Title: Wisconsin Sample Letter for Requesting Free Credit Report: Complying with Federal Law Introduction: In Wisconsin, just like anywhere in the United States, individuals are entitled to request a free credit report to stay informed about their credit history and financial standing. This article provides a detailed description of Wisconsin's Sample Letter for Requesting a Free Credit Report, which is permitted by federal law. By using this template, Wisconsin residents can exercise their rights and access vital financial information. Let's delve into the various types of sample letters available for different scenarios: 1. Standard Wisconsin Sample Letter for Requesting Free Credit Report: This sample letter is suitable for Wisconsin residents who haven't requested their annual credit report within the last 12 months. By following this template, individuals can effectively request their credit report from the authorized credit reporting agencies. 2. Wisconsin Sample Letter for Requesting Free Credit Report After Being Denied Credit: If a Wisconsin resident has been denied credit, employment, insurance, or any other benefits based on their credit report, they are entitled to a free credit report within 60 days of receiving the adverse action notice. This sample letter helps them outline their request and provide necessary details to the credit reporting agencies. 3. Wisconsin Sample Letter for Requesting Free Credit Report Due to Fraud or Identity Theft: If a Wisconsin resident suspects fraud or identity theft, they have the right to request a free credit report. This letter template aims to assist them in explaining the circumstances clearly to the credit reporting agencies, ensuring prompt action to protect their financial well-being. 4. Wisconsin Sample Letter for Requesting Additional Free Credit Reports: While consumers are typically entitled to a free credit report annually, certain circumstances may require additional reports. If a Wisconsin resident has experienced fraud, is unemployed, or is on public welfare, they may be eligible for additional free credit reports. This sample letter guides individuals through the process of requesting these additional reports. 5. Wisconsin Sample Letter for Disputing Inaccurate Credit Report Information: In case the credit report contains erroneous or outdated information, the Wisconsin resident can utilize this sample letter to dispute the inaccuracies. Following this template, individuals can initiate the process of rectifying their credit information and ensuring its accuracy. Conclusion: Wisconsin residents have the privilege of requesting a free credit report, in accordance with federal law, to guarantee financial well-being and protect against identity theft. The aforementioned sample letters cater to different scenarios, enabling individuals to navigate the process smoothly. By requesting and reviewing their credit reports regularly, Wisconsin residents can proactively manage their creditworthiness and secure their financial future.

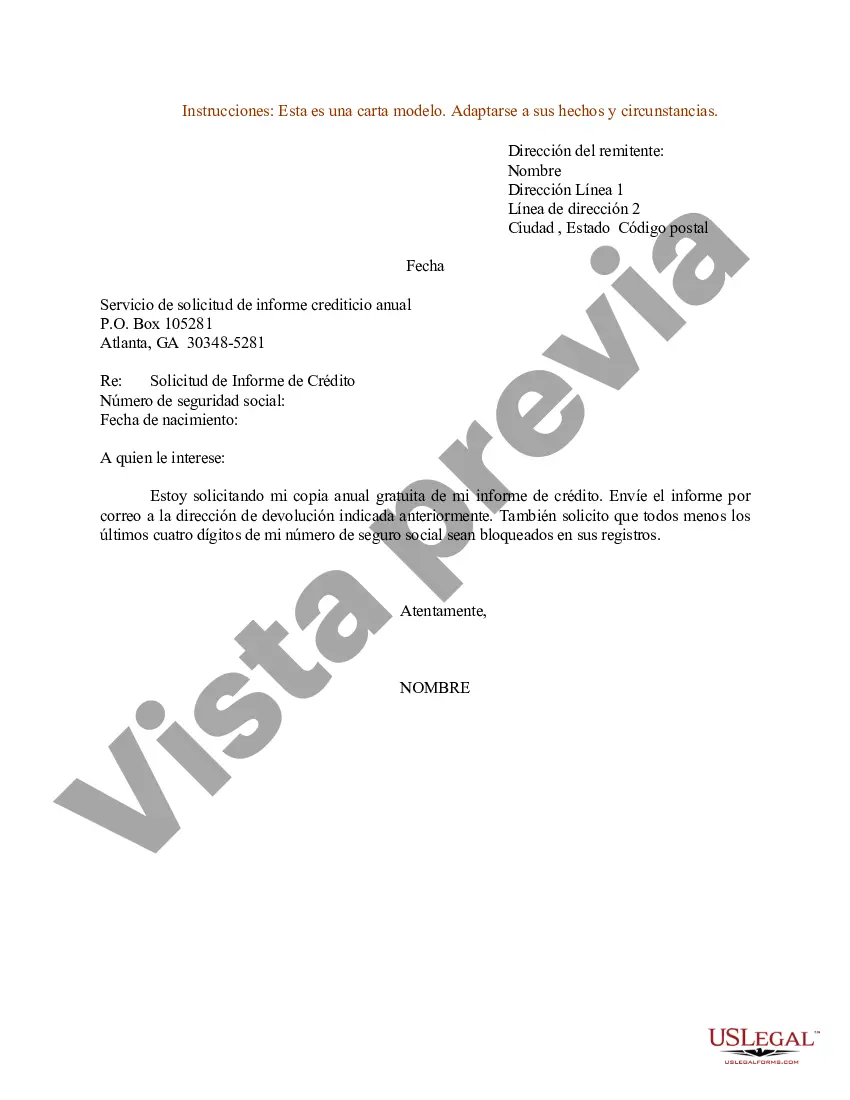

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wisconsin Ejemplo de carta de solicitud de informe de crédito gratuito permitido por la ley federal - Sample Letter for Request for Free Credit Report Allowed by Federal Law

Description

How to fill out Wisconsin Ejemplo De Carta De Solicitud De Informe De Crédito Gratuito Permitido Por La Ley Federal?

US Legal Forms - one of the largest libraries of legitimate kinds in America - gives a wide array of legitimate papers templates you are able to down load or print. Utilizing the internet site, you can find 1000s of kinds for company and person functions, categorized by groups, suggests, or search phrases.You can get the latest versions of kinds just like the Wisconsin Sample Letter for Request for Free Credit Report Allowed by Federal Law within minutes.

If you already have a subscription, log in and down load Wisconsin Sample Letter for Request for Free Credit Report Allowed by Federal Law from your US Legal Forms catalogue. The Down load button will show up on each type you look at. You have accessibility to all formerly saved kinds in the My Forms tab of your own profile.

If you would like use US Legal Forms the first time, allow me to share simple recommendations to obtain started out:

- Ensure you have picked out the right type to your area/region. Click on the Preview button to analyze the form`s articles. Browse the type explanation to ensure that you have selected the proper type.

- When the type does not suit your needs, utilize the Look for area at the top of the display to get the one that does.

- When you are satisfied with the shape, affirm your option by clicking the Get now button. Then, choose the prices plan you like and provide your credentials to sign up for an profile.

- Process the transaction. Utilize your credit card or PayPal profile to complete the transaction.

- Pick the formatting and down load the shape on the system.

- Make alterations. Fill out, revise and print and sign the saved Wisconsin Sample Letter for Request for Free Credit Report Allowed by Federal Law.

Each and every template you added to your account does not have an expiration day which is your own property permanently. So, if you would like down load or print one more duplicate, just proceed to the My Forms section and click in the type you want.

Obtain access to the Wisconsin Sample Letter for Request for Free Credit Report Allowed by Federal Law with US Legal Forms, probably the most considerable catalogue of legitimate papers templates. Use 1000s of professional and express-distinct templates that meet up with your small business or person demands and needs.