, this policy outlines the responsibilities of both the borrower and lender. Understanding this policy ensures that both parties adhere to legal requirements, making the transaction secure and transparent.