Title: Understanding the Wisconsin Promissory Note — Payable on Demand: Types and Key Features Introduction: The Wisconsin Promissory Note — Payable on Demand is a legal document that defines a contractual agreement where one party promises to repay a specified amount of money to another party. This article aims to provide a detailed overview of the key aspects of the Wisconsin Promissory Note — Payable on Demand, its types, and highlights its significance. Keywords: Wisconsin Promissory Note, Payable on Demand, legal document, contractual agreement, specified amount of money, types, significance. 1. Understanding the Concept of a Promissory Note: A Promissory Note is a legally binding agreement where one party (the “maker”) promises to repay a specific amount of money to another party (the “payee”) within a predetermined time frame or on demand. 2. Key Features of the Wisconsin Promissory Note — Payable on Demand— - Payable on Demand: The Payable on Demand aspect means that the note can be called due and payable at any time deemed necessary by the payee. — Unconditional Promise: The note represents an unconditional promise to pay back the borrowed amount on demand, without any additional conditions or contingencies. — Defined Principal Amount: The note clearly specifies the principal amount borrowed by the maker from the payee. — Interest Provisions: The note may include provisions detailing the interest rate, calculation method, and any applicable late fees. — Parties Involved: The note identifies the maker (borrower) and the payee (lender), establishing their roles and responsibilities. 3. Types of Wisconsin Promissory Note — Payable on Demand: a. Simple Promissory Note — Payable on Demand: This is the most common type of Promissory Note and contains the essential elements required for a legally enforceable agreement. b. Demand Note for Business Transactions: Geared towards business transactions, this type of Promissory Note outlines terms specific to commercial dealings such as trade credit and supplier agreements. c. Student Loan Demand Note: Designed specifically for educational purposes, this type of Promissory Note enables students to secure funds for their educational expenses, payable on demand. d. Personal Loans Payable on Demand: Often utilized for personal loans between friends, family, or acquaintances, this type of Promissory Note helps define terms and repayment obligations. 4. Significance and Benefits: — Legal Protection: A Promissory Note serves as a legally enforceable document, protecting both parties and ensuring repayment obligations. — Clarity and Consistency: By explicitly outlining the repayment terms, including interest rates and conditions, the Promissory Note ensures parties are on the same page, minimizing potential disputes. — Flexible Repayment: The Payable on Demand nature allows the payee to call for immediate repayment as needed, providing financial flexibility. — FinanciaRecorkeepingng: A properly documented Promissory Note supports accurate and transparent financial record keeping for both parties involved. Conclusion: The Wisconsin Promissory Note — Payable on Demand is a crucial legal instrument that secures monetary transactions and defines repayment obligations. With different types catering to specific situations, understanding the concept, features, and significance of such notes is vital for both lenders and borrowers. Disclaimer: This article provides a general overview and should not be considered legal advice. It is advisable to consult a legal professional to address specific concerns and ensure compliance with Wisconsin laws.

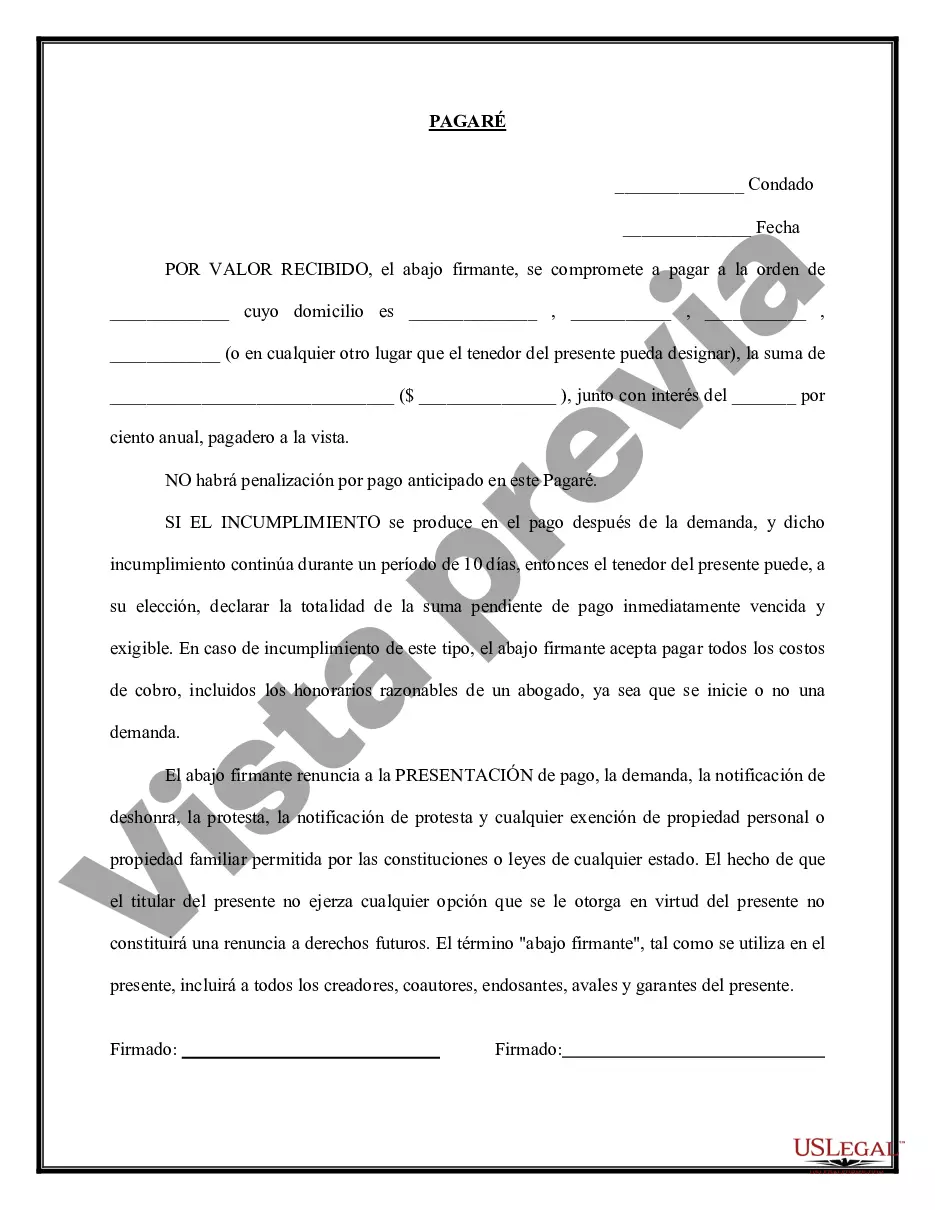

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wisconsin Pagaré - Pagadero a la vista - Promissory Note - Payable on Demand

Description

How to fill out Wisconsin Pagaré - Pagadero A La Vista?

If you wish to full, obtain, or print legitimate document templates, use US Legal Forms, the biggest variety of legitimate types, which can be found on-line. Use the site`s simple and easy handy search to obtain the papers you need. Different templates for enterprise and individual reasons are categorized by types and suggests, or search phrases. Use US Legal Forms to obtain the Wisconsin Promissory Note - Payable on Demand in a number of click throughs.

When you are currently a US Legal Forms buyer, log in to your account and click the Download key to obtain the Wisconsin Promissory Note - Payable on Demand. You can also gain access to types you in the past downloaded within the My Forms tab of your own account.

If you are using US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Make sure you have selected the shape for your proper metropolis/country.

- Step 2. Utilize the Review method to examine the form`s content material. Don`t forget to read the information.

- Step 3. When you are not satisfied together with the kind, use the Lookup discipline towards the top of the display to get other versions of the legitimate kind web template.

- Step 4. Once you have identified the shape you need, click on the Acquire now key. Opt for the costs plan you choose and add your qualifications to register for an account.

- Step 5. Procedure the deal. You can use your Мisa or Ьastercard or PayPal account to accomplish the deal.

- Step 6. Find the file format of the legitimate kind and obtain it on your own product.

- Step 7. Total, revise and print or indicator the Wisconsin Promissory Note - Payable on Demand.

Every legitimate document web template you acquire is your own property permanently. You may have acces to each kind you downloaded within your acccount. Go through the My Forms section and choose a kind to print or obtain again.

Remain competitive and obtain, and print the Wisconsin Promissory Note - Payable on Demand with US Legal Forms. There are thousands of skilled and condition-specific types you can utilize for your enterprise or individual demands.