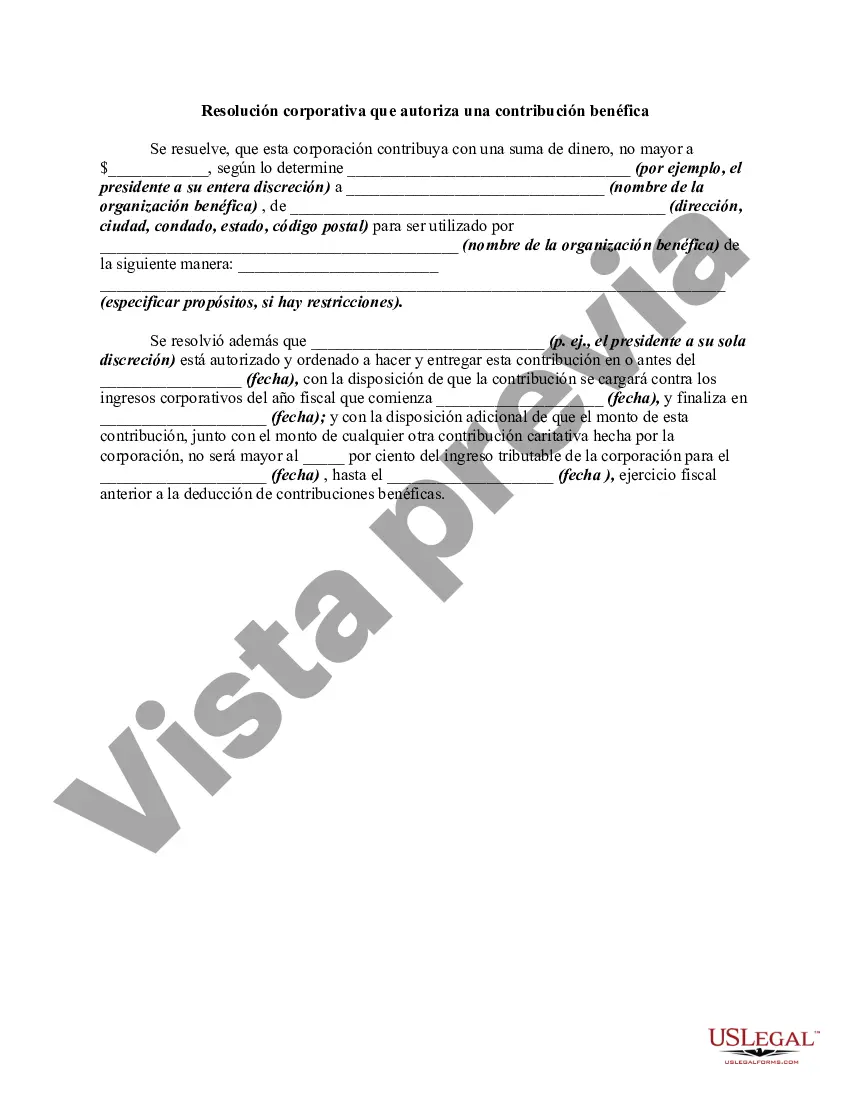

The RMBCA even authorizes a corporation to make charitable contributions. The following form is a sample of a corporate resolution authorizing a charitable contribution. A Wisconsin Corporate Resolution Authorizing a Charitable Contribution is a formal document issued by a corporation, specifying its intention to make a charitable donation. This resolution serves as written evidence of the corporation's decision and authorization to donate a specific amount or asset to a qualified charitable organization. The resolution includes key details such as the corporation's name, address, and legal representation. It outlines the purpose and objectives of the resolution, highlighting the corporation's desire to support a specific charitable cause. It also mentions the amount or nature of the contribution, as well as any conditions, restrictions, or obligations related to the donation. Different types of Wisconsin Corporate Resolution Authorizing a Charitable Contribution may include: 1. Monetary Donation Resolution: This type of resolution pertains to donations made in the form of cash, checks, wire transfers, or electronic transfers. It specifies the amount or range of the monetary contribution, along with any stipulations regarding its allocation or use. 2. In-Kind Donation Resolution: In certain cases, corporations may choose to donate goods, services, or assets instead of money. This resolution type outlines the specific items or assets being donated for charitable purposes and any relevant terms such as condition, valuation, or usage restrictions. 3. Corporate Volunteerism Resolution: Some corporations encourage employees to engage in volunteer activities, providing time and skills to charitable organizations. Therefore, this resolution type states the corporation's commitment to support employee participation in charitable initiatives during working hours or as part of the company's corporate social responsibility program. 4. Matching Gift Resolution: Companies often implement matching gift programs to double the impact of employee charitable donations. This resolution authorizes the corporation to match employee contributions up to a certain limit, emphasizing the company's commitment to supporting philanthropic activities. In summary, a Wisconsin Corporate Resolution Authorizing a Charitable Contribution is a written document that outlines a corporation's decision to make a charitable donation. It includes various types such as monetary, in-kind, corporate volunteerism, and matching gift resolutions, each tailored to specific circumstances. These resolutions reflect the corporation's commitment to giving back to the community and making a positive social impact.

A Wisconsin Corporate Resolution Authorizing a Charitable Contribution is a formal document issued by a corporation, specifying its intention to make a charitable donation. This resolution serves as written evidence of the corporation's decision and authorization to donate a specific amount or asset to a qualified charitable organization. The resolution includes key details such as the corporation's name, address, and legal representation. It outlines the purpose and objectives of the resolution, highlighting the corporation's desire to support a specific charitable cause. It also mentions the amount or nature of the contribution, as well as any conditions, restrictions, or obligations related to the donation. Different types of Wisconsin Corporate Resolution Authorizing a Charitable Contribution may include: 1. Monetary Donation Resolution: This type of resolution pertains to donations made in the form of cash, checks, wire transfers, or electronic transfers. It specifies the amount or range of the monetary contribution, along with any stipulations regarding its allocation or use. 2. In-Kind Donation Resolution: In certain cases, corporations may choose to donate goods, services, or assets instead of money. This resolution type outlines the specific items or assets being donated for charitable purposes and any relevant terms such as condition, valuation, or usage restrictions. 3. Corporate Volunteerism Resolution: Some corporations encourage employees to engage in volunteer activities, providing time and skills to charitable organizations. Therefore, this resolution type states the corporation's commitment to support employee participation in charitable initiatives during working hours or as part of the company's corporate social responsibility program. 4. Matching Gift Resolution: Companies often implement matching gift programs to double the impact of employee charitable donations. This resolution authorizes the corporation to match employee contributions up to a certain limit, emphasizing the company's commitment to supporting philanthropic activities. In summary, a Wisconsin Corporate Resolution Authorizing a Charitable Contribution is a written document that outlines a corporation's decision to make a charitable donation. It includes various types such as monetary, in-kind, corporate volunteerism, and matching gift resolutions, each tailored to specific circumstances. These resolutions reflect the corporation's commitment to giving back to the community and making a positive social impact.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.