Wisconsin Corporate Resolution Authorizing a Charitable Contribution

Description

The RMBCA even authorizes a corporation to make charitable contributions. The following form is a sample of a corporate resolution authorizing a charitable contribution.

How to fill out Corporate Resolution Authorizing A Charitable Contribution?

Have you ever found yourself in a circumstance where you require documents for potential business or personal purposes almost every day.

There are numerous legal document templates accessible online, yet locating ones you can rely on isn’t simple.

US Legal Forms offers a vast selection of form templates, such as the Wisconsin Corporate Resolution Authorizing a Charitable Contribution, that are designed to comply with state and federal requirements.

Utilize US Legal Forms, perhaps the most extensive collection of legal forms, to save time and avoid errors.

The service provides properly crafted legal document templates that you can utilize for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Wisconsin Corporate Resolution Authorizing a Charitable Contribution template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and verify that it is for the correct city/state.

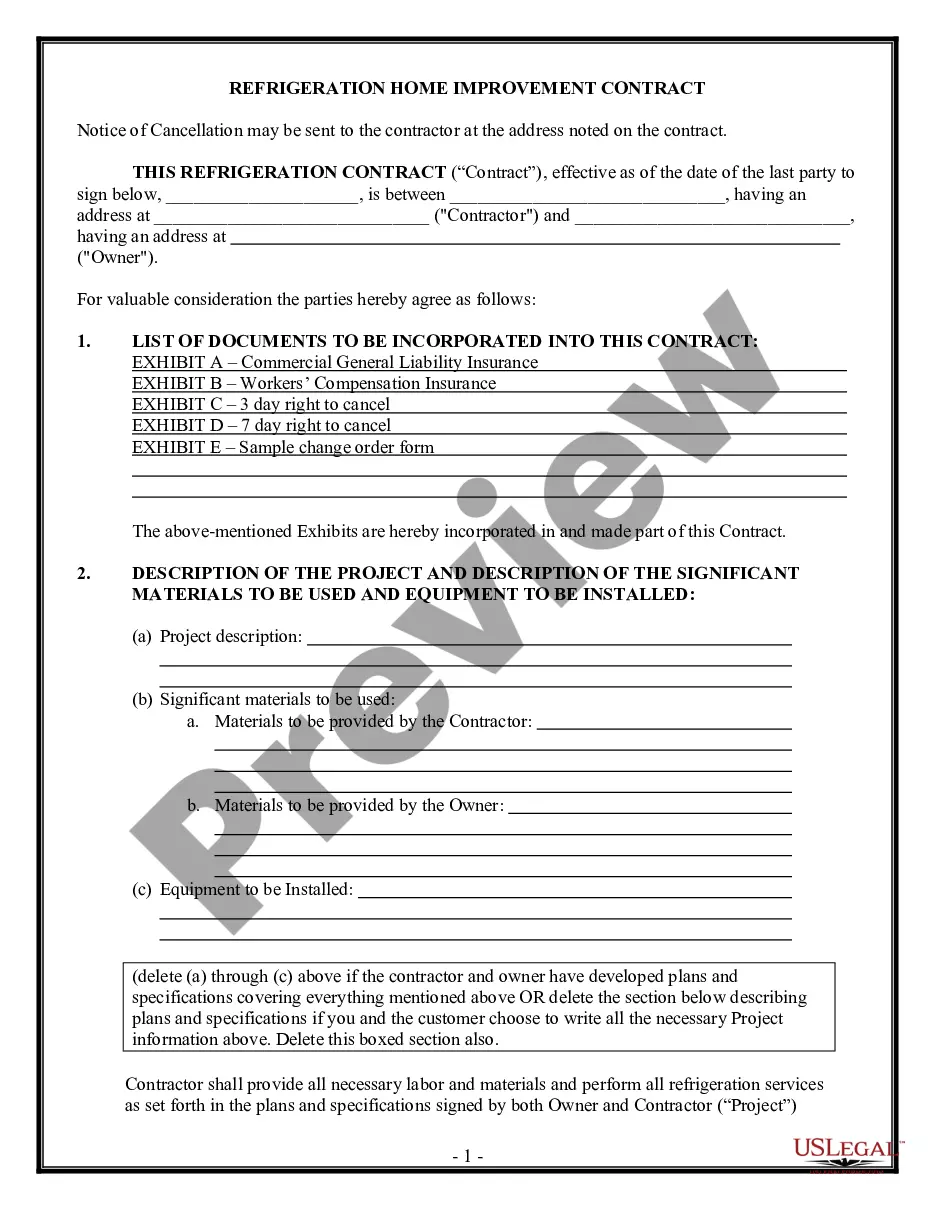

- Utilize the Preview button to review the form.

- Check the description to ensure you have selected the correct form.

- If the form isn’t what you are looking for, use the Search field to find the form that fits your needs.

- Once you locate the appropriate form, click on Acquire now.

- Select the pricing plan you prefer, fill in the necessary information to create your account, and purchase your order using PayPal or credit card.

- Choose a convenient document format and download your copy.

- Access all the document templates you have purchased in the My documents menu. You can obtain a duplicate of Wisconsin Corporate Resolution Authorizing a Charitable Contribution anytime you need it. Just select the desired form to download or print the document template.

Form popularity

FAQ

Forming a 501c3 in Wisconsin involves several key steps. You must start by writing your nonprofit's bylaws and then file the necessary Articles of Incorporation. Incorporate a Wisconsin Corporate Resolution Authorizing a Charitable Contribution in your documentation to validate future donations. Finally, secure your federal tax-exempt status through the IRS, and consider using USLegalForms to streamline the paperwork and ensure compliance with all requirements.

To set up a 501c3 in Wisconsin, you first need to choose a name for your organization that complies with state regulations. Next, you will draft and file Articles of Incorporation with the Wisconsin Department of Financial Institutions, ensuring that the document includes provisions for a Wisconsin Corporate Resolution Authorizing a Charitable Contribution. Once your application is approved, you should apply for the IRS tax-exempt status to receive 501c3 classification. Using a service like USLegalForms can simplify this process, providing you with templates and guidance.

Statute 202.12 in Wisconsin refers to the rules governing the management of nonprofit corporations, focusing on governance and compliance. This includes requirements about record-keeping and financial transparency. For organizations considering a Wisconsin Corporate Resolution Authorizing a Charitable Contribution, knowledge of this statute ensures that they operate within the law and maintain accountability. This legal backdrop strengthens the organization's commitment to its charitable goals.

Wisconsin has several crimes that lack a statute of limitations, including murder and certain sexual offenses. This means that perpetrators can be prosecuted at any time, regardless of when the crime occurred. Understanding these legal nuances is essential when forming a Wisconsin Corporate Resolution Authorizing a Charitable Contribution. Entities should ensure their charitable activities remain in good legal standing to prevent any potential criminal implications.

In Wisconsin, the burden of proof for self-defense lies with the individual claiming it. They must show that they had a reasonable belief that they faced imminent harm, and that their response was proportional. Awareness of such legal principles is essential for entities involved in charitable contributions, especially when drafting a Wisconsin Corporate Resolution Authorizing a Charitable Contribution, as it emphasizes responsible decision-making. Legal frameworks help protect the organization and the integrity of its initiatives.

Wisconsin's bigamy law makes it illegal for individuals to marry while already legally married to another person. Violating this statute can lead to criminal charges and complications in marital law. It's crucial for organizations, when drafting a Wisconsin Corporate Resolution Authorizing a Charitable Contribution, to maintain legally binding documents that adhere to state laws. This helps avoid any missteps that could arise from personal legal issues of involved parties.

In Wisconsin, the statute regarding power of attorney allows individuals to appoint someone to make decisions on their behalf. This designation can cover financial matters, healthcare decisions, or other critical areas of life. When establishing a Wisconsin Corporate Resolution Authorizing a Charitable Contribution, it's essential to understand how power of attorney can influence decisions regarding the allocation of funds for charitable initiatives. This understanding ensures the entity acts within its legal and ethical boundaries.

Wisconsin statute 244.16 pertains to the authority granted to certain entities to make charitable contributions. Under this statute, organizations can adopt a Wisconsin Corporate Resolution Authorizing a Charitable Contribution, ensuring that their philanthropic efforts are legally sound. This resolution is a vital tool for entities wishing to formalize their commitment to charitable giving. It provides clear guidance on the governing principles behind these contributions.

Yes, in Wisconsin, you must renew your LLC registration annually. This process includes filing an annual report and paying the associated fees, ensuring that your business remains compliant with state regulations. For nonprofit organizations, maintaining current registration is just as crucial, particularly when undertaking initiatives like Wisconsin Corporate Resolution Authorizing a Charitable Contribution.

Filing a nonprofit in Wisconsin involves submitting your articles of incorporation to the Department of Financial Institutions, along with necessary documents and fees. You also need to draft bylaws that outline the governance structure. After establishing your organization, you can confidently pursue actions like Wisconsin Corporate Resolution Authorizing a Charitable Contribution.