Washington Form — Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public Offering is a legally binding document that outlines the terms and conditions under which a strategic investor agrees to purchase stock from a company during its initial public offering (IPO) in the state of Washington. This agreement plays a crucial role in facilitating and formalizing the investment process and protects the rights and interests of both parties involved. The Washington Form — Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public Offering includes various key provisions and details that are essential for a smooth and transparent investment process. It typically covers the following aspects: 1. Parties involved: This section includes the names and contact details of the strategic investor and the issuing company. Both parties are clearly identified along with their respective roles and responsibilities. 2. Stock purchase details: The agreement specifies the number of shares that the strategic investor intends to purchase during the IPO. The total purchase price or the purchase price per share is also mentioned to ensure transparency and clarity. 3. Representations and warranties: This section outlines the representations and warranties made by the issuing company regarding the accuracy of the disclosed information, financial statements, business operations, and legal compliance. The strategic investor relies on these assurances before making the investment. 4. Conditions precedent: This segment lists the conditions that must be fulfilled before the completion of the stock purchase agreement. It may include the successful completion of the IPO, necessary regulatory approvals, and other relevant requirements. 5. Rights and obligations: The agreement delineates the rights and obligations of the strategic investor and the issuing company. It typically covers matters such as transfer restrictions, information sharing, voting rights, preemptive rights, and any special privileges or conditions attached to the investment. 6. Termination and remedies: This section specifies the circumstances under which either party may terminate the agreement. It also outlines the remedies available to the non-defaulting party in case of a breach or violation of the agreement's terms. Different types of Washington Form — Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public Offering may exist based on the specific terms and provisions included. They may vary depending on factors such as the nature of the investment, the strategic objectives of the investor, and the unique circumstances of the issuing company's IPO. Some possible variations or sub-types of Washington Form — Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public Offering could include: 1. Preferred Stock Purchase Agreement: This agreement may provide additional rights and privileges to the strategic investor, such as preference in dividend payments, liquidation rights, or conversion features. 2. Convertible Stock Purchase Agreement: In this case, the purchased stock may have the option to be converted into a different class of stock or to be converted into common shares at a predetermined conversion rate or price. 3. Restricted Stock Purchase Agreement: This type of agreement may include specific restrictions on the transferability or sale of the purchased stock for a certain period after the IPO. 4. Equity Incentive Stock Purchase Agreement: This agreement may encompass the purchase of stock by employees or executives as part of their compensation package, often with special terms or conditions attached. These variations demonstrate the flexibility of the Washington Form — Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public Offering to accommodate different investment structures and objectives. It is crucial for both parties to seek legal counsel to ensure compliance with applicable laws and to protect their interests throughout the investment process.

Washington Form - Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public Offering

Description

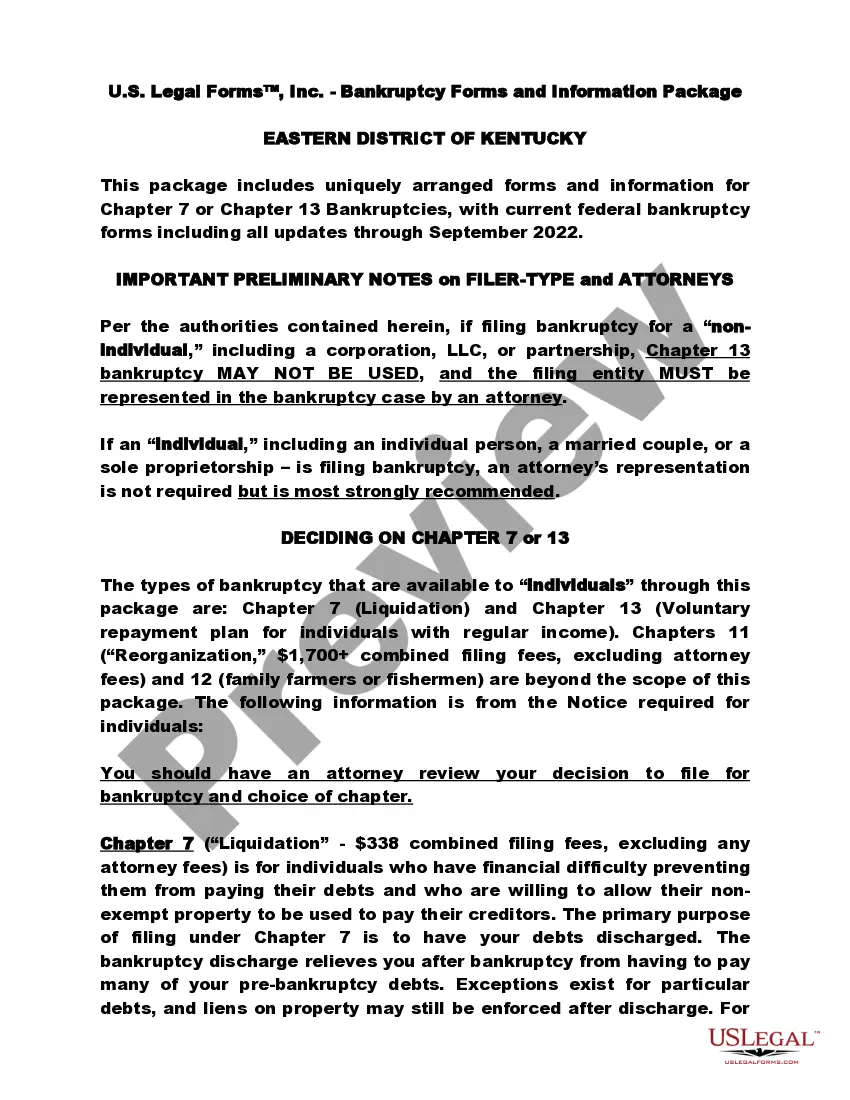

How to fill out Form - Stock Purchase Agreement For Strategic Investment Made At Time Of Initial Public Offering?

Are you presently inside a placement the place you will need paperwork for either company or individual reasons almost every day? There are a lot of legal document themes accessible on the Internet, but finding kinds you can depend on is not easy. US Legal Forms delivers thousands of develop themes, much like the Washington Form - Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public Offering, which are created to satisfy federal and state requirements.

Should you be previously familiar with US Legal Forms website and have an account, simply log in. After that, it is possible to obtain the Washington Form - Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public Offering template.

If you do not have an profile and wish to begin using US Legal Forms, adopt these measures:

- Obtain the develop you require and make sure it is for your right metropolis/county.

- Make use of the Preview key to check the shape.

- See the outline to actually have chosen the appropriate develop.

- In case the develop is not what you`re searching for, utilize the Look for field to find the develop that fits your needs and requirements.

- If you discover the right develop, simply click Get now.

- Pick the prices program you want, fill in the required information to produce your account, and pay for the transaction making use of your PayPal or bank card.

- Choose a convenient document file format and obtain your duplicate.

Discover each of the document themes you possess bought in the My Forms food list. You can obtain a further duplicate of Washington Form - Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public Offering whenever, if needed. Just select the needed develop to obtain or produce the document template.

Use US Legal Forms, probably the most extensive collection of legal types, to save efforts and steer clear of mistakes. The service delivers skillfully produced legal document themes that can be used for a variety of reasons. Make an account on US Legal Forms and begin generating your way of life easier.

Form popularity

FAQ

A share purchase agreement (SPA) is an agreement between a buyer and seller(s) of a target company, setting out the terms and conditions relating to the sale and the purchase of a specific number of shares in the target company.

A stock purchase agreement is a contract signed by two parties when they buy or sell stock in a corporation in the US. Small firms that sell stock frequently use these agreements. Stock can be sold to buyers by either the corporation or its shareholders.

At its most basic, a purchase agreement should include the following: Name and contact information for buyer and seller. The address of the property being sold. The price to be paid for the property. The date of transfer.

Stock purchase agreements (SPAs) are legally binding contracts between shareholders and companies. Also known as share purchase agreements, these contracts establish all of the terms and conditions related to the sale of a company's stocks.

A stock purchase agreement typically includes the following information: Your business name. The name and mailing address of the entity buying shares in your company's stocks. The par value (essentially the sale price) of the stocks being sold.

A purchase and sale agreement is used to document the parties' intentions and the terms they have agreed will govern the transaction. You can include specific terms like the product or property, the price of the product or property, conditions for the delivery of the product, and the date of product delivery.

A stock purchase agreement is a contract under which a seller transfers stock of a corporation to a buyer.

A stock purchase agreement typically includes the following information: Your business name. The name and mailing address of the entity buying shares in your company's stocks. The par value (essentially the sale price) of the stocks being sold. The number of stocks the buyer is purchasing.